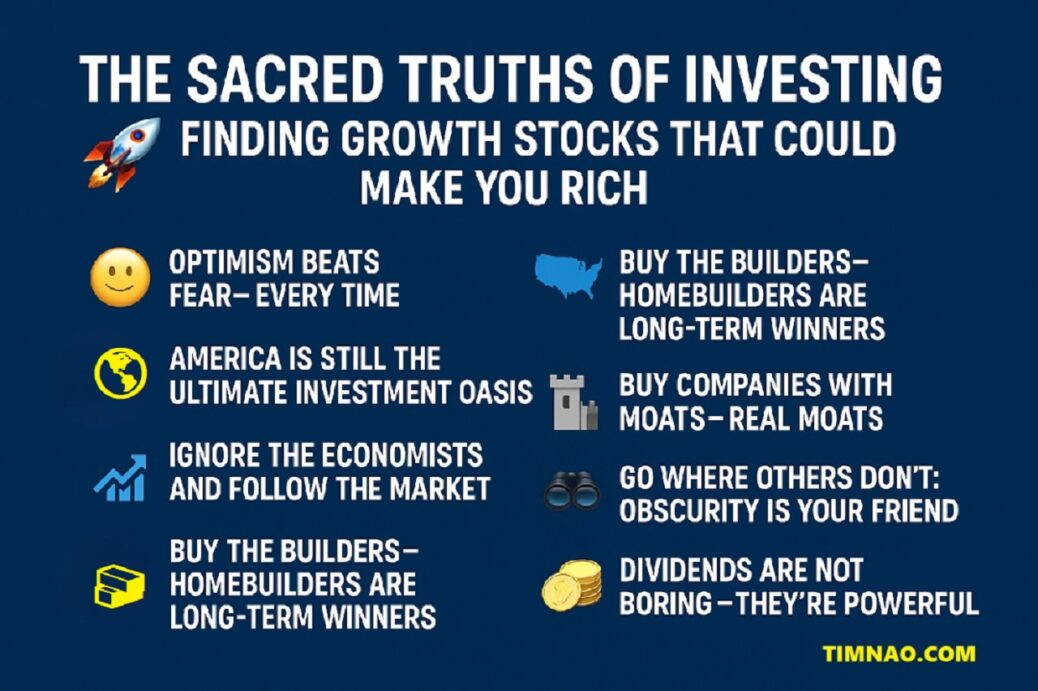

🚀 Unlock Amazing Wealth: 18 Sacred Truths for Finding Growth Stocks 🚀

Finding growth stocks that skyrocket your portfolio feels like uncovering hidden treasure. It’s the dream, right? Turning a modest investment into substantial wealth. But the stock market isn’t just a treasure map; it’s a vast, complex ocean with shifting tides, hidden currents, and the occasional storm. How do you navigate it successfully?

It turns out there are enduring principles, “sacred investing truths,” that can guide you toward finding growth stocks capable of generating incredible returns over time. This isn’t about chasing fleeting fads or complex financial wizardry. It’s about understanding foundational ideas, developing a solid framework, knowing where to look, and cultivating the right mindset.

Drawing inspiration from Louis Navellier’s insights in “The Sacred Truths of Investing” and combining them with current market realities, let’s embark on a journey to uncover these principles. Whether you’re a beginner dipping your toes into stock market investing or a seasoned investor looking to refine your strategy, these truths can illuminate your path to wealth building.

Laying the Groundwork: Essential Mindsets and Market Truths 🧭

Before diving into stock specifics, we need a solid foundation. Your mindset, understanding of the broader economic landscape, and approach to market volatility are just as crucial as any stock analysis tool.

Truth #1: Build Your Foundation with Bricks (Not Straw!) 🧱

Just like building a sturdy house requires solid bricks, successful investing needs a strong personal and intellectual foundation. Where you come from, your experiences, and even chance encounters shape how you see the world and, consequently, how you invest. Louis Navellier shares his background, from carrying hod for his bricklayer father to stumbling upon quantitative analysis concepts like Alpha while helping a professor at Cal State Hayward. These experiences, seemingly unrelated to finance, ingrained a numerical, analytical approach.

Your unique background matters. Embrace it. Understand how your experiences shape your risk tolerance and perspective. Build on your strengths – maybe you’re analytical, perhaps patient, maybe deeply optimistic. These personal “bricks” are the start of your successful investing journey.

Truth #2: Optimism Generates Wealth, Pessimism Breeds Losses 😊💰

This might sound simple, but it’s profoundly important: to succeed in stock market investing, especially with growth stocks, you must be an optimist. Why? Because stocks trade on future prospects. Growth isn’t linear; even the best stocks experience terrifying volatility.

Think about Nvidia (NVDA). Its chips are powering the AI revolution, and the stock reflects that. But between 2018 and 2022, it faced drops of over 50% twice! What keeps an investor holding on through such drops? Not fear, but optimism about the long-term potential. Those who held on have been massively rewarded.

Pessimism leads to selling at the wrong time. Remember the constant recession fears from 2021-2023? Economists predicted doom, media amplified it, yet the markets soared afterward. Those who listened to the pessimists missed significant gains. Even tech giants like Google (Alphabet) swooned during that period, dropping 40%. Optimistic investors who saw the long-term potential, perhaps in AI development, reaped far greater rewards than those who sold in fear.

Optimism isn’t blind faith; it’s a conviction in possibilities and the resilience to stay the course through turbulence. As Keith Fitz-Gerald puts it, “Optimism is the only true path to profits”.

Truth #3: The United States Is (Still) an Oasis for Investors 🏝️🇺🇸

Despite global challenges and competition, the U.S. economy remains a powerful engine for wealth creation. It possesses structural advantages: a culture of entrepreneurship, vast investment in research and development (nearly $800 billion annually), significant capital expenditures driving earnings, competitive states fostering innovation, and an unparalleled ability to assimilate global talent.

Think about it: U.S. stock markets represent 43% of the world’s total stock value, despite having only 4% of the population. Companies like Apple (AAPL) have market caps larger than the GDP of entire developed nations. The U.S. consistently generates enormous wealth through dividends ($580 billion from S&P 500 companies in 2023) and bond interest. This self-perpetuating growth creates a fertile ground, an “oasis,” for investors seeking growth stocks. While other economies face structural headwinds (Japan’s stagnation, China’s real estate and deflation issues, potential challenges in India), the U.S. continues to innovate and grow, making it a relatively stable and opportunity-rich environment.

Truth #4: Don’t Hang Your Hat on Economists’ Forecasts 📉📊

Economists try to predict the future, but their track record, especially regarding recessions, is notoriously poor. Relying solely on their forecasts for your investment strategy is a recipe for missed opportunities or unnecessary fear. The “imminent” recession predicted from 2021-2023 never materialized, yet many investors who heeded these warnings stayed on the sidelines, missing significant market gains.

Instead of economists, listen to the markets and focus on tangible data, particularly consumer data. Why the consumer? Because personal consumption drives nearly 70% of the U.S. GDP. Pay attention to:

- Employment Data: Real payroll data (like ADP reports) is often more reliable than government figures. Declining employment signals declining spending.

- Consumer Confidence: Indices like the University of Michigan’s survey indicate spending propensity.

- Consumer Credit & Delinquencies: Rising borrowing can be positive, but rising delinquencies signal stress. (Data from NY Fed).

- Consumer Spending Reports: Direct measure of consumer activity (BEA reports).

- Consumer Prices (Core CPI): Inflation impacts spending power, especially housing costs.

Focus on the consumer, the real engine of the economy, not the often-flawed predictions of the “dismal science”.

Truth #5: Patience Beats Greed Every Single Time ⏳🐢

Gordon Gekko was wrong. Greed isn’t good; it often leads to bubbles and crashes, like the dot-com bust and the Great Recession. In these events, the pain spreads far wider than the initial gains.

Market crashes fueled by greed (whether from venture capitalists pushing shaky IPOs or investment banks leveraging subprime mortgages) are inevitable. When they happen, you face a choice: panic or practice patience.

Patience is the investor’s superpower. Look at the long-term charts of the Nasdaq or S&P 500. The devastating crashes of 2000-2002 and 2008-2009 look like blips now. It took years to recover – the Nasdaq didn’t regain its 2000 peak until 2015 – but patient investors who held quality stocks eventually saw their wealth restored and grow far beyond previous highs.

Focusing on fundamentally superior stocks helps build the confidence needed for patience. These stocks tend to bounce back faster after downturns. Adjust your risk based on your time horizon, but remember that long-term, patient investing in quality companies is the proven path.

Truth #6: Our Debt is Unsustainable (But Dividends Offer Salvation!) 💸🛡️

The U.S. national debt is enormous ($34 trillion and counting), exceeding the nation’s GDP. Interest payments alone crossed $1 trillion in 2023. This isn’t just an abstract number; it has real implications for investors.

Rising debt and interest payments can lead foreign investors (who hold trillions in U.S. Treasuries) to demand higher yields, potentially creating a debt spiral. Weakening demand for Treasury auctions (lower bid-to-cover ratios) pushes yields up, increasing the government’s borrowing costs and potentially squeezing private investment. Some models suggest high debt levels already drag on GDP growth. While default isn’t immediate, the Penn Wharton Budget Model estimates corrective action is needed within ~20 years.

What does this mean for your income strategy, especially in retirement? Relying solely on government bonds becomes riskier. Rising interest rates erode the value of existing bonds if you need to sell before maturity.

Consider dividend-paying stocks as a potential alternative or supplement. Unlike bonds, quality dividend stocks offer:

- Income Growth: Companies often increase dividends over time, providing a hedge against inflation.

- Capital Appreciation: The underlying stock price can also grow, unlike a bond’s fixed principal.

Dividend investing requires careful selection (more in Chapter 14), but fundamentally sound companies with growing dividends offer a powerful combination of income and growth potential, providing a potential “salvation” in an era of uncertain debt markets.

Truth #7: Market Seasons Repeat – Use Them to Your Advantage ☀️❄️🍂🌸

The stock market, like nature, has seasons. Patterns repeat, driven by factors like holidays, tax deadlines, earnings seasons, and even collective investor mood (seasonal emotion). Understanding these seasonal tendencies helps you:

- Stay Rational: Recognize that some market swings are part of predictable patterns, tempering fear or irrational exuberance.

- Benchmark Appropriately: A calendar year captures a full cycle of seasons, making it a sensible timeframe for analyzing performance.

Here’s a quick look at typical seasonal patterns (based on historical S&P 500 data):

- January: Often strong due to the “January effect” (bonus investments, IRA/401k contributions), early earnings optimism, and the “fresh start” effect.

- February/March: February often consolidates January’s gains. March sees increased volume from quarter-end “window dressing” by funds and companies, plus analyst revisions.

- April: Historically strong, fueled by last-minute IRA contributions, earnings reports, and improved investor mood with spring weather.

- May: Often lackluster as earnings season winds down.

- June/July: June can see a lift from second-quarter window dressing and the Russell 2000 index realignment. July is historically often the best month, buoyed by holiday optimism and early positive earnings.

- August: Typically weak, with low volume due to vacations increasing anomaly risk (like flash crashes).

- September: Often the worst month. Post-Labor Day blues and tax-payment selling pressure outweigh late-month window dressing.

- October-December: Generally strong. October starts slow but finishes well with earnings. November sees an accelerating early “January effect” and holiday optimism. December involves tax-loss selling but finishes strong with holiday mood and year-end contributions.

Knowing these general tendencies provides context, helping you navigate the inevitable ups and downs with a steadier hand.

Truth #8: The Great Wealth Transfer is Here – And It’s Bullish 💰➡️👨👩👧👦

The Baby Boomer generation, the wealthiest in history, is now entering the stage where its vast assets ($73 trillion!) will transfer to younger generations, primarily Gen X and Millennials. This “great wealth transfer” isn’t just a future event; it’s happening now and will continue for the next ~20 years.

Why is this bullish for markets?

- Massive Inflows: Estimates suggest around $20 trillion from liquidated real estate, checking/savings, personal property, and bonds could flow into the equity market as more growth-oriented younger generations inherit conservatively allocated Boomer assets. This represents nearly 43% of the current total U.S. stock market value!

- Shrinking Supply: While demand is poised to increase, the supply of public stocks is shrinking due to buybacks, M&A, and companies going private. The number of public companies has roughly halved since the mid-1990s.

- Buying the Dips: This influx of capital, likely deployed gradually, creates a potential buffer against severe, prolonged downturns. Inherited funds may be used to “buy the dips,” potentially leading to quicker recoveries.

This demographic shift creates a powerful, long-term tailwind for the stock market, supporting prices and offering a degree of resilience against sell-offs.

Building Your Toolkit: A Practical Framework for Stock Analysis 🛠️🔍

Knowing the foundational truths is essential, but you also need a practical framework for identifying specific growth stocks. This involves digging into a company’s financial health (fundamentals) and understanding its market behavior (quantitatives).

Truth #9: Know Your Fundamentals (The Bedrock of Stock Selection) 📊📈

Fundamental analysis examines a company’s financial performance, forecasts, and strength. It’s the bedrock because it reveals how a company is actually doing relative to its peers and the market overall. While quantitative factors matter immensely (see Truth #10), fundamentals tell you if the underlying business engine is sound.

Key fundamental metrics to focus on (many emphasizing growth) include:

- Sales Growth: Is revenue increasing? Why? Organic growth and recurring revenue are generally higher quality than growth solely from acquisitions.

- Operating Margin & Operating Earnings Growth: Is the company becoming more profitable on its core business operations as it grows? Growing sales and margins simultaneously is a powerful sign. Look at income from operations, before taxes and non-core items.

- Cash Flow: Often a better indicator of health than reported earnings, as earnings can include non-cash items like depreciation. Is cash flow growing? Is it sufficient to fund investments, dividends, and buybacks? Compare cash flow growth to earnings growth.

- Earnings Momentum, Analyst Revisions, & Earnings Surprises: Is the rate of earnings growth accelerating? Consistent positive earnings surprises (beating analyst forecasts) and upward analyst revisions signal momentum and attract investors.

- Return on Equity (ROE): Measures how effectively management uses shareholders’ invested capital (including retained earnings) to generate profit (Net Income / Shareholder’s Equity). Is ROE trending upwards? Is it strong relative to industry peers?

Navellier’s approach ranks these fundamentals relative to thousands of other stocks, identifying leaders within the current market environment, rather than using absolute thresholds. Tools like the Portfolio Grader can help automate this relative comparison. Strong fundamentals identify companies worthy of a closer look.

Truth #10: Understand Alphas, Betas, and Deviants (The Quantitative Edge) 🤓🔢

Fundamentals tell part of the story, but growth stocks don’t operate in a vacuum. Market sentiment, volatility, and correlation drastically impact performance. Quantitative analysis helps measure these factors.

Key quantitative concepts:

- Beta (Systematic Risk): Measures how much a stock tends to move in relation to the overall market (e.g., the S&P 500). A beta of 1 means it moves with the market; >1 means more volatile; <1 means less volatile. High beta amplifies gains in bull markets but increases losses in downturns. Low beta offers protection but may lag in rallies. Understanding beta helps manage portfolio risk relative to market movements.

- Alpha (Unsystematic Risk / Excess Return): Measures a stock’s performance independent of the market’s movement. High alpha indicates the stock has drivers beyond the general market trend, often due to strong company-specific factors attracting buying pressure. Finding stocks with high alpha relative to the correct benchmark (e.g., Nasdaq for tech, not just S&P 500) is crucial.

- Standard Deviation (Volatility): Measures how much a stock’s price fluctuates around its average price (typically over 52 weeks). High standard deviation means a bumpy ride (like Cipher Mining); low standard deviation means smoother performance (like Illinois Tool Works or Hartford Financial). Lower standard deviation often indicates consistent buying pressure keeping the price stable or smoothly rising.

Quantitative analysis reveals risks and opportunities that fundamentals alone might miss.

Truth #11: Pull It All Together (Blend Fundamental & Quantitative) 🤝✨

Neither fundamental nor quantitative analysis alone is sufficient for superior returns. The magic happens when you blend them. Fundamentals identify financially sound companies, while quantitative analysis pinpoints those least susceptible to market noise and most likely to appreciate due to strong buying pressure and independent strength.

Navellier emphasizes weighting quantitative factors more heavily (70%) in the overall stock grade, based on decades of results showing this combined approach outperforms models based solely on fundamentals. Examples like Dave & Buster’s (strong fundamentals, weak quant, poor stock performance) versus Alarum Technologies (strong fundamentals, strong quant, stellar stock performance) illustrate this point.

The “secret sauce” involves calculating a Reward/Risk Ratio: Alpha / Standard Deviation. This ratio identifies stocks offering the most non-market-correlated return (Alpha) for the least amount of price volatility (Standard Deviation). Higher ratios (often 0.4 to 0.85 being a strong range) indicate more reward per unit of risk.

Using a tool like the Portfolio Grader, investors can access these combined rankings without needing sophisticated software, identifying stocks rated ‘A’ (Strong Buy) or ‘B’ (Buy) based on this blended approach. Historical performance suggests this method significantly outperforms market indexes over the long term.

Hunting Grounds: Discovering Where Growth Opportunities Lie 🗺️💎

With a solid foundation and analytical framework, where should you hunt for growth stocks? Opportunities often lie in specific sectors, company types, or overlooked corners of the market.

Truth #12: You Will Win With Homebuilders (Supply & Demand Kings) 🏠📈

The housing market embodies a fundamental economic principle: relatively fixed supply (land) versus consistently growing demand. This dynamic creates a long-term tailwind for homebuilders. While cyclical, the underlying trend favors companies like D.R. Horton (DHI), Lennar (LEN), NVR (NVR), PulteGroup (PHM), and Toll Brothers (TOL).

Why are homebuilders often winners?

- Pricing Power: Historically, home price appreciation has outpaced increases in material and labor costs, maintaining favorable margins.

- Scale Advantages: Large builders leverage bulk purchasing for materials, optimize market selection based on price/cost dynamics (e.g., Phoenix vs. Philadelphia), and possess expertise in land acquisition and navigating zoning.

- Improving Profitability: Top builders have significantly increased operating margins over the past decade, making each home sold more profitable.

- Share Buybacks: Most major builders consistently buy back stock, boosting Earnings Per Share (EPS) even faster than net income grows.

- Dividend Growth: Many offer growing dividends, enhancing total returns significantly over time. Lennar, for instance, turned a 0.4% initial yield in 2014 into a 5% yield-on-cost by 2024 through dividend growth alone.

Long-term returns for top homebuilders have been astronomical, often vastly outpacing the S&P 500, validating the “win with homebuilders” thesis.

Truth #13: Own Monopoly Stocks (The Power of the Moat) 🏰💰

While true monopolies like Standard Oil are rare today, companies with dominant market positions protected by strong competitive advantages, or “moats,” offer compelling growth stock potential. Investing in companies with wide, unassailable moats is a path to significant returns.

Types of Moats and Examples:

- Network Effect: Value increases as more users join. (Costco (COST): More members attract more suppliers/products, attracting more members. Facebook: More users attract advertisers, enhancing platform value). This allows companies like Costco to exert pricing pressure on suppliers, boosting margins and shareholder value.

- Technology/Intellectual Property: Superior, hard-to-replicate technology creates dominance. (Nvidia (NVDA): Years of focused R&D gave it a commanding lead in AI chips, forcing competitors into costly catch-up spending).

- Disruptive Brand/Marketing: Building a powerful brand connection, often through newer channels, that legacy players struggle to match. (e.l.f. Beauty (ELF): Mastered digital marketing and built a loyal community long before competitors adapted, leading to explosive growth while legacy brands lagged).

- Economies of Scale: Size creates cost advantages and barriers to entry that smaller players can’t overcome. (Home Depot (HD): Massive store footprint (2,300+ stores) covering all market types, significant real estate ownership, and optimized supply chains create insurmountable hurdles for new competitors. This scale allows continuous sales-per-store growth and margin improvement). Walmart (WMT) also exemplifies this.

Companies with strong moats often exhibit pricing power, improving margins, and sustained growth, leading to exceptional long-term returns (like Home Depot’s 1,100,000%+ gain since IPO).

Truth #14: Dividends Are Your Salvation (Income + Growth Powerhouse) 🛡️💸

As mentioned (Truth #6), dividends offer a compelling income stream, especially given concerns about bond market stability. But the real power lies in dividend growth.

Key points for dividend investing:

- Focus on Growth, Not Just Yield: A high starting yield can be deceptive if the dividend stagnates or gets cut (like Annaly Capital). A lower-yielding stock with strong dividend growth (like FedEx) often delivers far superior total returns over time.

- Assess Dividend Safety: Avoid companies likely to cut their dividend. Red flags include deteriorating performance, excessively high payout ratios (Dividend Per Share / Earnings Per Share), high debt levels forcing choices between dividends and investment/debt service, or strategic missteps signaling broader issues (like AT&T/Warner Media).

- Prioritize Cash Flow: Dividends are paid from cash, not accounting earnings. Analyze cash flow per share, not just EPS. Strong cash flow, especially exceeding earnings due to non-cash charges like depreciation (e.g., Trinity Industries), indicates a safer dividend. Look at cash flow relative to capital expenditures and share buybacks (e.g., McDonald’s (MCD)). Low debt also adds safety (e.g., American Eagle).

- Seek Consistent Growth: Aim for companies doubling dividends roughly every 7 years (approx. 10% annual growth). This growth significantly boosts your yield-on-cost over time and provides inflation protection. FedEx’s 24%+ average annual dividend growth turned a 0.6% initial yield into nearly 5% yield-on-cost over a decade.

Companies consistently growing dividends often possess strong fundamentals and fiscal discipline, making them resilient long-term holdings.

Truth #15: Find the Modern-Day “Picks and Shovels” ⛏️💡

During the Gold Rush, sellers of picks and shovels often profited more consistently than the prospectors themselves. The modern equivalent involves investing in companies providing essential infrastructure or components for booming industries, rather than betting on the ultimate winners within those industries.

A prime example today is the infrastructure needed to power Artificial Intelligence (AI). AI data centers consume enormous electricity; demand is projected to surge; and the existing U.S. electrical grid is aging and inadequate. Upgrading the grid is a multi-trillion dollar, multi-decade opportunity.

Companies poised to benefit (“picks and shovels” for the AI boom) include those specializing in power management and grid modernization, such as:

- Eaton Corporation (ETN): Makes essential power distribution, quality, and reliability equipment. They invest heavily in manufacturing capacity and R&D and have a strong track record of improving profitability (operating margins up significantly).

- EMCOR Group (EME): Provides electrical/mechanical contracting and installation services for power systems. Proven money-maker with rapidly growing earnings and margins, plus consistent share buybacks.

- Quanta Services (PWR): Specializes in constructing and maintaining high-voltage transmission lines and substations. Benefits directly from infrastructure spending bills and grows through strong revenue increases and strategic acquisitions (like Cupertino Electric).

Investing in these essential service/component providers can offer a less speculative way to capitalize on major technological shifts like AI.

Truth #16: Obscurity Can Be Your Friend (Look Beyond Borders) 🌍🤫

Don’t limit your search for growth stocks to familiar U.S. names. Incredible opportunities exist in foreign companies, many of which trade conveniently on U.S. exchanges via American Depository Receipts (ADRs).

While some ADRs are well-known giants (Alibaba (BABA), Nokia (NOK), Toyota (TM)), many start relatively obscure, lacking brand recognition or Wall Street analyst coverage. This obscurity, especially combined with small market capitalizations (often ignored by large institutions due to disclosure rules and position size limitations), creates fertile ground for individual investors.

Examples:

- Alarum Technologies (ALAR): An Israeli data-tech firm whose ADRs rocketed over 400% in early 2024 after demonstrating strong revenue/cash flow growth while still small and relatively unknown. Its potential was identified using the blended fundamental/quantitative analysis (high alpha, low standard deviation) before widespread recognition.

- Vista Energy (VIST): A Mexican oil/gas company operating in Argentina’s Vaca Muerta shale basin. Initially obscure with high extraction costs, rising oil prices and operational leverage led to explosive revenue/earnings growth identified in early 2022, resulting in 400%+ gains since.

Looking for fundamentally sound, technically strong ADRs, particularly smaller, overlooked ones, can uncover exceptional growth stock opportunities missed by the broader market.

Truth #17: Buy the Buybacks (When the Company Bets on Itself) 🤝📈

When a company uses its cash to repurchase its own shares, it’s sending a powerful signal: management believes the stock is undervalued and is confident in the future. While not a reason to buy in isolation, a significant buyback program added to strong fundamentals and technicals is a compelling factor.

Why buybacks matter:

- Mathematical Boost: Reducing the number of outstanding shares automatically increases Earnings Per Share (EPS), even if total net income is flat. Since stocks often trade based on EPS multiples (P/E ratio), this provides a direct upward pressure on the share price.

- Volatility Dampening: The company acts as a ready buyer in the market, absorbing shares from sellers and potentially reducing price swings, especially during periods of weakness.

- Supply Reduction: Consistent buybacks across the market (especially among S&P 500 giants like Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT)) reduce the overall supply of shares, contributing to long-term market appreciation when combined with steady demand.

AutoZone (AZO) is a prime example, having reduced its share count by 70% since 2008, drastically increasing its EPS and share price compared to what they would have been without buybacks.

Identifying strong buyback candidates requires homework: check company announcements (dollar amount vs. share count), compare authorized amounts to shares outstanding, and review historical buyback activity in 10-K filings and balance sheets to gauge long-term commitment.

Truth #18: Aim for the 100,000% Club (The Power of Compounding Giants) 🏆🚀

Turning $1,000 into $1 million requires a 100,000% return. It sounds mythical, but numerous companies have achieved this feat, creating substantial wealth for long-term, patient investors.

Members of this elite club often share common traits:

- Dominance & Moats: Many built unassailable competitive advantages (see Truth #13), like Home Depot (HD), Walmart (WMT), Sherwin-Williams (SHW), Microsoft (MSFT), or Apple (AAPL).

- Innovation & Adaptation: They continuously evolved, entering new markets or transforming their business models, like Amazon (AMZN) moving beyond books, Apple (AAPL) pivoting to services, Microsoft (MSFT) embracing cloud and AI, or Adobe (ADBE) shifting to subscriptions.

- Operational Excellence & Integration: Many grew through acquisitions but possessed the rare skill to integrate them effectively and improve profitability over time, like UnitedHealth Group (UNH), Sherwin-Williams (SHW), or HEICO (HEI).

- Capital Allocation: Smart use of cash, including reinvestment in the business (Berkshire Hathaway (BRK-A/B)), consistent share buybacks (Apple (AAPL), Home Depot (HD), Sherwin-Williams), and growing dividends (McDonald’s (MCD), Home Depot).

- Patience Required: These returns unfolded over decades, often involving significant volatility (Amazon, Nvidia). Reaching 100,000% requires holding through thick and thin.

While finding the next 100,000% stock is challenging, studying these past winners reveals the power of long-term investing in innovative, dominant companies with strong execution.

Conclusion: Investing with Truth and Patience 🏁

Finding growth stocks that deliver transformative wealth isn’t about luck; it’s about applying timeless investing truths. Build your strategy on a foundation of optimism and patience. Understand the broader economic currents, but don’t be swayed by every forecast. Develop a robust framework that blends fundamental strength with quantitative insights. Know where to look – whether it’s dominant companies with strong moats, essential “picks and shovels” providers, overlooked foreign opportunities, or consistent dividend growers.

The journey requires diligence, patience, and the courage to stay the course during inevitable market storms. By adhering to these sacred truths, you significantly increase your chances of finding growth stocks that will not just grow, but potentially make you rich over the long term. Happy investing!

Reference video: