🚀 Unlock the Amazing World of Cryptoassets: Your Ultimate Guide to Smart Investing!

The world of finance is undergoing a monumental shift, and at the heart of this revolution are cryptoassets. You’ve likely heard terms like Bitcoin, blockchain, and NFTs, but what do they really mean, and how can you, as a beginner, navigate this exciting new frontier? This guide is designed to demystify understanding cryptoassets, offering a clear path for anyone looking to dip their toes into crypto investing for beginners and grasp blockchain basics.

The emergence of cryptoassets marks a significant evolution from traditional financial systems. Born from the ashes of the 2008 financial crisis, Bitcoin introduced a new paradigm for decentralized, trustless transactions. Since then, the ecosystem has exploded, bringing forth thousands of different cryptoassets, each with unique functionalities and potential. While this rapid growth presents incredible opportunities, it also comes with a steep learning curve and inherent risks. This article will equip you with foundational knowledge, actionable insights, and the latest information to help you make informed decisions.

Our journey will cover everything from the fundamental concepts of cryptoassets and blockchain technology to practical steps for investing, managing risks, and exploring advanced topics like Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs). We’ll break down complex ideas into easily digestible pieces, using short paragraphs to enhance readability and ensure a smooth, natural flow. By the end, you’ll have a solid grasp of what cryptoassets are, why they matter, and how you can confidently begin your own crypto adventure.

📜 Table of Contents

- 🌟 Section 1: What Exactly Are Cryptoassets? Your Friendly Introduction

- Beyond Bitcoin: A Universe of Digital Assets

- Why “Crypto”? The Role of Cryptography

- Cryptocurrencies, Cryptocommodities, and Cryptotokens: Understanding the Categories

- Key Examples for Beginners: Bitcoin, Ethereum, and More

- 🧱 Section 2: Blockchain Basics: The Amazing Technology Powering Crypto

- What is a Blockchain? A Simple Analogy

- Decentralization: Why It’s a Game-Changer

- How Transactions Work on a Blockchain

- Public vs. Private Blockchains: Key Differences

- Understanding “Blocks” and “Chains”

- 💡 Section 3: Why Should Beginners Care About Understanding Cryptoassets?

- The Potential for Financial Growth (and the Risks!)

- Cryptoassets as an Alternative Investment

- Empowerment: Taking Control of Your Finances

- The Future of Money and the Internet (Web3)

- Real-World Use Cases Beyond Speculation

- 🚀 Section 4: Your First Steps: Crypto Investing for Beginners in 7 Manageable Stages

- Stage 1: Educate Yourself Thoroughly (You’re Doing It Now!)

- Stage 2: Assess Your Risk Tolerance – Crucial Advice

- Stage 3: Choosing Your First Cryptoassets to Invest In

- Stage 4: Selecting a Reputable Cryptocurrency Exchange

- Stage 5: How to Buy Your First Crypto (A Step-by-Step Overview)

- Stage 6: Understanding Crypto Wallets: Hot vs. Cold Storage

- Stage 7: Start Small and Diversify (Smart Investing Principles)

- 🛡️ Section 5: Navigating the Risks: Essential Crypto Security for Beginners

- The Infamous Volatility: Understanding Price Swings

- Security Best Practices: Protecting Your Digital Hoard

- Recognizing and Avoiding Scams and Fraud

- The Importance of Private Keys and Seed Phrases

- Regulatory Landscape: What Beginners Should Know

- 🌌 Section 6: Beyond the Basics: Exploring the Expanding Crypto Universe

- DeFi (Decentralized Finance): Banking Without Banks Explained

- NFTs (Non-Fungible Tokens): Digital Ownership and Collectibles

- Stablecoins: Bridging Traditional Finance and Crypto

- Web3 and the Metaverse: The Next Internet Frontier

- DAOs (Decentralized Autonomous Organizations): Community-Led Projects

- 📈 Section 7: The Future is Bright: Trends and Outlook for Cryptoassets (2024-2025 and Beyond)

- Institutional Adoption: Big Players Entering the Space

- Tokenization of Real-World Assets (RWAs)

- The Evolving Regulatory Environment and Its Impact

- Technological Advancements: Layer 2 Solutions and Scalability

- The Growing Importance of User Experience and Accessibility

- 🏁 Section 8: Conclusion: Your Crypto Journey Starts Now!

- Recap of Key Learnings for Understanding Cryptoassets

- Embracing Continuous Learning in a Dynamic Field

- Final Encouragement for Aspiring Crypto Investors

🌟 Section 1: What Exactly Are Cryptoassets? Your Friendly Introduction

Welcome to the fascinating realm of digital finance! If you’re new to the concept, “cryptoassets” might sound like something out of a science fiction movie. However, they are very real and are rapidly changing how we think about money, investments, and even ownership. Understanding cryptoassets is the first crucial step on your journey.

At its core, a cryptoasset is a digital or virtual asset that uses cryptography for security. Cryptography, a method of protecting information through complex codes, is what makes these assets secure and, in many cases, decentralized—meaning they aren’t controlled by a single entity like a central bank. Think of them as digital tokens that can represent value, a utility, or even a piece of a project.

The most famous cryptoasset is Bitcoin, which was created in 2009 by the anonymous Satoshi Nakamoto. Bitcoin aimed to be a peer-to-peer electronic cash system, allowing people to send and receive money without needing traditional banks. Since Bitcoin’s inception, thousands of other cryptoassets, often called “altcoins” (alternatives to Bitcoin), have emerged, each with its own purpose and underlying technology.

Types of Cryptoassets You Need to Know

Not all cryptoassets are created equal. Here’s a quick breakdown:

1. Cryptocurrencies

These are digital currencies used for payments—Bitcoin (BTC), Litecoin (LTC), and Monero (XMR) are examples.

2. Utility Tokens

These provide access to a product or service, like Ethereum’s (ETH) use in smart contracts or Filecoin’s token for decentralized storage.

3. Security Tokens

Backed by real-world assets or revenue streams, these are regulated similarly to stocks.

4. Stablecoins

Pegged to fiat currencies (like USD), stablecoins like USDC or Tether (USDT) reduce volatility for crypto users.

5. NFTs (Non-Fungible Tokens)

Unique digital assets tied to artwork, collectibles, and intellectual property.

Each asset type serves a different purpose. Understanding their role helps investors make better choices. Check Section 6 for more details.

Beyond Bitcoin: A Universe of Digital Assets

While Bitcoin remains the largest and most well-known cryptoasset, the universe has expanded dramatically. This diverse ecosystem includes assets designed for various functions, from powering decentralized applications to representing unique digital collectibles. Some are built to be faster or more private than Bitcoin, while others aim to solve entirely different problems.

It’s important for beginners to understand that not all cryptoassets are created equal. Some have strong technological foundations, active development teams, and clear use cases, while others might be more speculative or even fraudulent. That’s why thorough research is paramount before considering any investment in crypto investing for beginners.

The authors of “Cryptoassets” highlight that these digital assets are not just currencies but can also be commodities or tokens that provide access to specific services or platforms. This categorization helps in understanding cryptoassets and their potential value. This variety is what makes the crypto space so dynamic and full of potential, but also what necessitates careful study.

Why “Crypto”? The Role of Cryptography

The “crypto” in cryptoassets refers to cryptography, the science of secure communication using codes. This technology is fundamental to how cryptoassets function, ensuring the security of transactions and the integrity of the network. It’s what prevents counterfeiting and double-spending without needing a central authority to verify everything.

Cryptography is used in several ways: to secure wallets where cryptoassets are stored, to verify transactions on the blockchain (the underlying ledger technology), and to control the creation of new units of a cryptoasset. For example, your access to your crypto holdings is typically secured by a private key, which is a long, complex cryptographic code that only you should know.

This reliance on cryptography makes transactions transparent (as they are often recorded on a public ledger) yet pseudonymous (as your real-world identity isn’t directly tied to your transactions unless you choose to link it). Understanding cryptoassets involves appreciating this delicate balance between transparency and privacy that cryptography enables. It’s a core element of what makes these assets revolutionary.

Cryptocurrencies, Cryptocommodities, and Cryptotokens: Understanding the Categories

To better navigate the world of digital assets, it’s helpful to understand their different categories. The book “Cryptoassets” proposes a useful taxonomy: cryptocurrencies, cryptocommodities, and cryptotokens. This framework helps in understanding cryptoassets based on their utility and economic function.

- Cryptocurrencies: These are designed to function as a medium of exchange, a store of value, and a unit of account, much like traditional fiat currencies (e.g., USD, EUR). Bitcoin is the quintessential example, aiming to be digital cash. Litecoin is another example, often dubbed the “silver to Bitcoin’s gold,” designed for faster transactions.

- Cryptocommodities: These cryptoassets represent digital raw materials or resources. Think of them as building blocks for decentralized applications or platforms. Ethereum’s native asset, Ether (ETH), is often considered a cryptocommodity because it’s used to pay for computational resources (known as “gas”) on the Ethereum network, which acts like a decentralized world computer.

- Cryptotokens: These are digital assets that provide access to a specific product, service, or platform, often built on top of existing blockchains like Ethereum. They can represent utility (access to a service), governance rights (voting power in a project), or even ownership in a physical or digital item (like Non-Fungible Tokens, or NFTs).

This classification is not always rigid, and some assets might blur the lines. However, for crypto investing for beginners, recognizing these distinctions is vital for assessing an asset’s potential and risk.

Key Examples for Beginners: Bitcoin, Ethereum, and More

When starting your journey of understanding cryptoassets, a few names will repeatedly surface. These are foundational projects that have significantly shaped the industry.

- Bitcoin (BTC): The original cryptoasset, often referred to as “digital gold.” It’s primarily seen as a store of value and a decentralized currency. Its blockchain is highly secure due to its extensive network of miners.

- Ethereum (ETH): More than just a currency, Ethereum is a platform for building decentralized applications (dApps) and smart contracts (self-executing contracts with the terms of the agreement directly1 written into code). Its native asset, Ether, fuels these operations. Many other tokens are built on the Ethereum blockchain using standards like ERC-20.

- Ripple (XRP): While controversial in some crypto circles due to its more centralized nature and the company’s large holdings of XRP, Ripple aims to facilitate fast and low-cost international payments for financial institutions.

- Litecoin (LTC): One of the earliest altcoins, created as a lighter, faster alternative to Bitcoin, with a larger coin supply and a different mining algorithm.

- Stablecoins (e.g., USDT, USDC, DAI): These are cryptoassets designed to maintain a stable value by being pegged to another asset, typically a fiat currency like the US dollar. They aim to offer the benefits of crypto (speed, low fees) without the extreme volatility of assets like Bitcoin.

Exploring these examples will provide a practical context for the theories and concepts you’ll learn. Remember, the crypto space is vast and ever-evolving, so continuous learning is key.

🧱 Section 2: Blockchain Basics: The Amazing Technology Powering Crypto

At the heart of most cryptoassets lies a revolutionary technology called the blockchain. Understanding cryptoassets is impossible without grasping blockchain basics. Think of a blockchain as a special kind of digital database or ledger that is shared among many computers in a network.

What makes it special is its structure and how it’s managed. Instead of being stored in one central place (like a bank’s database), a blockchain is distributed across numerous computers, making it decentralized. Transactions are grouped into “blocks,” and each new block is cryptographically linked to the previous one, forming a “chain.”2 This chain is immutable, meaning once data is added, it’s extremely difficult to change or delete it.

This combination of decentralization, cryptographic security, and immutability makes blockchain technology transparent and trustworthy without needing a central intermediary. It’s the foundational layer that enables the existence and secure transfer of cryptoassets.

What is a Blockchain? A Simple Analogy

Imagine a shared digital notebook that everyone in a group has a copy of. Whenever someone wants to add a new entry (a transaction), they announce it to the group. Everyone then verifies if the person has the authority to make that entry (e.g., if they actually have the funds they want to send).

Once verified, the entry is written on a new page in everyone’s notebook. This page is then digitally “sealed” and linked to the previous page with a unique code (a cryptographic hash). This makes it part of a continuous, unalterable record. If anyone tries to tamper with an old page in their notebook, their unique code won’t match everyone else’s, and the group will know their copy is invalid. This is, in essence, how a public blockchain like Bitcoin’s operates, providing a secure and transparent record of all transactions.

Decentralization: Why It’s a Game-Changer

Decentralization is a core principle of blockchain basics and many cryptoassets. It means that control and decision-making are distributed among the network participants rather than being concentrated in a single entity, like a government, bank, or corporation. This has profound implications.

Firstly, it enhances security. With data replicated across many nodes (computers in the network), there’s no single point of failure. To corrupt the blockchain, an attacker would need to compromise a majority of the network’s computing power, which is incredibly difficult and expensive for well-established blockchains.

Secondly, it promotes censorship resistance. Since no single entity controls the network, it’s very hard for anyone to block or reverse legitimate transactions. This is particularly important in regions with unstable governments or restrictive financial systems. This was a key motivator behind Bitcoin’s creation. Finally, decentralization can reduce reliance on intermediaries, potentially lowering costs and increasing efficiency.

How Transactions Work on a Blockchain

When you want to send cryptoassets, say from your wallet to someone else’s, you initiate a transaction. This transaction typically includes the sender’s address, the recipient’s address, and the amount of cryptoasset being sent. You “sign” this transaction with your private key, which acts as your digital signature, proving you own the assets.

This signed transaction is then broadcast to the network. Computers in the network, often called “miners” (in Proof-of-Work systems like Bitcoin) or “validators” (in Proof-of-Stake systems), pick up these pending transactions. They verify their legitimacy (e.g., checking if the sender has sufficient funds) and group them into a new block.

Creating a new block and adding it to the chain involves solving a complex cryptographic puzzle (in Proof-of-Work) or meeting other consensus requirements. Once a block is added, the transactions within it are considered confirmed and immutable. The miners or validators are typically rewarded with newly created cryptoassets and/or transaction fees for their work in maintaining and securing the network. This process ensures the integrity and continuous growth of the blockchain.

Public vs. Private Blockchains: Key Differences

Not all blockchains are the same. One of the key distinctions in blockchain basics is between public and private blockchains.

- Public Blockchains: These are open, permissionless networks that anyone can join, participate in, and view. Bitcoin and Ethereum are prime examples. Transactions are transparent, and the software is typically open-source. Security is maintained by a large, distributed network of participants who are incentivized to act honestly (e.g., through mining rewards).

- Private Blockchains: These are permissioned networks, meaning access is restricted to a specific group of participants. They are often used by businesses or consortiums for specific purposes where privacy and control are paramount. While they offer more control and potentially faster transaction speeds (due to fewer participants), they are less decentralized than public blockchains.

- Consortium Blockchains: These are a hybrid, governed by a group of organizations rather than a single entity or being fully public. They offer shared control among pre-selected members.

- Permissioned Blockchains: This is a broader term that can apply to private or consortium blockchains, or even public ones with certain access controls. It means you need permission to participate in certain network activities.

For those interested in crypto investing for beginners, public blockchains and their native assets are typically the main focus, as they are openly tradable. However, understanding the existence and purpose of private blockchains is useful for a complete picture of the technology’s applications.

Understanding “Blocks” and “Chains”

The terms “block” and “chain” are fundamental to blockchain basics. A “block” is like a page in our digital ledger analogy. It’s a container that holds a batch of verified transactions that have been processed around the same time. Each block also contains a cryptographic hash of the previous block in the sequence, along with a timestamp.

The “chain” is formed by linking these blocks together in chronological order using these cryptographic hashes. Because each block contains the hash of the one before it, if someone tried to alter a transaction in an old block, the hash of that block would change. This change would then invalidate the hashes of all subsequent blocks, making the tampering immediately obvious to the rest of the network.

This chain structure is what makes the blockchain so secure and immutable. It creates a verifiable and auditable history of all transactions, ensuring that the ledger is consistent and trustworthy across the entire distributed network. This innovation is a cornerstone of understanding cryptoassets and their inherent security.

💡 Section 3: Why Should Beginners Care About Understanding Cryptoassets?

Now that you have a foundational understanding of what cryptoassets and blockchain technology are, you might be wondering: “Why should I, as a beginner, care about this?” The answer is multifaceted. Understanding cryptoassets is not just about a new investment opportunity; it’s about recognizing a technological shift that could redefine aspects of finance, the internet, and even how we interact with digital content.

The crypto world offers the allure of significant financial growth, though this comes with substantial risks. Beyond investment, it provides a pathway to financial empowerment by offering alternatives to traditional systems. Furthermore, the underlying technology is paving the way for a more decentralized and user-centric internet, often referred to as Web3.

The Potential for Financial Growth (and the Risks!)

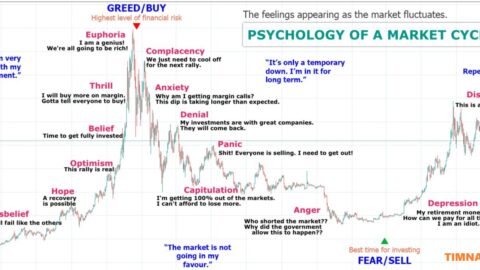

One of the primary attractions of crypto investing for beginners is the potential for high returns. Stories of early Bitcoin investors making fortunes are well-known. Many cryptoassets have experienced periods of rapid price appreciation. However, it’s absolutely crucial to balance this with a clear understanding of the risks involved.

Crypto markets are notoriously volatile. Prices can swing dramatically in short periods, driven by market sentiment, regulatory news, technological developments, and even social media trends. This means that while you could see significant gains, you could also experience substantial losses. Therefore, never invest more than you can afford to lose, and always conduct thorough research. The book “Cryptoassets” itself warns about the speculative nature of these markets and the “This Time Is Different” thinking that can lead investors astray.

Cryptoassets as an Alternative Investment

Cryptoassets are increasingly being considered as part of a diversified investment portfolio. They represent a new asset class that is largely uncorrelated with traditional assets like stocks and bonds. This means that their price movements may not always follow the same patterns as the broader financial markets, which can be beneficial for diversification.

However, their novelty also means they lack the long historical track record of traditional investments. Valuation can be complex, as traditional metrics often don’t apply directly. The authors of “Cryptoassets” delve into frameworks for fundamental analysis and valuation specific to this new asset class, emphasizing the importance of understanding network health, development activity, and community engagement. For beginners, starting with a small allocation and focusing on understanding the projects you invest in is a prudent approach.

Empowerment: Taking Control of Your Finances

A core tenet of the crypto movement is financial empowerment and sovereignty. Cryptoassets, particularly decentralized ones like Bitcoin, offer individuals greater control over their money. You can hold your assets in a personal wallet, to which only you have the private keys, making you your own bank.

This is particularly impactful for people in countries with unstable financial systems, high inflation, or restricted access to banking services. Cryptoassets can offer a way to store value, make international payments more efficiently, and participate in a global financial system without relying on traditional intermediaries. Understanding cryptoassets in this context reveals their potential to foster financial inclusion.

The Future of Money and the Internet (Web3)

Beyond individual financial empowerment, cryptoassets and blockchain technology are foundational to what many call Web3 – the next evolution of the internet. Web1 was about static web pages. Web2, the internet we largely use today, is characterized by dynamic content and social media platforms, but it’s also dominated by large centralized corporations that control user data.

Web3 aims to create a more decentralized, user-centric internet where individuals have more control over their data, identity, and digital assets. Blockchains, smart contracts, and cryptoassets are key enabling technologies for Web3. They allow for the creation of decentralized applications (dApps) that are not owned or controlled by a single entity. Concepts like DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) are early examples of Web3 applications, offering new ways to manage finances and own digital items. Understanding cryptoassets gives you a front-row seat to this evolving digital landscape.

Real-World Use Cases Beyond Speculation

While much of the early attention on cryptoassets has focused on their investment and speculative aspects, the underlying blockchain technology has numerous real-world applications that are increasingly being explored and implemented. These demonstrate the broader utility and potential of the technology.

Some examples include:

- Supply Chain Management: Using blockchain to track goods from origin to consumer, enhancing transparency and reducing fraud.

- Voting Systems: Exploring blockchain for more secure and transparent voting processes.

- Healthcare: Securely managing patient records and ensuring data integrity.

- Digital Identity: Creating self-sovereign identity solutions where users control their personal data.

- Intellectual Property Rights: Helping creators protect and manage their digital content.

As these use cases mature, they will likely drive further adoption and integration of cryptoassets and blockchain technology into various industries. For beginners, recognizing this broader potential helps in understanding cryptoassets not just as speculative instruments but as components of a transformative technology.

🚀 Section 4: Your First Steps: Crypto Investing for Beginners in 7 Manageable Stages

Embarking on your crypto investing for beginners journey can feel daunting, but by breaking it down into manageable stages, you can approach it with confidence and a clear strategy. This section outlines seven essential steps to guide you as you start exploring the world of digital assets. Remember, patience and continuous learning are your best allies.

The path involves educating yourself, understanding your financial limits, carefully selecting assets, choosing where and how to buy, and securing your investments. It’s not a race; it’s a marathon that requires diligence. The following stages will help you build a solid foundation for understanding cryptoassets and making informed investment decisions.

Stage 1: Educate Yourself Thoroughly (You’re Doing It Now!)

Before you even think about investing a single dollar, the most critical first step is education. The fact that you’re reading this article shows you’re already on the right track! Understanding cryptoassets, the underlying blockchain basics, and the associated risks is non-negotiable.

Dive into resources like this guide, reputable crypto news websites, project whitepapers (documents outlining a crypto project’s technology, goals, and tokenomics), and educational platforms. The book “Cryptoassets” itself is a comprehensive guide covering history, technology, and investment strategies. Be wary of hype on social media and “get rich quick” schemes; focus on credible sources that offer balanced perspectives. The more you learn, the better equipped you’ll be to identify legitimate opportunities and avoid pitfalls.

Stage 2: Assess Your Risk Tolerance – Crucial Advice

Crypto investing for beginners comes with significant risk, primarily due to high market volatility. Prices can change drastically and quickly. Therefore, before investing, you must honestly assess your risk tolerance. How comfortable are you with the possibility of losing some or all of your invested capital?

Your risk tolerance will depend on factors like your financial situation, investment goals, and emotional temperament. A cardinal rule in crypto investing is: never invest more than you can afford to lose. Don’t use funds earmarked for essential expenses like rent, bills, or emergency savings. Starting with a small amount allows you to gain experience without undue stress.

Stage 3: Choosing Your First Cryptoassets to Invest In

With thousands of cryptoassets available, deciding which ones to invest in can be overwhelming. For beginners, it’s often advisable to start with more established and well-understood cryptoassets like Bitcoin (BTC) and Ethereum (ETH). These have longer track records, larger market capitalizations, greater liquidity, and more extensive communities and development activity.

When researching any cryptoasset, consider factors such as:

- The Project’s Purpose and Use Case: What problem does it solve? Is there a real need for it?

- The Technology: Is the underlying blockchain sound and secure?

- The Team: Who are the developers and leaders behind the project? Do they have a strong track record?

- Tokenomics: How are the tokens created and distributed? What is the total supply? Is it inflationary or deflationary?

- Community and Adoption: Is there an active and engaged community? Is the asset being adopted and used?

Stage 4: Selecting a Reputable Cryptocurrency Exchange

To buy and sell cryptoassets, you’ll typically need to use a cryptocurrency exchange. These are online platforms that facilitate the trading of digital assets. There are many exchanges available, ranging from large, well-known global platforms to smaller, more specialized ones.

When choosing an exchange as a beginner, prioritize:

- Security: Look for exchanges with strong security measures, such as two-factor authentication (2FA), cold storage for the majority of funds, and a good track record regarding hacks.

- Ease of Use: A user-friendly interface will make your initial buying and selling experiences smoother.

- Supported Cryptoassets: Ensure the exchange lists the cryptoassets you’re interested in.

- Fees: Understand the fee structure for trading, deposits, and withdrawals.

- Regulation and Reputation: Check if the exchange complies with regulations in your jurisdiction and what its general reputation is within the crypto community.

- Customer Support: Good customer support can be invaluable if you encounter any issues.

Popular exchanges for beginners include Coinbase, Binance, and Kraken. Always do your own research before signing up.

Stage 5: How to Buy Your First Crypto (A Step-by-Step Overview)

Once you’ve chosen an exchange and set up an account, the process of buying your first crypto is generally straightforward. While specifics vary by platform, the typical steps involve:

- Account Verification: Most reputable exchanges require you to verify your identity (Know Your Customer – KYC process) to comply with anti-money laundering (AML) regulations. This usually involves submitting a government-issued ID.

- Funding Your Account: You’ll need to deposit fiat currency (like USD, EUR, etc.) into your exchange account. Common methods include bank transfers, debit/credit cards, or PayPal. Be aware of any deposit fees.

- Placing an Order: Navigate to the trading section for the cryptoasset you want to buy. You can usually place a “market order” (buy at the current market price) or a “limit order” (buy only if the price reaches a specific level you set). For beginners, a market order is often simpler.

- Confirming the Purchase: Review the details of your order (amount, price, fees) and confirm the transaction.

- Securing Your Crypto: Once the purchase is complete, the cryptoassets will appear in your exchange wallet. For larger amounts or long-term holding, it’s highly recommended to transfer your assets to a personal, more secure wallet that you control (see Stage 6).

Stage 6: Understanding Crypto Wallets: Hot vs. Cold Storage

A crypto wallet is a digital tool that allows you to store, send, and receive cryptoassets. It doesn’t “store” your coins in the traditional sense; rather, it holds your private keys – the secret codes that give you access to your assets on the blockchain. Understanding cryptoassets and their security heavily relies on understanding wallets.

There are two main types of wallets:

- Hot Wallets: These are connected to the internet. They include web-based wallets, mobile wallets, and desktop wallets. They are convenient for frequent transactions but are more vulnerable to online threats like hacking and phishing. Exchange wallets are also considered hot wallets.

- Cold Wallets (Cold Storage): These are kept offline and are considered the most secure way to store cryptoassets, especially for larger amounts or long-term holding (“HODLing”). Examples include:

For crypto investing for beginners, using a combination might be appropriate: a hot wallet for small amounts you plan to trade or use, and a cold wallet for the bulk of your investments.

Stage 7: Start Small and Diversify (Smart Investing Principles)

As a beginner, it’s wise to start with a small investment amount that you are entirely comfortable losing. This allows you to get a feel for the market, understand the process, and learn from any initial mistakes without significant financial consequences. You can always increase your investment gradually as your knowledge and confidence grow.

Diversification is another key principle in investing, and it applies to cryptoassets as well. Don’t put all your eggs in one basket. Spreading your investment across a few different reputable cryptoassets can help mitigate risk. However, for beginners, over-diversification into many obscure coins can also be risky. Stick to well-researched projects initially. Remember, understanding cryptoassets is an ongoing process, and careful, considered steps are better than rushing in.

🛡️ Section 5: Navigating the Risks: Essential Crypto Security for Beginners

While the world of cryptoassets offers exciting possibilities, it’s also fraught with risks that every beginner must understand and prepare for. Understanding cryptoassets means acknowledging their speculative nature and the potential for loss. This section focuses on the essential aspects of crypto security and risk management tailored for those new to crypto investing for beginners.

The crypto market is known for its high volatility, lack of comprehensive regulation in many areas, and the prevalence of scams and security threats. By being aware of these dangers and adopting best practices, you can significantly reduce your exposure and protect your hard-earned investments. Knowledge and caution are your strongest shields in this dynamic environment.

The Infamous Volatility: Understanding Price Swings

The most discussed risk in crypto is volatility. Cryptoasset prices can experience dramatic upward and downward swings in very short periods. A coin’s value might surge one day and plummet the next. This is due to various factors, including market sentiment, news events, regulatory changes, technological breakthroughs, and even influential social media posts.

For beginners, this volatility can be emotionally challenging. It’s crucial not to panic-sell during downturns or get caught up in “FOMO” (Fear Of Missing Out) during price surges. Having a long-term investment strategy and only investing what you can afford to lose can help you weather these fluctuations. Understanding cryptoassets involves accepting this volatility as part of the current market maturity.

Security Best Practices: Protecting Your Digital Hoard

Protecting your cryptoassets is paramount. Since you are often your own bank in the crypto world, security is your responsibility. Here are some fundamental security tips for crypto investing for beginners:

- Use Strong, Unique Passwords: For every exchange account and wallet, create complex passwords that are hard to guess and different for each platform. Consider using a password manager.

- Enable Two-Factor Authentication (2FA): Always activate 2FA (e.g., using Google Authenticator or a YubiKey) on your exchange accounts and any wallets that support it. This adds an extra layer of security beyond just your password.

- Secure Your Email: Your email account is often linked to your crypto accounts and can be a weak point if compromised. Secure it with a strong password and 2FA.

- Beware of Public Wi-Fi: Avoid accessing your crypto accounts or wallets on unsecured public Wi-Fi networks, as these can be vulnerable to hacking.

- Keep Software Updated: Ensure your computer, mobile device, and any wallet software are regularly updated to protect against known vulnerabilities.

Recognizing and Avoiding Scams and Fraud

The crypto space, unfortunately, attracts scammers. Beginners are often targeted due to their lack of experience. Being able to recognize common scams is crucial for understanding cryptoassets safely:

- Phishing Scams: Be wary of fake emails, messages, or websites that impersonate legitimate exchanges or wallet providers, trying to trick you into revealing your login credentials or private keys. Always double-check website URLs and email sender addresses.

- Fake Giveaways/Airdrops: Scammers often promise to send you a large amount of crypto if you first send them a small amount. Legitimate giveaways rarely require you to send crypto first.

- Pump-and-Dump Schemes: Groups artificially inflate the price of a low-value coin through coordinated buying and hype, then sell off their holdings, causing the price to crash and leaving later investors with losses.

- Impersonation: Scammers may impersonate support staff or influential figures on social media to gain your trust and solicit sensitive information or funds.

- Malicious Software/Apps: Only download wallet software or apps from official sources. Malware can be disguised as legitimate crypto tools to steal your assets.

If something sounds too good to be true, it usually is. Always do your own research (DYOR) and be skeptical.

The Importance of Private Keys and Seed Phrases

Your private keys are the cryptographic codes that grant access to your cryptoassets on the blockchain. If someone gets your private keys, they can steal your funds. Never share your private keys with anyone.

When you set up a non-custodial wallet (where you control the keys), you’ll typically be given a “seed phrase” or “recovery phrase.” This is usually a list of 12 to 24 random words that can be used to restore your wallet if you lose your device or forget your password.

- Guard your seed phrase meticulously. Write it down on paper and store it in multiple, secure, offline locations (e.g., a safe).

- Do not store it digitally (e.g., in a text file on your computer, in an email, or in the cloud), as this makes it vulnerable to hacking.

- Understand that anyone with access to your seed phrase has access to your crypto.

Losing your private keys or seed phrase can mean losing your cryptoassets forever, with no way to recover them. This is a critical aspect of understanding cryptoassets and self-custody.

Regulatory Landscape: What Beginners Should Know

The regulatory environment for cryptoassets is still evolving and varies significantly from country to country. Some nations have embraced crypto with clear guidelines, while others have imposed restrictions or are still figuring out their approach.

As a beginner, it’s important to be aware of the regulations in your jurisdiction regarding:

- Taxation: Crypto gains are often subject to taxes (e.g., capital gains tax). Understand your local tax obligations and keep good records of your transactions.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Reputable exchanges are typically required to implement AML/KYC procedures, which involve verifying your identity.

- Securities Laws: Some cryptoassets, particularly those sold through Initial Coin Offerings (ICOs) or that represent shares in a project, may be considered securities and subject to specific regulations.

Regulatory changes can impact market sentiment and the price of cryptoassets. Staying informed about developments in this area is part of responsible crypto investing for beginners. The trend for 2025 suggests increasing regulatory clarity globally, which could foster more institutional adoption.

🌌 Section 6: Beyond the Basics: Exploring the Expanding Crypto Universe

Once you’ve grasped the fundamentals of understanding cryptoassets and blockchain basics, and have taken your first steps into crypto investing for beginners, a whole new universe of innovation awaits. The crypto space is constantly evolving, with new concepts and applications emerging at a rapid pace. This section introduces some of these exciting frontiers.

These advanced areas, like DeFi and NFTs, are built upon the foundational blockchain technology you’ve learned about. They represent the ongoing effort to leverage decentralization and cryptoassets to create new financial systems, new forms of digital ownership, and new ways for communities to organize and interact. While they can be more complex and carry their own risks, understanding them provides a glimpse into the future potential of this technology.

DeFi (Decentralized Finance): Banking Without Banks Explained

Decentralized Finance, or DeFi, is one of the most significant and rapidly growing sectors within the crypto ecosystem. It aims to recreate traditional financial services – such as lending, borrowing, trading, insurance, and earning interest – but in a decentralized way, without relying on traditional intermediaries like banks or financial institutions.

DeFi applications (often called dApps) are typically built on smart contract platforms like Ethereum. Users can interact directly with these protocols using their crypto wallets. For example, you can:

- Lend your cryptoassets and earn interest from borrowers.

- Borrow cryptoassets by providing other crypto as collateral.

- Trade cryptoassets on decentralized exchanges (DEXs) directly from your wallet.

- Participate in “yield farming” or “liquidity mining,” where you provide liquidity to DeFi protocols and earn rewards in the form of tokens.

DeFi offers benefits like increased transparency (as transactions and code are often public on the blockchain), accessibility (anyone with an internet connection and crypto can participate), and potentially higher returns (though also higher risks). However, it’s also a complex area with risks including smart contract vulnerabilities, impermanent loss in liquidity pools, and regulatory uncertainty.

NFTs (Non-Fungible Tokens): Digital Ownership and Collectibles

Non-Fungible Tokens (NFTs) have exploded in popularity, bringing the concept of verifiable digital ownership to the mainstream. Unlike cryptocurrencies like Bitcoin, where each coin is interchangeable (fungible), each NFT is unique and represents ownership of a specific digital or physical item.

NFTs can represent:

- Digital Art: This has been the most popular use case so far.

- Collectibles: Like digital trading cards or virtual items in games.

- Music and Videos: Allowing creators to tokenize and sell their work directly to fans.

- Virtual Land: Parcels of land in metaverse platforms.

- Event Tickets, Memberships, and even physical items.

NFTs are typically created (“minted”) and traded on blockchain platforms, with Ethereum being the most common, though others like Solana are gaining traction. They provide a way to prove authenticity and scarcity of digital items, which was previously difficult. While the NFT market has seen its share of hype and volatility, the underlying technology offers powerful new ways for creators to monetize their work and for users to own unique digital assets. Understanding cryptoassets in the modern era involves getting to grips with the NFT phenomenon.

Stablecoins: Bridging Traditional Finance and Crypto

Stablecoins are a type of cryptoasset designed to minimize the price volatility often associated with cryptocurrencies like Bitcoin. They achieve this by pegging their value to a stable asset, most commonly a fiat currency like the U.S. dollar (e.g., 1 stablecoin = 1 USD).

There are different types of stablecoins:

- Fiat-Collateralized: These are backed by reserves of fiat currency held by a central issuer. Examples include Tether (USDT) and USD Coin (USDC).

- Crypto-Collateralized: These are backed by reserves of other cryptoassets. MakerDAO’s DAI is a well-known example.

- Algorithmic Stablecoins: These attempt to maintain their peg through algorithms that automatically adjust the coin’s supply (these have proven to be more risky and some have failed spectacularly).

Stablecoins play a crucial role in the crypto ecosystem. They provide a stable medium of exchange for traders, a store of value during market volatility, and a bridge between the traditional financial system and the crypto world. Their growth has been significant, and regulatory focus on them is increasing.

Web3 and the Metaverse: The Next Internet Frontier

Web3 is a vision for the next iteration of the internet, built on principles of decentralization, blockchain technology, and user ownership. It aims to shift power away from large tech companies and give users more control over their data, digital identity, and online experiences. Cryptoassets and NFTs are integral components of Web3, enabling new economic models and forms of interaction.

The Metaverse is a related concept, referring to persistent, shared, 3D virtual worlds or environments where people can interact as avatars. It’s envisioned as an immersive extension of the internet. Blockchains and NFTs are expected to play a key role in the metaverse, allowing users to truly own virtual land, digital items (like clothing for avatars), and participate in virtual economies. Understanding cryptoassets provides insight into these futuristic but rapidly developing concepts.

DAOs (Decentralized Autonomous Organizations): Community-Led Projects

A Decentralized Autonomous Organization (DAO) is an organization represented by rules encoded as a computer program (smart contracts)3 that is transparent, controlled by the organization members, and not influenced by a central government.4 Think of them as internet-native organizations where decisions are made collectively by token holders, often through voting mechanisms.

DAOs are used for various purposes, such as managing DeFi protocols, funding projects, governing online communities, and investing in assets. They represent a new model for collaboration and governance, aiming to be more transparent and democratic than traditional hierarchical structures. While still experimental, DAOs are a fascinating application of blockchain basics and cryptoassets for collective action.

📈 Section 7: The Future is Bright: Trends and Outlook for Cryptoassets (2024-2025 and Beyond)

The world of cryptoassets is in a constant state of flux, with new innovations, evolving regulations, and shifting market dynamics. As we look towards 2024, 2025, and beyond, several key trends are shaping the future of this exciting space. For those understanding cryptoassets and considering crypto investing for beginners, being aware of these trends is crucial for navigating the path ahead.

The overarching theme is one of maturation. While challenges remain, the crypto industry is seeing increased institutional interest, greater regulatory clarity in some regions, and ongoing technological advancements aimed at addressing scalability and user experience. These factors suggest a future where cryptoassets become more integrated into the mainstream financial system and digital life.

Institutional Adoption: Big Players Entering the Space

A major trend is the growing adoption of cryptoassets by institutional investors and traditional financial firms. What was once a niche area dominated by retail enthusiasts is now attracting significant attention from banks, asset managers, and corporations.

The launch of Bitcoin ETFs (Exchange Traded Funds) in the U.S. in early 2024 marked a significant milestone, providing easier access for mainstream investors to gain exposure to Bitcoin without directly owning the asset. Large financial institutions like BlackRock are not only offering crypto investment products but also exploring blockchain technology for tokenizing traditional assets. This influx of institutional capital is expected to bring more liquidity, stability (over the long term), and legitimacy to the crypto market.

Tokenization of Real-World Assets (RWAs)

Another exciting development is the tokenization of Real-World Assets (RWAs). This involves representing ownership of tangible assets like real estate, art, commodities, or even financial instruments like bonds and equities, as digital tokens on a blockchain.

Tokenization can bring numerous benefits, including:

- Increased Liquidity: Making traditionally illiquid assets easier to buy and sell.

- Fractional Ownership: Allowing smaller investors to own a share of high-value assets.

- Enhanced Transparency: Recording ownership and transactions on an immutable ledger.

- Greater Efficiency: Streamlining processes for transfer and settlement.

Financial institutions are actively exploring RWA tokenization, with platforms like Ethereum, Avalanche, and Polygon becoming hubs for this infrastructure. This trend is poised to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi).

The Evolving Regulatory Environment and Its Impact

Regulation remains a key factor shaping the future of cryptoassets. Governments and regulatory bodies worldwide are working to establish clearer frameworks for this new asset class. While some view regulation as a headwind, many in the industry see it as a necessary step for mainstream adoption and investor protection.

Trends indicate a move towards:

- Stricter Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) rules.

- Clearer guidelines for stablecoins.

- Frameworks for licensing crypto exchanges and service providers.

- Ongoing debate and clarification on which cryptoassets qualify as securities.

Regions like Hong Kong, Singapore, and the European Union (with its MiCA – Markets in Crypto-Assets regulation) are taking proactive steps. A more harmonized global regulatory approach is anticipated, which could further boost institutional confidence and market growth. For crypto investing for beginners, staying informed about regulatory developments in your jurisdiction is essential.

Technological Advancements: Layer 2 Solutions and Scalability

For blockchains like Bitcoin and Ethereum to handle a global scale of transactions efficiently, scalability is a major challenge. High network congestion can lead to slow transaction times and high fees. Addressing this, “Layer 2” scaling solutions are a significant area of development.

Layer 2 solutions operate on top of an existing Layer 1 blockchain (like Ethereum) to process transactions more quickly and cheaply, while still leveraging the security of the underlying Layer 1. Examples include Rollups (Optimistic and ZK-Rollups) and sidechains. These technologies aim to make using cryptoassets and dApps more practical for everyday use. Continued innovation in this area is vital for widespread adoption.

The Growing Importance of User Experience and Accessibility

For cryptoassets to achieve mass adoption, they need to become more user-friendly and accessible to people who are not technically savvy. Early crypto interfaces were often complex and intimidating for beginners. There’s a growing focus in the industry on improving the user experience (UX) of wallets, exchanges, and dApps.

This includes:

- Simpler onboarding processes.

- More intuitive interfaces.

- Better educational resources.

- Solutions that abstract away some of the underlying technical complexities (like gas fees or private key management, though the latter comes with its own trade-offs regarding self-custody).

As these aspects improve, the barrier to entry for understanding cryptoassets and participating in the ecosystem will lower, paving the way for broader adoption by the general public.

🏁 Section 8: Conclusion: Your Crypto Journey Starts Now!

Congratulations on reaching the end of this comprehensive guide! You’ve taken a significant first step in understanding cryptoassets, diving into blockchain basics, and exploring the landscape of crypto investing for beginners. The world of digital assets is vast, dynamic, and undeniably complex, but it’s also filled with innovation and transformative potential.

We’ve journeyed from the very definition of cryptoassets and the foundational technology of blockchain to the practicalities of getting started with investing, the crucial aspects of security, and a glimpse into the exciting future possibilities like DeFi, NFTs, and Web3. The key takeaway is that knowledge, caution, and continuous learning are your most valuable assets in this space.

Recap of Key Learnings for Understanding Cryptoassets

- Cryptoassets are digital or virtual assets secured by cryptography, with Bitcoin being the pioneer.

- Blockchain is the decentralized, immutable ledger technology that underpins most cryptoassets.

- The crypto world is diverse, encompassing cryptocurrencies, cryptocommodities, and cryptotokens.

- Investing in crypto offers potential rewards but comes with significant risks, especially volatility and security threats.

- Education, careful research, starting small, and prioritizing security are paramount for beginners.

- The crypto ecosystem is expanding rapidly with innovations like DeFi, NFTs, and Web3, which are reshaping finance and the internet.

- The future looks towards increased institutional adoption, clearer regulation, and technological advancements making crypto more accessible.

Embracing Continuous Learning in a Dynamic Field

The cryptoasset landscape is not static; it evolves daily. New projects emerge, technologies advance, and regulations adapt. Therefore, your learning journey doesn’t end here. Commit to staying informed by following reputable news sources, engaging with educational content, and perhaps even joining crypto communities to learn from others.

Be critical of the information you consume, especially on social media, where hype can often overshadow substance. The ability to discern credible information from noise is a crucial skill for anyone involved in understanding cryptoassets.

Final Encouragement for Aspiring Crypto Investors

The path of crypto investing for beginners can seem intimidating, but armed with the knowledge from this guide and a commitment to responsible practices, you are well-equipped to navigate it. Remember to:

- Start with Why: Understand your motivations and financial goals.

- Learn Continuously: The space is always changing.

- Manage Risk: Never invest more than you can afford to lose.

- Prioritize Security: Protect your assets diligently.

- Be Patient: Crypto is a long-term technological shift, not a get-rich-quick scheme.

The world of cryptoassets holds immense promise. By approaching it with curiosity, prudence, and a solid educational foundation, you can be part of this exciting financial and technological revolution. Your crypto journey starts now – explore wisely!

Reference video: