🚀 Unlock Amazing Profits: The Ultimate Beginner’s Guide to Gap Trading Strategies!

Welcome, aspiring trader! If you’ve ever looked at a stock chart and seen a sudden jump or drop in price between one day’s close and the next day’s open, you’ve witnessed a market gap. These “gaps” might seem mysterious, but for those in the know, they represent incredible opportunities. This comprehensive guide will demystify gap trading strategies, helping you in understanding market gaps and empowering you to spot potentially profitable gap setups.

The world of stock trading can feel overwhelming at first, with its own language and seemingly complex mechanics. However, gap trading, when approached with the right knowledge, can be a surprisingly accessible and potent strategy, even for beginners. We’re here to break it down for you, step-by-step, into easily digestible pieces, ensuring you grasp the core concepts and can move forward with confidence. Forget dry, textbook-style explanations; we’re going on an exciting journey to uncover how these market phenomena can become a cornerstone of your trading toolkit.

This article will guide you through the essentials of understanding market gaps, from what they are to the psychological drivers behind them. We’ll then dive into actionable gap trading strategies, including how to identify promising candidates, crucial rules for entry, and smart ways to manage your trades. By the end, you’ll have a solid foundation for identifying profitable gap setups and navigating this exciting niche of the stock market.

Table of Contents

- 🌟 What Exactly Are These Mysterious Market Gaps?

- 🧐 The Secret Language: Different Types of Stock Market Gaps Explained

- 🧠 Why Do Gaps Occur? Peeking into the Trader’s Mindset

- 🛠️ Your Power Blueprint: A Beginner-Friendly Strategy for Trading Gaps

- 🛡️ Guarding Your Gains: Smart Risk Management and Exit Tactics

- 🎯 Zeroing In: How to Identify the Most Profitable Gap Setups

- 🤸 Versatility is Key: Gap Trading for Short Bursts and Long Hauls

- ⚙️ Essential Tools & Resources for the Modern Gap Trader

- ⚠️ Common Stumbling Blocks for New Gap Traders (And How to Leap Over Them)

- 🎉 Your Adventure in Mastering Market Gaps Starts Now!

🌟 What Exactly Are These Mysterious Market Gaps?

Let’s kick things off by understanding market gaps at their most fundamental level. In the simplest terms, a stock market gap is a price range where no trading activity has occurred. Imagine a stock closes at $50 on Monday. On Tuesday, due to overnight news or a surge in pre-market interest, it opens at $52. That $2 difference, between $50 and $52, where no shares were exchanged during regular trading hours, forms a “gap” on the price chart.

These gaps can occur to the upside (an “up gap” like our example) or to the downside (a “down gap,” where the stock opens lower than its previous close). For instance, if our $50 stock opened at $48 on Tuesday, that would be a down gap. These aren’t just random blips; they often signify a significant shift in market sentiment or new information that has become available while the market was closed.

Think of it like a bridge missing a few planks. The price “jumps” from one level to another, leaving an empty space. This empty space is crucial because it tells a story about supply and demand. A major news event, an earnings announcement released after market hours, or even broader economic data can cause a flood of buy or sell orders before the market officially opens, leading to these price discontinuities. For traders, these gaps are not just curiosities; they are signals that can lead to profitable gap setups if interpreted correctly using sound gap trading strategies.

What is Gap Trading? (Explained Simply)

Gap trading is a strategy where traders buy or sell financial assets based on sudden price jumps or drops—these are called “gaps.” A gap happens when the price of an asset opens significantly higher or lower than it closed the previous day.

This usually signals a shift in market sentiment or a reaction to important news while the market was closed.

…..

Example: Understanding Gap Trading in Forex

Let’s break it down with a simple example:

-

On Monday, the EUR/USD currency pair closes at 1.1550

-

On Tuesday, it opens at 1.1600

That’s a gap up of 0.0050 (or 50 pips).

This gap suggests that traders are feeling bullish (positive) about the euro.

A trader sees this and thinks the euro might continue to rise, so they go long (buy).

-

If the euro rises further, the trader earns a profit

-

If the euro falls instead, they face a loss

This is the core of gap trading: You observe the gap, analyze market sentiment, and make a decision based on whether you expect the gap to be filled or extended.

…………………..

Can You Use Gap Trading in Other Markets?

Absolutely! While our example used forex (foreign exchange), gap trading also works in:

-

🟢 Stocks (e.g., a stock opens much higher after a good earnings report)

-

🟡 Indices (like S&P 500 or NASDAQ)

-

🟠 Commodities (gold, oil, etc.)

-

🔵 Crypto markets (especially on exchanges that close overnight)

Anywhere there’s a market that closes and reopens, there’s potential for a price gap—and a gap trading opportunity.

…………………..

Quick Recap: Gap Trading in Simple Terms

| Concept | What It Means |

|---|---|

| Gap | A sudden jump or drop in price between two trading sessions |

| Gap trading | Making trades based on whether the gap will close or expand |

| Gap up | Price opens higher than previous close (bullish signal) |

| Gap down | Price opens lower than previous close (bearish signal) |

| Gap fill | When price returns to the level before the gap |

| Trade decision | Based on whether you expect a fill or continuation |

🧐 The Secret Language: Different Types of Stock Market Gaps Explained

Not all gaps are created equal. Understanding market gaps involves recognizing their different personalities, as each type can suggest different future price movements. While there are several classifications, beginners should get comfortable with these four main types:

- Common Gaps (or Trading Gaps):These are, as the name suggests, quite common and usually don’t signify a major change in trend. They often occur in range-bound markets or on low-volume stocks. Think of them as small potholes on the trading road. Common gaps tend to get “filled” relatively quickly, meaning the price often retraces back to cover the gapped area within a few days or weeks. While they are part of understanding market gaps, they are generally not the primary focus for most active gap trading strategies seeking significant moves.

- Breakaway Gaps:Now these are exciting! Breakaway gaps typically occur when a stock’s price “breaks away” from a period of consolidation or a significant chart pattern (like a trading range or a triangle). This often happens on increased volume and signals the potential start of a new, strong trend in the direction of the gap. For example, if a stock has been trading sideways between $20 and $22 for weeks and then suddenly gaps up to $23 on high volume, that’s a bullish breakaway gap. These can lead to very profitable gap setups as they often mark the beginning of a sustained move.

- Runaway Gaps (or Measuring Gaps):Runaway gaps usually appear in the middle of a strong, established trend. Imagine a stock is already in a clear uptrend and then creates another significant up gap – that’s often a runaway gap. They indicate continued strength and conviction from traders in the direction of the current trend. Some traders call these “measuring gaps” because they sometimes occur around the midpoint of a price move, offering a clue as to how much further the trend might extend. Spotting these is key for traders looking to join an ongoing strong move.

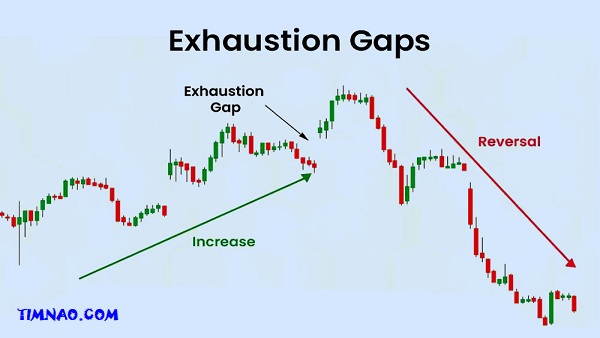

- Exhaustion Gaps:As the name implies, exhaustion gaps often signal the end of a trend. After a prolonged uptrend, a stock might make one final, dramatic gap upwards on high volume, only for the price to then stall or reverse. This can indicate that all the enthusiastic buyers have finally jumped in, and there’s no one left to keep pushing the price higher (or vice-versa in a downtrend). These gaps often get filled relatively quickly as the trend loses steam. Identifying an exhaustion gap can be crucial for taking profits or even considering a counter-trend trade, forming a distinct part of advanced gap trading strategies.

Learning to distinguish between these types is a vital step in developing your gap trading strategies and improving your ability to identify truly profitable gap setups. It takes practice and chart observation, but the insights gained are invaluable.

🧠 Why Do Gaps Occur? Peeking into the Trader’s Mindset

Understanding market gaps goes beyond just seeing them on a chart; it’s about understanding the human psychology and market dynamics that create them. Gaps are born from a rapid and significant shift in the balance of supply and demand, often triggered by new information hitting the market when regular trading is closed.

Consider a company, “InnovateCorp,” trading at $100 per share. After the market closes on Wednesday, InnovateCorp releases a surprisingly positive earnings report, far exceeding analysts’ expectations. They also announce a groundbreaking new product. What happens next?

- The “Wow” Moment: Investors and traders digest this news overnight. Many who don’t own the stock wish they did, thinking, “This company is going to soar! I need to buy!” Those who already own shares might think, “This is even better than I hoped; I should buy more!”

- The FOMO (Fear Of Missing Out) Kicks In: The dominant thought becomes a desire to get in on the action before the price skyrockets. Traders anticipate that when the market opens on Thursday, there will be a rush to buy. This anticipation itself fuels the pre-market demand.

- Pre-Market Action & Order Imbalance: Many decide not to wait. They place buy orders “at the market” or with higher limits in the pre-market session or queue them up for the opening bell. This creates a massive imbalance: a flood of buy orders and relatively few sell orders at the previous closing price of $100.

- The Gap Materializes: When the market officially opens on Thursday, the price has to adjust to this new reality of overwhelming demand. The stock might open at $108, for example, creating an $8 up gap. No trades occurred between $100 and $108 because the demand at those lower prices was so intense it was immediately absorbed, and sellers only became willing to part with their shares at much higher levels.

The reverse can happen with negative news, leading to a down gap. Significant events like clinical trial results for biotech companies, major economic announcements, geopolitical events, or even unexpected CEO changes can all trigger these gaps. The key is that the information is impactful enough to cause a widespread, collective reassessment of the stock’s value by a large number of market participants almost simultaneously. Understanding market gaps through this psychological lens helps in formulating more effective gap trading strategies.

🛠️ Your Power Blueprint: A Beginner-Friendly Strategy for Trading Gaps

Now for the exciting part: turning your understanding market gaps into actionable gap trading strategies. While there are many ways to approach gaps, we’ll focus on a straightforward yet powerful method that is particularly well-suited for beginners. This strategy emphasizes patience and confirmation, helping you avoid common pitfalls.

The core idea is not to jump in immediately when a gap occurs but to wait for the market to give a clearer signal. Remember the psychology we discussed? The initial moments of a gap can be chaotic, driven by emotion. Professionals often use this initial flurry to their advantage. Our strategy aims to align with more considered moves.

Step 1: Identifying Promising Gap Candidates 🔎

The first step is to find stocks that have gapped significantly. We’re not interested in tiny 1% gaps. Look for stocks that have gapped up (for buying opportunities) by at least 3% from their previous day’s closing price. This 3% figure isn’t arbitrary; it often indicates a level of interest strong enough to potentially sustain a move.

Crucially, this gap should be accompanied by significantly higher-than-average trading volume on the day the gap occurs. High volume suggests strong conviction and participation. Think of volume as the fuel behind the price move. A gap on low volume is less reliable. Many traders look for volume that is at least two to three times the stock’s average daily volume.

- How to find them? You don’t need to manually scan hundreds of charts. Stock screeners are your best friend here. Websites like Barchart, Finviz, or TradingView offer powerful screening tools that can filter for stocks gapping up (or down) with specific percentage changes and volume criteria. You can set up a scan for “gap up % > 3%” and “volume increase > 200% average volume.”

- Build a Watchlist: Once your screener identifies potential candidates that meet these initial criteria (e.g., a 3%+ gap up with 3x average volume), add them to a daily watchlist. This is your pool of potential profitable gap setups.

Step 2: The Golden Rule of Patience – Avoid Buying on Day One 🧘

This is perhaps the most crucial rule for beginners in this specific strategy: Do not buy the stock on the day the gap occurs (the “gap day”).

Why? As we discussed in the psychology section, the gap day can be highly emotional. Amateur traders might rush in, driven by FOMO. Professional traders, who may have bought earlier, might use this surge of buying interest to sell their shares and take profits, causing the stock price to fall from its initial gapped-up highs. The peak price reached on the gap day often remains a significant resistance level for some time.

By staying out on the gap day, you let the initial frenzy settle. You allow the “smart money” and the “emotional money” to have their initial battle. Your goal is to enter when the situation becomes clearer and the odds are more in your favor. This simple act of patience can save you from many losing trades and is a cornerstone of disciplined gap trading strategies.

Step 3: The Entry Trigger – Capitalizing on Confirmation ✅

After the market closes on the gap day, your job is simple:

- Mark the High: Identify and note down the highest price the stock reached during that gap day. This “gap day high” is now a critical reference point.

- Set Your Alert: Your entry trigger is when the stock price moves above this marked gap day high. You’re looking to buy when the stock price exceeds the high of the gap day by a small margin (e.g., one or a few cents/ticks, depending on the stock’s price). This move above the gap day high is your confirmation signal.

This signal suggests that the initial selling pressure (if any) that occurred on the gap day has been overcome, and buyers are strong enough to push the price to new short-term highs. It indicates that the bullish sentiment behind the gap is likely genuine and has staying power.

This entry could happen the very next day, a few days later, or even a week or two later. The timing isn’t as important as the price action itself. If the stock never breaks above the gap day high and instead continues to fall, then our strategy keeps us out of that potentially losing trade. This disciplined entry is key to finding profitable gap setups and is a hallmark of robust gap trading strategies.

Let’s illustrate with a hypothetical example:

- InnovateCorp closes at $100 on Monday.

- On Tuesday, due to great news, it gaps up, opening at $108. During Tuesday (the gap day), it trades between a low of $107 and a high of $112, eventually closing at $109. The volume is 5 times its average.

- Step 1 Fulfilled: It’s a >3% gap with high volume. Add to watchlist.

- Step 2 Applied: You do nothing on Tuesday.

- Step 3 Setup: You mark Tuesday’s high: $112. Your potential buy point is just above $112.

- Scenario A (Entry): On Wednesday, InnovateCorp trades higher and hits $112.05. This is your signal to buy.

- Scenario B (No Entry): On Wednesday, InnovateCorp trades lower, perhaps down to $106, and never breaks above $112. You do not buy. The setup is avoided.

This patient, confirmation-based approach to gap trading strategies helps filter out weaker setups and focuses on those with a higher probability of success.

🛡️ Guarding Your Gains: Smart Risk Management and Exit Tactics

Successful trading isn’t just about finding great entry points; it’s equally, if not more, about managing your risk and knowing when to exit your trades. Even the most profitable gap setups can turn sour, and even winning trades need an exit plan to lock in those profits. Effective gap trading strategies always incorporate robust exit rules.

The Non-Negotiable: Your Initial Stop-Loss 🛑

Before you even think about potential profits, you MUST decide where you’ll cut your losses if the trade goes against you. This is your initial stop-loss order.

A common approach for the strategy we’ve discussed is to place your stop-loss just below the low of the candle on the day you entered the trade (the day the price went above the gap day high).

- Example: You bought InnovateCorp at $112.05 when it broke the gap day high. On that entry day, suppose the lowest price it traded was $110.50. You might set your stop-loss at $110.45 (a few cents below the low).

- Why this placement? If the stock falls below the low of your entry day candle, it suggests that the buying momentum that triggered your entry has failed, and it’s wise to exit and protect your capital.

- Discipline is Key: Never widen your initial stop-loss if the trade moves against you, hoping it will “come back.” This is a path to larger losses. Your stop-loss is your safety net; respect it. The power of many gap trading strategies, including this one, is that the initial risk defined by the stop-loss is often relatively small compared to the potential reward if the gap leads to a sustained move.

Cashing In: Clever Ways to Exit Winning Trades 💰

When a trade moves in your favor, the challenge becomes how to maximize your gains without giving too much back if the trend reverses. Here are a few popular exit strategies to consider. It’s wise to test these with paper trading (simulated trading) to see which aligns best with your trading style and risk tolerance.

- The Warning Candle Exit: 🕯️Certain candlestick patterns can signal that a trend is losing steam or about to reverse. Keep an eye out for these “warning candles” when you’re in a profitable long position:

- Large Red (Bearish) Candle: A long, solid red candle after an uptrend can indicate that sellers have taken control with force. It might be time to take your profits.

- Long Upper Wick (Shooting Star-like): If a candle has a small body and a very long wick sticking out the top, it means buyers tried to push the price up during the day, but sellers overwhelmed them and pushed it back down. This shows selling pressure and can be an exit signal.

- Doji Candle at the Top: A Doji (where the open and close prices are very close or the same) after a strong run-up signifies indecision. Neither buyers nor sellers are in control. Often, this indecision can precede a reversal, so it’s a common signal to consider exiting.

- Trailing Stop-Loss Exit: 📈📉This is a dynamic way to protect profits while still allowing a trade room to grow. As the stock moves in your favor, you manually “trail” your stop-loss upwards.

- How it works: After each new day (or a significant price move up), you can adjust your stop-loss to sit just below the low of the previous day’s candle (or the low of the most recent significant swing low).

- Benefit: You lock in more profit as the stock rises.

- Downside: In volatile stocks, you might get “stopped out” prematurely on a minor pullback before the stock continues higher. It’s a trade-off between securing profit and giving the trade room to breathe.

- Fixed Percentage or Risk/Reward Exit: 🎯This is a more predefined approach. Before entering the trade, you decide on a profit target based on a fixed percentage (e.g., aim for a 15-20% gain) or a risk/reward ratio (e.g., if your initial stop-loss represents a $1 risk per share, you might aim for a $2 or $3 profit per share).

- Benefit: It’s systematic and removes emotion from the profit-taking decision. Good for traders who can’t monitor the market constantly.

- Downside: You might exit with a decent profit only to see the stock continue to run much higher.

- The “Always Profitable” Staged Exit (Scaling Out): 🪜This is a popular and psychologically comforting method.

- How it works: Once the stock reaches a certain initial profit target (e.g., up 10-15%), you sell a portion of your position (say, half). This locks in some profit.

- Next Step: For the remaining shares, you then move your stop-loss on that portion to your original entry price. Now, this remaining part of the trade is essentially “risk-free” (excluding initial commissions). If it comes back to your entry, you break even on that portion, but you’ve already pocketed profit from the first half.

- Managing the Rest: You can then let the remaining shares ride the trend, perhaps using a trailing stop-loss or warning candle signals to decide when to sell them.

- Benefit: Guarantees you walk away with some profit, reduces stress, and still allows you to participate in a potentially larger move. This is often favored in gap trading strategies due to the explosive potential of some gaps.

No exit strategy is perfect for all situations. The key is to have a plan before you enter the trade. This discipline is crucial for long-term success in understanding market gaps and executing profitable gap setups.

🎯 Zeroing In: How to Identify the Most Profitable Gap Setups

While our core strategy provides a solid framework, not all gaps that meet the initial criteria will be equally potent. Experienced traders learn to filter for A+ setups by considering additional contextual factors. Refining your selection process is key to consistently finding more profitable gap setups.

Rule #1: Beware of Overhead Resistance! 🚧

This is a critical checkpoint. Before you get too excited about a gap up, always look to the left on the stock chart. Are there any significant “overhead resistance” levels nearby that the price might struggle to break through?

- What is Resistance? Resistance is a price level where selling pressure has historically been strong enough to stop or reverse an uptrend. It could be a previous peak, an area where the stock failed to advance multiple times, or a significant moving average.

- Why it Matters for Gaps: If a stock gaps up directly into a major resistance zone, the rally might stall or even reverse quickly. The existing selling interest at that level could overwhelm the new buyers who created the gap.

- Action: Even if a gap looks tempting based on its size and volume, if it occurs just below a historically strong resistance area, it’s often wise to be extra cautious or even avoid the trade. The probability of failure is higher. Patiently waiting to see if the price can decisively break through that resistance after the gap might be a more prudent approach within your gap trading strategies.

Rule #2: Favor Gaps That Break Out of Ranges or Patterns! 🚀

This is the flip side of the resistance rule and often leads to some of the most profitable gap setups. Gaps that occur as a stock breaks out above a well-defined consolidation range or a bullish chart pattern (like an ascending triangle or a flag) can be exceptionally powerful. These are often the “Breakaway Gaps” we discussed earlier.

- Why They’re Powerful: A consolidation range signifies a period of balance between buyers and sellers. When a stock gaps above such a range, especially on high volume, it signals a decisive victory for the buyers. All the traders who were short (betting on the price to fall) within that range are now losing money and may be forced to buy back their shares (cover their shorts), adding further fuel to the upward move.

- What to Look For:

- Clear Consolidation: Has the stock been trading sideways in a relatively tight price band for several days, weeks, or even months?

- The Breakout Gap: Does the gap clearly lift the price above the upper boundary of this consolidation?

- Volume Confirmation: Is the breakout gap accompanied by a significant surge in volume?

- The “Fakeout” Caveat: Even with range breakouts, remember our core strategy: don’t buy on the gap day itself. Sometimes, a stock will briefly pop above resistance (a “fakeout”) only to fall back into the range. Waiting for the price to exceed the gap day high provides an extra layer of confirmation that the breakout is legitimate. This discipline helps in understanding market gaps that truly signal a new trend.

By incorporating these two rules – avoiding strong overhead resistance and favoring clear breakouts – you significantly tilt the odds in your favor when searching for profitable gap setups. This nuanced approach elevates basic gap trading strategies to a more professional level.

🤸 Versatility is Key: Gap Trading for Short Bursts and Long Hauls

One of the beautiful aspects of the gap trading strategies we’ve explored is their adaptability. Whether you’re aiming for quick profits over a few days or seeking to capture a more substantial trend over weeks or months, understanding market gaps can serve both objectives.

The Short-Term Sprint 🏃♂️

If your goal is to achieve relatively quick gains and then move on to the next opportunity, gap trading can be very effective.

- Example Scenario: A stock gaps up, you enter when it breaks the gap day high, and it rallies 15-20% within a week. Using a warning candle exit or a fixed percentage target, you can lock in your profits and redeploy your capital.

- Focus: You’d be particularly interested in the initial momentum following the breakout above the gap day high. Clear, quick follow-through is what you’re looking for.

The Long-Term Marathon 🧘♀️

Gaps, especially breakaway gaps that clear significant resistance, can often be the starting point of a major new trend that lasts for months.

- Example Scenario: Using the “Always Profitable” staged exit strategy, you might sell half your position for a 20% gain after a few weeks, move your stop on the remaining half to your entry price, and then let that portion ride a powerful uptrend for several months, potentially achieving a 100% or greater return on that second half.

- Focus: Here, the initial gap is seen as a powerful signal of a fundamental shift in the stock’s prospects. You’re willing to endure minor pullbacks as long as the broader uptrend signaled by the gap remains intact.

The Trader’s Choice 🎯

Ultimately, how you use gap trading depends on your personal trading plan, risk tolerance, and time horizon. The strategy of:

- Identifying a significant gap with volume.

- Waiting for the gap day to close.

- Entering only if the price exceeds the gap day high. …provides a solid foundation. Your exit strategy then dictates whether you’re playing for a short-term gain or a longer-term hold. This flexibility is a key reason why understanding market gaps and mastering gap trading strategies can be so valuable for a trader’s toolkit, allowing for the pursuit of various profitable gap setups according to individual preference.

⚙️ Essential Tools & Resources for the Modern Gap Trader

To effectively implement gap trading strategies and consistently identify profitable gap setups, you’ll need a few key tools and resources. Fortunately, many excellent options are available, often with free or affordable versions.

- Stock Screening Software: 🖥️As mentioned earlier, a good stock screener is indispensable for finding gap candidates. Manually searching through thousands of stocks each day is impractical.

- Features to look for: Ability to filter by percentage price change (gap percentage), volume increase, market capitalization, stock price, exchange, etc.

- Popular Options:

- Barchart.com: Offers robust free and premium screeners, including specific “Gap Up” and “Gap Down” screeners.

- Finviz.com: A very popular free screener with a wide array of fundamental and technical filters.

- TradingView.com: An excellent charting platform that also includes a powerful stock screener.

- StockCharts.com: Known for its high-quality charting, it also provides scanning capabilities.

- Tip: Experiment with the settings to create a scan that consistently delivers a manageable list of relevant gap candidates based on your specific criteria (e.g., >3% gap, >200% average volume, price > $5).

- Charting Platforms: 📊Once your screener identifies potential gaps, you’ll need a good charting platform to analyze the price action, identify the gap day high, look for resistance levels, and observe candlestick patterns.

- Features to look for: Clear candlestick charts, drawing tools (for marking highs, lows, resistance lines), volume indicators, ability to add moving averages, and preferably real-time or slightly delayed data.

- Popular Options: Most brokerage platforms (like Charles Schwab’s StreetSmart Edge, TD Ameritrade’s thinkorswim, Interactive Brokers’ TWS) offer excellent built-in charting. Standalone platforms like TradingView and StockCharts.com are also highly regarded. TradingView is particularly popular for its ease of use and community features.

- Paper Trading Account (Simulator): 📝Before risking real money, it is highly recommended that you practice your gap trading strategies in a paper trading environment. This allows you to test your understanding, refine your entry and exit rules, and get a feel for the emotional aspects of trading without any financial risk.

- Where to find them: Many brokers offer paper trading accounts. TradingView also offers a great simulated trading feature.

- Reliable News Source: 📰While our strategy doesn’t solely rely on knowing why a gap occurred, being aware of major news events (earnings, product launches, economic data) can provide context. However, be cautious not to let news override your technical trading rules. The price action and volume are your primary guides.

- Continuous Learning Resources: 📚The market is always evolving. Stay curious and continue learning about technical analysis, market psychology, and risk management. There are countless books, reputable websites, and courses dedicated to trading. Focus on sources that emphasize disciplined, rule-based trading.

Equipping yourself with these tools will significantly enhance your ability in understanding market gaps and executing your gap trading strategies more effectively, ultimately leading you to more profitable gap setups.

⚠️ Common Stumbling Blocks for New Gap Traders (And How to Leap Over Them)

While gap trading strategies can be highly rewarding, beginners often encounter a few common pitfalls. Being aware of these can help you sidestep them and accelerate your learning curve in understanding market gaps and finding profitable gap setups.

-

Impatience and FOMO (Fear Of Missing Out): 😩

- The Pitfall: Seeing a stock gap up significantly and immediately jumping in on the gap day, fearing you’ll miss the move. This often leads to buying at the day’s high, right before professionals might start selling.

- The Leap: Strictly adhere to the rule of not buying on the gap day. Wait for the confirmation of the price breaking above the gap day high. Patience is a virtue in gap trading.

-

Ignoring Volume: 🔇

- The Pitfall: Trading a gap based solely on price movement without considering the volume. A gap on low volume is often unreliable and more prone to failure.

- The Leap: Always ensure the gap day is accompanied by significantly higher-than-average volume (e.g., 2-3 times the average). Volume confirms interest and conviction.

-

Poor Risk Management (No Stop-Loss or Widening Stops): 💸

- The Pitfall: Entering a trade without a predefined stop-loss, or worse, moving your stop-loss further away from your entry if the trade goes against you, hoping it will turn around.

- The Leap: Always set your initial stop-loss before you enter the trade, based on your strategy (e.g., below the low of the entry day candle). Treat it as non-negotiable. Protecting your capital is paramount.

-

Chasing “Too Perfect” Setups or Over-Analysis: 🤯

- The Pitfall: Waiting for a setup that meets every conceivable criterion perfectly, leading to “paralysis by analysis” and missed opportunities. Or, conversely, overcomplicating the relatively simple core strategy.

- The Leap: Stick to the core rules of your chosen strategy. While filtering for quality (like avoiding major resistance) is good, accept that no setup is 100% guaranteed. Focus on consistent execution of a sound strategy.

-

Trading Too Big, Too Soon: 🎢

- The Pitfall: Risking too large a percentage of your trading capital on a single gap trade, especially when starting out.

- The Leap: Start small. Risk only a small percentage (e.g., 1-2%) of your trading capital on any single trade. This allows you to survive losing streaks (which are inevitable) and learn without devastating financial consequences.

-

Emotional Trading After a Win or Loss: 🎭

- The Pitfall: Becoming overconfident and reckless after a big win, or trying to “revenge trade” to make back money after a loss.

- The Leap: Strive for emotional neutrality. Stick to your trading plan regardless of the outcome of the previous trade. Each trade is a new event with its own probabilities.

By being mindful of these common challenges, you can approach gap trading strategies with greater discipline and increase your chances of long-term success in understanding market gaps and capitalizing on profitable gap setups.

🎉 Your Adventure in Mastering Market Gaps Starts Now!

You’ve now journeyed through the essentials of understanding market gaps, from their formation and the psychology behind them to the different types you might encounter. More importantly, you’re equipped with a clear, beginner-friendly framework for developing your own gap trading strategies, focusing on patience, confirmation, and disciplined risk management to identify potentially profitable gap setups.

Remember, the stock market is a domain where knowledge, strategy, and discipline are your greatest allies. The concept of trading gaps isn’t about finding a “get rich quick” scheme; it’s about learning a repeatable process that can, over time, tilt the odds in your favor. The path to proficiency involves practice, ongoing learning, and meticulous record-keeping of your trades to identify what works best for you.

Don’t be discouraged by initial challenges. Every experienced trader was once a beginner. Embrace the learning process, start with paper trading to build your confidence, and gradually transition to real capital when you feel ready. The power of gap trading lies in its ability to signal significant shifts in market sentiment, offering opportunities for both quick tactical wins and participation in longer, more substantial trends.

The strategies outlined here provide a robust starting point. As you gain experience, you may refine them, explore other nuances of gap trading, and develop an intuitive feel for market dynamics. But always anchor yourself to the core principles of sound analysis, patient execution, and unwavering risk control. Your adventure in mastering market gaps has just begun – trade wisely, stay disciplined, and the market’s “empty spaces” might just fill your portfolio with exciting possibilities.

Reference video: