Introduction: Stay Safe in the World of Cryptocurrency

Cryptocurrency offers exciting opportunities for financial growth, but it also attracts scammers looking to exploit unsuspecting investors. Common crypto scams are becoming more sophisticated, making it crucial to recognize the warning signs and protect your assets from fraud.

In this guide, we’ll explore the most prevalent cryptocurrency scams, how they work, and practical steps to avoid falling victim to them.

1. Phishing Scams: Fake Websites & Emails

How Phishing Scams Work

Phishing scams trick users into providing private keys, passwords, or login credentials through fraudulent websites, emails, or messages.

🚨 Common Phishing Tactics:

- Fake emails that appear to be from legitimate crypto exchanges.

- Scam websites mimicking well-known platforms like Binance or Coinbase.

- Telegram and Discord messages claiming urgent security issues.

How to Protect Yourself

✅ Always check the website URL before logging in.

✅ Enable two-factor authentication (2FA) on all accounts.

✅ Never click on links from unknown sources.

✅ Bookmark official websites to avoid mistyped URLs.

🔹 Pro Tip: If an email asks you to enter your credentials, go directly to the official website instead of clicking the link.

2. Ponzi & Pyramid Schemes

How Ponzi Schemes Work

Ponzi schemes promise high returns with little to no risk, but they pay early investors using money from new participants. These scams collapse when new investments stop.

🚨 Red Flags:

- Guaranteed high profits with no risk.

- Referral-based income structures.

- Lack of transparency about how returns are generated.

How to Protect Yourself

✅ Be skeptical of “too good to be true” returns.

✅ Verify if the project has a real use case.

✅ Check for clear, transparent documentation and audits.

🔹 Pro Tip: If a project requires you to recruit others to earn money, it’s likely a scam.

3. Fake Crypto Giveaways

How Giveaway Scams Work

Scammers impersonate celebrities, influencers, or companies and promise to double your crypto if you send them funds first. These scams often appear on Twitter, YouTube, or fake websites.

🚨 Warning Signs:

- “Send 0.1 BTC, get 0.2 BTC back!”

- Fake social media accounts impersonating Elon Musk, Vitalik Buterin, or Binance.

- Time-limited offers pressuring you to act quickly.

How to Protect Yourself

✅ No legitimate company will ask you to send crypto to receive more.

✅ Verify official social media accounts.

✅ Report and block suspicious accounts.

🔹 Pro Tip: If an offer sounds too good to be true, it probably is!

4. Rug Pulls & Scam Tokens

How Rug Pulls Work

A rug pull happens when developers create a fake cryptocurrency project, attract investors, and then suddenly withdraw all funds, leaving investors with worthless tokens.

🚨 How to Spot a Rug Pull:

- No liquidity lock: Developers can remove all funds anytime.

- No clear roadmap or use case.

- Anonymous team with no track record.

How to Protect Yourself

✅ Check if liquidity is locked on platforms like Uniswap.

✅ Research the team and project background.

✅ Look for smart contract audits.

🔹 Pro Tip: Avoid new tokens that skyrocket overnight—most are pump-and-dump scams.

5. Fake Investment Platforms & Cloud Mining Scams

How These Scams Work

Fake trading platforms and cloud mining websites lure investors by promising guaranteed profits and advanced trading bots.

🚨 Scam Warning Signs:

- No withdrawal option after depositing funds.

- Unrealistic daily ROI (e.g., 10% daily profits).

- No official regulation or licensing.

How to Protect Yourself

✅ Use reputable exchanges and trading platforms.

✅ Check reviews on Trustpilot and Reddit.

✅ Avoid platforms that require large upfront deposits.

🔹 Pro Tip: If a platform guarantees profits, it’s most likely a scam.

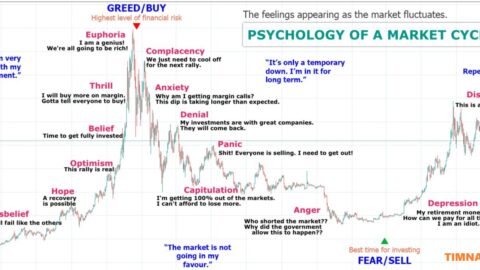

6. Pump-and-Dump Schemes

How Pump-and-Dump Works

A group of investors artificially inflates a cryptocurrency’s price by buying in bulk and promoting it. Once the price peaks, they sell off, leaving others with worthless tokens.

🚨 How to Identify Pump-and-Dump Scams:

- Sudden price spikes without real news.

- Social media hype pushing you to buy quickly.

- Low market cap coins being shilled in Telegram groups.

How to Protect Yourself

✅ Avoid investing based on hype alone.

✅ Check for organic growth and real utility.

✅ Be cautious with low-volume, unknown coins.

🔹 Pro Tip: Stick to well-established cryptocurrencies with real-world adoption.

7. Malware & Fake Wallet Apps

How These Scams Work

Scammers create fake wallet apps that look like trusted ones (e.g., MetaMask, Trust Wallet) to steal private keys and funds.

🚨 How to Spot Fake Wallet Apps:

- App has very few reviews or downloads.

- Requests for your seed phrase immediately.

- Not listed on the official website of the wallet provider.

How to Protect Yourself

✅ Download wallets only from official websites.

✅ Never share your seed phrase.

✅ Check for app legitimacy before installing.

🔹 Pro Tip: If an app asks for your private key or seed phrase, it’s a scam.

Conclusion: Stay Vigilant and Protect Your Crypto Assets

With crypto scams on the rise, knowing how to spot and avoid them is essential. By following best security practices, researching before investing, and staying alert, you can protect your crypto assets from fraudsters.

🚀 Want to stay safe? Follow official sources, enable strong security measures, and trust only reputable platforms for your investments!