💥 The Ultimate Beginner’s Guide to Profitable Money Models That Actually Work 🚀

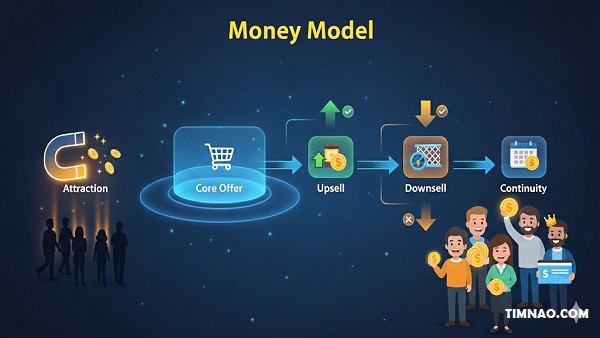

Money model might sound like a fancy term reserved for big corporations, but in reality, it’s the secret engine behind every successful business — from your local coffee shop to billion-dollar tech companies. At its heart, a money model is simply the way a business turns strangers into paying customers and then keeps them coming back for more.

For beginners, understanding this concept can be a game-changer. Too often, new entrepreneurs believe they need huge budgets, viral ads, or a “perfect product” to succeed. The truth? What matters most is how you design the flow of offers around your product or service. With the right money model, you can make more revenue from every customer, spend confidently on growth, and build long-term stability instead of chasing one-off sales.

Think about it: Starbucks doesn’t just sell you coffee. They upsell pastries, introduce seasonal specials, and keep you loyal with their rewards app. Apple doesn’t stop at selling iPhones — they stack AirPods, AppleCare, iCloud, and subscriptions on top. These businesses thrive not because of a single product, but because of the money models working behind the scenes.

The best part? You don’t need millions to start. By learning a few proven frameworks and applying them in your own small business, side hustle, or online project, you can start earning more, faster — while giving your customers even better results.

In this guide, we’ll break down how money models work, why they’re so powerful, and how you can design one step by step. Each section is packed with beginner-friendly insights, real-world examples, and actionable strategies you can use right away.

Table of Contents

- 📌 What Exactly Is a Money Model?

- 🎯 Attraction Offers: Turning Strangers into Buyers

- 🧩 Core Offers: Delivering Real Value to Your Customers

- 💡 Upsell Offers: Unlocking More Revenue with Every Sale

- 🔄 Downsell Offers: Winning Customers Who Would’ve Walked Away

- 🔁 Continuity Offers: Building Long-Term, Predictable Income

- 🛠️ Crafting Your Own Money Model Step by Step

- ⚡ Common Mistakes Beginners Make (and How to Avoid Them)

- 🌍 Real-World Examples of Money Models in Action

- 🚀 Scaling Your Business the Smart Way

📌 What Exactly Is a Money Model?

A money model is the blueprint of how your business earns money — not just once, but again and again. Instead of thinking about sales as a single transaction, a money model views them as a sequence of steps that guide customers through their journey with you. Each step solves a problem, offers more value, and creates more revenue.

Think about the last time you booked a flight online. You clicked to buy the ticket, but before checkout, you probably saw a screen offering travel insurance, seat upgrades, extra luggage, or even rental cars. What happened there? You didn’t just buy a flight — you entered their money model.

This is the key difference between businesses that struggle and those that scale. Businesses with weak models often rely on one product or one-time sales. That creates stress because they’re constantly chasing new customers. Strong businesses, on the other hand, structure offers in a way that maximizes revenue from each customer they already have. This gives them the confidence to spend more on marketing, serve better, and grow faster.

Why Beginners Must Understand Money Models

If you’re just starting out, you might think, “I just want to sell my product — isn’t that enough?” The short answer is no. Imagine opening a bakery and only selling single cupcakes. Sure, you’ll make some money, but you’ll struggle to cover rent, staff, and ingredients. But if you also sell coffee, offer a dozen cupcakes at a discount, or create a loyalty card where customers get the 10th visit free, suddenly your revenue and repeat business grow dramatically.

That’s the essence of a money model: it’s not about changing your product, but about changing how you package, present, and expand what you already have.

🎯 Attraction Offers: Turning Strangers into Buyers

The first stage of any money model is simple: get people in the door. Attraction offers are designed to do just that. They grab attention and turn strangers into paying customers — often by reducing risk, lowering barriers, or creating irresistible deals.

If you’ve ever seen a “first month free” ad at a gym, a “buy one, get one free” pizza promotion, or an online course offering a $1 trial, you’ve already experienced an attraction offer. These aren’t random discounts — they’re carefully designed strategies to acquire new customers at scale.

Why Attraction Offers Work

People are naturally cautious when buying from someone new. They’re asking themselves:

- “Is this worth my money?”

- “Will this actually help me?”

- “What if I regret it?”

Attraction offers remove these objections by making the first purchase too good to resist. The goal isn’t to profit big on the first transaction — it’s to start the relationship. Once someone says “yes” the first time, it becomes much easier to show them additional products, upgrades, or memberships later.

Practical Examples of Attraction Offers

Let’s break down a few types of attraction offers you can use, even as a beginner:

1. Win Your Money Back

This strategy lets customers “bet” on their own success. They pay upfront but have the chance to earn all or part of it back if they hit a certain milestone.

- Fitness Example: A gym charges $300 for a 6-week challenge. If participants attend all sessions and hit their goal weight, they get their money back as store credit. Many reinvest in longer memberships anyway.

- Online Business Example: A marketing coach offers a “5 Clients in 30 Days Challenge” for $500. If participants complete all required steps and don’t land at least one client, they get their money back. The risk feels minimal, so more people join.

Why it works: Customers feel protected, motivated, and confident — while you get upfront cash and plenty of chances to upsell.

2. Giveaways and Scholarships

Everyone loves free stuff. A giveaway creates buzz, collects leads, and gives you a chance to offer discounts to everyone who doesn’t win the grand prize.

- Education Example: A course creator runs a “Full Scholarship Giveaway” for their $1,000 program. One person gets in free, while everyone else is offered a “partial scholarship” — say, $300 off. The losers still feel like winners, and many enroll.

- Local Business Example: A dental clinic gives away a free set of braces ($6,000 value). Hundreds of leads apply. Those who don’t win are offered $1,000 off treatment, which feels like a bargain compared to the full price.

Why it works: You generate a large pool of interested people who already see value in your product. The “discounted” offer feels exclusive and time-sensitive.

3. Decoy Offers

A decoy offer is a small, less appealing option placed next to a much better one. Its purpose is to make the premium choice look irresistible.

- Example: A tanning salon sells a $5 five-day pass. Customers quickly realize they can’t get the tan they want in five days, so staff “credits” the $5 toward a $20 unlimited monthly membership. Most people upgrade.

- Digital Example: A software tool offers a limited free version, but when users see how restricted it is, they happily pay for the $29/month premium plan.

Why it works: People don’t like feeling limited. The decoy option pushes them toward the higher-value choice.

4. Buy X, Get Y Free

One of the oldest tricks in the book, but still powerful. It feels like a bonus, even if you’ve already baked the cost into the price.

- Example: A pizzeria offers “Buy 2, Get 1 Free.” Families order more than they normally would, increasing total sales volume.

- E-commerce Example: A skincare brand promotes “Buy 3, Get a Travel Kit Free.” Customers who might have bought one or two products now buy three to qualify.

Why it works: Customers focus on what they’re gaining rather than the money they’re spending.

5. Pay Less Now, Pay More Later

This type of offer lowers the upfront cost, making it easier for people to say yes.

- Example: A fitness trainer offers a $50 “try it out” fee for the first two weeks, with the option to continue at the regular $200/month afterward.

- Software Example: SaaS companies often give a $1 trial month, then roll customers into full-price billing once they’ve seen the value.

Why it works: People commit when the initial risk is tiny. Once they experience results, most continue paying.

How Beginners Can Apply Attraction Offers Today

Even if you’re just starting, you can design a simple attraction offer around your product or service. Here’s a quick framework:

- Pick your main product. What do you already sell or want to sell?

- Find the entry point. How can you lower risk or boost perceived value?

- Discount it.

- Offer a free trial.

- Add a money-back guarantee.

- Layer in urgency or scarcity. Set a deadline or limit spots to push people to act quickly.

- Connect it to your next offer. Don’t stop at the first purchase — plan what comes after.

For example, if you’re a freelance web designer:

- Attraction offer → $99 “Website Audit & Action Plan.”

- Upsell later → Full redesign package.

- Continuity → Monthly maintenance service.

See how the first step creates trust and opens the door to bigger opportunities?

Key Takeaways on Attraction Offers

- Attraction offers are not about profit — they’re about starting the relationship.

- Make the first deal irresistible by lowering risk or stacking value.

- Always design the next step: an upsell, downsell, or subscription.

- Keep it simple. Beginners often overthink offers, but the best attraction offers are easy to understand and quick to act on.

👉 Attraction offers are just the beginning of a complete money model. Once you’ve brought people in, the real growth happens when you learn how to maximize revenue with upsells, save sales with downsells, and build long-term stability with continuity offers.

🧩 Core Offers: Delivering Real Value to Your Customers

When it comes to building a money model, everything revolves around one key element: your Core Offer. Attraction offers might get people in the door, upsells and downsells might increase revenue, and continuity programs might keep income steady, but none of these matter if your core offer isn’t strong. It’s the beating heart of your business — the product or service that delivers the real transformation customers are paying for.

For beginners, it’s easy to overcomplicate this step or get lost chasing flashy marketing tricks. But the truth is simple: if your core offer isn’t compelling, your business will always struggle. So let’s unpack exactly what a core offer is, how to design one that customers love, and how to make it the foundation of a long-lasting money model.

What Is a Core Offer?

A Core Offer is the main product or service your business is built around. It’s not the cheapest “entry point” or the ongoing subscription. It’s the primary solution that solves your customer’s most pressing problem or fulfills their biggest desire.

Think of it as the reason your business exists. For Apple, it’s the iPhone. For Starbucks, it’s coffee. For Netflix, it’s the library of movies and shows. Everything else — accessories, memberships, loyalty programs — supports this centerpiece.

A good core offer has three main traits:

- Clarity — Customers know exactly what they’re getting and how it helps them.

- Value — The benefits far outweigh the price.

- Deliverability — You can consistently provide the promised result without burning yourself out.

Why Core Offers Matter

Beginners sometimes think the real money comes from upsells or subscriptions. But those work best only if the core offer is irresistible in the first place. Here’s why it’s so critical:

- It sets the tone. A strong core offer creates trust and positions you as credible.

- It drives most of your revenue. Even if upsells add extra profit, most customers will buy the core first.

- It creates long-term customers. Delivering on your core promise keeps people coming back for continuity or upgrades.

Put simply: if your core offer is weak, your whole money model collapses.

The Core Offer Formula for Beginners

So how do you design a core offer that actually works? Here’s a beginner-friendly formula:

- Identify your customer’s #1 problem or desire. What keeps them awake at night? Or what big dream do they want to achieve?

- Define a clear, measurable result. Example: “Launch your first website in 30 days” is stronger than “Web design help.”

- Add structure and deliverables. Spell out exactly what’s included (product features, training modules, coaching calls, etc.).

- Provide proof. Use testimonials, demos, or even your own story as evidence it works.

- Set a fair, value-based price. Price according to the transformation, not just your costs.

This approach works whether you’re selling physical products, digital courses, or services.

Examples of Core Offers

Let’s look at different industries to make this concrete:

- Fitness coach: Core Offer = a 12-week weight-loss program with workout plans, meal guidance, and coaching support.

- Freelance graphic designer: Core Offer = a complete brand identity package (logo, color palette, social media kit).

- E-commerce brand: Core Offer = a 30-day skincare system with cleanser, serum, and moisturizer.

- SaaS startup: Core Offer = a Pro Plan with advanced features and priority support.

- Local café: Core Offer = high-quality coffee beverages. Upsells (pastries) and continuity (loyalty app) come later.

Notice how each example centers around solving one main problem or delivering one main result.

How to Price a Core Offer

One of the biggest struggles for beginners is pricing. Set it too low and you’ll attract bargain hunters and struggle to scale. Set it too high without justification and customers walk away.

Here are some beginner tips:

- Price on value, not cost. If your offer helps a business earn $10,000, charging $1,000 is a bargain — even if it only costs you $100 to deliver.

- Use tiered options. Offer three versions: Basic, Standard, Premium. Most customers choose the middle, making it a sweet spot.

- Anchor pricing. Show the premium version first to make the standard version look like a deal.

💡 Example: A web designer could offer:

- Basic = $500 for a simple site.

- Standard = $1,200 with SEO and mobile optimization.

- Premium = $3,000 with ongoing support.

Most clients will pick the $1,200 option.

Making Your Core Offer Stand Out

Competition is fierce, and beginners often worry: “Why would someone buy from me?” The answer is positioning. You don’t need to be the cheapest or the most advanced — you just need to be the clearest about your value.

Ways to stand out:

- Niche down. Instead of “marketing services,” offer “Instagram growth plans for local gyms.”

- Add bonuses. Throw in extras that cost you little but feel valuable to customers (templates, checklists, guides).

- Guarantee results. Offer a satisfaction or money-back guarantee. It reduces risk and increases trust.

Common Mistakes Beginners Make with Core Offers

Even with the best intentions, many beginners stumble when creating their core offer. Here are the most common pitfalls:

- Being too vague. “Coaching services” is unclear. “12-week weight-loss coaching with weekly calls” is specific.

- Overloading with features. Customers don’t want everything — they want the solution to their problem.

- Underpricing from fear. Don’t assume cheap = attractive. Often it signals “low quality.”

- Ignoring delivery. If you can’t consistently fulfill your promise, you’ll burn out or damage your reputation.

- Skipping proof. People won’t just take your word. Even one testimonial or case study is better than none.

Beginner-Friendly Checklist for Core Offers

Here’s a quick list to test if your core offer is ready:

✅ Does it solve a specific problem or deliver a clear result?

✅ Is it structured with clear deliverables?

✅ Do you have some form of proof or guarantee?

✅ Is the price fair based on the transformation, not just cost?

✅ Can you deliver it consistently without burning out?

✅ Does it naturally lead to upsells, downsells, or continuity?

If you can say “yes” to most of these, you’re ready to launch.

Why Core Offers Are the Bridge to the Rest of the Money Model

Remember: the entire money model revolves around this step. Attraction offers create curiosity, but they’re worthless without a solid core to point toward. Upsells and downsells increase value, but they only work when customers already trust your main product. Continuity keeps income steady, but people will only stick around if your core offer delivered on its promise.

In other words, the core offer is the bridge between curiosity and loyalty. Get this right, and the rest of your money model has a solid foundation to grow on.

Key Takeaways

- The Core Offer is the centerpiece of your business — the main product or service customers are really buying.

- It must be clear, valuable, and consistently deliverable.

- Pricing should reflect transformation, not just cost.

- A strong core offer makes upsells, downsells, and continuity possible.

- Beginners should start with one clear, irresistible core offer before adding complexity.

👉 With your core offer in place, you now have the “engine” of your money model. Next, you can confidently build upsells, downsells, and continuity programs around it — knowing your foundation is solid.

💡 Upsell Offers: Unlocking More Revenue with Every Sale

If attraction offers are about opening the door, upsell offers are about showing customers the staircase — the next natural step after their first purchase. An upsell is when you encourage someone who’s already buying to add more value, convenience, or results to their order.

Think about the last time you ordered food at a drive-thru. You asked for a burger, and the cashier asked, “Would you like fries and a drink with that?” That’s the classic upsell. Simple, natural, and highly effective.

Businesses that master upsells don’t just increase revenue; they make the customer experience better. After all, fries complete the meal. The secret is that the best upsells feel like a service, not a sales pitch.

Why Upsells Are So Powerful

When someone has already decided to buy, their resistance drops dramatically. They’ve trusted you enough to pull out their wallet, which means they’re more open to hearing about additional offers.

From a beginner’s perspective, this matters for two big reasons:

- Cheaper customer acquisition. Getting new customers is expensive. Upsells let you earn more from the ones you already have.

- Better lifetime value. If a customer usually spends $50 with you, but your upsell raises that to $100, you’ve doubled revenue without doubling effort.

Even small upsells can add up to big results. Imagine a digital course creator selling a $99 course. If 30% of buyers also grab a $29 workbook upsell, that’s an extra $870 per 100 customers — almost 9 extra full sales, without attracting new leads.

Different Types of Upsells

Not all upsells are created equal. Some are small add-ons, others are full-blown upgrades. Let’s look at common types you can use as a beginner.

1. The Classic Upsell: Add More to the Order

This is the simplest: when someone buys one thing, ask if they’d like more of the same.

- E-commerce Example: Buying one T-shirt? Offer a second one at 20% off.

- Local Business Example: A bakery sells one slice of cake. At checkout, the cashier says, “For just $4 more, you can get the whole cake instead.”

Why it works: Customers already want the product, so offering more at a better deal feels like a win.

2. Menu Upsell: Give Options in Tiers

People love choices, but too many can overwhelm them. A smart way to upsell is by presenting “good, better, best” packages.

- Example: A SaaS platform offers three tiers — Basic ($29), Pro ($59), and Premium ($99). Most people gravitate toward the middle or top option because it feels like better value.

- Service Example: A photographer offers a $300 basic package, a $600 advanced package with more edited photos, and a $1,000 premium package with albums and prints.

Why it works: People naturally compare options. By anchoring them with higher-priced packages, your mid-tier or premium packages look more attractive.

3. Anchor Upsell: Highlight the Premium First

Anchoring is about setting a high reference point so everything else feels like a bargain.

- Example: A gym offers a $1,200 yearly membership first, then mentions the $120/month option. Suddenly, the monthly option feels easier to commit to.

- Digital Example: A webinar software shows its $299/month plan before the $99/month plan, making the lower tier look “cheap” in comparison.

Why it works: People judge value by comparison, not absolute price.

4. Rollover Upsell: Apply Payment Toward Bigger Purchases

This tactic credits what the customer already paid toward an upgrade.

- Fitness Example: A $99 six-week bootcamp can be rolled into a $499 three-month membership. Customers feel like their money isn’t wasted.

- Online Learning Example: A $47 mini-course can be credited toward a $497 flagship program.

Why it works: Customers feel their first purchase is an “investment” toward something greater, making the upsell easier to accept.

5. Value-Add Upsell: Solve Related Problems

Upsells don’t have to be more of the same product. They can be complementary.

- Example: A laptop store sells a computer, then upsells antivirus software or an extended warranty.

- Online Example: A course on blogging upsells SEO templates, content calendars, or a toolkit of plugins.

Why it works: Customers see you as anticipating their needs, not just selling.

Real-World Upsell Examples

To make this more concrete, let’s look at how familiar businesses use upsells daily.

- McDonald’s: Their entire system runs on upsells — supersizing meals, adding dessert, or promoting combo deals. Each one increases average ticket size.

- Amazon: The “Frequently bought together” section is an automated upsell machine, often adding 20–30% more to every order.

- Apple: Buy an iPhone? You’ll likely be offered AirPods, an Apple Watch, iCloud storage, or AppleCare. Each upsell is positioned as enhancing the original purchase.

For beginners, this is encouraging — if billion-dollar companies rely heavily on upsells, you can use them too, even on a small scale.

How to Create Effective Upsells

Designing upsells doesn’t need to be complicated. Here’s a simple process:

- Start with your core product. What are customers already buying?

- Ask: what’s the next logical step? Does your product require accessories, advanced features, or ongoing support?

- Make it easy to say yes. The upsell should feel natural, not forced. Think “complete your order” instead of “buy more stuff.”

- Use psychology. Leverage scarcity (“Only 3 left at this price”), urgency (“Upgrade now before checkout closes”), or social proof (“Most customers choose this bundle”).

- Keep the price proportional. A good rule: upsells work best when they’re 30–50% of the original purchase price.

Common Mistakes Beginners Make with Upsells

While upsells can transform your revenue, beginners often trip up in a few areas:

- Overloading customers. Too many upsells can overwhelm and frustrate buyers. Keep it simple — one or two clear options.

- Forcing irrelevant offers. If you sell a $20 digital ebook on productivity, don’t upsell a $5,000 coaching program right away. The jump feels unnatural.

- Using pushy language. The best upsells feel like helpful suggestions. Customers should feel guided, not pressured.

- Ignoring timing. Present the upsell at the right moment — usually after the first “yes” but before checkout finishes.

Remember: upsells should feel like a natural extension of the customer’s original decision, not a desperate attempt to squeeze more money.

Beginner-Friendly Upsell Ideas You Can Try

If you’re just starting out and wondering how to implement upsells in your own business, here are some easy options:

- Freelancers: Offer an upsell of priority delivery or additional revisions.

- Coaches/Consultants: Add a 1:1 session or group Q&A upsell after someone buys your online program.

- E-commerce Sellers: Upsell product bundles, gift wrapping, or extended warranties.

- Content Creators: Upsell templates, checklists, or premium resources alongside your main course.

- Local Businesses: Restaurants can upsell appetizers or desserts; salons can upsell deep-conditioning treatments or product bundles.

Why Upsells Build Long-Term Loyalty

Here’s the surprising part: upsells aren’t just about making more money. They can actually improve customer satisfaction.

Think about it — when you buy a camera and the store offers a protective case and memory card, they’re not being pushy. They’re helping you avoid frustration later. Done well, upsells show you understand your customer’s journey and want to set them up for success.

This creates trust, repeat business, and referrals. Customers who feel taken care of are much more likely to stay loyal — and spend more with you in the long run.

Key Takeaways on Upsells

- Upsells increase revenue by offering customers more value after they’ve already said yes.

- They work because buyers have lower resistance after the first purchase.

- There are many types: classic, menu, anchor, rollover, and value-add.

- Keep upsells simple, relevant, and proportionally priced.

- The best upsells feel like solutions, not sales tactics.

For beginners, mastering upsells can be the difference between a struggling side hustle and a thriving business. Even one well-designed upsell can double your average revenue per customer — without needing a single extra lead.

👉 Now that you understand how to grow sales with upsells, the next step is learning how to save the sale when customers hesitate. That’s where downsells come in — turning “no” into “yes” without slashing your profits.

🔄 Downsell Offers: Winning Customers Who Would’ve Walked Away

No matter how good your product is, not every customer will say yes to your main offer. Some hesitate because of price, others because of commitment, and some just aren’t ready yet. That’s where downsell offers come in. Instead of losing these potential customers, a downsell gives them a lower-risk, lower-priced, or simpler way to stay in the game.

Think about it: how many times have you walked away from a purchase because it felt “too much” at that moment? Imagine if the seller had offered you a lighter version, a trial, or a more affordable option — you probably would’ve said yes. That’s exactly what downsells are designed to do: turn a no into a yes.

For beginners, mastering downsells can be the difference between wasted leads and steady income. Let’s break down how they work, why they matter, and how you can use them in your own business.

Why Downsells Are Crucial

Most beginners put all their energy into upsells — increasing the value of each sale. While upsells are powerful, downsells are your safety net. They make sure you don’t lose customers entirely.

Here’s why they’re so valuable:

- Catch hesitant buyers. Some people want what you’re offering but can’t afford the premium version. A downsell lets them participate at their level.

- Build trust. Giving people a smaller, safer option shows you care more about helping them than squeezing money out of them.

- Create future upsell opportunities. A downsell customer today can become a premium customer tomorrow once they see results.

Instead of thinking, “I lost that sale,” you can think, “I just started the relationship at a smaller step.”

Common Types of Downsell Offers

There are several ways to structure downsells, and you don’t need to overcomplicate things. Let’s look at beginner-friendly approaches you can try.

1. Lite Version of the Main Product

This is the most straightforward downsell. If someone doesn’t want the full version, offer a simplified one at a lower cost.

- Online Course Example: If your $997 full course feels too expensive, offer a “lite” version for $197 with fewer modules.

- Coaching Example: Instead of a $2,000 one-on-one program, offer a $500 group coaching option.

Why it works: Customers still get value, but they feel more comfortable with a smaller investment.

2. Payment Plan

Sometimes the objection isn’t price, but cash flow. A downsell can be as simple as breaking the price into smaller chunks.

- Example: A software license costs $500 annually. Offer a downsell of $49/month instead.

- Example: A photography package costs $1,000 upfront. Offer $250/month over four months.

Why it works: It lowers the immediate financial barrier without lowering the perceived value.

3. Trial Period or Starter Package

If customers aren’t ready for the full deal, let them dip their toes in.

- Example: A fitness studio offers a $300 unlimited monthly membership. The downsell is a $49 one-week trial.

- Example: A SaaS platform charges $99/month. The downsell is a $1 seven-day trial.

Why it works: Customers can test your service with minimal risk. Once they experience results, many stay.

4. DIY or Self-Serve Version

Sometimes people don’t want hand-holding — they just want the essentials at a lower cost.

- Example: A marketing agency charges $2,500/month for full-service campaigns. The downsell is a $197 template pack or strategy guide so clients can do it themselves.

- Example: A web designer offers a $3,000 custom site. The downsell is a $300 pre-made template.

Why it works: Customers still solve their problem, but with more effort on their part.

5. Smaller Quantity or Entry-Level Product

Offer less of the same thing at a lower cost.

- Example: A bakery sells a $40 full cake. The downsell is a $6 slice.

- Example: A coaching program is $1,000 for 12 weeks. The downsell is $97 for a two-hour workshop.

Why it works: Customers who can’t commit big still get a taste of your value.

Real-World Examples of Downsells

Downsells aren’t just theory — they’re everywhere in successful businesses.

- Netflix: If you cancel, they often offer a cheaper plan with limited features before you leave.

- Spotify: Cancelling Premium? You might see an offer for three months at half price.

- Airlines: Can’t afford business class? They’ll offer economy with extra legroom as a middle ground.

- E-learning platforms: Cancel a subscription, and you may get offered a discounted student or “basic” plan to stay onboard.

These companies understand that even a smaller monthly payment is better than losing a customer completely.

How to Create Your First Downsell

If you’re just starting out, here’s a step-by-step way to design a downsell:

- Identify your main offer. What’s your flagship product or service?

- Look at the common objections. Why do people say no? (Too expensive? Too big a commitment? Not enough trust yet?)

- Match the objection to a downsell.

- Too expensive → lite version or smaller package.

- Too much commitment → trial or shorter-term option.

- Not enough trust → cheaper self-serve version.

- Present it at the right moment. Offer the downsell right after a “no,” or during cancellation checkout.

- Keep it simple. Don’t confuse customers with five different options. One strong downsell is enough.

Mistakes to Avoid with Downsells

Downsells are powerful, but if done poorly, they can backfire. Beginners often make these mistakes:

- Cannibalizing your main offer. Don’t make the downsell so attractive that people choose it over the main product from the start.

- Devaluing your brand. A downsell should feel like a smaller step, not a desperate discount. If you slash prices too much, it may hurt your credibility.

- Overcomplicating the choices. Too many options overwhelm customers. Keep the flow clear: main offer → downsell.

- Offering downsells too early. Don’t show a cheaper option before someone has had the chance to consider the main one.

The downsell should feel like a fallback, not the primary path.

Beginner-Friendly Downsells You Can Try Today

- Freelancers: If a client says no to a full-service package, offer a one-hour consultation at a lower price.

- Coaches: If your group program feels too big for someone, offer a self-paced course.

- E-commerce Sellers: If someone abandons their cart, send a follow-up email offering free shipping or a smaller bundle.

- Local Businesses: If a customer won’t buy a year-long gym membership, offer a pay-as-you-go class pass.

These simple adjustments can turn missed sales into steady income streams.

Why Downsells Build Long-Term Relationships

A downsell isn’t just about money — it’s about showing flexibility. Customers appreciate businesses that meet them where they are. By giving them an easier way to say yes, you build goodwill and trust.

And here’s the kicker: many downsell customers later come back for the full product once they see results. For example, someone who buys a $97 workshop may later upgrade to your $1,000 course once they realize you deliver value.

Downsells, in this way, become an on-ramp to your premium offers.

Key Takeaways on Downsells

- Downsells catch customers who would’ve otherwise left.

- They work best when they address specific objections like price, commitment, or trust.

- Effective downsells include lite versions, payment plans, trials, DIY options, or smaller quantities.

- Always position downsells as a step forward, not a desperate discount.

- Done right, they keep customers engaged and pave the way for future upsells.

For beginners, downsells may feel counterintuitive — why offer less? But in reality, a smaller sale today often leads to a bigger one tomorrow. It’s about playing the long game and making sure every interaction moves customers closer, not further away.

👉 Once you’ve mastered attraction offers, upsells, and downsells, the next piece of the puzzle is building continuity offers — systems that bring in recurring revenue month after month. That’s where we’ll head next.

🔁 Continuity Offers: Building Long-Term, Predictable Income

If attraction offers get people in the door, upsells increase the size of each order, and downsells rescue lost sales, then continuity offers are what keep the lights on. Continuity is all about recurring revenue — income that comes in every month without you having to start from scratch.

Think of continuity as the “subscription model.” Instead of constantly chasing new customers, you build a system where existing customers pay you again and again. This is what makes businesses stable, predictable, and scalable.

Imagine waking up on the first day of the month and knowing you already have $5,000 or $50,000 coming in from memberships, subscriptions, or retainers — before you’ve sold anything new. That’s the power of continuity offers.

Why Continuity Matters for Beginners

When you’re starting out, income often feels like a rollercoaster. One month you land a few clients or sell a bunch of products, and the next month it’s quiet. That unpredictability makes it stressful to plan, invest, or even pay yourself consistently.

Continuity solves this problem by creating predictable cash flow. Even a modest continuity offer — say, 50 people paying you $30/month — adds stability and breathing room. That’s $1,500/month you can count on while you focus on growing.

For beginners, it’s one of the smartest strategies you can adopt early, because it frees you from the “hustle and hope” cycle.

Common Types of Continuity Offers

The beauty of continuity is that it comes in many forms. You don’t need to build the next Netflix to benefit from it. Let’s explore some beginner-friendly continuity models.

1. Membership Sites

A membership site gives paying customers access to exclusive content, resources, or a community.

- Example: A fitness coach offers a $29/month membership site with weekly workout videos, recipes, and live Q&As.

- Example: A writing coach creates a $19/month community where members share drafts, get feedback, and join workshops.

Why it works: People crave support, accountability, and fresh content. A membership site offers all three in one place.

2. Subscription Boxes

Physical products can also run on continuity. Subscription boxes deliver curated items each month.

- Example: Dollar Shave Club built a billion-dollar business on $1 razors sent monthly.

- Example: Local bakeries are now offering “bread of the month” subscriptions — customers pay upfront and pick up fresh loaves every week.

Why it works: People love surprises and convenience. Subscriptions turn everyday items into experiences.

3. Software-as-a-Service (SaaS)

If you can build or resell software, this is one of the most lucrative continuity models. Customers pay monthly for tools they use regularly.

- Example: Canva charges for design tools with premium templates and features.

- Example: Zoom built its empire on recurring subscriptions for video calls.

Why it works: Once software becomes part of someone’s workflow, it’s hard to cancel. The value compounds every month.

4. Continuity Through Retainers

Service providers can build continuity by offering ongoing support instead of one-off projects.

- Example: A web designer shifts from one-time builds to $200/month maintenance packages.

- Example: A social media manager offers $500/month retainers for content creation and posting.

Why it works: Clients value reliability, and service providers gain predictable income instead of constantly finding new projects.

5. Hybrid Models

You can mix continuity with other offers for maximum effect.

- Sell a course (one-time payment), then offer a membership community for ongoing support.

- Sell physical products, then bundle them into a monthly “refill subscription.”

- Offer a high-ticket service, then transition clients into lower-cost monthly retainers.

The flexibility of continuity makes it adaptable to almost any business.

How to Create a Continuity Offer as a Beginner

Designing your first continuity offer doesn’t have to be complicated. Here’s a step-by-step process:

- Start with what you already sell. Do you offer products, services, or knowledge?

- Identify repeatable value. Ask: what could I deliver every month that people would happily pay for?

- Knowledge → tutorials, templates, coaching.

- Products → consumables, curated boxes.

- Services → ongoing support or management.

- Choose a delivery method. Membership site, subscription box, retainer contract, or software.

- Set a fair price. Beginners often underprice continuity offers. Even $20/month from 100 members = $2,000/month.

- Keep it simple. Focus on one core benefit instead of overwhelming members with too much.

For example: If you’re a personal trainer, your continuity could be a $29/month “virtual fitness club” with workout videos and meal plans. Simple, scalable, and recurring.

Real-World Continuity Examples

- Netflix: The poster child of continuity. Millions pay monthly, and the company invests in more content to keep them subscribed.

- Amazon Prime: Members pay yearly or monthly for free shipping, streaming, and deals. The perks keep them locked in.

- Adobe Creative Cloud: Instead of one-time software sales, Adobe shifted to a subscription model, creating steady recurring revenue.

- Local Gyms: Classic continuity — memberships bring in predictable income regardless of how often people attend.

Even small businesses can replicate these principles. A local car wash with a $25/month unlimited wash club is running the same continuity playbook as billion-dollar giants.

Common Mistakes Beginners Make with Continuity

While continuity can transform your business, it’s easy to stumble. Here are pitfalls to avoid:

- Overpromising content. Many new membership sites fail because the creator tries to deliver too much. Keep it simple and consistent.

- Ignoring churn. Customers will cancel. Your job is to constantly add value and remind them why staying is worth it.

- Pricing too low. If you charge $5/month, you’ll need thousands of members to survive. Price based on value, not fear.

- Forgetting the journey. Continuity should feel like part of your overall money model, not an afterthought. Connect it to your attraction offers, upsells, and downsells.

Beginner-Friendly Continuity Ideas You Can Try

Here are some simple ideas depending on your business type:

- Freelancers: Offer ongoing support packages — e.g., “3 hours of design tweaks per month” for $150/month.

- Coaches: Create a monthly mastermind or accountability group at $50–$100/month.

- E-commerce: Add a “subscribe and save” option for consumable products (coffee, supplements, skincare).

- Content Creators: Launch a Patreon or private community with exclusive content for $10/month.

- Local Businesses: Offer memberships — e.g., unlimited yoga classes for $99/month or free coffee refills for $20/month.

Even one of these ideas can add a steady income stream to your business.

Why Continuity Builds Wealth, Not Just Revenue

Continuity isn’t just about smoothing cash flow — it’s about building assets. A business with recurring revenue is far more valuable than one relying on one-off sales. Investors, buyers, and even banks favor businesses with predictable income.

For you as a beginner, continuity provides peace of mind. You can plan ahead, invest in growth, and focus on serving customers instead of constantly hunting for the next sale.

This is why many entrepreneurs say: “One-time sales feed you. Continuity feeds your future.”

Key Takeaways on Continuity

- Continuity offers create stable, predictable income through recurring payments.

- They can take many forms: memberships, subscription boxes, SaaS, retainers, or hybrids.

- Start simple — even 20 members at $30/month creates $600 in reliable income.

- Avoid common mistakes like overpromising, underpricing, or neglecting churn.

- Continuity doesn’t just earn you money now; it builds long-term wealth and business value.

For beginners, adding continuity early is like planting a tree. It may start small, but with time, it grows into something that gives shade, fruit, and stability for years to come.

👉 Now that we’ve covered attraction offers, upsells, downsells, and continuity, it’s time to put all the pieces together. In the next part, we’ll look at how to craft your own money model step by step, so you can design a system that grows with you.

🛠️ Crafting Your Own Money Model Step by Step

By now, you’ve explored each part of the money model: attraction offers, core offers, upsells, downsells, and continuity. But understanding them in isolation isn’t enough. The real transformation happens when you connect these elements into a step-by-step system that guides your customers naturally from first contact all the way to long-term loyalty.

Think of it like building a staircase. Each step takes your customer higher, and if they hesitate, you’ve got a safe path to keep them moving instead of dropping out. Let’s walk through how to craft your own money model from scratch.

Step 1: Build Your Attraction Offer 🎯

Every journey begins with attention. You can’t sell to someone who doesn’t know you exist. That’s why your first step is creating an attraction offer — a low-cost, low-risk way for strangers to try what you do.

Attraction offers should be:

- Affordable or even free.

- Quick to deliver.

- Tied directly to your main solution.

Examples:

- A bakery gives away a free cupcake for new customers.

- A fitness trainer sells a $29 “7-Day Home Workout Challenge.”

- A SaaS company offers a free 14-day trial.

💡 Pro Tip: Don’t overcomplicate this. Your attraction offer isn’t about making profit. It’s about starting a relationship and proving your value.

Step 2: Define Your Core Offer 🧩

Once people trust you, they’re ready for your core offer — the main product or service you want to be known for. This is what drives your revenue and establishes your brand.

Ask yourself:

- What problem do I solve most effectively?

- What’s the main transformation I can deliver?

- If I could only sell one thing, what would it be?

Examples:

- A web designer’s core offer: a $2,000 custom WordPress website.

- A nutrition coach’s core offer: a $499 12-week transformation program.

- A course creator’s core offer: a flagship $497 online course.

💡 Beginner Tip: Don’t scatter your focus. Choose one core offer you can consistently deliver well. Build the rest of your model around it.

Step 3: Add an Upsell Path 💡

Now that your customer has bought your core offer, the door is open to increase value with upsells. Upsells aren’t about being pushy — they’re about helping your customer go further, faster, or easier.

Great upsells should feel like:

- A logical next step.

- A premium version of what they already bought.

- An enhancement that makes their results better.

Examples:

- After buying a laptop (core), customers are offered extended warranty, software bundles, or a premium bag.

- After a $497 course, students can upgrade to a $997 group coaching program.

- After a $2,000 website design, clients can add $500 brand guidelines or $200/month maintenance.

💡 Pro Tip: Always frame upsells as a way to help the customer succeed faster or easier. If it feels unrelated, it won’t work.

Step 4: Create a Downsell Safety Net 🔄

Not every prospect will say yes to your core offer. Some will find it too expensive, too advanced, or too big of a commitment. Without a backup, you’ll lose them entirely. That’s where the downsell comes in.

A downsell is a lighter version of your main offer — easier to say yes to but still valuable.

Examples:

- A $2,000 coaching package (core) → downsell: a $297 self-study toolkit.

- A $497 flagship course → downsell: a $97 mini-course.

- A $50 monthly subscription → downsell: a $10 “starter pack” ebook.

💡 Pro Tip: Frame your downsell as a “starter option” rather than a downgrade. This way, people feel like they’re still making progress, not settling.

Step 5: Build Continuity for Stability 🔁

One-time sales are exciting, but they’re not sustainable. What you need is continuity — a recurring income stream that gives you predictable revenue.

Continuity offers could be:

- Memberships (e.g., $29/month learning community).

- Subscriptions (e.g., $20/month coffee delivery).

- Retainers (e.g., $500/month social media management).

Examples:

- Netflix charges $15/month for ongoing entertainment.

- A gym sells annual memberships instead of single classes.

- A local café offers a prepaid monthly coffee pass.

💡 Beginner Tip: Start small. Even a $10/month subscription with 50 loyal customers means $500 every month you can count on.

Step 6: Map the Full Customer Journey 🗺️

Now that you’ve built each piece, it’s time to connect them into a smooth pathway. Imagine your customer walking through these doors:

- Attraction Offer → 2. Core Offer → 3. Upsell (if yes)

- If no to core → Downsell

- Either path eventually → Continuity

Example: A fitness business

- Attraction: $29 “7-Day Challenge.”

- Core: $499 12-week transformation.

- Upsell: $99/month VIP group coaching.

- Downsell: $97 mini-course.

- Continuity: $29/month workout membership.

Example: A freelance designer

- Attraction: $99 website audit.

- Core: $2,000 custom website.

- Upsell: $500 branding kit.

- Downsell: $297 pre-made template.

- Continuity: $99/month hosting & support.

Mapping ensures that no matter what choice a customer makes, they always stay in your world.

Step 7: Test and Refine ⚡

The first version of your money model won’t be perfect — and that’s okay. The secret is testing.

- Track conversions: Which offers get the most yes’s?

- Collect feedback: Where do customers get stuck or hesitate?

- Adjust pricing: Sometimes a $10 change makes a huge difference.

💡 Pro Tip: Launch fast, learn fast. Don’t wait for perfection — the market will tell you what works.

Why This Works

This step-by-step model works because it mirrors how people make buying decisions. Not everyone is ready to jump into your highest-priced offer right away. Some need a taste (attraction), others need reassurance (downsell), while loyal fans want to stay long-term (continuity).

By building a system that accounts for all these behaviors, you:

- Capture more customers at different readiness levels.

- Earn more per customer over time.

- Create stable, predictable income.

- Build a business that grows instead of starting over each month.

Key Takeaways

- Start with an attraction offer to bring strangers in.

- Guide them to your core offer, your main product or service.

- Use upsells to add value and increase revenue.

- Catch hesitant buyers with downsells.

- Secure long-term growth with continuity offers.

- Always map the journey so customers know their next step.

- Keep it simple at first, then refine with testing.

👉 With your money model structured step by step, you’re no longer guessing. You have a roadmap that turns strangers into loyal customers, and sales into stability.

Next, we’ll explore ⚡ Common Mistakes Beginners Make (and How to Avoid Them) so you can sidestep the pitfalls and focus on building a model that actually works.

⚡ Common Mistakes Beginners Make (and How to Avoid Them)

Starting a business is exciting — you have a product or service you believe in, and you’re ready to share it with the world. But here’s the hard truth: enthusiasm alone doesn’t guarantee success. Many beginners unintentionally sabotage themselves by making mistakes that could have been avoided with a little guidance.

The good news? Once you know what these mistakes are, you can sidestep them and build your business faster, smarter, and with less stress. Let’s look at the most common pitfalls new entrepreneurs face when building their money models, and more importantly, how you can avoid them.

Mistake 1: Relying on a Single Offer

A common beginner mindset is: “If I just make this one product amazing, people will buy it and I’ll succeed.” But relying on a single offer is risky. You’re putting all your eggs in one basket.

Here’s why this doesn’t work:

- If people say no to your only product, you lose the sale entirely.

- You leave money on the table by not offering upsells or continuity.

- It forces you to constantly chase new customers just to survive.

How to Avoid It:

Think in terms of a journey, not a single sale. Start with one core offer, but build at least one attraction offer, one upsell, one downsell, and one continuity option. Even simple additions like a $27 workbook upsell or a $19/month membership can make your business more resilient.

Mistake 2: Overcomplicating the Money Model

On the flip side, some beginners try to launch with a massive funnel: five attraction offers, multiple upsells, endless downsells, and a dozen continuity programs. This usually leads to overwhelm — both for you and your customers.

Why it hurts:

- Too many moving parts are hard to manage as a beginner.

- Customers get confused when faced with too many choices.

- You spend more time building systems than actually selling.

How to Avoid It:

Keep it simple. Start with one of each building block. Perfect those before adding more. Remember: clarity beats complexity. A clean, simple path converts far better than a confusing maze.

Mistake 3: Pricing Based on Fear, Not Value

Beginners often underprice their offers because they’re afraid no one will buy. But low pricing can actually backfire. Customers may assume your product is low-quality, and you’ll struggle to earn enough to reinvest in your business.

Example:

A coach charges $50 for a three-month program. While this feels “safe,” it undervalues their expertise and makes it impossible to deliver quality at scale.

How to Avoid It:

Price based on value, not insecurity. Ask: “What transformation am I providing, and what is that worth to my customer?” Start fair but confident. And remember — you can always test different price points, but don’t sell yourself short.

Mistake 4: Ignoring Customer Objections

Beginners often design offers based on what they think is great, without considering why customers hesitate. This leads to frustration when sales don’t come in.

Common objections:

- “It’s too expensive.”

- “I don’t trust this yet.”

- “I’m not ready to commit.”

How to Avoid It:

Anticipate objections and build solutions into your money model. For example:

- Too expensive → Offer a downsell or payment plan.

- Lack of trust → Add a money-back guarantee or free trial.

- Fear of commitment → Create a starter version or short-term package.

By removing friction, you make it easier for customers to say yes.

Mistake 5: Forgetting Continuity

It’s easy to focus on attraction offers, upsells, and downsells, while ignoring continuity. But without recurring revenue, your business will feel like a treadmill — constantly running just to stay in place.

Why it’s a problem:

- Income becomes unpredictable month to month.

- You waste time chasing new sales instead of serving existing customers.

- Scaling feels impossible without stable cash flow.

How to Avoid It:

Add even a simple continuity offer early. This could be a membership site, subscription, or retainer. You don’t need hundreds of members — even 20 customers at $30/month gives you $600 in predictable income.

Mistake 6: Not Mapping the Customer Journey

Beginners often treat each offer as separate instead of part of a bigger system. This creates disjointed experiences where customers don’t know what to do next.

Example:

A freelancer sells a website design, but doesn’t offer maintenance or support afterward. Clients leave, and the relationship ends.

How to Avoid It:

Always ask: “What’s the next logical step for my customer?” Map the journey: attraction → core → upsell → downsell → continuity. Make it clear and natural, so customers feel guided, not sold.

Mistake 7: Overloading Customers with Choices

Sometimes beginners think offering lots of options makes them look professional. In reality, too many choices overwhelm people and cause decision paralysis.

Example:

A course creator offers 10 different pricing tiers. Potential students get confused and abandon the purchase.

How to Avoid It:

Stick to clear, simple options: three pricing tiers, one or two upsells, and one downsell. Enough to give choice, but not so much that it paralyzes.

Mistake 8: Neglecting Marketing and Traffic

Even the best money model won’t work if no one sees it. Many beginners spend months perfecting offers but forget to attract customers.

Why it hurts:

- A great funnel with zero traffic = zero sales.

- Without marketing, you can’t test or improve your model.

How to Avoid It:

Dedicate time to learning and applying basic marketing. For beginners, simple strategies like social media posting, email newsletters, partnerships, or running small paid ads can drive traffic. Remember: your money model is only as strong as the number of people entering it.

Mistake 9: Treating Customers Like Transactions

When you’re desperate for sales, it’s easy to see customers as numbers instead of people. But this mindset kills trust and long-term loyalty.

Why it’s a problem:

- Customers feel used, not cared for.

- They won’t stick around or refer others.

- Your brand reputation suffers.

How to Avoid It:

Shift from selling to serving. Design offers that genuinely help your customers succeed. Check in with them, provide support, and celebrate their wins. When customers feel valued, they buy more and stay longer.

Mistake 10: Quitting Too Soon

The final — and perhaps biggest — mistake beginners make is giving up too early. Building a successful money model takes time, testing, and refinement.

Why it happens:

- They expect instant results.

- They compare themselves to established businesses.

- They see early failure as proof it won’t work.

How to Avoid It:

Adopt a long-term mindset. Every failed offer is feedback, not failure. Refine, test, and adjust. Even the most successful entrepreneurs went through multiple iterations before finding what worked.

Beginner Checklist to Stay on Track

To avoid these mistakes, here’s a quick checklist you can use:

✅ Do I have at least one attraction, upsell, downsell, and continuity offer?

✅ Am I keeping things simple, or overcomplicating them?

✅ Have I priced my offers based on value, not fear?

✅ Do I address common customer objections in my model?

✅ Have I mapped the customer journey clearly?

✅ Am I focusing on building relationships, not just transactions?

✅ Do I have a plan to bring consistent traffic to my offers?

If you can answer yes to most of these, you’re ahead of most beginners already.

Key Takeaways

- Relying on one product, underpricing, or overcomplicating are beginner traps.

- Continuity and customer journey mapping are often ignored but critical for growth.

- Marketing matters — a funnel without traffic won’t work.

- Success requires patience, persistence, and constant refinement.

Avoiding these mistakes won’t guarantee instant success, but it will keep you on the right track. And more importantly, it will save you months of frustration and wasted effort.

👉 With common pitfalls out of the way, you’ll be better prepared to succeed. Next, we’ll look at 🌍 Real-World Examples of Money Models in Action so you can see how these concepts come alive in the businesses you already know and love.

🌍 Real-World Examples of Money Models in Action

So far, we’ve talked about the building blocks of a money model: attraction offers, upsells, downsells, and continuity. But theory only takes you so far. To really understand how powerful these models are, it helps to see them in action. The good news? They’re everywhere. From global giants to your neighborhood café, successful businesses use money models every day — often without you even realizing it.

Let’s explore how well-known companies and small businesses alike apply these strategies. By the end, you’ll see that you don’t need to reinvent the wheel — you just need to adapt proven models to your own situation.

Example 1: Starbucks — The Daily Habit Machine

Starbucks isn’t just selling coffee; they’re selling a money model disguised as your daily routine.

- Attraction Offer: Seasonal promotions like Pumpkin Spice Lattes bring in new customers and keep regulars excited. Limited-time drinks act as irresistible hooks.

- Core Offer: Coffee and beverages, usually around $5 each.

- Upsells: Add-ons like pastries, breakfast sandwiches, and larger cup sizes (“venti instead of tall”). Each small upgrade boosts revenue.

- Downsells: Smaller or cheaper drinks for those who hesitate — like a tall drip coffee instead of a specialty latte.

- Continuity: The Starbucks Rewards app keeps customers locked in. Points and free drinks encourage repeat visits, turning a daily $5 purchase into $1,500 per year for loyal customers.

💡 Lesson for beginners: You don’t need a billion-dollar brand to apply this. Even a small café can replicate the model with daily specials, loyalty cards, and snack upsells.

Example 2: Apple — The Ecosystem Play

Apple is one of the clearest examples of a money model in action. Their business isn’t just about selling iPhones; it’s about creating an entire ecosystem where every product feeds into the next.

- Attraction Offer: Entry-level products like older iPhone models or refurbished devices bring new customers into the Apple world at a lower price point.

- Core Offer: Flagship products — iPhones, MacBooks, iPads.

- Upsells: Accessories like AirPods, AppleCare protection plans, and higher storage versions of devices. Customers rarely walk out with just the base product.

- Downsells: Cheaper versions like iPhone SE or refurbished laptops give hesitant buyers a way to join without paying premium prices.

- Continuity: Subscriptions like iCloud, Apple Music, and Apple TV+ ensure recurring revenue.

💡 Lesson for beginners: Even if you can’t build a tech ecosystem, you can still think in terms of complementary offers. What product or service naturally goes with your main one?

Example 3: Amazon — The “Everything” Funnel

Amazon’s success isn’t just about having the biggest catalog. It’s about structuring offers in a way that maximizes every transaction.

- Attraction Offer: Loss leaders like heavily discounted books, electronics, or free shipping trials bring people in.

- Core Offer: A massive product catalog with competitive pricing.

- Upsells: “Frequently bought together” recommendations, sponsored product placements, and one-click add-ons at checkout.

- Downsells: Budget alternatives or warehouse deals offered alongside premium products.

- Continuity: Amazon Prime is the crown jewel. Customers pay annually for free shipping, streaming, and perks — and end up spending far more because of it.

💡 Lesson for beginners: You don’t need millions of products. Even a small online store can use “bundle deals,” suggested add-ons, or loyalty subscriptions.

Example 4: Netflix — Recurring Revenue at Scale

Netflix built its empire on continuity. Instead of selling DVDs one by one, they shifted to a subscription model where customers pay monthly for unlimited access.

- Attraction Offer: Free trials or low-cost first months to get people in.

- Core Offer: Unlimited streaming library.

- Upsells: Higher-tier plans with multiple screens or Ultra HD.

- Downsells: Before canceling, Netflix often offers cheaper plans with fewer features.

- Continuity: The entire model is subscription-based, generating predictable billions in revenue.

💡 Lesson for beginners: Even if you’re not in entertainment, you can borrow this model. Could you offer ongoing access to training, a private community, or monthly product deliveries?

Example 5: Gyms and Fitness Studios — The Local Continuity Model

Gyms are a perfect example of how continuity works at the local level.

- Attraction Offer: Free trial classes or discounted “first month” memberships.

- Core Offer: Standard monthly membership.

- Upsells: Personal training, group classes, supplements, or merchandise.

- Downsells: Pay-per-class options for people hesitant to commit to a full membership.

- Continuity: Monthly auto-renewing memberships keep income steady whether members show up or not.

💡 Lesson for beginners: If you run a local service, think about how you can turn one-time customers into subscribers. Could you sell punch cards, maintenance plans, or memberships?

Example 6: E-Learning Platforms — Turning Knowledge into Revenue

Platforms like Udemy and Coursera thrive by applying the same model to online education.

- Attraction Offer: Free mini-courses or discounted $9.99 sales to attract new students.

- Core Offer: Paid courses on specialized skills.

- Upsells: Course bundles, certificates, or advanced programs.

- Downsells: Lower-priced short courses for beginners who aren’t ready for full programs.

- Continuity: Subscription models like Udemy Business or Coursera Plus give unlimited course access for a monthly fee.

💡 Lesson for beginners: If you have knowledge to share, even small e-learning offers can become continuity programs with memberships or subscription bundles.

Example 7: Local Restaurants — Small Tickets, Big Impact

Restaurants often rely on clever money models to increase their margins.

- Attraction Offer: Lunch specials or “kids eat free” nights to bring people in.

- Core Offer: Main meals.

- Upsells: Appetizers, drinks, and desserts — often the most profitable items.

- Downsells: Smaller portions, kids’ meals, or cheaper combos.

- Continuity: Loyalty cards, delivery subscriptions (like Domino’s “Pizza Pass”), or catering contracts.

💡 Lesson for beginners: Even small local businesses can add upsells (sides, desserts), downsells (smaller meals), and continuity (subscriptions or loyalty rewards).

Example 8: Freelancers and Service Providers — Turning Clients into Long-Term Partners

Freelancers often start with one-off projects, but the most successful build continuity into their work.

- Attraction Offer: Low-cost audits or strategy sessions.

- Core Offer: Full-service project (e.g., website build, marketing campaign).

- Upsells: Add-ons like branding kits, content packages, or extended consulting.

- Downsells: Templates or DIY guides for clients who can’t afford full service.

- Continuity: Retainer contracts for ongoing support, updates, or maintenance.

💡 Lesson for beginners: Even as a solo freelancer, you can structure your work to avoid feast-or-famine cycles. Add retainers or memberships for stability.

What All These Examples Have in Common

Whether it’s Starbucks, Apple, Amazon, Netflix, or your local gym, the pattern is the same:

- Attract customers with an irresistible entry offer.

- Deliver core value through a main product or service.

- Maximize revenue with upsells and complementary products.

- Save the sale with downsells for hesitant buyers.

- Lock in stability with continuity.

This isn’t a coincidence — it’s a proven framework. And the best part? You can apply it whether you’re a global brand or a beginner running a side hustle from home.

Key Takeaways from Real-World Examples

- Big brands and small businesses alike rely on money models.

- Continuity (subscriptions, memberships, retainers) is the backbone of stability.

- Attraction offers get people in, but upsells and downsells maximize every opportunity.

- You don’t need to copy giants like Apple or Amazon — you just need to adapt the principles to your scale.

By studying real-world examples, you can see that money models aren’t abstract theories — they’re the engine behind every thriving business.

🚀 Scaling Your Business the Smart Way

By now, you’ve seen how a money model works and how companies — both big and small — use it to maximize revenue. But building a money model is only the beginning. The real challenge (and opportunity) comes when you want to scale it. Scaling means growing your business in a way that multiplies your income without multiplying your stress, costs, or hours worked.

Unfortunately, many beginners try to scale too soon or in the wrong way. They rush into running ads, hiring teams, or launching multiple products before their foundation is solid. The result? Burnout, wasted money, and disappointment.

The smart way to scale is systematic. Let’s break it down step by step.

Step 1: Strengthen Your Foundation

Before scaling, ask yourself: “Is my current money model actually working?” If your attraction offer doesn’t convert, or customers rarely take your upsell, adding more traffic will only make you lose money faster.

💡 Beginner Tip: Focus on improving conversions before scaling. Tweak your offers, test your pricing, and make sure each stage of your money model is generating consistent results.

Step 2: Increase Customer Value First

The cheapest way to grow isn’t by getting more customers — it’s by earning more from the ones you already have. This is why upsells, downsells, and continuity matter so much.

Example: If your average customer spends $100 and you increase that to $150 by adding a simple upsell, you’ve grown by 50% without spending a single dollar on marketing.

💡 Beginner Tip: Always look for ways to add more value to existing customers before pouring money into finding new ones.

Step 3: Automate and Systemize

Scaling is impossible if everything depends on you personally. You’ll hit a ceiling of time and energy. Instead, start systemizing tasks and automating where possible.

- Use tools like Zapier to automate workflows.

- Schedule content with platforms like Buffer or Later.

- Use CRM systems like HubSpot to track leads and customers.

💡 Beginner Tip: Even simple systems — like email sequences that automatically follow up with leads — can free your time and boost sales.

Step 4: Add Paid Traffic

Once your model is proven and automated, it’s time to add fuel to the fire with paid traffic. Platforms like Meta Ads, Google Ads, or even TikTok ads can bring in consistent new leads.

The difference between beginners and pros? Beginners spend money hoping for results. Pros know exactly how much they can spend to acquire a customer because they’ve tested their money model.

💡 Beginner Tip: Don’t start with a huge budget. Test small ($10–$20/day), track your results, and scale up once you know your numbers.

Step 5: Build a Team

At some point, you’ll need help. But instead of hiring a large staff right away, start lean. Outsource repetitive tasks to freelancers or virtual assistants.

Examples:

- Hire a VA to handle customer support.

- Work with a freelancer to edit videos or graphics.

- Partner with an accountant to manage finances.

💡 Beginner Tip: Only hire when the return is clear. For instance, if a $10/hour assistant frees you to do $50/hour work, it’s a smart investment.

Step 6: Expand Offers Strategically

Scaling doesn’t mean launching 10 new products overnight. It means expanding strategically.

Examples:

- If you sell a course, create an advanced course or a mastermind.

- If you run an e-commerce store, add complementary products or bundles.

- If you’re a coach, launch group programs in addition to 1:1 sessions.

💡 Beginner Tip: Always build on what’s already working. Don’t chase shiny objects.

Step 7: Think Long-Term

Scaling isn’t just about making more money today. It’s about building a business that can thrive for years. That means focusing on brand, customer experience, and retention.

Remember: It’s cheaper to keep a customer than to find a new one. Build loyalty through great service, rewards, and genuine relationships.

Key Takeaways for Scaling

- Fix your foundation before trying to grow.

- Focus on increasing customer value first.

- Automate and delegate to free your time.

- Use paid traffic only when your model is proven.

- Grow step by step, not all at once.

Scaling the smart way means building on solid ground, not rushing into chaos.

🙋 FAQs: Beginner Questions About Money Model Answered

Even with all this information, beginners often have lingering questions. Let’s address the most common ones in plain language.

1. Do I need a big budget to start a money model?

No. In fact, many entrepreneurs start with almost nothing. You can build attraction offers using free social media posts, run a simple upsell manually, and use free trials of tools. A budget helps later, but it’s not required to begin.

2. How many offers should I start with?

Start with the basics: one attraction offer, one core offer, one upsell, one downsell, and one continuity option. That’s enough to build momentum. You can always expand later.

3. What if I don’t have a product yet?

No problem. Start with services — coaching, freelancing, consulting — because they’re faster to launch. Once you understand your customers better, you can create products.

4. How do I know if my attraction offer is working?

A good attraction offer should get people to say yes easily. If no one’s buying, it’s probably not irresistible enough. Try lowering the risk (money-back guarantee), increasing value (add bonuses), or making it more specific (solve a smaller, urgent problem).

5. Isn’t offering downsells just admitting failure?

Not at all. A downsell is smart business. It gives hesitant buyers a way to start small instead of leaving completely. Many customers who enter through a downsell eventually upgrade later.

6. How do I choose a continuity offer?

Ask yourself: What can I deliver consistently each month that customers would value? This could be knowledge (membership sites), convenience (subscription boxes), or services (retainers). Start simple and expand over time.

7. How long will it take to see results?

It depends on your effort, offer quality, and audience. Some people see results in weeks, while others take months. The key is to keep testing, improving, and not quitting too early. Remember: every failed attempt is feedback, not failure.

8. What tools do I need to get started?

You don’t need expensive tools at first. Start with:

- A payment processor (Stripe, PayPal).

- A landing page builder (Carrd, WordPress, or Shopify for e-commerce).

- An email tool (Mailchimp, ConvertKit).

As you grow, you can upgrade to more advanced platforms like Kajabi, ClickFunnels, or Skool.

9. What if my audience is small?

A small audience is fine. In fact, small audiences often convert better because trust is higher. Focus on serving them well, then grow gradually. Even 100 loyal fans can be enough to build steady income if your money model is solid.

10. How do I avoid overwhelm as a beginner?

Keep things simple. Don’t try to build everything at once. Start with your core offer, add one attraction offer, then layer in an upsell and downsell. Once that works, add continuity. One step at a time beats trying to run before you can walk.

Money models aren’t just for giant corporations — they’re tools that anyone, even beginners, can use to grow a business systematically. By building step by step, avoiding common mistakes, and scaling the smart way, you can create a business that doesn’t just make money today but provides predictable income for the future.

Your goal isn’t perfection. It’s progress. Every offer you test, every customer you serve, and every improvement you make is another brick in the foundation of your long-term success.

📌 Disclaimer

The information provided in this article is for educational and informational purposes only. It is not intended as financial, legal, tax, or professional advice. While we’ve taken care to ensure the accuracy of the examples and strategies shared, results will vary depending on your individual effort, market conditions, and business decisions.

Building a business always involves risk, and there are no guarantees of income or success. You should do your own research, seek independent professional advice where necessary, and make informed decisions based on your unique situation.

We are not responsible for any losses, damages, or outcomes that may result from applying the information presented here. By using this content, you acknowledge that you are solely responsible for your own business choices.