Unlock Your Fortune: The Ultimate 2025 Crypto Trader’s Playbook for Profitable Cryptocurrency Investing (Including Derivatives!)

Welcome, aspiring crypto millionaire! If you’ve been watching the meteoric rise of digital currencies from the sidelines, or perhaps dipped your toes in and felt a little overwhelmed, you’ve come to the right place. Profitable cryptocurrency investing isn’t just a pipe dream; it’s an achievable reality for those armed with the right knowledge and strategies. This is your ultimate Crypto Trader’s Playbook for 2025, designed to guide you from novice to a confident investor, even touching upon the exciting world of crypto derivatives.

The digital gold rush is in full swing, and the landscape is constantly evolving. Forget dense textbooks and confusing jargon. We’re here to break down complex concepts into easily digestible, engaging insights. Think of this as your friendly mentor, walking you through the thrilling, and sometimes volatile, world of cryptocurrencies. We’ll blend timeless trading wisdom with the very latest updates and trends for 2025, ensuring you’re not just learning, but learning what works now.

So, grab a coffee, get comfortable, and let’s embark on this exciting journey to unlock your potential in the digital economy. Your path to profitable cryptocurrency investing starts here!

🌟 The Dawn of a New Financial Era – Understanding Cryptocurrency & Blockchain

Before you can conquer the crypto markets, you need to speak the language. Let’s start with the absolute basics, made simple.

What Exactly is Cryptocurrency?

Imagine digital money that isn’t controlled by any single bank or government. That’s the core idea behind cryptocurrency! It’s a form of digital or virtual currency secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies1 are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

Think of Bitcoin, the OG crypto. It popped onto the scene in 2009, and since then, thousands of different cryptocurrencies (often called “altcoins”) have emerged, each with unique features and purposes. Some, like Bitcoin, aim to be a new form of money. Others, like Ethereum, allow developers to build new kinds of applications (dApps) and even new tokens on their platforms.

Key characteristics of cryptocurrencies generally include:

- Decentralization: No central authority. Power to the people (network)!

- Transparency (often): Many transactions are recorded on a public ledger (the blockchain), though identities are usually pseudonymous.

- Security: Cryptographic techniques secure transactions and control the creation of new units.

- Global Reach: Send and receive value across borders with relative ease.

- Potential for High Returns (and High Risk!): We’ll get to this in detail.

The Magic Behind it All: Blockchain Technology Explained 🧱🔗

If cryptocurrency is the vehicle, blockchain is the revolutionary engine powering it.

Imagine a shared digital notebook that many computers hold a copy of. Every time a new transaction happens, it’s written down as a “block” of information. This block is then cryptographically linked to the previous block, forming a “chain.”

Here’s why this is cool:

- Super Secure: Once a block is added to the chain, it’s incredibly difficult to change. To alter one block, you’d have to alter all subsequent blocks across most of the network’s computers – a monumental and practically impossible task.

- Transparent: Everyone (on public blockchains) can see the transactions (though, again, personal identities are typically hidden behind wallet addresses). This builds trust.

- No Middlemen: Because the ledger is shared and verified by many, you often don’t need traditional intermediaries like banks to validate transactions. This can reduce costs and speed things up.

Blockchain isn’t just for money. It’s being used for smart contracts (self-executing contracts with the terms of the agreement directly written into code), supply chain management, voting systems, NFTs (Non-Fungible Tokens – we’ll cover those!), and so much more. Understanding blockchain is key to understanding the long-term potential of many cryptocurrency projects.

Fresh Insight for 2025: The conversation around blockchain in 2025 is heavily focused on scalability (how many transactions a network can handle), interoperability (how different blockchains can communicate), and sustainability (energy consumption, especially for older “Proof-of-Work” blockchains like Bitcoin, though many newer ones use “Proof-of-Stake” which is far more energy-efficient). Layer 2 solutions (protocols built on top of existing blockchains to improve speed and lower fees) are becoming mainstream.

🚀 Your Crypto Launchpad – Getting Started with Cryptocurrency Investing

Feeling the buzz? Ready to take the first step towards profitable cryptocurrency investing? Here’s how to get off the ground.

Your Digital Vault: Choosing a Cryptocurrency Wallet 🔑

Before you buy any crypto, you need a place to store it. This is where crypto wallets come in. They don’t store your actual coins (those live on the blockchain), but they hold your private keys – the secret codes that prove you own your crypto and allow you to make transactions. Losing your private keys can mean losing your crypto forever, so security is paramount!

Types of Wallets:

-

Hot Wallets (Software Wallets):

- Desktop Wallets: Software you install on your computer. Examples include Exodus, Atomic Wallet.

- Mobile Wallets: Apps for your smartphone, great for convenience and on-the-go transactions. Popular choices for 2025 include Trust Wallet, MetaMask (especially for DeFi and NFTs), and Coinbase Wallet. Some newer wallets like Zengo offer keyless security using MPC technology.

- Web Wallets (Exchange Wallets): Often provided by cryptocurrency exchanges. Convenient for active trading, but you’re trusting the exchange’s security. Not ideal for long-term storage of large amounts.

-

Cold Wallets (Hardware Wallets):

- These are physical devices (like a USB stick) that store your private keys offline, making them highly resistant to online hacking. Ideal for storing significant amounts of crypto.

- Leading hardware wallets in 2025 include Ledger (e.g., Nano X, Nano S Plus) and Trezor (e.g., Model T, Model One).

- Paper Wallets: A piece of paper with your public and private keys printed on it. Secure if stored safely, but can be fragile and inconvenient.

Choosing Your Wallet – 2025 Tips:

- Security First: Look for wallets with strong security features, backup options (recovery phrases – guard these with your life!), and a good reputation.

- Coins Supported: Ensure the wallet supports the specific cryptocurrencies you plan to invest in.

- Ease of Use: Especially for beginners, a user-friendly interface is crucial.

- Control Your Keys: Ideally, choose a “non-custodial” wallet where YOU control the private keys, not a third party.

The Marketplace: Selecting a Cryptocurrency Exchange 🏛️

Exchanges are online platforms where you can buy,2 sell, and trade cryptocurrencies. Think of them like stock exchanges, but for digital assets.

Factors to Consider When Choosing an Exchange in 2025:

- Security: This is non-negotiable. Look for exchanges with robust security measures like two-factor authentication (2FA), cold storage for user funds, and insurance policies. Check for any history of security breaches.

- Fees: Exchanges charge fees for trading, deposits, and withdrawals. Compare these carefully. Some popular exchanges offer tiered fees that decrease with higher trading volumes.

- Supported Cryptocurrencies: Does the exchange offer the coins you want to trade? Some offer a vast selection, while others focus on major coins.

- Liquidity: High liquidity (lots of buyers and sellers) means you can execute trades quickly at stable prices.

- User Interface (UI) and User Experience (UX): Is the platform easy to navigate, especially if you’re a beginner? Many exchanges offer both simple and advanced trading interfaces.

- Customer Support: Good customer support can be a lifesaver if you run into issues. Check reviews for responsiveness.

- Regulation and Compliance: Is the exchange regulated in your jurisdiction? This can offer some level of investor protection. The regulatory landscape is evolving rapidly in 2025, with frameworks like MiCA in Europe setting precedents.

- Fiat On-Ramp/Off-Ramp: Can you easily deposit and withdraw traditional currency (like USD, EUR, etc.)?

Top Cryptocurrency Exchanges for 2025 (Always Do Your Own Research – DYOR!):

- For Beginners:

- For More Advanced Traders (and often wider coin selection/lower fees):

- Binance: One of the largest exchanges globally, offering a massive array of coins and advanced trading features (including derivatives). Regulatory status varies by country, so check Binance US if you’re in the USA.

- Crypto.com: Offers a wide range of services, including an exchange, app, card, and DeFi products.

- Bitstamp: One of the oldest and most respected exchanges.

Your First Purchase: A Step-by-Step (Generic) Guide

- Choose an Exchange & Create an Account: Sign up and complete any required Know Your Customer (KYC) verification (usually involves providing ID).

- Secure Your Account: Enable 2FA immediately!

- Deposit Funds: Link your bank account, use a debit/credit card, or transfer funds via other supported methods.

- Navigate to the Trading Section: Find the cryptocurrency you want to buy.

- Place Your Order:

- Market Order: Buys at the current best available price. Simple, but price can fluctuate.

- Limit Order: You set the maximum price you’re willing to pay (or minimum for selling). Your order only executes if the market reaches your price. Offers more control.

- Confirm and Buy!

- Consider Transferring to Your Personal Wallet: For amounts you don’t plan to actively trade, especially larger sums, transferring your crypto to your secure personal wallet (ideally a hardware wallet) is highly recommended for better security and control.

Congratulations! You’re now a crypto owner. But buying is just the beginning. The real journey to profitable cryptocurrency investing involves understanding the market.

📊 Decoding the Crypto Market – Mastering Analysis for Profit

Just like in traditional markets, making informed decisions in crypto requires analysis. Blindly following hype is a recipe for disaster. Let’s explore the three main types of analysis that can give you an edge.

Technical Analysis (TA): Reading the Charts3 📈📉

Technical analysis involves studying historical price charts and trading volumes to identify patterns and predict future price movements. It’s based on the idea that market trends and human psychology repeat themselves.

Key TA Tools & Concepts for 2025:

- Candlestick Charts: The most common way to visualize price action. Each “candle” shows the open, high, low, and close price for a specific period (e.g., 1 minute, 1 hour, 1 day).

- Common Candlestick Patterns:

- Doji: Indicates indecision in the market.

- Hammer/Hanging Man: Potential reversal signals.

- Engulfing Patterns (Bullish/Bearish): Strong reversal indicators.

- Common Candlestick Patterns:

- Support and Resistance Levels: Price levels where the crypto historically has trouble falling below (support) or rising above (resistance). Breakouts above resistance or below support can signal significant moves.

- Trendlines: Drawn to connect a series of highs or lows to identify the prevailing trend (uptrend, downtrend, or sideways).

- Moving Averages (MAs): Smooth out price data to show the average price over a specific period (e.g., 50-day MA, 200-day MA).

- Golden Cross: A shorter-term MA (e.g., 50-day) crosses above a longer-term MA (e.g., 200-day) – often seen as a bullish signal.

- Death Cross: The opposite of a Golden Cross – often seen4 as a bearish signal.

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100.

- Generally, an RSI above 70 indicates an asset is “overbought” (potentially due for a pullback).

- An RSI below 30 indicates it’s “oversold” (potentially due for a bounce).5

- MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price. Crossovers can signal buy or sell opportunities.

- Bollinger Bands: Bands plotted two standard deviations away from a simple moving average. They can help identify volatility and potential overbought/oversold conditions.

- Volume: The amount of a cryptocurrency traded during a given period. High volume accompanying a price move adds conviction to the move. The Volume Profile is a more advanced tool showing trading activity at different price levels.

TA in 2025: While the core principles remain, AI and machine learning are increasingly being integrated into TA tools for more sophisticated pattern recognition and predictive modeling. Many trading platforms offer robust charting tools with these indicators built-in.

Fundamental Analysis (FA): Digging Deeper than the Price 🧐

Fundamental analysis in crypto involves evaluating the intrinsic value of a cryptocurrency project to determine if it’s overvalued or undervalued. It’s about understanding the “why” behind a project.

Key FA Factors for Crypto in 2025:

- The Whitepaper: The project’s foundational document outlining its purpose, technology, problem it solves, tokenomics, and roadmap. Is it clear, innovative, and achievable?

- The Team: Who are the founders and developers? Do they have relevant experience, a strong track record, and are they transparent? (Look for LinkedIn profiles, GitHub activity).

- Technology & Use Case:

- Is the underlying technology sound, secure, and scalable?

- Does the project solve a real-world problem or offer a unique value proposition?

- What is its competitive advantage?

- Tokenomics (Token Economics): Crucial for understanding a token’s potential value.

- Total Supply & Circulating Supply: Is there a maximum supply (like Bitcoin’s 21 million), or is it inflationary?

- Distribution: How were the tokens initially distributed? Was there a fair launch, or did insiders get a large portion?

- Utility: What is the token used for within the ecosystem? (e.g., governance, transaction fees, staking). Real utility drives demand.

- Vesting Schedules & Lock-ups: For team/investor tokens, are there periods where they can’t sell? This prevents sudden dumps.

- Token Burns: Some projects “burn” (permanently remove) tokens from circulation, which can be deflationary and potentially increase value.

- Community & Network Effect: A strong, active, and engaged community can be a powerful driver of adoption and growth. Look at social media channels (Twitter, Telegram, Discord, Reddit), developer activity (GitHub), and user adoption metrics.

- Market Capitalization (Market Cap): Total value of all circulating coins (Market Cap = Current Price x Circulating Supply). Helps compare the relative size of different projects.

- Also consider Fully Diluted Valuation (FDV): Market cap if all possible tokens were in circulation. A large gap between Market Cap and FDV might indicate future sell pressure.

- Trading Volume & Liquidity: High volume and liquidity on reputable exchanges are good signs.

- Roadmap & Development Progress: Is the project hitting its milestones? Is there ongoing development and innovation?

- Partnerships & Integrations: Meaningful partnerships can validate a project and expand its reach.

- Regulatory Landscape: How might current or future regulations (e.g., MiCA in the EU, evolving stances in the US) impact the project?

- Broader Economic Factors: Macroeconomic trends like inflation, interest rates, and global stability can also influence the crypto market.

FA in 2025: With increased institutional interest, the rigor of FA in crypto is intensifying. Tools that track on-chain data (transactions, wallet activity, smart contract interactions) are becoming essential for deeper FA.

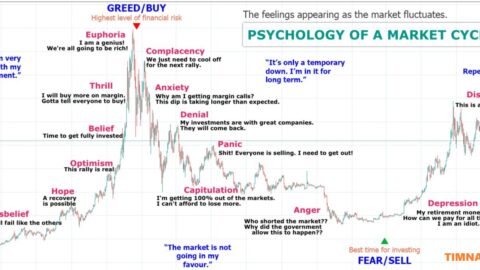

Sentiment Analysis: Gauging the Market Mood 🎭

Sentiment analysis involves assessing the overall attitude or feeling of investors and traders towards a particular cryptocurrency or the market as a whole. This “market mood” can significantly influence price movements, especially in a market as sentiment-driven as crypto.

How to Gauge Crypto Sentiment in 2025:

- Social Media Monitoring: Platforms like Twitter (X), Reddit (especially subreddits like r/CryptoCurrency), Telegram, and Discord are hotbeds for crypto discussions. Look for the general tone (bullish/bearish), specific keywords, and influencer opinions (but be wary of “shills”!).

- News & Media Coverage: How are mainstream media and crypto-specific news outlets portraying certain projects or the market?

- Fear & Greed Index: A popular indicator (e.g., from Alternative.me) that aggregates various data points (volatility, market momentum, social media, surveys, etc.) to produce a score from extreme fear to extreme greed. Extreme fear can sometimes present buying opportunities, while extreme greed might signal a market top.

- On-Chain Data: Metrics like exchange inflows/outflows (large inflows can indicate selling pressure, outflows can mean accumulation) or whale activity (large holders) can offer sentiment clues.

- Dedicated Sentiment Analysis Tools: Several platforms now use AI and machine learning to analyze vast amounts of text and social data to provide sentiment scores and trends. Some tools mentioned for 2025 include Token Metrics, LunarCrush, Santiment, Mentionlytics, Medallia, and Lexalytics.

Using Sentiment Analysis Wisely:

Sentiment can change rapidly and is often a lagging indicator. It’s best used in conjunction with TA and FA, not as a standalone decision-maker. Be aware of echo chambers and manufactured hype.

By combining these three analytical approaches, you can build a more holistic view of the market and make more strategic investment decisions on your path to profitable cryptocurrency investing.

💰 Crafting Your Battle Plan – Profitable Crypto Trading Strategies

Knowing how to analyze the market is one thing; knowing how to act on that analysis is another. Let’s explore some popular trading strategies, from short-term sprints to long-term marathons. Remember, there’s no one-size-fits-all strategy. The best approach for you will depend on your risk tolerance, time commitment, and personality.

The Long Game: HODLing (Buy and Hold) 💎🙌

“HODL” (a misspelling of “hold” that became a beloved crypto meme) is perhaps the simplest strategy. It involves buying cryptocurrencies you believe have strong long-term potential and holding onto them through market ups and downs, often for years.

- Pros: Less stressful than active trading, potentially large gains if you pick solid projects early, lower transaction fees.

- Cons: Requires patience and conviction to weather volatility, your capital is tied up, you might miss out on short-term profit opportunities.

- Best For: Investors with a long-term outlook, strong belief in the fundamental value of their chosen cryptos, and who prefer a less hands-on approach.

- 2025 Tip: Even HODLers should periodically review their portfolio and the fundamentals of their chosen assets. The crypto space evolves fast!

Short-Term Sprints: Active Trading Strategies

1. Scalping 🤏

Scalping involves making numerous small trades throughout the day to profit from tiny price fluctuations. Scalpers aim to take small profits quickly and repeatedly.

- Pros: Potential for many small wins, less exposure to large market swings.

- Cons: Requires intense focus, fast execution, low trading fees are crucial, can be stressful, high transaction volume.

- Best For: Highly disciplined traders who can make quick decisions and dedicate significant time to monitoring charts. Often relies on technical analysis of very short timeframes (e.g., 1-minute or 5-minute charts).

- 2025 Strategies: Market making (providing liquidity), exploiting small breakout or momentum moves, mean reversion on tight ranges.

2. Day Trading ☀️🌙

Day traders open and close positions within the same trading day, aiming to profit from intraday price movements. They don’t hold positions overnight.

- Pros: No overnight risk, potential for consistent daily profits if skilled.

- Cons: Requires significant time commitment, in-depth knowledge of TA, emotional control, can be high-pressure.

- Best For: Traders who can dedicate several hours a day, are adept at technical analysis, and can manage risk effectively.

- 2025 Strategies: Similar to scalping but on slightly longer intraday timeframes; includes breakout trading, trend following within the day, and mean reversion strategies.

3. Swing Trading 🎢

Swing traders aim to capture “swings” in price that occur over a few days to several weeks. They typically hold positions longer than day traders but shorter than HODLers.

- Pros: Less time-intensive than day trading, can capture larger price moves, often balances TA and FA.

- Cons: Exposure to overnight and weekend risk, requires patience to wait for setups.

- Best For: Traders with some patience, a good understanding of identifying trends and momentum, and who can’t monitor charts constantly.

- 2025 Strategies: Identifying emerging trends using indicators like MAs and MACD, trading breakouts from consolidation patterns, playing pullbacks within established trends.

Riding the Wave: Trend Following 🌊

This strategy involves identifying the prevailing market trend (uptrend or downtrend) and trading in the direction of that trend. “The trend is your friend” is a common mantra.

- Pros: Can lead to significant profits if you catch a strong, sustained trend.

- Cons: Difficult to identify trends accurately, susceptible to “whipsaws” (false signals) in ranging markets.

- Best For: Patient traders who are good at spotting longer-term directional moves.

Chasing the Hype (Carefully!): Momentum Trading 💨

Momentum traders look for assets that are already making significant price moves (up or down) accompanied by high volume, and they jump on board hoping the momentum will continue.

- Pros: Can result in quick profits during strong market moves.

- Cons: High risk, as you’re often buying high hoping to sell higher (or selling low to buy lower); susceptible to sharp reversals when momentum fades.

- Best For: Experienced traders who can manage risk tightly and react quickly to changing market conditions.

Finding Bargains: Arbitrage ⚖️

Arbitrage involves exploiting tiny price differences for the same asset across different exchanges. For example, if Bitcoin is $60,000 on Exchange A and $60,100 on Exchange B, an arbitrageur might buy on A and sell on B for a quick, small profit (minus fees).

- Pros: Relatively low risk (in theory) if executed correctly and quickly.

- Cons: Opportunities are often short-lived and require sophisticated tools (bots) to execute profitably, transaction fees can eat into profits, withdrawal/deposit times between exchanges can be a factor.

- Best For: Technically savvy traders, often using automated trading bots.

- 2025 Note: While still possible, arbitrage has become more challenging due to faster markets and more efficient pricing.

Dollar-Cost Averaging (DCA) 🗓️💲

Not strictly a “trading” strategy but a powerful investment approach. DCA involves investing a fixed amount of money at regular intervals (e.g., $100 every week) regardless of the asset’s price.

- Pros: Reduces the risk of investing a large sum at the wrong time, averages out your purchase price over time, disciplined approach, removes emotion.

- Cons: You might miss out on some gains if the market rises sharply and consistently, still subject to overall market declines.

- Best For: Long-term investors, especially beginners, who want a steady and less stressful way to build a position.

Choosing Your Strategy for Profitable Cryptocurrency Investing:

Experiment with different strategies (perhaps using a paper trading account first) to find what resonates with your style and goals. Many successful traders combine elements from various strategies. And remember, risk management is paramount, no matter which strategy you choose.

💣 Level Up Your Game – Crypto Derivatives for Enhanced (and Riskier!) Profits

Once you’ve mastered the basics of spot trading (buying and selling the actual cryptocurrencies), you might feel ready to explore more advanced instruments. Welcome to the world of crypto derivatives! These are financial contracts that derive their value from an underlying cryptocurrency. They allow traders to speculate on price movements without owning the actual coins, and often involve leverage.

Warning: Crypto derivatives are complex and significantly riskier than spot trading. They can lead to substantial profits but also equally substantial (or even greater) losses, especially with leverage. This section is for informational purposes and should be approached with extreme caution. Do not trade derivatives unless you fully understand the risks and can afford to lose your invested capital.

Understanding Crypto Futures 📜

A futures contract is an agreement to buy or sell a specific cryptocurrency at a predetermined price on a specific date in the future.

- How they work: If you believe the price of Bitcoin will rise, you could buy a Bitcoin futures contract (go “long”). If the price rises by the contract’s expiration, you profit. If it falls, you lose. Conversely, if you believe the price will fall, you can sell a Bitcoin futures contract (go “short”).

- Perpetual Futures: Very popular in crypto. These are futures contracts that don’t have an expiration date. They mimic the spot market closely and use a “funding rate” mechanism to keep their price aligned with the underlying asset’s spot price.

- Key Terms:

- Contract Size: The amount of crypto represented by one contract (e.g., 1 BTC, 0.1 BTC, or even smaller “micro” contracts).

- Margin: The amount of capital you need to deposit to open a futures position. This is where leverage comes in.

- Funding Rate (for perpetuals): Periodic payments exchanged between long and short position holders to keep the perpetual contract price close to the spot price. If the funding rate is positive, longs pay shorts. If negative, shorts pay longs.

Why Trade Futures?

- Speculation: Bet on price direction (up or down).

- Hedging: Protect an existing spot portfolio from price declines. For example, if you own Bitcoin and fear a price drop, you could short Bitcoin futures.

- Leverage: Control a larger position with a smaller amount of capital (more on this below).

Platforms for Futures Trading (2025): Major exchanges like Binance, Bybit, OKX, and traditional exchanges like the CME (Chicago Mercantile Exchange) offer crypto futures.

Exploring Crypto Options 🎭

An options contract gives the buyer the right, but not the obligation, to buy (a “call” option) or sell (a “put” option) an underlying cryptocurrency at a specific price (the “strike price”) on or before a certain date (the “expiration date”).

- Call Option: You buy a call if you believe the price of the crypto will go UP.

- Example: You buy a Bitcoin $70,000 call option expiring next month. If Bitcoin rises above $70,000 before expiration, your option becomes profitable (you can buy BTC at $70k and sell it at the higher market price, or sell the option itself for a profit). If BTC stays below $70k, you likely lose the premium you paid for the option.

- Put Option: You buy a put if you believe the price of the crypto will go DOWN.

- Example: You buy a Bitcoin $60,000 put option. If Bitcoin falls below $60,000, your option becomes profitable. If it stays above, you likely lose the premium.

- Premium: The price you pay to buy an options contract. This is the maximum you can lose if you are an option buyer.

- Selling Options (Writing Options): This is more complex and carries higher risk (potentially unlimited for selling naked calls). Sellers receive the premium but take on the obligation to fulfill the contract if exercised. Strategies like “covered calls” (selling calls against crypto you already own) are popular for income generation.

Why Trade Options?

- Limited Risk (for buyers): Your maximum loss is the premium paid.

- Flexibility: Can be used for various strategies – speculation, hedging, income generation.

- Leverage (inherent): Control exposure to a larger amount of crypto for a smaller premium.

Platforms for Options Trading (2025): Exchanges like Deribit are specialists in crypto options. Binance and OKX also offer them.

Pricing Models: The Black-Scholes model is often referenced for option pricing, though it has limitations in the volatile crypto markets.

Leverage: The Double-Edged Sword in Crypto Derivatives 🗡️💰

Leverage allows you to control a larger position than your actual capital would normally allow. For example, with 10x leverage, a $100 deposit (your “margin”) can control a $1,000 position.

- The Allure:

- Amplified Profits: If the market moves in your favor, your percentage gains are magnified. A 5% price increase on a 10x leveraged position can result in a 50% profit on your initial margin.

- The Danger:

- Amplified Losses: Leverage works both ways. A 5% price move against your 10x leveraged position can result in a 50% loss of your margin.

- Liquidation: If the market moves against you significantly, your losses can exceed your initial margin. When this happens, the exchange will automatically close your position to prevent further losses for them. This is called liquidation, and you lose your entire margin for that trade. A smaller adverse price move is needed to liquidate a higher-leveraged position. For instance, with 100x leverage, a mere 1% adverse move can wipe out your margin.

- Margin Calls: Before liquidation, you might receive a “margin call” asking you to add more funds to your account to keep the position open.

Using Leverage Safely (Relatively Speaking):

- Start Low: If you’re new to leverage, use very low levels (e.g., 2x or 3x) or avoid it altogether until you are highly experienced.

- Use Stop-Loss Orders: Essential for managing risk with leverage. A stop-loss automatically closes your position if the price reaches a certain loss level.

- Understand Liquidation Price: Always know at what price your position will be liquidated.

- Never Risk More Than You Can Afford to Lose: This is especially true with leveraged trading.

- Practice on a Demo Account: Most exchanges offering derivatives have paper trading or demo accounts. Use them extensively!

Strategies for Trading Crypto Derivatives (2025 Focus)

- Hedging Existing Holdings:

- If you hold a significant amount of Bitcoin and are worried about a short-term price drop, you could sell (short) Bitcoin futures or buy Bitcoin put options to offset potential losses in your spot holdings.

- Speculating on Price Direction:

- Long Futures/Calls: If you’re bullish.

- Short Futures/Puts: If you’re bearish.

- Spread Trading (Futures):

- Simultaneously buying one futures contract and selling another (e.g., different expiration dates or even related assets) to profit from the change in the price difference (spread) between them. Generally considered lower risk than outright directional bets.

- Volatility Trading (Options):

- Strategies like Straddles (buying a call and a put at the same strike price and expiration) or Strangles (buying an out-of-the-money call and put) can profit if the underlying asset makes a large price move in either direction. You’re betting on high volatility.

- Income Generation (Options):

- Covered Calls: Selling call options against crypto you already own. If the price stays below the strike, you keep the premium. If it rises above, your crypto gets “called away” (sold at the strike price), but you still keep the premium.

- Momentum/Trend Following with Leverage:

- Using leverage to amplify potential profits from identified trends (very high risk).

- Algorithmic Trading:

- Using bots to execute derivative strategies, often high-frequency, based on pre-programmed rules and technical indicators. AI-driven algorithms are a growing trend in 2025 for derivatives.

Key Considerations for Crypto Derivatives in 2025:

- Regulatory Scrutiny: Derivatives markets are often under closer regulatory watch. Be aware of the rules in your jurisdiction.

- Counterparty Risk: You are trusting the exchange to honor contracts and manage its risk properly.

- Complexity: The learning curve is steep.

Crypto derivatives can be a powerful tool for profitable cryptocurrency investing but also a quick way to lose capital if not handled with extreme care, knowledge, and robust risk management.

🛡️ Fortifying Your Fortress – Smart Crypto Investing, Risk Management & Security

Profitable cryptocurrency investing isn’t just about picking winners; it’s also about protecting your capital and your digital assets. The crypto world has its share of dangers, from market volatility to scams and hacks.

The Golden Rules of Risk Management

- Only Invest What You Can Afford to Lose: This is rule number one, especially in a volatile asset class like crypto. Never invest money you need for essential living expenses or that you can’t bear to see diminish.

- Diversification (Don’t Put All Your Eggs in One Basket):

- Across Different Cryptocurrencies: Spread your investments among various projects with different use cases, risk profiles, and market caps (e.g., established coins like Bitcoin/Ethereum, promising altcoins, sector-specific tokens like DeFi or Metaverse).

- Across Asset Classes (Potentially): Some investors diversify their overall portfolio by including crypto alongside traditional assets like stocks and bonds.

- Position Sizing (The 1-2% Rule): Don’t risk too much of your trading capital on a single trade. Many professional traders risk only 1-2% of their portfolio on any given trade. This means if you have a $10,000 portfolio, you’d risk $100-$200 per trade.

- Use Stop-Loss Orders: An essential tool to limit potential losses. A stop-loss order automatically sells your crypto if it drops to a predetermined price.

- Trailing Stop-Loss: A stop-loss that moves up with the price if your trade is in profit, helping to lock in gains while still protecting against reversals.

- Take Profits (Don’t Get Too Greedy): It’s easy to get caught up in a rising market and hope for even more gains. Have a plan for taking profits at certain targets. “Pigs get fat, hogs get slaughtered.”

- Understand Market Volatility: Crypto prices can swing wildly. Be mentally prepared for this. Volatility can present opportunities, but it also brings risk.

- Manage Your Emotions (FOMO & FUD):

- FOMO (Fear Of Missing Out): Chasing coins that are already pumping high can lead to buying at the top. Stick to your analysis.

- FUD (Fear, Uncertainty, and Doubt): Negative news or rumors (sometimes spread intentionally) can cause panic selling. Evaluate information critically.

- Avoid Overtrading: Trading too frequently, often driven by emotion or the desire to recoup losses, can lead to poor decisions and rack up transaction fees.

- Keep Learning & Stay Updated: The crypto space evolves rapidly. Continuously educate yourself about new projects, technologies, market trends, and risks.

Top-Tier Security Practices for Your Crypto

Protecting your crypto from hackers and scammers is paramount.

- Use Strong, Unique Passwords: For every exchange, wallet, and crypto-related account. Use a password manager to generate and store them.

- Enable Two-Factor Authentication (2FA) EVERYWHERE: Use authenticator apps like Google Authenticator or Authy rather than SMS-based 2FA if possible, as SMS can be vulnerable to SIM swapping.

- Secure Your Email Account: Your email is often the gateway to resetting passwords. Protect it with a strong password and 2FA.

- Beware of Phishing Scams:

- Never click on suspicious links in emails, direct messages, or social media posts.

- Always double-check website URLs to ensure you’re on the legitimate site (e.g., bookmark official exchange sites).

- Scammers often create fake login pages that look identical to the real ones.

- Never Share Your Private Keys or Recovery Phrase: Anyone asking for these is trying to scam you. Store your recovery phrase offline in multiple secure locations.

- Use Hardware Wallets for Significant Holdings: As mentioned before, cold storage is the safest way to store crypto long-term.

- Keep Your Software Updated: Regularly update your computer’s operating system, antivirus software, and any crypto wallet software.

- Be Wary of “Too Good To Be True” Offers: If someone promises guaranteed high returns or free crypto for sending them some first, it’s almost certainly a scam.

- Secure Your Devices: Protect your computer and smartphone from malware.

- Public Wi-Fi Caution: Avoid accessing your crypto accounts or making transactions on public Wi-Fi networks unless you’re using a reputable VPN.

2025 Security Trends: Expect more advanced multi-factor authentication methods, increased use of multi-party computation (MPC) wallets for enhanced key security without single points of failure, and more sophisticated AI-driven threat detection by exchanges and security firms.

By implementing robust risk management and top-notch security, you build a strong foundation for long-term profitable cryptocurrency investing.

🌌 The Expanding Crypto Cosmos – DeFi, NFTs, and the Metaverse

The crypto world is far more than just Bitcoin. Innovation is happening at lightning speed, opening up new avenues for investment and participation. Let’s explore some of the most exciting sectors in 2025.

DeFi (Decentralized Finance): Banking Without Banks 💸🔗

DeFi aims to rebuild traditional financial systems (lending, borrowing, trading, insurance, etc.) using decentralized blockchain technology and smart contracts, removing the need for traditional intermediaries.

Key DeFi Concepts & Opportunities (2025):

- Decentralized Exchanges (DEXs): Trade crypto directly from your wallet without needing to deposit funds on a centralized exchange. Examples: Uniswap, SushiSwap, PancakeSwap. They often use Automated Market Makers (AMMs) instead of traditional order books.

- Lending & Borrowing Platforms: Lend out your crypto to earn interest or borrow crypto by providing collateral. Examples: Aave, Compound.

- Yield Farming & Liquidity Mining: Provide liquidity (deposit pairs of tokens) to DEXs or lending protocols and earn rewards in the form of new tokens or trading fees. Can offer high returns but also comes with risks like impermanent loss.

- Staking: Lock up your crypto in certain Proof-of-Stake networks to help secure the network and validate transactions, earning staking rewards in return. Many exchanges and wallets offer staking services.

- Stablecoins: Cryptocurrencies pegged to stable assets like the US dollar (e.g., USDC, USDT, DAI). Crucial for DeFi as a stable medium of exchange and store of value.

- Decentralized Autonomous Organizations (DAOs): Many DeFi projects are governed by DAOs, where token holders vote on proposals and the future direction of the project.

- Tokenization of Real-World Assets (RWAs): A major trend for 2025, RWA tokenization brings physical assets like real estate, art, or commodities onto the blockchain, increasing liquidity6 and accessibility.

DeFi Risks: Smart contract vulnerabilities (bugs in the code that can be exploited), impermanent loss (in liquidity provision), regulatory uncertainty, and the complexity of some protocols.

NFTs (Non-Fungible Tokens): Unique Digital Ownership 🎨🖼️🕹️

NFTs are unique cryptographic tokens that represent ownership of a specific digital or physical item. Unlike cryptocurrencies like Bitcoin, which are fungible (one Bitcoin is interchangeable with another), each NFT is unique.

Popular NFT Use Cases (2025):

- Digital Art & Collectibles: This is where NFTs first exploded. Think CryptoPunks, Bored Ape Yacht Club.

- Gaming: In-game items like characters, skins, weapons, and virtual land can be NFTs, allowing players true ownership and the ability to trade them on marketplaces.

- Music & Entertainment: Artists can tokenize their music, videos, or offer exclusive experiences as NFTs.

- Virtual Real Estate: Plots of land in metaverse worlds are often sold as NFTs.

- Domain Names: Some blockchain-based domain name systems use NFTs.

- Memberships & Access Passes: NFTs can grant access to exclusive communities, events, or content.

- Digital Identity & Credentials: Potential for using NFTs to represent identity documents or qualifications.

Investing in NFTs: Highly speculative and driven by trends, community, and perceived rarity. Requires different research than traditional crypto – look at the artist/creator, utility, community strength, and marketplace activity.

NFT Marketplaces (2025): OpenSea, Magic Eden (popular for Solana NFTs), Blur, LooksRare.

NFT Trends 2025: Shift towards NFTs with more utility beyond just collectibles, integration into DeFi (e.g., using NFTs as collateral), and evolving legal frameworks around NFT ownership and copyright.

The Metaverse: Where Digital and Physical Worlds Converge 👓🌐

The Metaverse is a persistent, shared, 3D virtual world or worlds where users can interact with each other, digital objects, and AI agents, often using avatars. It’s envisioned as the next iteration of the internet.

Crypto’s Role in the Metaverse (2025):

- Native Currencies: Many metaverse platforms have their own cryptocurrencies used for in-world transactions, buying virtual land, assets, and services (e.g., MANA for Decentraland, SAND for The Sandbox, AXS for Axie Infinity).

- NFTs for Assets: Virtual land, avatars, wearables, art, and other in-metaverse items are often NFTs, ensuring true digital ownership.

- Play-to-Earn (P2E) & Create-to-Earn Economies: Users can earn crypto or NFTs through gameplay, creating content, or offering services within the metaverse.

- Decentralized Governance (DAOs): Some metaverse projects are governed by their communities through DAOs.

- Interoperability (The Goal): The dream is for assets and identities to be transferable across different metaverse platforms, though this is still a major challenge.

Investing in the Metaverse:

- Metaverse Tokens: Investing in the native cryptocurrencies of leading metaverse projects.

- Virtual Land NFTs: Buying plots of digital real estate in popular metaverses.

- Gaming NFTs: Investing in assets for P2E games.

Metaverse in 2025: Continued development of immersive experiences, more brands and businesses establishing a metaverse presence, and ongoing debate about centralization vs. decentralization in how the metaverse evolves. Companies like Meta (Facebook) are heavily invested, but decentralized platforms are also thriving. The global metaverse market is projected for massive growth. AI-driven content creation and NPC behavior are enhancing these virtual worlds.

Exploring DeFi, NFTs, and the Metaverse can add exciting new dimensions to your profitable cryptocurrency investing journey, but always remember to DYOR (Do Your Own Research) and understand the specific risks of these newer, often more volatile, sectors.

📜 Playing by the Rules – Crypto Regulations & Taxation in 2025

As the crypto market matures and integrates more with traditional finance, governments and regulatory bodies worldwide are paying closer attention. Understanding the evolving legal and tax landscape is crucial for every crypto investor.

The Global Regulatory Tapestry: An Overview for 2025

The approach to crypto regulation varies significantly from country to country:

- Embracing Innovation: Some jurisdictions (e.g., parts of Switzerland, Singapore, Dubai) have created relatively clear and supportive frameworks to attract crypto businesses and innovation.

- Cautious Approach / Evolving Frameworks: Many major economies, including the US and the European Union, are actively developing comprehensive regulatory frameworks.

- European Union: The Markets in Crypto-Assets (MiCA) regulation is a landmark piece of legislation providing7 a harmonized framework for crypto assets across the EU, aiming for consumer protection, market integrity, and financial stability. It’s expected to be fully implemented and influencing global standards by 2025.

- United States: The regulatory landscape is still fragmented, with various agencies like the SEC (Securities and Exchange Commission), CFTC (Commodity Futures Trading Commission), and FinCEN (Financial Crimes Enforcement Network) having oversight depending on how a crypto asset is classified (e.g., as a security, commodity, or currency). 2025 sees continued debate and potential legislative action to create clearer federal guidelines. Some sources indicate a potentially more pro-crypto stance from the administration, possibly leading to deregulation, though this brings its own concerns about investor protection.

- Strict Restrictions or Bans: A few countries have imposed strict limitations or outright bans on cryptocurrency trading or mining.

Key Regulatory Focus Areas in 2025:

- Investor Protection: Measures to prevent fraud, manipulation, and scams.

- Anti-Money Laundering (AML) & Counter-Terrorist Financing (CTF): Requirements for exchanges and crypto businesses to implement KYC (Know Your Customer) procedures and report suspicious activities. The “Travel Rule” (requiring information sharing for transactions above certain thresholds) is a key component.

- Market Integrity: Rules for exchanges, stablecoin issuers, and DeFi protocols.

- Clarity on Asset Classification: Determining whether specific tokens are securities, commodities, or something else, which dictates regulatory oversight.

- Stablecoins: Specific regulations are emerging for stablecoin issuers regarding reserves, audits, and operational resilience due to their potential systemic importance.

- DeFi Regulation: How to regulate decentralized protocols without stifling innovation is a major challenge regulators are grappling with. Some DEXs are facing pressure to integrate KYC.

- NFTs: Legal questions around copyright, ownership, and consumer protection for NFTs are being addressed.

Impact on Traders: Increased transparency, potentially more secure trading environments on regulated platforms, but also stricter compliance requirements (KYC/AML) and potential limitations on certain types of assets or trading activities (e.g., privacy coins, high leverage).

Staying Informed: Follow reputable crypto news sources, official government publications, and consult legal professionals if you have significant investments or operate a crypto business.

Untangling Crypto Taxes: What You Need to Know for 2025

Taxes are an inevitable part of profitable cryptocurrency investing. Tax authorities globally are increasingly focusing on crypto. Disclaimer: I am an AI and cannot provide tax advice. Consult with a qualified tax professional in your jurisdiction.

General Principles (Varies by Country – Focus on US for examples):

- Crypto as Property: In many countries, including the US (as per IRS guidance), cryptocurrencies are treated as property for tax purposes, not currency. This means capital gains tax rules apply.

- Taxable Events:

- Selling crypto for fiat currency (e.g., USD, EUR).

- Trading one cryptocurrency for another (e.g., swapping Bitcoin for Ethereum). This is considered a disposal of the first crypto, and you realize a capital gain or loss.

- Using crypto to pay for goods or services. This is treated as selling the crypto for its fair market value and then making the purchase.

- Receiving crypto as income:

- Mining or Staking Rewards: Generally taxed as ordinary income at the fair market value when received.

- Airdrops: Often taxed as ordinary income when you gain control of the tokens.

- Getting Paid in Crypto (Salary/Wages): Taxed as ordinary income.

- Interest/Yield from DeFi: Typically taxed as ordinary income.

- Calculating Capital Gains/Losses:

- Cost Basis: The original purchase price of your crypto, including fees.

- Proceeds: The fair market value of the crypto when you sold, traded, or spent it.

- Gain/Loss = Proceeds – Cost Basis.

- Holding Period:

- Short-Term Capital Gains: For assets held for one year or less (in the US). Taxed at your ordinary income tax rates.

- Long-Term Capital Gains: For assets held for more than one year (in the US). Taxed at lower preferential rates (0%, 15%, or 20% depending on your income).

- Non-Taxable Events (Generally):

- Buying crypto with fiat currency.

- Holding crypto (HODLing).

- Transferring crypto between your own wallets.

- Donating crypto to a qualified charity (often tax-deductible).

- Gifting crypto (up to annual exclusion limits, though the recipient inherits your cost basis).

Record Keeping is CRUCIAL:

Keep detailed records of all your crypto transactions: dates, types of crypto, amounts, prices in fiat currency at the time of transaction, fees paid, and wallet addresses involved. Crypto tax software can help automate this.

Tax Reporting (US Example – 2025):

- Form 8949 (Sales and Other Dispositions of Capital Assets): To report individual crypto sales and trades.

- Schedule D (Capital Gains and Losses): To summarize totals from Form 8949.

- Income from mining, staking, etc., may be reported on Schedule C (if a business) or Schedule 1 (miscellaneous income).

- Form 1099-DA: A new form for digital assets. Starting January 1, 2025, US crypto brokers must report users’ digital asset sales to the IRS on this form. This increases tax transparency.

- Cost Basis Accounting Methods: Until Dec 31, 2025, US taxpayers can often choose methods like FIFO (First-In, First-Out) or Specific Identification. However, FIFO may become mandatory from Jan 1, 2026, so plan accordingly.

Tax Loss Harvesting: You can potentially offset capital gains with capital losses, which might reduce your overall tax bill.

International Considerations: If you trade on foreign exchanges or hold crypto abroad, be aware of foreign account reporting requirements (e.g., FBAR in the US).

Navigating regulations and taxes is complex but essential. Proactive compliance will save you headaches (and potential penalties) down the line.

🔮 Peering into the Crystal Ball – The Future of Crypto & Your Next Moves

The cryptocurrency and blockchain space is one of the most dynamic and rapidly evolving sectors in the world. While predicting the future is impossible, we can look at current trends and expert insights to get a sense of what might be next.

Emerging Trends Shaping Crypto in 2025 and Beyond:

- Increased Institutional Adoption: More traditional financial institutions, hedge funds, and corporations are entering the crypto space, bringing liquidity, legitimacy, and new investment products (like Bitcoin ETFs, which have seen significant interest).

- Maturation of DeFi: DeFi protocols are becoming more sophisticated, user-friendly, and integrated with traditional finance. Expect more focus on security, scalability (Layer 2 solutions are key), and regulatory clarity. The tokenization of Real-World Assets (RWAs) is a massive growth area for DeFi.

- Evolution of NFTs and the Metaverse: NFTs will likely move beyond collectibles to encompass more utility-driven applications (gaming, identity, ticketing, memberships). The Metaverse will continue to develop, with more immersive experiences and deeper integration of crypto economies. AI will play a larger role in content creation and user interaction within these spaces.

- The Rise of AI-Driven Crypto Projects: AI is being integrated into blockchain for enhanced security, smarter trading algorithms, intelligent contracts, and more efficient decentralized systems. AI-driven tokens and platforms are gaining traction.

- Focus on Scalability & Interoperability: Solutions to make blockchains faster, cheaper, and able to communicate with each other (cross-chain bridges, interoperability protocols) are critical for mass adoption.

- Web3 Development: The concept of a decentralized internet (Web3) built on blockchain, crypto, and user ownership continues to gain momentum.

- Regulatory Clarity and Frameworks: As discussed, governments worldwide will continue to develop and implement clearer regulations, which could foster more mainstream adoption while also bringing compliance burdens.

- Central Bank Digital Currencies (CBDCs): Many central banks are exploring or piloting their own digital currencies. The impact of CBDCs on the existing crypto ecosystem is still being debated.

- Sustainability Concerns & Green Solutions: The environmental impact of Proof-of-Work mining remains a concern, driving innovation in more energy-efficient consensus mechanisms (like Proof-of-Stake) and green mining initiatives.

- Enhanced Security and Privacy Technologies: As the value in crypto grows, so does the need for advanced security solutions and potentially privacy-enhancing technologies (though these can also attract regulatory scrutiny).

Your Next Steps in the Crypto Trader’s Playbook:

You’ve absorbed a massive amount of information. So, what now?

- Continue Learning: This article is a starting point. The crypto world changes daily. Follow reputable news sources, researchers, and educators. Read whitepapers. Join communities (but be discerning!).

- Start Small & Practice: If you’re new, begin with a small amount of capital you can afford to lose. Consider paper trading (simulated trading) to test strategies without real financial risk.

- Develop Your Own Strategy: Based on your risk tolerance, goals, and time commitment, craft an investment or trading plan. Don’t blindly follow others.

- Prioritize Security: Implement all the security best practices from day one.

- Master Risk Management: This is the key to long-term survival and success.

- Stay Patient & Disciplined: Profitable cryptocurrency investing is often a marathon, not a sprint. Avoid emotional decisions. Stick to your plan.

- Network & Engage (Carefully): Join online communities, attend webinars or local meetups (if available and safe). Learn from others, but always maintain a critical mindset and beware of scams.

- Revisit and Adapt: Periodically review your portfolio, strategies, and understanding of the market. Be willing to adapt as the landscape evolves.

🏁 Conclusion: Your Journey to Crypto Mastery Has Begun!

Congratulations on making it through this extensive Crypto Trader’s Playbook! You’re now equipped with a foundational understanding of cryptocurrencies, blockchain, trading strategies, risk management, crypto derivatives, the exciting frontiers of DeFi, NFTs, the Metaverse, and the crucial aspects of regulation and taxation.

The world of profitable cryptocurrency investing is dynamic, challenging, and incredibly exciting. It offers the potential for significant financial growth and the opportunity to be part of a technological revolution that is reshaping industries.

Remember, knowledge is power, but applied knowledge with discipline and sound risk management is what truly leads to success. There will be ups and downs, euphoric highs, and testing lows. The key is to remain curious, cautious, and confident in your well-researched decisions.

This playbook is your starting map. The journey ahead is yours to navigate. Keep learning, stay updated, and approach the market with a strategic mindset. The future of finance is unfolding before our very eyes, and you now have the tools to be an active participant.

May your crypto journey be prosperous, your knowledge ever-expanding, and your conviction in informed decisions unwavering. Happy trading and investing!

Reference video: