What is Cryptocurrency?

Cryptocurrency 101 starts with a simple definition: Cryptocurrency is a digital currency that operates on decentralized networks using blockchain technology. Unlike traditional money, cryptocurrencies are not controlled by any government or central authority, making transactions faster, more secure, and transparent.

Bitcoin, the first and most well-known cryptocurrency, launched in 2009, but today, thousands of digital currencies exist, including Ethereum, Binance Coin, and Solana, each serving different purposes in the digital economy.

How Does Cryptocurrency Work?

Understanding how cryptocurrency works is key to navigating the crypto world. Here’s a breakdown:

- Blockchain Technology – A decentralized ledger that records transactions across a network of computers, ensuring security and transparency.

- Decentralization – Unlike traditional banking systems, cryptocurrencies operate on a peer-to-peer network, meaning no central authority controls them.

- Mining and Transactions – Some cryptocurrencies, like Bitcoin, require mining (solving complex algorithms) to validate transactions, while others use different consensus mechanisms like Proof of Stake (PoS).

- Wallets and Exchanges – Users store cryptocurrencies in digital wallets and buy/sell them on exchanges like Binance, Coinbase, and Kraken.

Why is Cryptocurrency Important?

Cryptocurrencies are revolutionizing finance by offering faster transactions, lower fees, and increased security compared to traditional banking. Many also see crypto as a hedge against inflation and a way to achieve financial independence outside government-controlled systems.

Benefits of Cryptocurrency:

✅ Decentralization – No government or bank control

✅ Lower Transaction Costs – Send money globally with minimal fees

✅ Security & Transparency – Immutable transactions recorded on blockchain

✅ Financial Inclusion – Access to financial services without a bank account

Different Types of Cryptocurrencies

Cryptocurrency 101 isn’t complete without understanding the different types of digital assets:

1. Bitcoin (BTC) – The Pioneer

Bitcoin remains the gold standard of cryptocurrencies, often referred to as digital gold. It has a limited supply of 21 million coins, making it a scarce asset with high value.

2. Altcoins (Ethereum, Binance Coin, Solana, etc.)

- Ethereum (ETH) – Enables smart contracts and decentralized applications (dApps).

- Binance Coin (BNB) – Used for discounted trading fees on Binance.

- Solana (SOL) – Known for high-speed transactions and low fees.

3. Stablecoins (USDT, USDC, DAI)

These cryptocurrencies are pegged to traditional assets like the US dollar, offering price stability. They’re ideal for avoiding volatility while using crypto for payments.

4. Meme Coins & NFTs

- Dogecoin (DOGE) & Shiba Inu (SHIB) – Community-driven coins with speculative value.

- NFTs (Non-Fungible Tokens) – Digital collectibles that prove ownership of unique assets.

How to Start Investing in Cryptocurrency

Step 1: Choose a Secure Crypto Wallet

To store your crypto, you need a wallet:

- Hot Wallets (e.g., MetaMask, Trust Wallet) – Connected to the internet, convenient but less secure.

- Cold Wallets (e.g., Ledger, Trezor) – Offline and highly secure, ideal for long-term storage.

Step 2: Select a Trusted Exchange

Popular exchanges include:

- Binance – Best for diverse trading options.

- Gate – Ideal for beginners.

- OKX – Strong security features.

Step 3: Buy Your First Crypto

Use fiat currency (USD, EUR, local fiat currency, etc.) to buy Bitcoin, Ethereum, or stablecoins on an exchange (P2P). Start with a small investment to minimize risk.

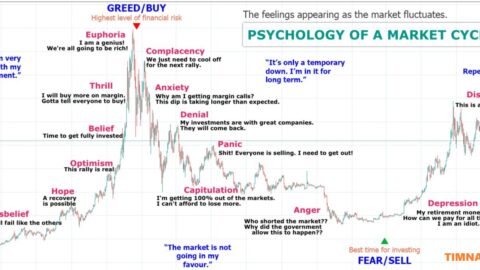

Step 4: Understand Market Trends

Use tools like CoinGecko and CoinMarketCap to track crypto prices, market cap, and trends before investing.

Crypto Safety Tips for Beginners

🚨 Never share your private keys or seed phrase.

🔐 Enable two-factor authentication (2FA) on exchanges.

🛑 Avoid scams and phishing links.

📉 Only invest what you can afford to lose.

Future of Cryptocurrency

The crypto industry is evolving, with trends like Decentralized Finance (DeFi), Web3, and the Metaverse gaining traction. Many experts believe blockchain will reshape industries beyond finance, including gaming, real estate, and digital identity management.

Conclusion

Cryptocurrency 101 provides a solid foundation for anyone looking to enter the digital asset space. Whether you’re investing, trading, or just learning, understanding crypto’s basics is the first step toward financial freedom.

🚀 Ready to explore more? Check out our in-depth guides on trading strategies, crypto security, and market trends!