Introduction: Why the Psychology of Crypto Investing Matters

The psychology of crypto investing is often overlooked, yet it plays a crucial role in long-term success. Cryptocurrency markets are notoriously volatile, triggering fear, greed, and impulsive decisions among investors. If you don’t learn to manage emotions in crypto, you could fall victim to panic selling, FOMO-driven buying, or overtrading.

This guide will explore 10 proven strategies to help you stay calm, control risk, and invest smarter in the unpredictable world of crypto.

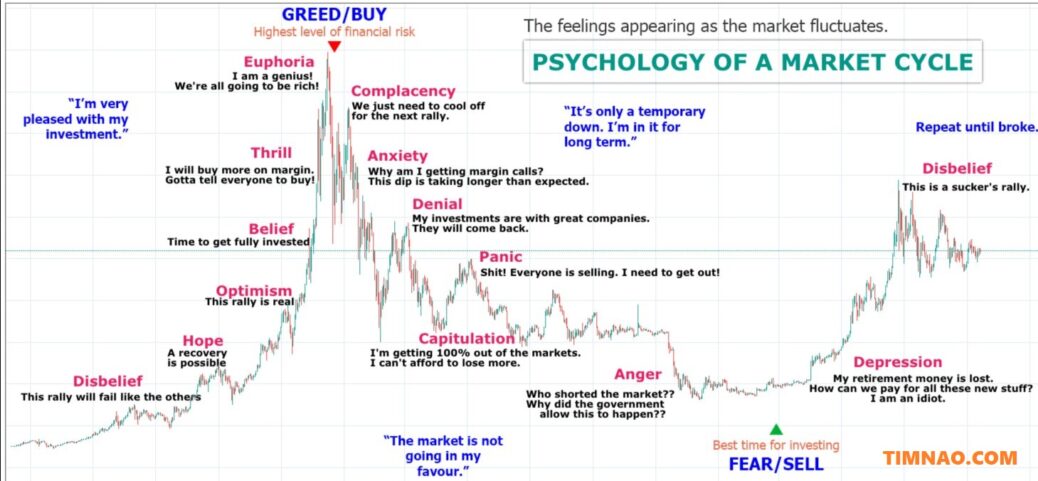

1. Understand the Emotional Cycle of Crypto Investing

The Market Psychology Cycle

Crypto investors often go through a predictable emotional cycle:

😃 Optimism & Excitement – Prices rise, and investors feel confident.

🚀 Euphoria & FOMO – Fear of missing out leads to reckless buying at peak prices.

😨 Anxiety & Denial – Prices drop, but investors convince themselves it’s temporary.

😱 Panic & Capitulation – Fear takes over, leading to panic selling at a loss.

😌 Hope & Recovery – The market stabilizes, and confidence gradually returns.

🔹 Pro Tip: Recognizing this cycle helps you make logical decisions rather than emotional ones.

2. Develop a Strong Crypto Investment Mindset

Shift from Short-Term Thinking to Long-Term Success

Many investors treat crypto as a get-rich-quick scheme, leading to impulsive trades. Instead, think long-term and focus on solid projects with strong fundamentals.

✅ Invest in proven cryptocurrencies like Bitcoin and Ethereum.

✅ Research before buying – avoid hype-driven investments.

✅ Accept that volatility is normal in crypto markets.

🔹 Pro Tip: The best investors focus on long-term gains rather than chasing short-term profits.

3. Master Risk Management in Crypto

How to Manage Risk Effectively

Managing risk is crucial for long-term survival in crypto investing. Here’s how:

📉 Only invest what you can afford to lose.

📊 Diversify your portfolio – avoid putting all your money into one coin.

⏳ Use stop-loss orders to minimize losses on bad trades.

💰 Take profits gradually instead of holding forever.

🔹 Pro Tip: Even the best traders experience losses—what matters is how well you manage them.

4. Avoid FOMO (Fear of Missing Out)

Why FOMO is Dangerous

FOMO is one of the biggest psychological traps in crypto investing. Seeing others profit from a rally can make you feel like you’re missing out, leading to rushed, irrational purchases.

🚨 Signs of FOMO Trading:

- Buying at all-time highs due to social media hype.

- Entering trades without research just because others are making money.

- Ignoring risk in pursuit of quick gains.

How to Overcome FOMO

✅ Set clear entry and exit strategies before investing.

✅ Remember that there will always be another opportunity.

✅ Focus on fundamentals rather than short-term price movements.

🔹 Pro Tip: If a coin has already surged 100%, you’re likely late—wait for a pullback instead.

5. Control Fear During Market Crashes

Why Fear Leads to Poor Decisions

Market crashes trigger panic, leading many investors to sell at the worst possible time. Fear-based decisions often result in locking in losses rather than riding out market fluctuations.

How to Stay Calm in a Bear Market

✅ Zoom out – look at historical market trends (crypto has always recovered).

✅ Have a long-term perspective – short-term dips are part of investing.

✅ Avoid checking prices constantly – this reduces stress and impulsive reactions.

🔹 Pro Tip: Successful investors buy during fear and sell during greed—not the other way around.

6. Use a Structured Trading or Investing Plan

Benefits of Having a Plan

Having a clear strategy removes emotional decision-making from investing.

📌 For Traders:

✅ Set stop-loss and take-profit targets before entering a trade.

✅ Stick to risk-reward ratios (e.g., 3:1 profit-to-loss ratio).

✅ Follow a consistent trading strategy instead of gambling.

📌 For Long-Term Investors:

✅ Use Dollar-Cost Averaging (DCA) to smooth out volatility.

✅ Hold strong assets through market cycles.

✅ Take partial profits when significant gains occur.

🔹 Pro Tip: Making pre-planned decisions prevents panic reactions when markets swing unexpectedly.

7. Avoid Overtrading and Impulse Buying

Why Overtrading Hurts Your Portfolio

Many investors trade too frequently, hoping to maximize profits but often end up losing more due to fees and bad timing.

How to Prevent Overtrading

✅ Stick to a few high-quality trades instead of chasing every move.

✅ Avoid revenge trading after a loss.

✅ Take breaks—markets will always be there.

🔹 Pro Tip: Trading less, but making smarter trades, often leads to higher profitability.

8. Learn from Mistakes and Losses

Turning Losses into Lessons

Instead of getting discouraged by losses, treat them as learning experiences:

✅ Keep a trading journal – document wins, losses, and mistakes.

✅ Analyze past trades to identify patterns and weak points.

✅ Improve decision-making based on experience.

🔹 Pro Tip: The best investors embrace mistakes and adapt over time.

9. Use Crypto Communities Wisely

Avoid the Herd Mentality

While crypto communities (Twitter, Telegram, Discord) provide insights, blindly following others can be dangerous.

🚨 Warning Signs:

- People hyping a coin without technical backing.

- Unrealistic price predictions with no basis.

- Encouragement to “buy now” without solid reasoning.

🔹 Pro Tip: Follow credible sources and do your own research (DYOR).

10. Develop Emotional Discipline for Long-Term Success

The Key to Winning in Crypto

Success in crypto investing isn’t just about choosing the right coins—it’s about managing your emotions when things get tough.

✅ Accept that volatility is part of crypto.

✅ Stay informed, but avoid emotional news cycles.

✅ Focus on long-term trends rather than daily fluctuations.

🔹 Final Pro Tip: Those who stay disciplined and control emotions have the best chance of long-term success in crypto investing.

Final Thoughts

Mastering the psychology of crypto investing is just as important as understanding technical analysis or market trends. By controlling emotions, developing a structured approach, and avoiding common psychological traps, you can increase your chances of long-term success.

🚀 Stay disciplined, trust your strategy, and always manage risk wisely. The best investors are not just those who pick the right coins—but those who master their emotions in the face of volatility.