Fearless & Proven Crypto Portfolio Diversification: Build a Resilient Beginner Strategy 🚀

Crypto portfolio diversification is one of the most misunderstood ideas for new investors — yet it’s the foundation of long-term success. In crypto, prices swing fast, narratives change weekly, and new projects appear every day. That’s why learning to spread your risk and build a structured portfolio isn’t just “smart”; it’s essential for survival.

This first section will walk you through:

- Why diversification matters in crypto (and how it works differently than in stocks)

- A beginner’s roadmap to building a crypto portfolio

- The core building blocks — Bitcoin, Ethereum, and stablecoins — that every investor should understand before touching altcoins.

Table of Contents

- 🔎 Why Diversifying Your Crypto Portfolio Matters

- 🧭 The Beginner’s Roadmap: How to Build a Crypto Portfolio

- 🧱 Core Building Blocks: Bitcoin, Ethereum, and Stablecoins

- 🌱 Growth Layers: Smart-contract platforms, DeFi, and real-world assets

- 🧰 Risk Tools That Actually Work

- 📊 Position Sizing & Rebalancing: Simple math, big impact

- ⏱️ Timing Without Guessing: DCA, re-entries, and re-risking

- 🧲 Liquidity Tiers & “Cash Within Crypto”

- 🔐 Security, Custody & Operational Hygiene

- 🌍 Taxes, Regulation & Staying Compliant

- 📦 Model Portfolios for Three Risk Levels

- 🧪 Due Diligence Checklist (10 minutes)

- 🧩 Example Scenarios & Walk-Throughs

- ⚙️ Tools & Platforms You’ll Use

- 🧭 Ongoing Maintenance: Your monthly 1-hour routine

- 🙋 FAQs: Beginner Questions About Crypto portfolio diversification Answered

- 🧠 Key Lessons & Takeaways

🔎 Why Diversifying Your Crypto Portfolio Matters

1. Diversification = Risk Control + Opportunity

Diversification doesn’t just mean buying “a bit of everything.” It’s about spreading your bets across assets that behave differently under stress. In crypto, some coins rise when others fall, some hold steady, and some collapse completely. When you diversify, you reduce the chance that a single bad move — a protocol hack, a ban, or a hype crash — wipes out your capital.

In traditional finance, diversification spreads risk across industries or countries. In crypto, it’s across functions, use cases, and ecosystems:

- Functions: store of value (Bitcoin), utility (Ethereum), yield (DeFi tokens), or stability (stablecoins).

- Use cases: payments, infrastructure, governance, or NFTs.

- Ecosystems: Layer-1s like Ethereum and Solana vs. Layer-2s like Arbitrum and Optimism.

Each of these responds differently to global events, regulation, and sentiment. That variety gives your portfolio breathing room.

2. Why It Works — Even in a Volatile Market

Crypto assets don’t all move in perfect sync. Bitcoin may tank during a panic, but DeFi tokens might rebound faster when activity shifts on-chain. A stablecoin position provides a cash cushion during turmoil. Academic studies have confirmed that adding assets like Bitcoin or Ethereum to a diversified portfolio can increase overall risk-adjusted returns, even when volatility remains high.

In short, diversification doesn’t eliminate risk — it smooths it out. You’ll still experience ups and downs, but they’ll be less extreme and more manageable.

3. Practical Benefits for Beginners

For new investors, diversification means:

- Reducing emotional stress: You don’t have to watch one coin 24/7.

- Learning safely: You can experiment with DeFi or staking using smaller positions.

- Staying in the game: You’ll survive bear markets with enough liquidity to re-enter.

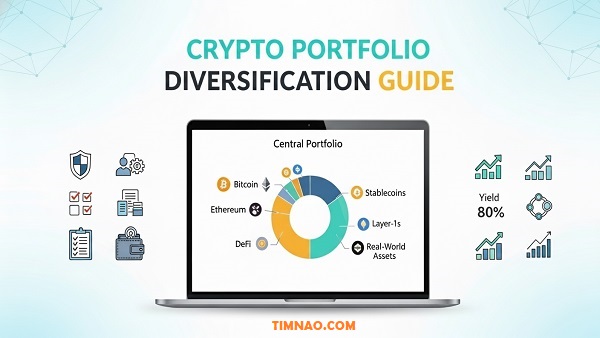

Start by dividing your crypto holdings into three buckets:

Core (60–70%), Growth (20–30%), and Experimental (5–10%).

You’ll learn how these buckets work in the next section.

Think of diversification like a safety net — it won’t stop you from falling, but it’ll make sure you bounce back instead of hitting the floor.

🧭 The Beginner’s Roadmap: How to Build a Crypto Portfolio

1. Step One: Define Your Purpose and Risk Level

Before buying a single coin, ask yourself:

- “What am I investing for?” (long-term growth, yield, or experimentation)

- “How much risk can I handle emotionally and financially?”

- “How long can I keep this capital invested without needing to touch it?”

If your answers lean conservative — maybe you’re saving for a home, or you’re new to investing — your crypto allocation should likely stay between 5–15% of total investments. If you’re more risk-tolerant and experienced, you might go up to 20–30%, but beyond that, you’re in speculative territory.

Write these numbers down. Your portfolio’s design should follow your real-world goals, not Twitter hype.

2. Step Two: Structure with Layers

Crypto portfolios work best when structured in three functional layers:

🧱 Core Layer – Stability and Long-Term Value

This is your foundation. Bitcoin and Ethereum dominate this layer because they have:

- Longest operational history

- Deep liquidity

- Strong developer ecosystems

- Institutional adoption (spot ETFs, custodians, global integration)

Keep 60–70% of your crypto in the core layer. It gives your portfolio direction and credibility.

🌱 Growth Layer – Scalable Opportunities

Here you allocate to strong altcoins, DeFi projects, or Layer-2s with genuine traction. Examples: Solana, Arbitrum, Aave, or Chainlink. Limit this section to 20–30%. It’s your performance driver — higher potential, higher volatility.

🎯 Satellite or Experimental Layer – Controlled Curiosity

This is your “learning capital.” You might explore new narratives like AI tokens, gaming, or tokenized real-world assets (RWAs). Keep this at 5–10% and treat every bet as if it could go to zero. This approach keeps your curiosity alive without risking your foundation.

3. Step Three: Create Rules Before You Invest

The biggest difference between amateurs and professionals? Pros write down their rules before emotions hit.

Set clear, written policies:

- Entry & Exit triggers: When will you buy or take profits?

- Rebalance schedule: Monthly, quarterly, or when allocations drift 20–30%.

- Stop-loss / cut rules: What % loss will trigger a reduction?

- Reinvestment policy: Will profits roll back into BTC/ETH, or stay in stablecoins?

Automation helps too. Many exchanges now support recurring buys (great for DCA — dollar-cost averaging), and portfolio-tracking apps like CoinStats or Zerion make rebalancing easier.

4. Step Four: Manage Risk from Day One

Risk management isn’t about avoiding losses; it’s about controlling damage. Follow these starter habits:

- Never allocate more than 2–4% to any single growth or experimental token.

- Keep at least 15–25% in stablecoins for liquidity and peace of mind.

- Reinvest only from profits, not borrowed money.

- Track your exposure — know exactly what % of your portfolio is in BTC, ETH, or DeFi.

A simple spreadsheet or tracker can make this easy. What matters is consistency — not perfection.

5. Step Five: Review, Adjust, Repeat

Your crypto portfolio isn’t static. Every few months:

- Review performance against your goals.

- Trim overperformers (lock in profits).

- Add to underweighted but high-conviction assets.

- Reassess the ecosystem — are fundamentals improving or fading?

Think of it like tending a garden. Regular care keeps growth steady and prevents weeds (bad bets) from taking over.

Now that you understand the structure, let’s explore the core foundation of every successful crypto portfolio.

🧱 Core Building Blocks: Bitcoin, Ethereum, and Stablecoins

1. Bitcoin (BTC): The Digital Bedrock

Bitcoin is the original crypto asset — the digital equivalent of gold. It’s designed to be scarce (only 21 million coins will ever exist), decentralized, and resistant to manipulation. In early 2024, Bitcoin’s spot ETF approval in the U.S. marked a major milestone, bringing billions in institutional capital and confirming its role as a legitimate asset class.

For beginners, Bitcoin serves three purposes:

- Store of value: A hedge against inflation and fiat currency devaluation.

- Anchor of stability: Less correlated with smaller altcoins.

- Liquidity base: Easily exchangeable on every major platform.

Allocating 40–60% of your crypto holdings to Bitcoin provides strength and long-term exposure without overcomplication.

Pro Tip: You don’t need to buy a full Bitcoin. Fractional ownership lets you invest any amount through exchanges like Coinbase or Binance.

2. Ethereum (ETH): The Smart Economy Engine

Ethereum is more than a currency — it’s a programmable network that runs thousands of decentralized applications (DeFi, NFTs, DAOs). Since moving from Proof of Work to Proof of Stake in 2022, Ethereum has reduced energy consumption by 99% and enabled staking rewards of 3–6% annually.

Ethereum’s importance is that it:

- Powers the majority of smart contracts.

- Hosts most DeFi and NFT ecosystems.

- Evolves constantly (latest upgrade: “Dencun,” 2024) to scale and cut fees.

For new investors, Ethereum offers exposure to crypto’s innovation layer — the infrastructure where the next decade of applications will be built.

Keep 20–35% of your crypto holdings in Ethereum. Staking through platforms like Lido or RocketPool can earn passive yield while supporting network security.

Example Application: When you deposit ETH into DeFi protocols like Aave, you can borrow stablecoins or earn yield — turning a static investment into an active asset.

3. Stablecoins: Your “Cash Within Crypto”

Stablecoins (e.g., USDT, USDC, DAI) are digital tokens pegged to traditional currencies like the U.S. dollar. Their main value is stability. When markets crash, stablecoins give you instant liquidity — no need to exit to fiat.

Why Stablecoins Matter:

- Liquidity buffer: Move instantly between tokens or exchanges.

- Opportunity fund: Ready to buy dips without waiting for bank transfers.

- Yield options: Deposit into platforms like Aave or Compound to earn 3–6% APY.

- Geographical resilience: In countries facing inflation, USD-backed stablecoins can protect value.

A balanced crypto portfolio should hold 15–25% in stablecoins — enough to stay flexible but not so much that you lose growth exposure.

Safety Tip: Prefer fully audited, transparent issuers like USDC (Circle) or DAI (MakerDAO). Avoid unknown algorithmic stablecoins — they’ve historically failed under stress.

4. Putting the Core Together

When combined, Bitcoin, Ethereum, and stablecoins form the “base trio” that anchors your crypto journey:

- Bitcoin gives you durability.

- Ethereum gives you innovation.

- Stablecoins give you flexibility.

This trio covers the three pillars of investing: store of value, growth, and liquidity.

Once this foundation is set, you can safely explore additional sectors — Layer-2s, DeFi, or gaming — without jeopardizing your main capital.

Think of it like building a house: Bitcoin is the foundation, Ethereum is the wiring and infrastructure, and stablecoins are the cash in your emergency drawer.

At this point, you’ve built the mindset and structure of a real investor. You understand that diversification isn’t about chasing every new coin — it’s about designing balance, liquidity, and long-term resilience.

Up next, we’ll explore how to expand your foundation into the growth layers — including DeFi, Layer-2s, and tokenized real-world assets — while keeping your portfolio disciplined and future-proof.

🌱 Growth Layers: Smart-Contract Platforms, DeFi, and Real-World Assets

Once your foundation of Bitcoin, Ethereum, and stablecoins is in place, it’s time to add a growth layer — the part of your crypto portfolio designed to capture innovation and higher upside potential. Think of it as your “engine room,” where the real progress of blockchain adoption takes shape.

Growth layers include smart-contract platforms, DeFi protocols, and tokenized real-world assets (RWAs). Each offers different growth drivers, levels of risk, and ways to earn passive income.

Understanding the Role of Growth Layers

In traditional investing, your core assets might be index funds, and your growth layer might be small-cap or emerging-market stocks. The same principle applies to crypto: your growth layer gives you exposure to newer technologies and projects that could outperform — but may also fluctuate more dramatically.

The trick is measured exposure — enough to move the needle, but not enough to destroy your base.

1. Smart-Contract Platforms: The Infrastructure of Crypto

Smart-contract blockchains like Ethereum, Solana, Avalanche, BNB Chain, and Cardano are the engines powering decentralized apps (dApps). These networks process transactions, run decentralized finance apps, and host entire economies.

How to Evaluate Smart-Contract Platforms

When selecting which platforms to invest in, ask:

- Adoption & Activity — How many developers and users does it have?

Ethereum remains the clear leader, but Solana and Arbitrum are fast-growing. - Scalability & Fees — Are transactions affordable? Solana and Polygon excel here.

- Security & Decentralization — How distributed are validators? Ethereum still sets the gold standard.

- Ecosystem Depth — Are there real projects (DEXs, lending apps, NFT platforms) or just hype?

Pro Tip: Avoid chasing the “Ethereum killer” narrative. Instead, think of these platforms as an internet of blockchains — each serving a unique purpose. Diversify across a few strong networks rather than betting on one winner.

Example Allocation

For a balanced portfolio:

- ETH: 15–25% (if not already counted in your core)

- SOL / AVAX / BNB / ADA: 5–10% total combined

- Layer-2s (e.g., ARB, OP): 3–5% combined

That’s enough exposure to growth without taking on excessive volatility.

2. DeFi: The Financial Heart of the Blockchain

DeFi (Decentralized Finance) replaces banks with code. You can lend, borrow, earn interest, or trade — all peer-to-peer and without intermediaries. It’s one of the most transformative innovations in crypto.

Why DeFi Matters

DeFi lets your assets work for you. Instead of holding idle tokens, you can:

- Earn yield by supplying liquidity or staking.

- Borrow stablecoins against your crypto without selling it.

- Participate in governance and earn additional tokens.

Platforms like Aave, Compound, and Uniswap are battle-tested leaders. As of 2025, total value locked (TVL) in DeFi exceeds $100 billion, with Ethereum, Arbitrum, and Solana leading the pack.

How to Get Started Safely

- Start small. Begin with blue-chip DeFi platforms only.

- Avoid yield traps. If something promises 1000% APY, it’s probably unsustainable.

- Understand impermanent loss. If you provide liquidity in a volatile pair, token price changes can reduce your final return.

- Use reputable aggregators. Sites like DeFiLlama and Zapper track yields and protocol safety.

- Stake through trusted intermediaries. Protocols like Lido or RocketPool make Ethereum staking simple, transparent, and decentralized.

Example DeFi Allocation

Allocate 5–15% of your total crypto portfolio to DeFi positions. Within that:

- 50% in lending (Aave, Compound)

- 30% in DEXs (Uniswap, Curve)

- 20% in staking or restaking protocols (Lido, EigenLayer)

Always keep enough liquidity to withdraw if the market shifts suddenly.

3. Real-World Assets (RWAs): Bridging Finance and Blockchain

RWAs bring traditional assets — like treasury bills, bonds, or real estate — onto the blockchain. This new wave is transforming DeFi into a legitimate yield marketplace.

Why RWAs Are the Next Big Thing

In 2025, tokenized treasuries have surpassed $8 billion in value, led by platforms like Ondo Finance, Maple, and Centrifuge. These allow investors to:

- Earn yield from U.S. Treasuries directly on-chain.

- Get exposure to real assets while maintaining crypto liquidity.

- Diversify with assets backed by legal, off-chain collateral.

For beginners, RWAs can offer a bridge between crypto and traditional finance — delivering stability and yield with lower volatility than altcoins.

How to Integrate RWAs

- Allocate 5–10% of your crypto sleeve to RWA tokens or funds.

- Focus on regulated and audited issuers.

- Treat them as your “bond equivalent” within your crypto strategy.

Example: Tokenized T-bill funds like OUSG (Ondo) or USYC (Superstate) yield ~4–5% annually — higher than stablecoin lending but with institutional safeguards.

🧰 Risk Tools That Actually Work

Crypto’s volatility demands more than luck. Even the best assets can nosedive 50% overnight. That’s why you need clear, mechanical risk tools that prevent emotion-driven decisions.

1. Risk Budgeting

Risk budgeting means deciding how much pain you can handle — in advance.

Ask: “How much can I lose without panicking or selling at the bottom?”

For most beginners, a maximum drawdown of 25–30% of your crypto sleeve is reasonable. Once that’s set, distribute your allocations so that no single asset can cause a portfolio loss beyond that.

Example:

If your total crypto investment is $10,000, a 25% max drawdown = $2,500.

You might allocate:

- $5,000 to low-risk (BTC, ETH, stablecoins)

- $3,000 to medium-risk (DeFi, L1s)

- $2,000 to high-risk (emerging projects)

That way, even if all high-risk positions crash, your portfolio remains intact.

2. Volatility Targeting

Crypto markets are cyclical. You can reduce exposure when volatility spikes.

Use simple metrics like:

- 30-day realized volatility — trackable via Glassnode or CoinMetrics.

- Fear & Greed Index — gauges overall sentiment.

When markets are euphoric, scale down. When fear dominates, re-accumulate gradually.

3. Scenario Planning

Ask: “What if…?”

- What if Bitcoin drops 40% overnight?

- What if a stablecoin depegs?

- What if a major exchange halts withdrawals?

Write responses in advance. For example: “If BTC drops below $50k, I’ll rebalance 10% of my stables into ETH.” These pre-written rules save you from panic.

4. Correlation Awareness

Not all cryptos move alike — and that’s good. Studies show Bitcoin and Ethereum’s correlation is not constant; it weakens during certain market phases.

Exploit that by mixing assets from different categories (L1s, L2s, DeFi, RWAs). Even small diversification across uncorrelated assets improves stability.

5. Portfolio Tracking & Alerts

Don’t fly blind. Use tools like:

- CoinStats, Zerion, or Debank for portfolio analytics.

- Coindix or YieldMonitor for yield tracking.

- Set price alerts and allocation alerts — many apps notify you when your weighting drifts 20% or more.

Good risk management isn’t about predicting crashes — it’s about staying alive when they happen.

📊 Position Sizing & Rebalancing: Simple Math, Big Impact

1. Why Position Sizing Matters

Position sizing decides whether a loss is a bruise or a knockout. In crypto, the difference between smart and reckless often comes down to how big your bets are.

A simple rule:

- Core assets (BTC, ETH): 30–50% combined

- Growth (L1s, DeFi): 20–30% combined

- Stablecoins / RWAs: 20–25%

- Experimental (new narratives): ≤5%

Never let any single small-cap position exceed 2–3% of your total portfolio. This ensures one bad bet won’t wipe you out.

2. Using Position Sizing Formulas

You don’t need complex models. Here are two beginner-friendly methods:

a) The Fixed Fraction Method

Allocate a fixed percentage per position (e.g., 2–3%) regardless of asset. If you invest $10,000 total, each altcoin gets $200–300. It’s simple and avoids overconcentration.

b) The Risk-Based Method

Base position size on how much you’re willing to lose if wrong.

Example:

If your loss tolerance is $100 per trade, and a token’s stop-loss is 20% below entry, your max position = $500 ($100 ÷ 0.2). This helps you size positions logically, not emotionally.

3. Rebalancing: The Discipline That Saves Portfolios

Rebalancing restores your allocations to their targets when market moves distort them. It forces you to sell high and buy low, automatically improving long-term returns.

When to Rebalance

- Calendar-based: every month or quarter.

- Threshold-based: when any asset drifts 25–30% from its target.

- Event-based: after big news (ETFs, protocol exploits, regulation shifts).

How to Rebalance

- Check your weights monthly using a tracker.

- Trim overgrown positions (take profits from outperformers).

- Add to undervalued ones (if fundamentals are intact).

- Keep stablecoins ready for opportunistic re-entries.

Example:

Suppose your ETH allocation grew from 25% to 40% of your portfolio after a rally. Rebalancing means trimming 15% of ETH back into BTC or stables — locking in gains and keeping risk steady.

4. Dynamic Rebalancing in Crypto

Because crypto moves faster than traditional assets, static rules sometimes fail. Consider a volatility-adjusted approach:

- During high volatility → rebalance more often.

- During stable markets → let winners run longer.

This flexible rhythm helps you participate in rallies while maintaining control.

5. Automate Where Possible

Many exchanges and tools (e.g., Shrimpy, BitUniverse) allow auto-rebalancing with custom parameters. Automation reduces emotional interference — your portfolio adjusts quietly while you sleep.

By now, your crypto strategy has evolved from “just buying coins” into a structured, risk-aware system.

- The growth layer lets you capture innovation.

- Risk tools protect you from the worst-case scenarios.

- Position sizing and rebalancing keep your strategy steady and scalable.

You’re no longer reacting to the market — you’re running a plan.

Next, we’ll build on this foundation by exploring timing strategies, liquidity management, and security practices that help your portfolio perform across all conditions.

⏱️ Timing Without Guessing: DCA, Re-Entries, and Re-Risking

Why timing frameworks beat “gut feel”

Trying to outsmart crypto’s swings is a fast way to churn capital and confidence. A timing framework removes guesswork and makes your actions repeatable. You’ll rely on three simple tools: Dollar-Cost Averaging (DCA) to build positions, planned re-entries to get back in after selloffs, and re-risking rules to scale exposure when conditions improve. Each tool is mechanical, beginner-friendly, and easy to automate.

DCA you can actually stick to

Dollar-Cost Averaging spreads your entries over time so a single unlucky buy doesn’t define your outcome. Pick one or two fixed days per week or month (e.g., every Tuesday and Friday) and automate equal purchases of BTC/ETH via a reputable exchange’s recurring-buy feature. Keep it boring:

- Cadence: weekly or biweekly beats “whenever I remember.”

- Amount: a fixed dollar figure (e.g., $50–$200 per buy).

- Scope: start with BTC/ETH; add one growth asset later if you want.

To make DCA resilient:

- Pre-commit a stop-pause rule. If your financial situation changes (job loss, emergency), pause instantly—no guilt, no FOMO.

- Layer a small “down-shift.” During extremes (e.g., parabolic moves), temporarily route DCA into stablecoins so you keep saving without buying euphoric spikes.

- Add a small “up-shift.” When broad fear dominates, you may boost DCA by 25–50% for a few weeks, then revert to baseline. This is optional—discipline first, tweaks second.

Re-entries without FOMO

Selling happens—by plan (rebalancing) or by emotion. The hard part is getting back in. Use a three-step re-entry template:

- Define zones in advance. Example: “Re-enter BTC in three tranches if it falls 20%/30%/40% from the recent high or touches the 200-day moving average.”

- Stagger your entries. Deploy 30% of your dry powder at each zone rather than going all-in.

- Run a quick checklist: network activity holding up, liquidity healthy, no red-flag protocol incidents, and your original thesis still valid.

This approach lowers your average cost and your stress. You’re not trying to nail the bottom; you’re building back in with structure.

Re-risking, but in the right order

When markets stabilize, scale exposure gradually:

- Core first: top up BTC/ETH until they hit your target weights.

- Then growth: add measured positions in L1/L2 or blue-chip DeFi.

- Last, experiments: reintroduce small satellite ideas (≤5% combined).

Signals that support re-risking:

- BTC reclaims and holds above the 200-day moving average.

- Stablecoin dominance starts drifting down (risk appetite returning).

- DeFi activity and total value locked trend up; fewer exploit headlines.

If conviction is still shaky, use half-risk mode: redeploy only 50% of your stablecoin buffer now; leave the rest for confirmation later.

A practical timing playbook (quick reference)

- Build: automated DCA into BTC/ETH weekly.

- Defend: pause DCA to stables during euphoric spikes or personal cash-flow stress.

- Re-enter: staged tranches at predefined drawdown zones.

- Re-risk: core → growth → experiments as signals improve.

- Review: reset your zones and cadence every quarter.

Next, let’s make sure your plan has the liquidity to execute—without forced selling or slow withdrawals when speed matters.

🧲 Liquidity Tiers & “Cash Within Crypto”

Liquidity tiers at a glance

Think of liquidity as how fast you can turn an asset into opportunity. A solid crypto plan separates holdings into three tiers so you’re never stuck when it’s time to act.

Tier 1 — Instant liquidity (hours or less)

What lives here: cash-equivalent stablecoins (USDC/USDT/DAI), small operational balances on reputable exchanges, and hot-wallet funds for routine DeFi interactions.

Why it matters: this is your opportunity fund for dip-buys, fast rebalancing, or taking profits without on-ramping delays.

Typical share: 10–20% of your crypto sleeve (higher in choppy markets).

How to use it well:

- Keep most of Tier 1 in stablecoins you trust; avoid obscure pegs.

- Park idle stables in conservative money-market-like options or blue-chip lending markets so your “cash” still works while it waits.

- Use wallet-allowance revocation tools monthly to reduce hot-wallet risk.

Tier 2 — Semi-liquid yield (1–7 days)

What lives here: staked ETH (queue applies), lending positions in Aave/Compound, liquid staking tokens, conservative DeFi pools, or centralized accounts with short withdrawal times.

Why it matters: you earn yield with moderate access speed.

Typical share: 20–30% (adjust by market regime).

How to use it well:

- Prefer blue-chip protocols with audits, time in market, and large TVL.

- Track exit frictions (cooldown, unlock, queue length) before you deposit.

- Set a rule: if market volatility passes your threshold, rotate part of Tier 2 back to Tier 1 to rebuild your buffer.

Tier 3 — Illiquid or locked (weeks to months)

What lives here: long lockup staking, farming with lock periods, vesting tokens, RWA funds with redemption windows, or early-stage allocations.

Why it matters: potential excess return—but you pay with time.

Typical share: 10–20% max for most beginners.

How to use it well:

- Cap any single Tier-3 position at ≤3% of your total crypto sleeve.

- Keep a simple calendar of unlocks and redemption windows.

- Pair every Tier-3 deposit with a liquidity plan (which assets you’ll sell first if you need cash while the lock holds).

Managing liquidity dynamically

Your tier mix should breathe with the market:

- In high-volatility phases or before major events (e.g., protocol upgrades, macro prints), raise Tier 1 by 5–15% so you can buy fear or sidestep drawdowns.

- When conditions calm and setups improve, redeploy methodically from Tier 1 to Tier 2 (and occasionally Tier 3) according to your risk budget.

A practical rhythm many beginners like:

- Hold 15–25% in Tier 1 by default.

- Push toward 25–35% Tier 1 during turbulence.

- Drift back to 15–20% Tier 1 when trend and liquidity recover.

Quick liquidity checklist

- Do I have enough Tier 1 to rebalance without selling losers?

- Do I understand every exit friction (queues, cool-downs, fees)?

- Is my Tier-3 bucket capped and diversified across ideas and platforms?

- Is my “cash within crypto” (Tier 1) earning modest, conservative yield?

You’ve now got the fuel (liquidity) to act on your timing plan. The last piece is safeguarding everything you’ve worked for—through smart custody and clean daily habits.

🔐 Security, Custody & Operational Hygiene

The mindset that prevents most losses

Most crypto losses don’t come from clever hacks; they come from simple mistakes: phishing, approvals you forgot, mixing hot and cold funds, or losing a seed phrase. Treat security like brushing your teeth—short, regular routines that prevent expensive problems.

Hot vs. cold: what to keep where

- Hot wallets (online): MetaMask, Rabby, Trust Wallet. Perfect for frequent use, not for long-term storage. Keep 5–10% of your portfolio here at most.

- Cold wallets (offline): hardware devices like Ledger or Trezor, or air-gapped solutions. This is where your long-term core belongs.

Practical setup for beginners:

- One hot wallet for daily DeFi and minting.

- One cold wallet for BTC/ETH and long-term holdings.

- Separate addresses for growth/satellite positions so approvals don’t cross-contaminate.

Custodial vs. self-custody (and when to blend)

- Custodial (CEX/broker holds your keys): easiest onboarding, fiat ramps, recurring buys, tax reports—but you rely on the provider’s solvency and controls.

- Self-custody (you hold the keys): maximum control and portability—and maximum responsibility.

A pragmatic blend:

- Keep operational funds and small trading balances with a reputable exchange for convenience.

- Hold long-term assets in self-custody cold storage.

- For larger stacks or teams, use a multi-sig (e.g., Safe/Casa) so one lost device can’t move funds.

The approvals & phishing routine

- Review token approvals monthly with tools like Revoke.cash and remove anything you don’t need.

- Treat every signature as a bank wire—read what you’re signing.

- Never click wallet pop-ups from random DMs or “support agents.” Legit teams won’t DM you first.

- Bookmark the official URLs for exchanges and DeFi apps; reach them from your bookmarks only.

Keys, backups, and recovery hygiene

- Write seed phrases on acid-free paper or metal; never store them in cloud notes or screenshots.

- Keep two copies in separate, secure locations (safe, deposit box).

- Use a passphrase (25th word) if your wallet supports it; memorize it like a password you never write down.

- Consider a duress PIN on hardware devices that opens a decoy account if you’re coerced.

Multi-signature for peace of mind

Multi-sig wallets require multiple approvals (e.g., 2-of-3) to move funds. Benefits:

- One compromised device isn’t enough to drain funds.

- Roles can be split (you + spouse + trusted hardware device in a safe).

- You can structure recovery by distributing keys across locations.

Start simple: keep a normal hardware wallet for daily cold storage and a separate multi-sig for long-term reserves once your portfolio grows.

Insurance and audits: the underused shields

- When depositing to DeFi, check audits and time in market. Blue-chip protocols with long histories tend to carry lower smart-contract risk.

- Consider on-chain insurance for specific exposures (e.g., smart-contract exploits, stablecoin depegs). Premiums cost money—but so do tails.

- For centralized storage, prefer custodians with clear cold-storage percentages, insurance arrangements, and third-party attestations.

Weekly 15-minute security ritual

- Open your tracker and scan balances and allocations.

- Open Revoke.cash and prune old approvals.

- Update device OS and wallet apps; check hardware wallet firmware quarterly.

- Test a small send from each active wallet (proves you still control keys).

- Glance at your calendar for lockups/unlocks and major market dates.

A final operations checklist (printable)

- Separate hot vs. cold funds; cap hot wallet at ≤10%.

- Two seed-phrase backups in different locations.

- Hardware 2FA (YubiKey) for exchange logins.

- Bookmarked official URLs only; no link-clicking from DMs.

- Monthly allowance revocation; quarterly firmware updates.

- Multi-sig for long-term reserves once portfolio size justifies it.

With timing you can trust, liquidity you can access, and security you practice, your crypto plan stops depending on luck—and starts depending on process. In the next part, we’ll turn that process into simple monthly routines and example scenarios you can copy, adapt, and run with right away.

🌍 Taxes, Regulation & Staying Compliant

Understanding how crypto taxation really works

Most new investors discover taxes only when it’s too late—after a tax letter lands in their inbox. But handling taxes in crypto isn’t as scary as it sounds if you know how to track your cost basis, identify taxable events, and use loss harvesting smartly.

In most countries (including the U.S., U.K., and EU), crypto is taxed as property, not currency. That means every sale, trade, or use of crypto counts as a disposition—and you owe capital gains tax on the difference between your buy price (cost basis) and your sell price.

Common taxable events:

- Selling crypto for fiat (e.g., selling ETH for USD).

- Swapping crypto-to-crypto (e.g., exchanging BTC for ETH).

- Using crypto to buy goods or services.

- Earning crypto via staking, mining, or airdrops—this is typically taxed as ordinary income at the fair market value when received.

Example:

You bought 1 ETH for $2,000 and later used it to buy an NFT when ETH was worth $3,000. You must report a $1,000 capital gain—even though you never converted it to cash.

Tracking and reporting made simple

- Use tools like Koinly, CoinTracking, or Accointing to automatically sync wallets and exchanges.

- Record the date, cost, and value at each transaction.

- Keep copies of exchange CSVs and wallet addresses for at least 5 years.

To stay compliant:

- If your jurisdiction applies a short-term vs. long-term distinction (like the U.S.), remember: crypto held less than 1 year is taxed at your ordinary income rate, while longer than 1 year enjoys lower capital gains rates.

The evolving regulation map

Governments are tightening crypto regulation faster than ever. Key trends you must know:

- KYC (Know Your Customer) and AML (Anti-Money Laundering) checks are now required on all major exchanges.

- Privacy coins (like Monero and Zcash) face bans or restrictions in several jurisdictions (e.g., Japan, Australia, South Korea) due to money-laundering risks.

- Centralized exchanges often report trading data to tax authorities automatically, meaning you can’t assume anonymity.

Compliance mindset for peace of mind

- Avoid privacy tools that mix or obfuscate transactions unless you fully understand legal implications.

- Always declare staking and yield income—these are visible on-chain and easily traceable.

- Don’t skip reporting just because your exchange is offshore—cross-border tax-sharing agreements are expanding.

- Consult a tax professional for your first filing year—it’s an investment in avoiding audits later.

When you understand the tax and legal side, your portfolio becomes more robust—not just profitable, but sustainable.

📦 Model Portfolios for Three Risk Levels

How to think about risk tiers

Crypto investing isn’t one-size-fits-all. The right portfolio depends on your time horizon, volatility tolerance, and need for liquidity. Below are three practical models inspired by institutional frameworks and academic research.

🟩 Conservative (preserve capital, slow growth)

Goal: Participate in digital asset growth with minimal downside risk.

Allocation example:

- Bitcoin: 40% — store of value, long-term compounder.

- Ethereum: 20% — smart-contract exposure.

- Stablecoins (USDC, DAI): 30% — yield via low-risk DeFi or custodial savings.

- DeFi blue chips (Aave, Lido): 10% — modest yield growth.

Tips:

- Focus on yield-bearing stablecoin strategies (3–6% APY).

- Avoid NFTs or meme coins.

- Rebalance quarterly back to targets.

- Keep at least 20% liquidity for emergencies or dip buys.

🟨 Balanced (growth with risk control)

Goal: Blend capital appreciation with resilience.

Allocation example:

- Bitcoin: 35%

- Ethereum: 25%

- Layer-1 / Layer-2 (Solana, Polygon, Avalanche): 20%

- Stablecoins: 10%

- DeFi / RWAs (Aave, Maker, Ondo, Maple): 10%

Tips:

- Diversify across ecosystems to mitigate chain-specific risk.

- Automate DCA for BTC and ETH.

- Rebalance bi-monthly; harvest losses during drawdowns.

- Use yield from stablecoins to cover transaction fees and taxes.

🟥 Aggressive (high conviction, long horizon)

Goal: Maximize upside through innovation exposure.

Allocation example:

- Bitcoin: 25%

- Ethereum: 25%

- Altcoins (L1/L2, DeFi, AI, gaming): 30%

- Stablecoins: 10%

- NFTs or early-stage tokens: 10%

Tips:

- Limit any single altcoin to ≤5% of your total portfolio.

- Use secure staking (not custodial) for yield.

- Rebalance monthly to lock gains.

- Keep a “cold vault” for long-term bets you won’t touch for 3–5 years.

Smart portfolio hygiene

Regardless of risk level:

- Rebalance regularly—a small Bitcoin move can skew allocations.

- Keep a liquidity buffer—10–20% in stablecoins avoids forced selling.

- Track performance—use CoinStats or Zapper for real-time rebalancing views.

By matching your allocation to your temperament, you remove the biggest threat to returns: emotional decisions.

🧪 Due Diligence Checklist (10 minutes)

Why due diligence matters

Crypto rewards curiosity—but punishes haste. Before investing in any token or protocol, follow this quick 10-minute checklist. It’s your shield against scams, hype, and bad code.

1️⃣ Project fundamentals

- Whitepaper clarity: Can you explain what it does in one sentence?

- Problem-solving: Does it address a real pain point (scalability, interoperability, yield, identity)?

- Team background: Are founders public and experienced? Check LinkedIn, GitHub, and prior startups.

2️⃣ Tokenomics

- Supply cap: Fixed or inflationary?

- Distribution: How much is held by insiders or VCs (watch for >40%)?

- Utility: Does the token drive genuine network activity or is it speculative?

- Emission schedule: Are new tokens being minted rapidly (potential dilution)?

3️⃣ Technical & security audit

- Smart contract audits: Look for reports from firms like CertiK, Quantstamp, or Trail of Bits.

- Exploit history: Check community forums and DeFiLlama for any breach records.

- Open-source code: Transparency builds trust.

4️⃣ Market dynamics

- Liquidity depth: Is the token listed on reputable exchanges with sufficient volume?

- Community activity: Telegram, Discord, and GitHub are better metrics than Twitter hype.

- Competition: Who else is solving this problem? Is the project differentiated?

5️⃣ Legal and jurisdiction check

- Token classification: Is it a utility token or security?

- Compliance: Does it follow local KYC/AML norms?

- Regulatory red flags: Avoid projects promising “tax-free” or “anonymous” returns.

Quick 10-minute flow:

| Step | Task | Time |

|---|---|---|

| 1 | Skim website & whitepaper | 2 min |

| 2 | Scan tokenomics + team | 3 min |

| 3 | Verify audit + exchange listings | 3 min |

| 4 | Read recent community posts | 2 min |

If a project fails more than one of these checks—walk away. In crypto, missing one opportunity is far better than losing all your capital in one blow.

Bonus: Red-flag signals

- Guaranteed “risk-free” yield.

- Anonymous founders with opaque token supply.

- No audit or outdated GitHub commits.

- Excessive referral bonuses.

- Sudden token unlocks without warning.

Ten minutes of diligence can save you years of regret—and it only gets faster with habit.

🧩 Example Scenarios & Walk-Throughs

Why learning through examples works

Theory gives you structure, but examples give you confidence. By seeing how actual crypto investors handle different conditions—bull runs, crashes, and sideways markets—you’ll learn to apply strategies instead of memorizing them. Below are realistic walk-throughs based on a mix of historical data and institutional best practices from Cryptocurrencies and Beyond (Zhong) and Investing in Cryptocurrencies and Digital Assets (Black).

Scenario 1: The First $1,000 Portfolio

Goal: Learn fundamentals, minimize risk.

Starting position: You’re a beginner with $1,000 and no prior crypto experience.

Steps:

- Start small and automate.

- Allocate 50% ($500) to Bitcoin (BTC).

- Allocate 25% ($250) to Ethereum (ETH).

- Keep 25% ($250) in USDC stablecoin.

Use recurring weekly buys via Coinbase or Binance to smooth volatility.

- Set up your security.

- Store BTC/ETH in a hardware wallet (Ledger, Trezor).

- Keep stablecoins on a reputable platform with proof-of-reserves.

- Learn by observing.

- Track price moves for 3 months before making any changes.

- Focus on learning how DCA feels during both up and down weeks.

Result: You build exposure safely, avoid emotional mistakes, and gain real experience with minimal downside.

Scenario 2: The Sideways Market (2022–2023 Style)

Goal: Earn yield while prices stagnate.

Starting position: $10,000 portfolio with long-term outlook.

Steps:

- Split for stability and yield.

- 40% Bitcoin

- 25% Ethereum

- 25% stablecoins (USDC, DAI)

- 10% DeFi protocols (Aave, Lido)

- Earn passive yield.

- Stake ETH via Lido (4–5% APR).

- Deposit stablecoins on Aave (3–6% APR).

- Avoid unaudited yield farms or double-digit APYs—focus on liquidity and security.

- Set quarterly rebalancing.

- Reinvest earned yield into BTC or ETH when prices drop 10–15%.

- Revert to more stablecoins if market sentiment turns euphoric.

Result: While prices move sideways, your capital keeps compounding—earning yield and staying liquid enough to buy dips.

Scenario 3: The Bull Run Rebalancing

Goal: Lock profits without leaving the market.

Starting position: $20,000 portfolio grown 80% during a bull run.

Steps:

- Take partial profits.

- Sell 20% of your BTC and 20% of your ETH into USDC.

- Move 15% of altcoin profits into stable yield pools.

- Rebalance monthly.

- Maintain a 60/20/20 ratio: 60% large caps (BTC/ETH), 20% stablecoins, 20% growth assets.

- This locks gains while keeping upside exposure.

- Set mental “de-risk” triggers.

- If BTC rallies +100% from your cost basis, rebalance automatically.

- Avoid “all-in” greed—systematic rebalancing is your discipline anchor.

Result: You lock in profit, maintain liquidity, and protect against inevitable pullbacks.

Scenario 4: Surviving a Crash

Goal: Minimize loss, prepare to re-enter.

Starting position: $15,000 portfolio down 40% in a market correction.

Steps:

- Stop panic-selling.

- Pause all sales for 72 hours; volatility usually subsides quickly.

- Rebuild structure.

- Use stablecoins to rebalance: buy small BTC/ETH tranches at -50% drawdowns.

- Avoid altcoins until major assets stabilize above 200-day MA.

- Reset allocations.

- New target: 50% BTC, 25% ETH, 20% stablecoins, 5% small caps.

- Resume DCA once sentiment improves (Fear & Greed Index <30).

Result: You avoid emotional liquidation and position yourself for the next recovery cycle.

Scenario 5: ESG & Tokenized Asset Portfolio

Goal: Align values with performance.

Starting position: $5,000 portfolio, sustainable-investing focus.

Steps:

- Prioritize green protocols.

- 40% Ethereum (PoS)

- 20% Cardano

- 10% Polkadot

- 20% ESG DeFi protocols (e.g., KlimaDAO, YieldNest Green Vaults).

- 10% stablecoins in green-yield pools (e.g., carbon-offset platforms).

- Track with ESG tools.

- Use SustAIn Crypto or Veridium to verify sustainability ratings.

- Engage in governance.

- Vote on proposals promoting transparency or renewable-energy funding.

Result: You invest consciously and still capture DeFi yield—proving sustainability and profit can coexist.

Scenario 6: AI-Driven Portfolio Optimization

Goal: Use data tools for smarter decisions.

Approach:

- Integrate AI-based analytics (e.g., LunarCrush, Santiment, IntoTheBlock).

- Monitor on-chain metrics: wallet activity, exchange inflows/outflows.

- Use sentiment analysis models to spot hype or fear cycles early.

Example:

You set alerts for BTC net exchange outflows >10k coins/day. Historically, that signal predicts 2–6 week bullish phases. Combine this with DCA scaling to improve entry precision.

⚙️ Tools & Platforms You’ll Use

1️⃣ Exchanges for buying crypto

| Type | Examples | Notes |

|---|---|---|

| Centralized (CEX) | Binance, Coinbase, Kraken | Easy onboarding, high liquidity, KYC required. |

| Decentralized (DEX) | Uniswap, 1inch, PancakeSwap | No KYC, wallet-to-wallet swaps, slightly higher fees. |

Pro tip:

Use CEX for fiat on/off-ramps, then transfer to DEX or wallets for full control.

2️⃣ Wallets for storage

| Purpose | Tool | Highlights |

|---|---|---|

| Hot wallet | MetaMask, Rabby, Trust Wallet | Quick access; limit exposure. |

| Cold wallet | Ledger, Trezor, Keystone | Offline safety; ideal for long-term storage. |

| Smart contract wallets | Safe (formerly Gnosis), Argent | Multi-signature and recovery options for teams. |

Setup workflow:

- Create hot wallet for daily DeFi use.

- Create cold wallet for savings.

- Store recovery seeds offline (metal or encrypted USB).

3️⃣ Portfolio tracking

- Zapper / DeBank: unified dashboards for DeFi + NFTs.

- CoinStats / Kubera: track total holdings across CEX and wallets.

- Rotki (open source): privacy-first, self-hosted portfolio tracker.

Set weekly alerts for:

- Net worth fluctuations >10%.

- Portfolio deviation from target allocations.

- Token unlock events in your holdings.

4️⃣ Research & analytics

| Tool | Use Case |

|---|---|

| Glassnode / CryptoQuant | On-chain metrics (active addresses, exchange flows). |

| Token Terminal | Fundamental data: fees, revenues, user growth. |

| Messari / DefiLlama | Compare TVL, project categories, and ecosystems. |

| LunarCrush / Santiment | Sentiment and social data. |

| CoinGecko / CoinMarketCap | Price, volume, and tokenomics snapshots. |

Routine:

Spend 15 minutes each week checking network activity trends for your top holdings—rising active users usually precede price strength.

5️⃣ DeFi platforms

| Type | Top Platforms | Key Benefit |

|---|---|---|

| Lending | Aave, Compound | Earn APY on idle assets. |

| Staking | Lido, RocketPool, Frax | Yield from ETH or other PoS chains. |

| DEX Aggregators | 1inch, Matcha | Find best swap rates. |

| Yield strategies | Yearn, Beefy Finance | Automate optimized yield rotation. |

| Bridges | Synapse, Stargate | Move assets cross-chain. |

Caution:

Always verify audits and avoid protocols with low TVL (<$10M). Use tools like DefiSafety or RugDoc for risk reviews.

6️⃣ Tax & compliance tools

| Tool | Function |

|---|---|

| Koinly / Accointing / CoinTracking | Automated portfolio sync + tax reports. |

| ZenLedger | Integrates DeFi, NFTs, and staking income. |

| Reconcile | Enterprise-grade compliance and reporting. |

Annual checklist:

- Export all CEX/DEX CSVs.

- Record staking yields as income.

- Match wallet activity with tax software imports.

7️⃣ Automation & alerts

- Coinrule / 3Commas: automate buy/sell rules (e.g., “Buy ETH if it drops 10%”).

- Zapier + Notion: log trades, tax events, and allocations automatically.

- TradingView alerts: set triggers for RSI, moving averages, or key levels.

Example rule:

“If BTC closes above 200-day MA, deploy 25% of stablecoin reserve into ETH and SOL equally.”

Automation ensures you follow logic, not emotion.

8️⃣ Educational & ESG tools

From Zhong’s Cryptocurrencies and Beyond:

- SustAIn Crypto: ESG ratings for crypto assets.

- Veridium: blockchain-based carbon credit tracking.

- Crypto Carbon Ratings Institute: compares energy footprints across networks.

Why it matters:

Understanding sustainability metrics will soon be as common as checking tokenomics or APY—especially as regulators push for transparent carbon data.

9️⃣ AI-powered assistants

AI tools now help investors synthesize huge data streams:

- ChatGPT + Token Terminal plugin: summarize project fundamentals.

- Arkham Intelligence: link wallet identities to project activity.

- Nansen.ai: track “smart money” flows across blockchains.

Example use:

Use AI to monitor new whale wallets buying certain tokens—an early signal before public FOMO.

10️⃣ Your personal crypto stack (sample setup)

| Category | Tool | Reason |

|---|---|---|

| Exchange | Coinbase | Fiat gateway, reliable reporting |

| Wallet | Ledger + MetaMask | Safe long-term + fast access |

| Tracker | Zapper | DeFi + NFT unified view |

| Analytics | Glassnode | On-chain health |

| Automation | Coinrule | Rules-based rebalancing |

| Taxes | Koinly | Global reporting support |

| AI Insight | Nansen + ChatGPT | Data + narrative synthesis |

In one dashboarded setup, you control, track, and optimize without getting lost in hype.

Final takeaway

Crypto mastery isn’t about predicting markets—it’s about systematizing good habits.

- Scenarios teach you context.

- Tools enforce discipline.

- Together, they turn crypto chaos into a structured wealth-building process.

Your next move? Choose one scenario that feels closest to your life right now. Implement it using the tools listed here—and watch how much calmer, clearer, and more confident your investing becomes.

🧭 Ongoing Maintenance: Your Monthly 1-Hour Routine

Building a crypto portfolio is one thing — keeping it healthy is another. Like tending a small digital garden, regular checkups help your investments grow while preventing costly mistakes. You don’t need to live on charts all day; a simple one-hour monthly review can make a huge difference.

Step 1: Quick Market Pulse

Start your routine by scanning the overall crypto market sentiment. Use tools like CoinMarketCap or Crypto Fear & Greed Index to gauge market mood.

- Bullish sentiment: consider trimming profits on overheated assets.

- Bearish sentiment: check if strong projects are undervalued and ripe for dollar-cost averaging (DCA).

Your goal isn’t to time the market perfectly — it’s to stay informed and emotionally balanced.

Step 2: Portfolio Snapshot

Log into your tracking app (e.g., CoinStats, Zerion, or Zapper) and review your portfolio performance.

Ask:

- What are my best and worst performers?

- Have any coins drifted far from their target allocation?

- Are my stablecoins earning yield safely?

If allocations have changed by more than ±5–10%, it’s time to rebalance. For instance, if Ethereum now makes up 55% of your portfolio instead of 40%, sell part of it to restore balance and reduce concentration risk.

Step 3: Income & Yield Review

If you earn passive income via staking, lending, or liquidity pools, check:

- Are rewards consistent and safe?

- Has the APY dropped significantly?

- Are there new risks (smart contract issues, platform insolvency)?

Remember, yield is never “free.” High returns often come with hidden smart-contract or liquidity risks. If you’re staking long-term, monitor your validator’s performance and uptime to avoid missed rewards.

Step 4: Security Checkup

Spend 10 minutes ensuring your crypto hygiene is sharp:

- Review your seed phrase storage (no photos, always offline).

- Update exchange and wallet passwords.

- Enable 2FA on every platform.

- Check Have I Been Pwned to see if your email has appeared in any data breaches.

Security complacency is the silent killer of crypto portfolios.

Step 5: Plan Adjustments & Record-Keeping

Crypto evolves fast. Every month, reflect on:

- Are my investment goals still aligned?

- Have regulations or taxes changed in my country?

- Did I add or remove assets this month?

Keep a simple spreadsheet or use apps like CoinTracker or Koinly to log transactions and tax details. Consistent tracking prevents chaos during tax season.

🙋 FAQs: Beginner Questions About Crypto Portfolio Diversification Answered

Even experienced investors revisit the basics. Let’s clear up the most common beginner questions about diversification and crypto portfolio management.

🧩 1. How many cryptocurrencies should I hold?

For most beginners, 5–10 assets is plenty. Too few, and you’re overly exposed to one coin’s risk; too many, and you can’t keep track.

Start with the big three — Bitcoin, Ethereum, and stablecoins — then add a mix of layer-1s, DeFi tokens, and real-world asset (RWA) projects as you gain confidence.

💡 2. Should I rebalance monthly or quarterly?

Rebalancing monthly works well for active investors, but quarterly is fine for long-term holders. The key is consistency, not frequency.

Set a rule — for example, “rebalance when an asset deviates ±10% from target allocation” — and stick to it.

💰 3. What’s a good allocation for stablecoins?

Holding 10–30% in stablecoins gives you liquidity and flexibility. During market dips, this “dry powder” lets you buy assets at a discount. During rallies, it acts as a safety cushion.

⚖️ 4. Is diversification just about coins?

No — true diversification includes categories and use cases, such as:

- Smart-contract platforms (Ethereum, Solana, Avalanche)

- DeFi projects (Aave, Uniswap)

- Infrastructure tokens (Chainlink, Filecoin)

- Real-world assets (tokenized Treasury bills, gold-backed stablecoins)

You can even diversify across risk profiles — holding both speculative and stable-yield assets.

🔒 5. What’s the biggest beginner mistake in diversification?

Overconfidence. Many new investors pile into trendy tokens without understanding the underlying tech or risks. Diversification isn’t about owning “everything”; it’s about owning uncorrelated, quality projects.

📈 6. Can I diversify with ETFs or funds instead?

Yes. As of 2025, Bitcoin and Ethereum ETFs are available in many countries, offering regulated exposure. Crypto index funds (like Bitwise 10) allow one-click diversification without managing multiple wallets.

🪙 7. Do stablecoins earn interest safely?

Platforms like Aave and Compound offer 2–5% APY on stablecoins. For conservative investors, regulated alternatives like Circle Yield provide compliance assurance. Always prioritize security over yield.

🌐 8. How does regulation affect my portfolio?

Regulation can impact exchange access, tax rates, and asset classification. Stay updated on local laws — especially around staking income, capital gains, and reporting requirements. Use compliant exchanges like Coinbase or Kraken.

⏳ 9. What if I miss a big market rally?

Don’t chase pumps. Stick to your DCA plan and let time compound returns. Even missing one or two rallies won’t matter if you’re consistent — markets always offer new opportunities.

💬 10. Should I copy influencers’ portfolios?

Absolutely not. Many influencers promote paid tokens or risky microcaps. Use them for research ideas, but verify independently. Your portfolio should reflect your goals, risk tolerance, and timeline, not someone else’s hype.

🧠 Key Lessons & Takeaways

To wrap up this entire guide, here are the most important insights to carry forward as you diversify and grow your crypto portfolio:

- Diversification = Survival. Crypto is volatile; spreading your investments across categories and assets cushions against unexpected losses.

- Balance risk and growth. Core holdings like Bitcoin, Ethereum, and stablecoins act as anchors, while smaller altcoins and DeFi projects add upside potential.

- Consistency beats timing. Regular rebalancing and DCA outperform sporadic emotional trades.

- Security first, profits second. Even the best strategy fails if your wallet gets hacked. Maintain impeccable operational hygiene.

- Documentation saves sanity. Track every transaction, yield source, and exchange movement. Tax time becomes effortless when you stay organized.

- Stay curious. The crypto world changes monthly — keep learning, questioning, and refining your strategy.

⚠️ Disclaimer

The information provided in this article is for educational and informational purposes only and should not be considered financial, investment, or legal advice. Cryptocurrency investing carries a high level of risk, and you should only invest money that you can afford to lose. Always conduct your own research (DYOR) and consider consulting with a licensed financial advisor or tax professional before making any investment decisions.

While every effort has been made to ensure the accuracy of the information at the time of writing, the cryptocurrency market is highly volatile and subject to rapid change. The author and publisher assume no responsibility or liability for any errors, omissions, or outcomes resulting from the use of this content.

Past performance does not guarantee future results. By using or relying on this content, you agree that you are solely responsible for your own investment decisions and risk management.

Normally I don’t read article on blogs, however I wish to say that this write-up very pressured me to try and do it!

Your writing taste has been surprised me. Thanks, very nice post.

Way cool! Some very valid points! I appreciate you penning this article and also the rest of the website is really good.

hi!,I love your writing very much! percentage we keep in touch extra about your

article on AOL? I require an expert in this area to solve my

problem. May be that is you! Looking forward to look you.