🚀 Unlock Amazing Financial Freedom: The Ultimate Guide to DeFi for Beginners!

Welcome, future financial pioneer! If you’ve heard whispers of “DeFi” and wondered if it’s your ticket to a new kind of financial empowerment, you’re in the right place. Decentralized Finance is more than just a buzzword in the crypto world; it’s a revolutionary movement reshaping how we think about money, borrowing, lending, and investing. This guide is crafted specifically for DeFi for beginners, aiming to demystify DeFi and show you how to confidently take your first steps towards financial freedom. Get ready to unlock a world of possibilities!

Table of Contents

- Introduction: Welcome to the Future of Finance! 🔮

- Part 1: Core Concepts: Understanding Decentralized Finance Basics 🧱

- What Exactly is Decentralized Finance (DeFi for beginners)? 🤔

- The Magic Behind DeFi: Blockchain Basics for Beginners 🔗

- Smart Contracts: Automated Engines in DeFi for Beginners 🤖

- Part 2: Getting Started with DeFi: Your First Steps 🚶♀️

- Choosing Your Command Center: Crypto Wallets for DeFi Beginners 🛡️

- Setting Up Your First Wallet: A Guide to Getting Started with DeFi 🛠️

- Top Security Tips: Keeping Your Assets Safe as a DeFi Beginner 🔒

- Part 3: Key Applications: Exploring DeFi for Beginners 🧭

- Decentralized Exchanges (DEXs): A DeFi for Beginners Guide to Trading 📈

- Earning with DeFi for Beginners: An Intro to Lending and Borrowing 💰

- Passive Income for DeFi Beginners: The Power of Staking 💸

- Advanced Earning in DeFi: Yield Farming and Liquidity Mining for Ambitious Beginners 🌱

- Stablecoins: The Bedrock of Stability in Decentralized Finance Basics 💵

- Part 4: Navigating the Wider Ecosystem: More DeFi for Beginners 🌍

- Protecting Investments: DeFi Insurance Explained for Beginners 🛡️

- Having Your Say: Governance & DAOs in DeFi for Beginners 🗳️

- Part 5: Essential Knowledge for Success: More on Getting Started with DeFi ✅

- Research is Key: Analyzing Projects – A DeFi for Beginners Skill 🧐

- Critical Security Practices for DeFi Beginners 🚨

- The Legal Landscape: DeFi Taxes and Regulations for Beginners (2025 Overview) ⚖️

- Part 6: The Future is Decentralized: Next Steps in Your DeFi for Beginners Journey 🚀

- Emerging DeFi Trends for Beginners to Watch (2025 and Beyond) ✨

- Your DeFi Journey: 7 Powerful Ways for Beginners to Get Started with DeFi 🗺️

- Conclusion: Embracing Your Financial Empowerment with DeFi 💪

Introduction: Welcome to the Future of Finance! 🔮

Have you ever felt frustrated with traditional banking? Perhaps it was the high fees, the slow transaction times, or the feeling that you don’t truly control your own money. These are common sentiments, and they highlight the limitations of an aging financial system. But what if there was a different way? A way that puts you in the driver’s seat, offering transparency, accessibility, and opportunities previously reserved for large institutions?

Enter Decentralized Finance, or DeFi. This isn’t just a fleeting trend; it’s a fundamental shift in how financial services are built and accessed. DeFi aims to create an open-source, permissionless, and transparent financial service ecosystem available to everyone with an internet connection, operating without any central authority. Imagine a world where you can lend, borrow, trade, and invest without needing to trust a third party – that’s the powerful promise of DeFi.

For beginners, the world of DeFi might seem intimidating with its new terms and technologies. However, at its heart, DeFi is about democratizing finance. It’s about providing tools and services that can lead to greater financial freedom and control over your assets. This article will break down the essentials of DeFi for beginners, guiding you through its core concepts, how to get started with DeFi safely, and how to explore its exciting applications.

Part 1: Core Concepts: Understanding Decentralized Finance Basics 🧱

Before diving into the “how-to,” it’s crucial to grasp what DeFi is and the technologies that make it possible. Understanding these Decentralized Finance basics will empower you to navigate the DeFi space with more confidence.

What Exactly is Decentralized Finance (DeFi for beginners)? 🤔

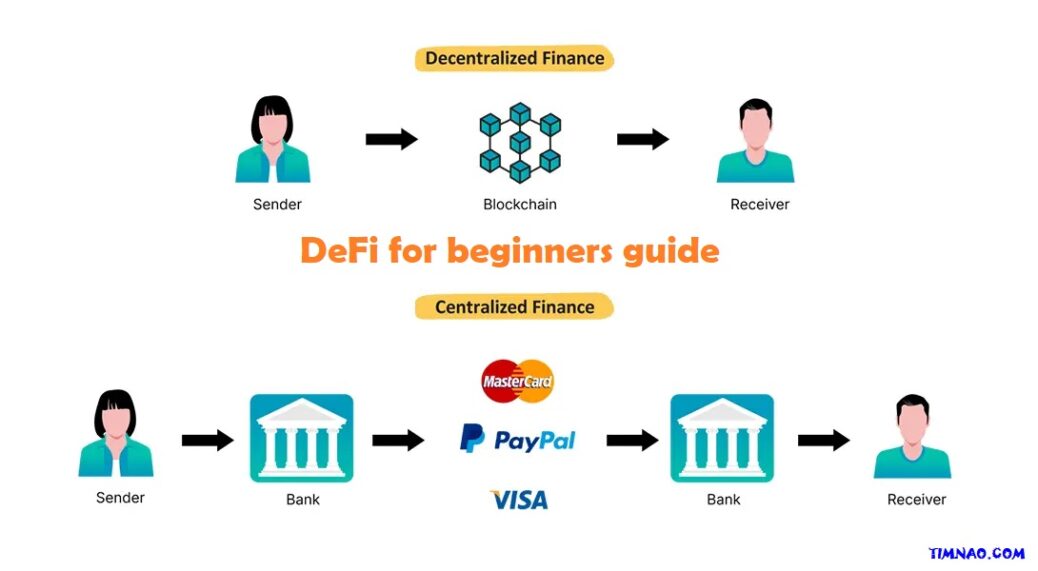

Decentralized Finance (DeFi) refers to a broad category of financial applications built on blockchain technology, aiming to recreate and improve1 upon traditional financial systems without relying on central intermediaries like banks or brokerages. Think of it as taking the services you’re used to – like saving, lending, borrowing, trading, insuring – and making them open, global, and accessible to anyone. This concept is foundational for anyone interested in DeFi for beginners.

The core principles of DeFi that make it so revolutionary for beginners include:

- Accessibility: Anyone with an internet connection and a crypto wallet can access DeFi services. This is a massive step towards financial inclusion.

- Transparency: Most DeFi transactions are recorded on a public blockchain, meaning they are visible and verifiable by anyone.

- No Intermediaries (Disintermediation): DeFi applications often use smart contracts to automate processes, removing traditional financial go-betweens.

- User Control (Self-Custody): In many DeFi applications, you retain control of your private keys and, therefore, your assets.

- Permissionless: Generally, you don’t need permission to use DeFi protocols or build on top of them.

How does this differ from Traditional Finance (TradFi)? TradFi is centralized, often slow, expensive, and exclusionary. DeFi, on the other hand, aims to be more open, efficient, and user-centric, which are key attractions for DeFi for beginners.

The Magic Behind DeFi: Blockchain Basics for Beginners 🔗

The technology that underpins the entire DeFi ecosystem is blockchain. It’s more than Bitcoin; it’s a versatile platform. For DeFi beginners, understanding blockchain is key to understanding Decentralized Finance basics.

Imagine a digital ledger, distributed across many computers, recording transactions in “blocks.” Once a block is filled, it’s chained to the previous one, creating a secure and transparent record.

Key blockchain characteristics vital for DeFi:

- Decentralization: No single point of control, enhancing security.

- Transparency: Transactions are typically public and verifiable.

- Immutability: Once recorded, data is extremely hard to change.

- Security: Cryptography protects transactions and data integrity.

Ethereum is a prominent blockchain for DeFi, but others like Solana and Avalanche also host thriving ecosystems. This foundational layer is what makes DeFi for beginners possible and secure.

Smart Contracts: Automated Engines in DeFi for Beginners 🤖

If blockchain is the foundation, then smart contracts are the engines that power DeFi applications, a crucial concept in DeFi for beginners.

A smart contract is a self-executing contract with agreement terms written directly into code. It automatically runs when predefined conditions are met, no intermediary needed.

How smart contracts work in DeFi for beginners:

- Code is Law: The financial agreement rules are programmed in.

- Self-Executing: Actions trigger automatically when conditions are met.

- Automation: Streamlines complex financial processes, reducing costs.

- Trustless: Users interact based on code logic, not personal trust.

For instance, a DeFi lending platform uses smart contracts to manage loans, collateral, and interest automatically. This automation is a cornerstone of Decentralized Finance basics.

Part 2: Getting Started with DeFi: Your First Steps 🚶♀️

Now that you grasp Decentralized Finance basics, let’s get practical. Your journey into DeFi for beginners starts with setting up secure access to this new financial world. Getting started with DeFi involves a few key initial actions.

Choosing Your Command Center: Crypto Wallets for DeFi Beginners 🛡️

Your crypto wallet is your primary tool for interacting with the DeFi ecosystem. For DeFi beginners, selecting the right wallet is crucial. It’s more than storage; it’s your gateway to dApps and asset management.

Types of Wallets for DeFi Beginners:

- Software Wallets (Hot Wallets): Apps on your computer/smartphone (e.g., MetaMask, Trust Wallet, Coinbase Wallet). Convenient for frequent use but require internet, posing slight risks. Great for DeFi for beginners to learn with small amounts.

- Hardware Wallets (Cold Wallets): Physical devices (e.g., Ledger, Trezor) storing keys offline. Offer top security for larger sums. A good investment as your DeFi involvement grows.

- Non-Custodial Wallets: You control your private keys. Essential for true DeFi interaction and highly recommended for DeFi for beginners.

Popular beginner-friendly wallets in 2025 for getting started with DeFi include MetaMask, Coinbase Wallet, and Trust Wallet. Look for security, ease of use, and blockchain compatibility.

Setting Up Your First Wallet: A Guide to Getting Started with DeFi 🛠️

Let’s walk through setting up a wallet like MetaMask, a common step for getting started with DeFi:

- Download and Install: From the official website only (e.g.,

metamask.io). - Create a New Wallet: Choose to create a new wallet and set a strong password.

- Secure Your Seed Phrase: This 12 or 24-word phrase is vital. Write it on paper, store it in multiple secure offline locations. Never share it. This is paramount for anyone getting started with DeFi.

- Understand Keys: Your public address is like a bank account number (sharable). Your private key (derived from the seed phrase) is secret and controls your funds.

- Wallet Ready: You can now connect to dApps and manage assets.

This setup is a fundamental part of the DeFi for beginners experience.

Top Security Tips: Keeping Your Assets Safe as a DeFi Beginner 🔒

As a DeFi beginner, you are your bank’s security chief. Prioritize these practices:

- Guard Seed Phrase/Private Keys: Offline, secure, never shared.

- Strong, Unique Passwords: For wallets and related accounts.

- Bookmark Official Sites: Avoid phishing by using bookmarks for DeFi platforms.

- Beware of Scams: Skepticism towards unsolicited offers or requests for keys is healthy for DeFi beginners.

- Verify Contracts: Check smart contract addresses from reliable sources.

- Hardware Wallet for Larger Sums: Essential as your DeFi portfolio grows.

- Keep Software Updated: For security patches on your wallet, browser, and OS.

- Revoke Token Approvals: Regularly manage dApp permissions via tools like Etherscan.

- Start Small: When learning, especially for DeFi for beginners, use amounts you can afford to lose.

Staying vigilant is key when getting started with DeFi.

Part 3: Key Applications: Exploring DeFi for Beginners 🧭

With your wallet ready and security in mind, let’s explore what DeFi for beginners has to offer. The DeFi ecosystem is vast, but some core applications are particularly relevant when you’re getting started with DeFi.

Decentralized Exchanges (DEXs): A DeFi for Beginners Guide to Trading 📈

A core DeFi for beginners activity is trading on Decentralized Exchanges (DEXs). These platforms allow peer-to-peer crypto trading directly from your wallet, without intermediaries.

Many DEXs use an Automated Market Maker (AMM) model with liquidity pools. Users (liquidity providers) supply token pairs, and traders swap against these pools. Prices are set algorithmically. This is a key Decentralized Finance basic to grasp.

Benefits for DeFi Beginners:

- Fund Control: Assets stay in your wallet until traded.

- Token Access: Wider range of tokens, often listed faster than on centralized exchanges.

- Reduced Counterparty Risk: No central entity holding funds.

Popular DEXs for getting started with DeFi in 2025: Uniswap, PancakeSwap, SushiSwap. Understand slippage (price difference on execution) and gas fees (network transaction costs) before trading.

Earning with DeFi for Beginners: An Intro to Lending and Borrowing 💰

DeFi for beginners offers revolutionary ways to lend and borrow. DeFi lending platforms let you:

- Lend: Deposit crypto to earn interest from borrowers.

- Borrow: Use crypto as collateral to take out loans, often over-collateralized.

Benefits:

- Lenders: Potentially higher interest rates than traditional savings.

- Borrowers: Access liquidity without selling crypto.

Popular platforms for DeFi beginners include Aave, Compound Finance, and MakerDAO. Risks include smart contract vulnerabilities and liquidation if collateral value drops. Lending stablecoins can be a safer start for DeFi for beginners.

Passive Income for DeFi Beginners: The Power of Staking 💸

Staking is a popular way for DeFi beginners to earn passive income while securing a Proof-of-Stake (PoS) blockchain. It involves locking up tokens to participate in network operations (like validating transactions) in return for rewards.

Benefits:

- Earn Rewards: Generate passive income.

- Support Networks: Contribute to blockchain security.

Many PoS coins like Ethereum (ETH), Solana (SOL), and Cardano (ADA) offer staking. Platforms like Lido (for liquid staking) make ETH staking accessible for DeFi beginners. Be aware of lock-up periods and slashing risks (penalties for validator misbehavior).

Advanced Earning in DeFi: Yield Farming and Liquidity Mining for Ambitious Beginners 🌱

Yield farming and liquidity mining are more advanced DeFi strategies, not typically for absolute DeFi beginners due to higher risks and complexity.

- Liquidity Mining: Provide asset pairs to liquidity pools on DEXs/lending platforms for rewards (platform tokens, fee shares).

- Yield Farming: Strategically moving assets across DeFi protocols to maximize returns.

These offer high potential APYs but come with risks like impermanent loss (value difference if token prices diverge significantly in a pool) and greater smart contract exposure. Approach with extreme caution if you are just getting started with DeFi.

Stablecoins: The Bedrock of Stability in Decentralized Finance Basics 💵

In the volatile crypto world, stablecoins are crucial for DeFi beginners and understanding Decentralized Finance basics. They are pegged to fiat (e.g., USD), reducing volatility.

Importance in DeFi:

- Store of Value: Hedge against crypto price swings.

- Trading Pair: Common base for DEX trades.

- Lending/Borrowing: Popular for earning predictable interest.

Types: Fiat-collateralized (USDT, USDC), crypto-collateralized (DAI). Popular stablecoins in 2025: USDT (Tether), USDC (Circle), DAI. Using established stablecoins is a good practice for DeFi for beginners.

Part 4: Navigating the Wider Ecosystem: More DeFi for Beginners 🌍

Beyond core applications, other DeFi tools and concepts enhance the DeFi for beginners experience. Understanding these will help you navigate the broader DeFi world.

Protecting Investments: DeFi Insurance Explained for Beginners 🛡️

As DeFi grows, so does the need for protection against risks like smart contract exploits. DeFi insurance helps mitigate these. For DeFi beginners with growing investments, this is an important consideration.

DeFi insurance protocols (InsurAce.io, Nexus Mutual) allow users to buy coverage for specific protocols. If a covered event occurs, policyholders can claim losses. While beginners with small amounts might defer this, it’s a key risk management tool as investments grow.

Having Your Say: Governance & DAOs in DeFi for Beginners 🗳️

A key aspect of “decentralized” in DeFi is community governance, often via governance tokens and Decentralized Autonomous Organizations (DAOs). This is an exciting part of DeFi for beginners to understand.

- Governance Tokens: Tokens (e.g., UNI, AAVE) granting voting rights on protocol development, upgrades, etc.

- DAOs: Organizations run by code and community members via token-based voting.

They foster decentralization and community engagement. While active DAO participation might be a later step for DeFi beginners, knowing many protocols are community-governed is important.

Part 5: Essential Knowledge for Success: More on Getting Started with DeFi ✅

Successfully getting started with DeFi requires diligence, a security-first mindset, and awareness of the broader context.

Research is Key: Analyzing Projects – A DeFi for Beginners Skill 🧐

With many DeFi projects, “Do Your Own Research” (DYOR) is vital for DeFi beginners to avoid scams.

Beginner’s Checklist:

- Team: Experienced and reputable? Anonymous or public?

- Whitepaper: Clear goals, tech, and tokenomics?

- Tokenomics: Token utility, supply, distribution?

- Community: Active and supportive (Twitter, Discord)?

- Security Audits: By reputable firms (CertiK, ConsenSys Diligence)?

- Value Proposition: Real problem solved?

- Total Value Locked (TVL): (via DeFi Llama) Indicates user trust.

Red flags include guaranteed high returns, anonymous teams with no track record, and lack of audits. This research skill is critical when getting started with DeFi.

Critical Security Practices for DeFi Beginners 🚨

Security is paramount for DeFi beginners. Recap and expansion:

- “Not Your Keys, Not Your Crypto”: Emphasizes non-custodial wallets.

- Smart Contract Risks: Even audited contracts can have bugs. Favor projects with multiple reputable audits.

- Phishing/Social Engineering: Be vigilant against fake sites, emails, and DMs asking for keys.

- Transaction Verification: Carefully review what you approve in your wallet.

- Limit Token Approvals: Periodically revoke unnecessary dApp permissions.

- Use Reputable dApps: Stick to well-known platforms when getting started with DeFi.

Your security is your responsibility, a core tenet of DeFi for beginners.

The Legal Landscape: DeFi Taxes and Regulations for Beginners (2025 Overview) ⚖️

DeFi for beginners must understand that DeFi is not a tax-free zone. Most tax authorities treat crypto as property, with transactions triggering taxable events.

Common Taxable Events:

- Trading/Swapping crypto.

- Earning interest/yield/staking rewards.

- Selling crypto for fiat.

- Receiving airdrops.

Keep meticulous records. Regulations are evolving; in the US, Form 1099-DA for digital assets is emerging. Disclaimer: This is not financial or tax advice. Consult a qualified tax professional. This is a crucial step for anyone serious about getting started with DeFi.

Part 6: The Future is Decentralized: Next Steps in Your DeFi for Beginners Journey 🚀

The DeFi space is dynamic. For DeFi for beginners, staying informed and knowing how to continue learning is key.

Emerging DeFi Trends for Beginners to Watch (2025 and Beyond) ✨

The DeFi landscape evolves. Trends for DeFi beginners to note:

- Institutional Adoption: More traditional finance entering DeFi.

- Interoperability (Cross-Chain): Seamless asset transfer between blockchains.

- TradFi-DeFi Integration: Hybrid models bridging both worlds.

- Layer 2 Scaling: Faster, cheaper transactions (Optimism, Arbitrum).

- Real-World Assets (RWAs): Tokenizing physical assets for DeFi.

- Sustainable Yields: Focus on long-term value.

- Enhanced Security/Insurance: Growing with the value locked in DeFi.

- Regulatory Clarity: Evolving guidelines for DeFi operations.

These trends will shape the future experience for DeFi for beginners.

Your DeFi Journey: 7 Powerful Ways for Beginners to Get Started with DeFi 🗺️

Feeling excited and perhaps a little overwhelmed? That’s normal! To help you navigate your entry into Decentralized Finance, here are 7 powerful and practical ways for DeFi beginners to get started with DeFi:

- Master DeFi Basics & Commit to Continuous Learning:

- Action: Understand core concepts (Part 1). Commit to ongoing education as the DeFi space evolves.

- Resources: Reputable educators (Bankless, The Defiant), project docs, Ethereum.org.

- Secure Your Journey: Get the Right Crypto Wallet & Protect It Fiercely:

- Action: Choose a beginner-friendly, non-custodial wallet. Secure your seed phrase offline.

- Why it’s Powerful: Your wallet is your gateway. Security is paramount for DeFi for beginners.

- Dip Your Toes: Make Your First DEX Swap (Small Scale):

- Action: With a small amount of crypto, try a swap on a known DEX (Uniswap, PancakeSwap).

- Why it’s Powerful: Hands-on experience demystifies decentralized trading in a low-risk way for those getting started with DeFi.

- Earn Safely: Explore Lending Stablecoins for Passive Income:

- Action: Lend a small amount of stablecoins on platforms like Aave or Compound Finance.

- Why it’s Powerful: A lower-risk way for DeFi for beginners to earn passive income.

- Support Networks & Earn: Try Staking Well-Established Cryptocurrencies:

- Action: Explore staking PoS coins (ETH, SOL, ADA) via liquid staking (Lido) or other reputable methods.

- Why it’s Powerful: Earn rewards while contributing to blockchain security – great for DeFi beginners.

- Become a Smart Investor: Learn to Research DeFi Projects (DYOR):

- Action: Before investing, research teams, whitepapers, tokenomics, audits (Part 5).

- Why it’s Powerful: Crucial for identifying legitimate projects and avoiding scams when getting started with DeFi.

- Fortify Your Defenses: Implement Robust Security Practices Always:

- Action: Use strong passwords, 2FA, be vigilant against phishing, review token approvals.

- Why it’s Powerful: In DeFi, you are your bank and security chief.

Key Principles for Your DeFi for Beginners Journey:

- Start Small: Only invest what you can comfortably lose.

- Understand Risks: Smart contracts, impermanent loss, volatility.

- Patience: Building knowledge takes time.

- Engage Communities (Responsibly): Learn, but beware of DMs/scams.

Your journey into Decentralized Finance basics is a marathon.

Conclusion: Embracing Your Financial Empowerment with DeFi 💪

You’ve now taken a significant first step into understanding the incredible world of Decentralized Finance. From grasping Decentralized Finance basics like blockchain and smart contracts to exploring wallets, DEXs, lending, and staking, this DeFi for beginners guide has equipped you with foundational knowledge.

DeFi is about a shift towards a more open, transparent, and user-controlled financial system. It offers potential for greater financial freedom and innovative earning opportunities. However, this power comes with responsibility. The path for DeFi beginners requires continuous learning, diligent research, and an unwavering commitment to security.

Welcome to the future of finance. Your journey to financial empowerment through DeFi starts now. Explore responsibly, learn continuously, and may your adventures in Decentralized Finance be rewarding!

Reference video: