Unlock Astonishing Crypto Gains: An Insider’s Ultimate Guide to Tokenomics 📈

It’s easy to get swept up in the excitement of the cryptocurrency market. Prices soar, new projects launch daily, and stories of incredible gains are everywhere. But if you’ve ever wondered why one token skyrockets while another fades into obscurity, the answer often lies in a concept that’s less about hype and more about economics. This powerful concept is known as tokenomics.

Understanding tokenomics is like having a blueprint for a token’s potential success. It moves you from being a passenger in the volatile crypto market to being an informed driver, capable of making strategic decisions. By looking past the noise and focusing on the fundamental structure of a digital asset, you can begin to perform a more robust crypto analysis and identify projects with true, long-term potential.

This guide will demystify tokenomics for you. We’ll break down the core pillars that determine a token’s value—its supply, the factors driving its demand, its real-world token utility, and its governance structure. Forget the complex jargon; we’re focused on clear, actionable insights that will empower you to evaluate any token with confidence. Get ready to transform your approach to crypto investing.

Table of Contents

- What is Tokenomics, Really? Breaking Down the Blueprint of Crypto Value 🪙

- The Scarcity Game: Understanding Token Supply Dynamics 📊

- The Popularity Contest: Decoding What Drives Token Demand 🔥

- A Token’s True Calling: A Deep Dive into Crypto Utility ⚙️

- Putting It All Together: Your Ultimate 5-Step Crypto Analysis Checklist ✅

- Beyond the Basics: Common Pitfalls and Pro-Tips for Beginners 🚀

- Your Journey to Confident Investing Starts Now

What is Tokenomics, Really? Breaking Down the Blueprint of Crypto Value 🪙

Before we dive deep, let’s start with a simple idea. Think of any company you know. Its success depends on its business model: what it sells, who its customers are, how it manages its finances, and how it makes decisions. Tokenomics is essentially the business model for a cryptocurrency or a digital token. It’s the set of rules and systems that govern its creation, management, and value within its ecosystem.

The word itself is a blend of “token” and “economics.” It answers the fundamental questions that every savvy investor should ask: How many tokens are there? How are new tokens created or destroyed? What can you actually do with the token? And who gets to make decisions about its future? These aren’t just technical details; they are the very forces that shape a token’s journey.

A project can have groundbreaking technology, but if its tokenomics are flawed—for instance, if it creates too many tokens too quickly or offers no real reason to hold them—it’s likely to fail. Conversely, a project with solid tokenomics creates a balanced ecosystem that incentivizes holding, participation, and long-term growth. The four core pillars that make up this blueprint are Supply, Demand, Utility, and Governance, and understanding them is your first step toward mastering crypto analysis.

The Scarcity Game: Understanding Token Supply Dynamics 📊

The first and most fundamental piece of the tokenomics puzzle is supply. Just like with any valuable asset, from gold to real estate, the principle of scarcity plays a massive role in determining value. If something is rare and in high demand, its price tends to rise. In crypto, a token’s supply mechanics are deliberately designed and coded into its protocol from the very beginning.

There are three main supply models you’ll encounter, each with its own implications for investors. Understanding which model a token uses is a critical part of any crypto analysis, as it directly impacts its potential for future value appreciation.

The Never-Ending Story: Inflationary Tokens

Inflationary tokens are those whose total supply increases over time. New tokens are continuously “minted” or created, often as rewards for network participants, such as stakers who help secure the blockchain. A prime example is Ethereum (ETH), which issues new ETH to validators to incentivize them to maintain the network’s integrity. Many decentralized finance (DeFi) platforms also use inflationary models to reward users for providing liquidity.

This model is great for encouraging participation and network growth. However, it comes with a risk: dilution. If the supply of tokens increases faster than the demand for them, the value of each individual token can decrease over time. For an inflationary token to be a good investment, the project must have powerful mechanisms to drive persistent demand that can outpace the creation of new tokens.

Less is More: The Power of Deflationary Tokens

In direct contrast, deflationary tokens are designed to decrease in supply over time. This is usually achieved through a mechanism called “token burning,” where a certain number of tokens are permanently removed from circulation. By creating increasing scarcity, deflationary models aim to make the remaining tokens more valuable.

One of the most famous examples of a deflationary mechanism is Binance Coin (BNB). Binance uses a portion of its profits to buy back BNB tokens and “burn” them, a process that will continue until the total supply is reduced by half. More recently, meme coins like Shiba Inu have implemented massive burn programs to reduce their vast supplies and create value. These burns can be a powerful narrative for investors, but remember: reducing supply alone doesn’t guarantee a price increase. Demand must still be present and growing.

The Gold Standard: Fixed Supply Tokens

The third model is the fixed supply, where there is an absolute maximum number of tokens that can ever be created. This is the model that started it all with Bitcoin (BTC), which has a hard-coded maximum supply of 21 million coins. Once all 21 million BTC are mined, no more will ever be created. This predictable scarcity is a primary reason why Bitcoin is often referred to as “digital gold.”

Other projects, like Cardano (ADA), also have a fixed maximum supply. This model is highly attractive to long-term investors because it provides a strong defense against inflation. If demand for a fixed-supply token continues to grow over time, its value is mathematically inclined to increase, as there will never be more tokens to dilute the existing supply.

Circulating vs. Total vs. Max Supply: What’s the Difference?

When performing your crypto analysis, you’ll see these three terms on sites like CoinMarketCap or CoinGecko. It’s vital to know the difference.

- Circulating Supply: The number of tokens actively available to the public and trading on markets.

- Total Supply: The total number of tokens that currently exist, including those that are locked and not on the market (e.g., tokens held by the team or treasury).

- Max Supply: The absolute maximum number of tokens that will ever be created.

Pay close attention to the difference between circulating and total supply. A project might have a low circulating supply now, but a huge number of tokens locked away for the team and early investors. These locked tokens are often subject to “vesting schedules” and will be released onto the market over time. These “token unlocks” can create significant selling pressure and drive the price down, a crucial factor in any sound tokenomics evaluation.

The Popularity Contest: Decoding What Drives Token Demand 🔥

Having a scarce supply is only half the battle. A token can be the rarest in the world, but if nobody wants it, it’s worthless. This is where demand comes in—the engine that drives a token’s value. In the crypto world, demand is a complex mix of genuine utility, community-driven hype, and strategic positioning. A thorough crypto analysis involves digging into what makes people want to buy and, more importantly, hold a token.

The Power of Purpose: Why Token Utility is Non-Negotiable

The single most important and sustainable driver of demand is a token’s utility. A strong token utility means it has a clear and valuable purpose within its ecosystem. Does it allow you to vote on the project’s future? Does it grant you access to exclusive features? Is it required to pay for services on the platform? A token with a compelling use case gives people a tangible reason to own it beyond pure speculation.

Think of it this way: the demand for Ethereum isn’t just because people want to trade it. The real demand comes from its incredible token utility as “gas” to power the entire ecosystem of decentralized applications (dApps), from DeFi to NFTs. Without ETH, you can’t perform transactions on the network. This fundamental utility creates a constant, underlying demand for the token, making its value more resilient.

The Community Effect: Hype, Loyalty, and Network Growth

Never underestimate the power of community in crypto. A passionate, engaged, and loyal community can be one of the most powerful demand drivers a project has. These communities—think of the “Shiba Army” for Shiba Inu or the “Link Marines” for Chainlink—act as a decentralized marketing force, spreading awareness and fostering a sense of shared identity and purpose.

This community effect creates a powerful feedback loop. Strong community engagement builds credibility and attracts new investors, which in turn fuels more excitement and demand. However, it’s crucial for your crypto analysis to distinguish between genuine, organic community growth and short-lived, bot-driven hype. Spend time in the project’s Discord or Telegram channels. Are the discussions intelligent and constructive, or is it just filled with “wen moon?” emojis? A healthy community is a strong indicator of a project’s long-term viability.

Stronger Together: The Impact of Strategic Partnerships

A project doesn’t exist in a vacuum. Strategic partnerships with established companies, other blockchain projects, or key industry players can significantly boost a token’s credibility and expand its token utility, thereby driving demand. When a respected brand integrates a token, it serves as a powerful vote of confidence.

For example, imagine a gaming token that partners with a major video game studio to be used for in-game purchases. This instantly exposes the token to a massive new user base and gives it a clear, real-world application. Similarly, when a DeFi project integrates a price oracle service like Chainlink (LINK), it enhances the security and reliability of its platform, making its own token more attractive to users. When evaluating a project, look for meaningful partnerships that actually enhance its ecosystem, not just superficial “partnership announcements” with no substance.

A Token’s True Calling: A Deep Dive into Crypto Utility ⚙️

We’ve established that token utility is a cornerstone of demand, but what does that look like in practice? A token’s use case is its job description—it defines what the token does and why it’s essential to its ecosystem. The more indispensable a token is, the more likely it is to maintain and grow its value over the long term. A key part of your tokenomics review is to dissect these use cases.

The Right to Rule: Governance Tokens

In the world of decentralized finance, many projects aim to be governed by their users, not by a central authority. This is where governance tokens come in. Holding these tokens gives you voting rights, allowing you to have a say in crucial decisions about the project’s future. This could include proposing or voting on protocol upgrades, changes to fee structures, or how to spend the project’s treasury funds.

Projects like Uniswap (UNI) and Aave (AAVE) are leading examples. Their governance tokens empower their communities, creating a system where the users who have a financial stake in the platform’s success are the ones guiding its evolution. This form of token utility is powerful because it creates a deep sense of ownership and aligns the incentives of the token holders with the long-term health of the project.

The Fuel for the Machine: Platform & Gas Tokens

Some tokens are the lifeblood of their entire blockchain. These are platform or “gas” tokens, and their utility is fundamental. As mentioned earlier, Ethereum’s ETH is the classic example. Every single transaction, whether it’s sending money, minting an NFT, or interacting with a DeFi app, requires a fee paid in ETH. This creates a constant, functional demand.

Other Layer-1 blockchains have their own native tokens that serve a similar purpose, such as SOL for the Solana network or MATIC for the Polygon network. Their utility is directly tied to the activity and adoption of their respective blockchains. As more developers build on these platforms and more users transact, the demand for their native tokens naturally increases. This is one of the most robust forms of token utility you can find.

Unlocking Exclusive Perks: Membership and Access Tokens

Another common form of token utility is granting access to exclusive benefits. This can take many forms. For instance, some social platforms or content creators issue “social tokens,” and holding them might give you access to a private chat group, exclusive content, or early access to new products.

NFTs are also increasingly being used for this purpose. An NFT might serve as your ticket to a real-world event, a membership pass to a digital club, or a voucher for special perks in a game. This model transforms a token from a purely financial asset into a key that unlocks unique experiences and communities, creating a form of value that goes beyond its market price.

How to Spot Red Flags in a Token’s Utility

As you conduct your crypto analysis, be wary of projects with weak or poorly defined utility. A major red flag is when a token’s use case feels “bolted on” or unnecessary. Ask yourself: does this project really need a token to function? If the token’s only purpose is to be bought and sold, or if its utility is vague and offers no real advantage to the user, its long-term demand is likely to be fragile.

Be cautious of projects that promise revolutionary future utility but have no concrete roadmap or existing proof-of-concept. While ambition is great, a token’s value should be rooted in what it can do now or in the very near future, not just in far-off promises. Strong projects build utility first and let the value follow.

Putting It All Together: Your Ultimate 5-Step Crypto Analysis Checklist ✅

Now that we’ve explored the core components of tokenomics, it’s time to bring them together into a practical framework. A systematic approach will help you analyze any token consistently and avoid making emotional decisions. Think of this as your personal checklist for performing a thorough crypto analysis.

Step 1: Investigate the Supply Model

First, get a clear picture of the token’s supply mechanics.

- Identify the Model: Is it inflationary, deflationary, or fixed-supply?

- Check the Numbers: Use a site like CoinGecko to find the circulating supply, total supply, and max supply. Is there a large gap between the circulating and total supply?

- Look for Unlocks: Investigate the token’s vesting schedule. Are there large “token unlocks” coming up for the team or early investors? These events can create significant selling pressure. A project’s official documentation or blog should have this information.

Step 2: Map the Demand Drivers

Next, identify what creates demand for the token.

- Community Strength: Join the project’s Discord and Telegram. Is the community active and engaged? Is the conversation constructive?

- Narrative and Hype: What is the story around this token? Is it riding a current trend (like AI or DePIN)? Assess whether the hype feels sustainable or like a temporary fad.

- Partnerships: Look for official announcements of strategic partnerships. Do these partnerships add real value and expand the token’s ecosystem, or are they just for show?

Step 3: Scrutinize the Token Utility

This is arguably the most critical step. Dig deep into the token’s purpose.

- Primary Use Case: What is the token’s main function? Is it for governance, paying gas fees, staking, or something else?

- Is it Essential? How vital is the token to its platform? Could the platform operate just as well without it? The more integral the token, the stronger its utility.

- Value Proposition: What benefits does holding or using the token provide to the user? Does it offer discounts, rewards, or exclusive access? A strong token utility provides clear advantages.

Step 4: Assess the Governance Structure

Understand who holds the power and how decisions are made.

- Decision-Making Process: Is there a Decentralized Autonomous Organization (DAO)? How are proposals submitted and voted on?

- Token Holder Power: Do governance token holders have real influence, or are decisions ultimately made by a centralized team?

- Transparency: Look for a history of governance votes. Are the results and discussions public? Transparency builds trust and indicates a healthy, decentralized project.

Step 5: Check the Team and Roadmap

Finally, look at the people behind the project and their vision for the future.

- The Team: Are the founders and developers public and credible? Do they have a track record of success in the tech or crypto space? Anonymous teams can be a major red flag.

- The Roadmap: Does the project have a clear, detailed, and realistic roadmap? Look for specific milestones and timelines.

- Execution: Has the team consistently delivered on its past promises? A team that meets its deadlines and communicates progress effectively is far more trustworthy.

Beyond the Basics: Common Pitfalls and Pro-Tips for Beginners 🚀

Mastering the fundamentals of tokenomics is a huge step, but the crypto world is filled with nuances and potential traps. As a beginner, being aware of common pitfalls can save you from costly mistakes and help you refine your crypto analysis skills even further.

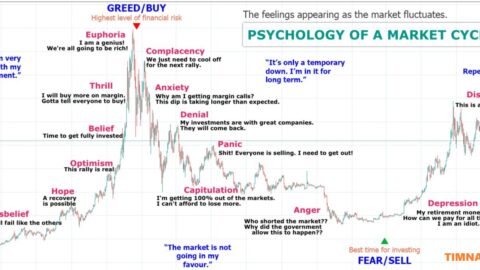

One of the biggest challenges is learning to differentiate between genuine, sustainable hype and fleeting, speculative bubbles. Hype isn’t always bad—it can bring attention and users to a great project. However, when a token’s price is driven only by hype, with little underlying token utility or a weak supply model, it’s often a recipe for a crash. Look for substance behind the excitement. Is the community growing because the product is useful, or just because influencers are talking about it?

Another critical area to watch is token unlocks. We mentioned them earlier, but their importance cannot be overstated. A project might look fantastic on paper, but if 20% of its total supply is scheduled to be unlocked and given to early investors next month, that could create a massive wave of selling that tanks the price. Always research a token’s vesting schedule. Reputable projects are transparent about this information.

Finally, remember that even the best crypto analysis can’t protect you completely without proper risk management. Don’t put all your eggs in one basket. Diversify your investments across different projects, sectors (like DeFi, gaming, infrastructure), and even different types of tokenomics models. This ensures that if one of your investments doesn’t pan out, your entire portfolio isn’t wiped out.

Your Journey to Confident Investing Starts Now

Navigating the world of cryptocurrency investing can feel like an overwhelming journey, but it doesn’t have to be a game of chance. By grounding your strategy in the principles of tokenomics, you equip yourself with a powerful lens to see through the hype and identify true value. You now have a framework to analyze a token’s supply dynamics, understand what drives its demand, critically evaluate its token utility, and assess its governance.

This knowledge transforms you from a passive spectator into an active, informed participant. It empowers you to ask the right questions, spot red flags, and build a portfolio based on sound crypto analysis rather than fleeting trends. The path to becoming a successful crypto investor is a marathon, not a sprint, and it’s paved with continuous learning and disciplined decision-making.

Embrace this framework as the foundation of your investment strategy. Continue to stay curious, keep learning, and apply these principles with diligence. By doing so, you’re not just investing in digital assets; you’re investing in your own financial literacy and confidence in this exciting and revolutionary space.

Reference video: