Smart Reverse Logistics Made Simple: A Powerful Circular Supply Chain Playbook ♻️

Smart reverse logistics is no longer a “nice-to-have” sustainability project—it’s quickly becoming a competitive advantage for companies drowning in returns, packaging waste, and rising compliance pressure. In this guide, you’ll learn how to turn reverse flow into a circular supply chain engine you can start asset-light, validate with real customers, and scale into a defensible network with data and recurring revenue.

Idea Snapshot: an asset-light circular supply chain business

The fastest way to fail in this space is to start with “we handle everything.” The fastest way to win is to start with one clear stream, one tight area, and one buyer type—then build the playbook until it runs like clockwork.

At a high level, your service answers three operational questions for a client:

- What used items/materials are we generating?

- Where should each category go next (reuse, resale, repair, recycle, dispose)?

- Can we prove it happened—with simple, audit-friendly documentation?

Idea Snapshot (quick scan)

- Best first customer: multi-site retailers, warehouses, or light manufacturers with repeatable streams (returns, cardboard, plastic film, pallets)

- Core offer: scheduled collection + basic sorting/triage + routing to verified partners + monthly reporting

- First sale format: 30-day pilot (3–10 sites) → then a 3-month rollout

- Early traction channel: targeted outreach (LinkedIn + cold email) plus local partner introductions

- Startup cost: low if asset-light (bins, labels, scale, basic PPE; small staging corner if needed)

- Time to a real signal: 2–6 weeks if you can run the pilot and show measurable outcomes

- Moat you’re building: route density + sorting standards + downstream partner network + traceability data

What “asset-light” really looks like

You don’t need to buy trucks or lease a big facility on day one. In the beginning, you’re a coordinator with strong operations:

- Collection: partner with local couriers or rent vehicles only on pickup days

- Sorting: start with a small staging area and simple grading rules

- Downstream: pre-agree acceptance specs and handoff schedules with recyclers/refurbishers/liquidators

- Reporting: track weights, categories, and receipts consistently

A lightweight tool stack is enough to feel “smart” without building software:

- Intake requests in Google Forms

- A simple operations database in Airtable

- Reminders and auto-confirmations via Zapier

Tools won’t save a messy process. But a clean process plus basic tools is surprisingly powerful.

Your first wedge: one stream + one geography + one buyer

If you only remember one rule, make it this: pick a wedge you can execute repeatedly.

Choose a first stream with:

- Consistent volume (weekly/daily, not random)

- Simple sorting (clear accept/reject rules)

- Existing downstream demand (someone already buys/processes it)

Beginner-friendly wedges that often work:

- Cardboard + plastic film from retail stores in one district

- Pallets and reusable crates from warehouses in one industrial park

- “Returns triage” for a local retailer (grade and route to resale/refurb/recycle)

Once your first stream runs smoothly, adding a second stream becomes an upgrade—not a reinvention.

Why now: EPR rules, return volumes, and the new packaging reality

Reverse logistics has always existed, but it used to be treated like an annoying edge case. Today, it’s becoming a strategic priority because the costs, rules, and customer expectations have shifted.

EPR is turning “waste” into a compliance and reporting problem

Extended Producer Responsibility (EPR) policies push responsibility upstream by making producers (and often brand owners/importers) accountable for post-consumer outcomes. The practical result is more reporting, more scrutiny, and more pressure to show that materials were handled properly.

For your business, this creates a premium layer: traceability. If you can provide clear chain-of-custody and simple monthly reporting, you’re not “a waste vendor.” You’re helping the client reduce compliance and reputational risk.

Beginner move: prioritize streams where documentation matters (packaging, take-back programs, multi-site recovery). Reporting is where you can charge more than a pickup fee.

Return volumes are massive—and they’re forcing operational upgrades

Returns are no longer seasonal noise. In the U.S., total merchandise returns were reported around $743B in 2023. For 2024, major industry surveys projected returns closer to $890B, and some 2025 projections still keep returns in the high hundreds of billions with return rates in the mid-teens. Different reports measure returns differently, but the buyer’s reality stays the same: processing returns eats labor, space, and margin.

That’s the opening. Companies aren’t “shopping for a recycler.” They’re shopping for fewer backlogs, faster triage, and fewer write-offs. If you can shorten the time between “returned” and “routed,” you create value immediately.

The new packaging reality: recovery is becoming part of procurement

Packaging is being redesigned for recovery: less material, clearer sorting, more recycled content, and more reuse where feasible. Procurement and sustainability teams increasingly ask, “Can this stream stay clean, and can we prove where it went?”

This favors operators who can standardize sorting rules, reduce contamination, and document outcomes across multiple sites. In other words, it rewards disciplined reverse logistics—not just hauling.

Why startups can win here

Reverse logistics is coordination-heavy: different sites, different staff habits, inconsistent materials, and a long chain of partners. Large incumbents often treat this as “extra scope.” A focused startup can win by offering a narrow, repeatable service, measuring every step, and improving weekly.

Your edge isn’t size. It’s speed of learning and process discipline.

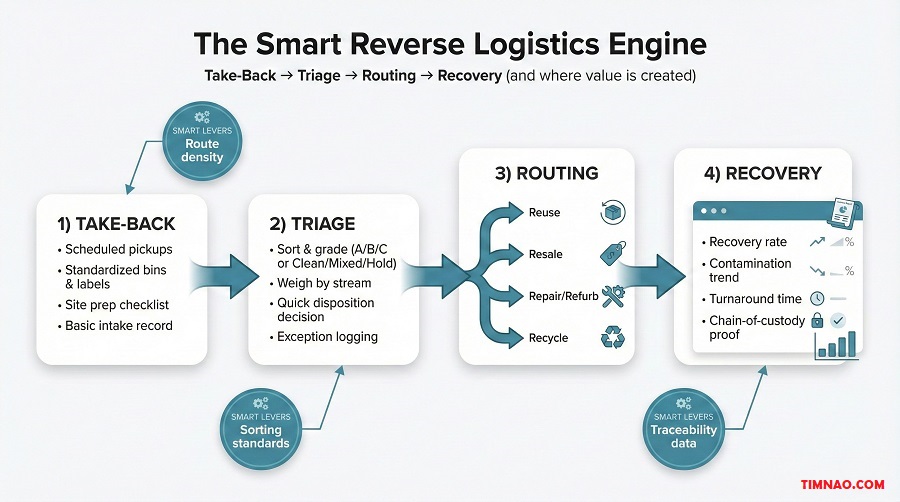

The smart reverse logistics engine: take-back → triage → routing → recovery

Let’s turn the concept into a workflow you can run next week. A “smart reverse logistics engine” is a repeatable process that converts messy inputs into valuable outputs—plus proof.

Take-back: make collection predictable (and boring)

Take-back is where most operators leak money. Random pickup requests create wasted miles and constant firefighting.

Set three simple rules:

- Fixed pickup windows (e.g., Tue/Thu mornings)

- Standard containers with clear labels (Accepted / Not Accepted)

- A short site checklist (where to place, how to pack, what to avoid)

Beginner tip: if you can’t control timing perfectly, control packaging and labeling. It cuts sorting time faster than most “tech.”

Triage: decide quickly before value decays

Triage is sorting plus decision-making. It’s also where your margin is protected.

Use a simple disposition tree:

- Reuse: intact pallets, reusable crates, clean packaging → route back into use

- Resale: returns/surplus in good condition → grade A/B/C and send to resale/liquidation

- Repair/Refurb: fixable items → route to a repair/refurb partner with clear specs

- Recycle: clean, sorted materials → route to recyclers by category

- Reject/Regulated: contaminated or regulated items → reject or route to licensed processors

Speed matters. Sellable returns lose value sitting unsorted. Recyclables lose value when contaminated. Your promise is “fast, consistent decisions.”

Routing: build options so you’re never stuck

Routing is choosing the best destination based on quality, reliability, and economics. Don’t become dependent on one processor.

A practical early rule:

- Maintain two options per major stream (primary + backup)

- Confirm specs and rejection rules in writing (even a simple email)

- Schedule handoffs so your staging area doesn’t overflow

When you can say, “This portion went to reuse, this to resale, this to recycling—here’s the proof,” you’re no longer a pickup service. You’re supply chain infrastructure.

Recovery: turn outcomes into a report the buyer can use

Recovery is the measurable result. In B2B, it only “counts” when it’s documented.

Your minimum viable report can be one page:

- Total collected by stream (kg/tons)

- Contamination rate (even a basic estimate)

- Disposition breakdown (reuse/resale/repair/recycle/dispose)

- Chain-of-custody receipts from downstream partners

What to automate first (so you stay lean)

Automate the boring, error-prone parts:

- Pickup confirmations and reminders

- A weekly route list for drivers/partners

- A monthly report template that pulls from your weight logs

Keep triage rules manual until you’ve seen enough real-world edge cases. The workflow itself will teach you what to standardize next—and that sets you up perfectly to choose a specific customer segment and design your pilot offer around their daily reality.

Choose your wedge ICP: retailers, manufacturers, industrial sites, and 3PLs

If you try to serve “everyone with waste,” you’ll spend your first six months chasing random leads, doing custom work, and wondering why nothing feels repeatable. The wedge is what makes this business real: a narrow starting point where the pain is obvious, the workflow is similar across customers, and you can build momentum fast.

A good wedge is not the “biggest market.” It’s the easiest market to win first.

A beginner-friendly wedge scorecard (use this before you pick)

When you’re choosing between retailers, manufacturers, industrial sites, and 3PLs, score each option on a simple 1–5 scale:

- Repeatability: Will the same workflow work across multiple customers?

- Route density: Can you serve multiple sites in one area without wasting miles?

- Material clarity: Is the stream easy to sort (low contamination risk)?

- Buyer urgency: Does someone feel the pain weekly (not “someday”)?

- Downstream demand: Do you already have a clear outlet for the stream?

- Proof value: Will reporting/traceability be worth paying extra for?

If you get high scores on 4–5 of these, you’ve likely found a wedge you can execute as a beginner.

Segment 1: Retailers and e-commerce operators (returns + packaging)

Retailers often have two very visible problems: returns and packaging waste. Both create backroom chaos, take staff time, and eat space that could be used for selling inventory.

For a wedge, you want retailers with:

- Multiple sites in one city (so your routes are tight)

- A consistent stream (returns weekly, cardboard daily, plastic film daily)

- A manager who is accountable for operations or loss prevention

Why they pay quickly:

Retailers don’t want an explanation of circularity. They want fewer headaches. If you can (1) pick up on schedule, (2) prevent overflow, and (3) make decisions fast—what goes to resale, what gets refurbished, what goes to recycling—you become a “problem reducer.”

Beginner wedge idea (retail):

- Start with packaging recovery (cardboard + plastic film) because it’s predictable and simple

- Add returns triage only after your basic pickup + reporting is stable

Segment 2: Manufacturers and brand owners (take-back + warranty returns + parts)

Manufacturers and brand owners can be great customers because their “waste” can be high-value: parts, components, reusable packaging, warranty returns, and production scrap. They also tend to care more about documentation and consistency.

This segment works best when:

- The business already has a take-back or after-sales flow

- There are clear categories (good parts vs defective vs recyclable materials)

- Someone owns the KPI (operations, quality, sustainability, or after-sales)

Why they pay:

They’re buying control. A manufacturer doesn’t want items leaking into informal channels or being mishandled. They also hate uncertainty—especially when leadership asks, “Where did all of this go, exactly?”

Beginner wedge idea (manufacturing):

- Pick one stream like pallets / reusable crates or specific packaging

- Keep handling rules simple at first; don’t touch regulated streams until you have partners and SOPs

Segment 3: Industrial sites and warehouses (repeatable streams + route density)

Industrial parks, warehouses, and distribution centers often produce the most repeatable streams: pallets, stretch film, cardboard, and mixed packaging. The difference between a profitable route and a money-losing route is usually density—and industrial areas give you that density faster than scattered SMEs.

Look for:

- A cluster of sites that can be served in one route

- Predictable pickup needs (e.g., twice a week)

- Staff who will actually follow a simple sorting rule

Why they pay:

Warehouses hate disruption. Missed pickups create overflow. Overflow creates safety problems. Safety problems create management attention. If you can make the flow boring and consistent, you’ll get renewed.

Beginner wedge idea (industrial):

- “Pallets + plastic film recovery program” for one industrial park

- Bundle: fixed pickup windows + simple contamination rules + monthly report

Segment 4: 3PLs and logistics providers (white-label reverse logistics)

3PLs can be a shortcut to scale, but they’re not always the best first customer. They often have complex expectations, and they will judge you on reliability immediately. That said, once you have a working playbook, 3PLs become a powerful distribution channel.

This segment works best when:

- A 3PL already has customers asking for reverse logistics

- They don’t want to build the sorting/reporting system themselves

- They’re open to a partnership (not squeezing you into thin margins)

Why they pay:

They can sell an additional service line without building it from scratch. If you position your service as a plug-in module—“we manage reverse flow, triage, routing, and reporting”—you become their capability upgrade.

Beginner wedge idea (3PL):

- Start with a single lane (one client, one stream, one facility)

- Prove the SOPs. Then offer a white-label version.

The simplest decision rule: choose the wedge you can execute next week

If you’re still stuck, pick the wedge that meets these conditions:

- You can name 20 potential customers in one area.

- You can find 2 downstream partners who want the material.

- You can define sorting rules in one page.

That’s the wedge that gives you speed—and speed is your advantage early on.

Offer design that sells: the “Minimum Viable Take-Back” pilot

Your first offer should not be “end-to-end circular supply chain transformation.” That’s expensive, vague, and scary to buy. Instead, sell a pilot that feels small, specific, and measurable—while still proving you can run the system.

Think of the pilot as your “paid proof.” It’s how you turn interest into momentum.

The Minimum Viable Take-Back Pilot (what it is)

A simple pilot is a 30-day program that covers:

- Take-back: scheduled pickups for one stream (or two max)

- Triage: basic sorting + grading rules

- Routing: delivery to agreed downstream partners

- Recovery proof: a monthly report + chain-of-custody receipts

Your goal is to show you can create a stable reverse flow with clear outcomes—not to perfect everything.

Pilot scope: keep it narrow on purpose

Here are starter constraints that make the pilot easier to deliver and easier to sell:

- 3–10 sites max (or one warehouse/factory site)

- 1 geography cluster (no long-distance routes)

- 1 primary stream (add a second only if it shares the same handling)

- Fixed pickup windows (e.g., Tue/Thu mornings)

- Clear “accepted vs rejected” rules (reduce confusion immediately)

This is where many beginners slip: they expand scope to “please the customer.” But scope creep kills your margin and your learning speed. You want the pilot to be small enough that you can run it flawlessly.

Pilot deliverables that buyers actually care about

When you present the pilot, don’t list features. List outcomes that feel operational:

- No-overflow guarantee (within agreed windows)

You set pickup schedules so sites stop piling materials in random corners. - Simple sorting system

Labeled bags/bins + a one-page guide. The goal is not perfect sorting—it’s consistent sorting. - Downstream routing with verified handoff

The buyer wants to know materials didn’t vanish. Your receipts and documentation reduce risk. - Monthly performance report (1–2 pages)

Include:- Total collected by stream

- Contamination estimate or rejection rate

- Disposition breakdown (reuse / resale / refurb / recycle / disposal)

- Notes on operational improvements (what changed week to week)

If you do only these four well, you’ll already be ahead of most informal solutions.

The pilot success metrics (so renewal feels obvious)

Your pilot should have a few simple metrics you can measure without fancy systems:

- On-time pickup rate: did you hit the promised windows?

- Contamination trend: is it improving with training and labeling?

- Turnaround time: how quickly did you route materials after collection?

- Site feedback: did staff feel less disruption?

Pro tip: make one of the metrics about the customer’s pain, not yours. For example, “backroom overflow incidents” or “hours spent by staff managing waste.” That’s what gets budget approved.

A clean pilot proposal structure (copy this)

When you send a pilot proposal, keep it short and skimmable:

- Goal: what you’ll improve (cost, clutter, speed, reporting)

- Scope: sites, streams, pickup windows

- How it works: collect → triage → route → report

- What you provide: bins/labels, scheduling, handling, reporting

- What the client provides: staging spot, basic staff cooperation, point of contact

- Success metrics: 3–5 bullet metrics

- Price + timeline: pilot fee, start date, next-step meeting

The pilot is a product. Treat it like one.

“What NOT to include” in your first pilot

To keep execution tight, avoid these early:

- Handling hazardous or regulated waste without licensed partners

- Custom workflows per site (“this store wants pickups anytime…”)

- Unlimited streams (“just take everything we have”)

- Overpromising value recovery (“we will monetize everything”)

- Building software during the pilot

Your credibility comes from doing a small thing extremely well.

Converting the pilot into a rollout (the natural next offer)

At the end of 30 days, the buyer is usually thinking: “Can you keep doing this, and can you expand to more sites?”

Your rollout offer should feel like an obvious continuation:

- 3-month commitment

- Expanded coverage (more sites in the same cluster)

- Better reporting cadence (monthly + quarterly summary)

- A refined SOP and training refresh

If you did the pilot right, the rollout isn’t a new sale. It’s the customer saying, “Please don’t stop.”

Reverse logistics businesses become durable when they have two things:

- Predictable service revenue (so you can operate steadily)

- Upside from recovery (so you can improve margins as you get better)

The mistake is trying to rely on recovery upside before you have stable operations.

The revenue stack (how you get paid repeatedly)

Most successful setups combine these layers:

- Pilot fee (one-time)

Covers onboarding, setup, and the first month of learning. - Monthly service retainer (recurring)

Covers scheduling, account management, reporting, training refresh, and baseline pickups. - Variable volume fee (scales with usage)

Per pickup, per kg, or per ton—whatever matches the stream. - Value-share (upside)

You take a percentage of recovered value only after you’ve improved sorting quality and routing. - Compliance/reporting package (premium add-on)

Better documentation, quarterly summaries, chain-of-custody organization, audit-ready files.

This is a strong mix because it balances stability (retainer + variable) with upside (value-share).

Service-to-software ladder (how you evolve without forcing it)

You don’t start as a software company. You earn your way into software by repeating the same workflow until the data becomes valuable.

Here’s the ladder in plain terms:

- Stage 1: Manual service + simple reporting

You run pickups, sorting, and routing with spreadsheets and discipline. - Stage 2: Standardized SOPs + partner network

You can onboard a new site and get it working fast because the playbook is clear. - Stage 3: Lightweight dashboard (paid)

Customers can see pickups, weights, and disposition reports in one place. This is when software becomes something they’ll pay for. - Stage 4: Analytics + integrations (optional later)

You optimize yields, compare sites, forecast volumes, and plug into warehouse systems.

If you try to jump to Stage 3 before Stage 2, you’ll build software around a workflow that isn’t stable yet. That’s expensive and usually frustrating.

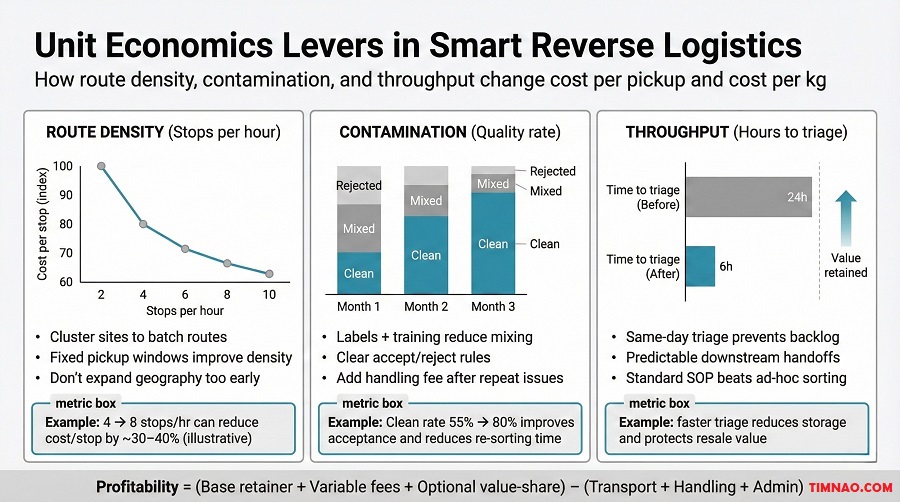

Where margin actually comes from (the 3 levers)

Beginners often think margin comes from “charging more.” In reverse logistics, margin usually comes from improving these three levers:

- Route density

More stops per route lowers cost per stop dramatically. - Contamination reduction

Cleaner streams increase downstream acceptance and reduce handling time. - Throughput speed

Faster triage means less space, less labor, and higher resale value for returns.

You can improve all three without fancy tech—just tighter SOPs and better site behavior.

How to structure pricing so you don’t get trapped

A simple pricing structure protects you while still being easy to buy:

- Base retainer: covers fixed work (reporting, coordination, training, baseline pickups)

- Variable fee: covers marginal costs (extra pickups, extra weight/volume)

- Value-share: optional upside once you prove better outcomes

This avoids the classic trap: taking on a large customer at a low flat price, then getting crushed when volume doubles.

The “input → process → output → revenue” model (use this in sales)

If a buyer asks why your service costs more than informal hauling, explain your business as a system:

- Input: used materials/returns + messy site habits

- Process: scheduled take-back + sorting + routing + documentation

- Output: less disruption + cleaner recovery + proof of disposition

- Revenue: service fee for reliability + optional upside on recovered value

That framing makes it clear you’re not selling transport. You’re selling control and measurable outcomes.

What data to collect from day one (so software is possible later)

Even if you never build software, this data improves pricing, sales, and operations:

- Site ID + pickup date/time

- Stream type + weight

- Rejection/contamination notes

- Destination partner + handoff confirmation

- Simple issue log (missed pickups, overflow, staff confusion)

Once you have 2–3 months of this, you can show patterns:

- Which sites are cleanest

- Which routes are most profitable

- Which streams are worth expanding

And that’s exactly what turns a “service” into a scalable business.

Pricing + unit economics levers: route density, contamination, and throughput

Pricing in reverse logistics feels tricky at first because you’re juggling two worlds: logistics (which can be low-margin) and value recovery (which can be high-upside but inconsistent). The way out is to price like a calm operator, not like a gambler.

Your goal for the first 90 days is simple: get paid for reliability and coordination, and treat recovered value as a bonus you can share later once you’ve proven you can deliver clean streams.

A beginner-friendly pricing structure that won’t trap you

A clean starting structure has three layers:

- Pilot fee (one-time): covers onboarding, setup, and the first month of learning

- Monthly base retainer (recurring): covers scheduling, reporting, training refresh, and a defined baseline of service

- Variable fee: scales with volume (by pickup / by kg / by ton) so you’re protected when waste spikes

This structure is easy for customers to understand and protects you from the classic mistake: agreeing to a flat monthly price and then getting crushed when volume doubles.

What you’re actually pricing

In plain terms, customers pay for three outcomes:

- Predictable take-back (less chaos, fewer overflow incidents)

- Clean routing decisions (reuse/resale/recycle with fewer mistakes)

- Proof (simple reporting and chain-of-custody so nobody panics later)

If your pitch sounds like “we pick up waste,” you’ll be compared to the cheapest hauler. If your pitch sounds like “we run a reverse-flow system and prove outcomes,” you’ll be compared to the cost of disruption and risk—which is a very different conversation.

The 3 unit economics levers that decide your margin

If you want this business to work long-term, obsess over these three levers. They matter more than fancy tech early on.

Lever 1: Route density (stops per hour)

Route density is the fastest way to improve margins without raising prices.

- If you have 3 stops spread across a city, your cost per stop is high.

- If you have 12 stops in one industrial park, your cost per stop drops dramatically.

Beginner rule: don’t expand geography until you can reliably batch routes. A tight cluster can make a small operation profitable; a scattered set of sites can sink a bigger one.

Practical ways to increase route density:

- Offer fixed pickup windows (customers adapt)

- Start in one district / one industrial park

- Bundle similar customers (retail strip, mall tenants, warehouse cluster)

- Add sites only if they are “on the route,” not “somewhere else”

Lever 2: Contamination (quality drives value and cost)

Contamination doesn’t just reduce downstream value. It also increases your labor, slows sorting, and causes rejections that waste time and reputation.

Think of contamination as a double tax:

- You spend more to handle it (more sorting time, more rebagging, more storage)

- You earn less from it (lower acceptance, lower pricing, higher rejection)

Your main job in month one is not “more volume.” It’s cleaner volume.

How beginners reduce contamination quickly:

- Give sites labeled bags/bins (even simple color-coding helps)

- Provide a one-page “Accepted / Not Accepted” guide with photos

- Do a 10-minute staff walkthrough on week 1

- Add gentle feedback: “This load had X issues; here’s how to fix it next time”

- Use a clear rule: repeated contamination triggers a separate handling fee

That last point matters. If contamination costs you, it must cost the customer too—or it won’t change.

Lever 3: Throughput (how fast you triage and move material)

Throughput is the hidden lever that beginners ignore. It shows up as:

- smaller staging area needs

- fewer labor hours per load

- lower risk of overflow and mixing

- higher resale value for returns (value decays with time)

In early operations, you don’t need perfect sorting. You need fast, consistent sorting to keep material moving.

A simple throughput goal:

- Materials collected today are triaged the same day (or next morning)

- Routed to downstream partners on a predictable schedule (e.g., twice per week)

A simple way to set starter pricing without guessing

Here’s a straightforward method to avoid “pricing by vibes.”

- Estimate your weekly operating cost for the route

- driver/courier cost

- vehicle rental/fuel (if applicable)

- handling labor time

- supplies (bags, labels, PPE)

- admin time (scheduling + reporting)

- Decide a minimum weekly margin buffer

- not a huge margin—just enough to absorb surprises

- Translate into base + variable

- base retainer covers fixed work

- variable covers the marginal cost per pickup or per kg/ton

If you want a simple mental model:

- Base retainer = coordination + reporting + “readiness”

- Variable = movement + handling

A lightweight unit economics example (for learning, not promises)

Let’s say you service 8 sites in one tight area, with 8 pickups/week.

Your rough weekly costs:

- Partner courier / driver time: $X

- Handling/sorting time: $Y

- Supplies/admin: $Z

Total weekly cost = X + Y + Z

Now design pricing:

- Monthly retainer covers the fixed portion (admin, reporting, training, baseline coordination)

- Variable fee covers pickups/weight (so if sites generate more, you don’t eat the cost)

Your “win” is not a magic price. Your win is that after 3–4 weeks you can see:

- cost per stop

- cost per kg/ton handled

- contamination rate trend

- how many labor minutes per load

That’s when pricing becomes confident instead of stressful.

Value-share sounds attractive, but introduce it only when two things are true:

- you can measure recovered value consistently

- you can influence it (through better sorting and routing)

Until then, recovered value is too variable to base your business on.

A beginner-friendly way to add it later:

- Keep service fees as the foundation

- Add a value-share only on specific categories where you have clear downstream pricing and acceptance rules

And always keep it simple. Complexity makes buyers hesitate and makes you harder to trust.

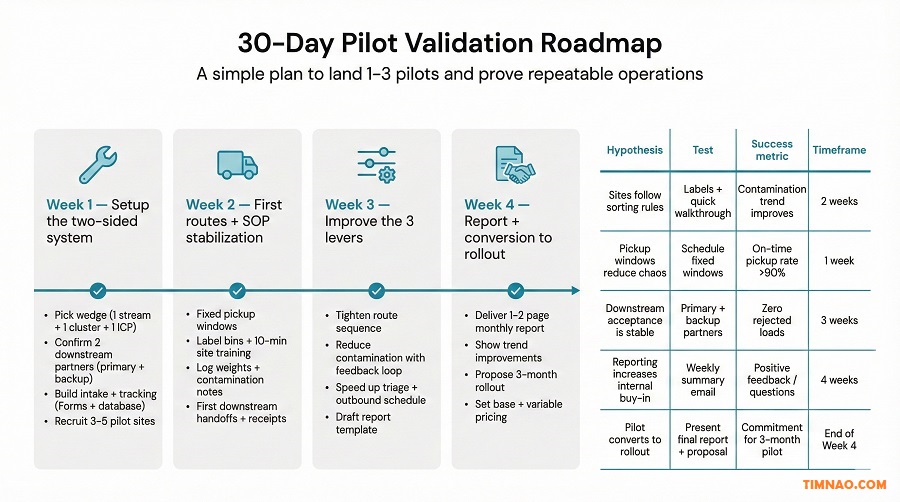

30-day lean validation plan (with a simple test table)

A reverse logistics business becomes real when you can prove one claim:

“We can run a repeatable reverse-flow service for a specific stream in a specific area, with measurable outcomes and clean handoffs.”

The 30-day plan below is designed to get you there quickly—without overbuilding, over-hiring, or over-promising.

Your 30-day goal (what “success” actually looks like)

By the end of 30 days, you want:

- 1–3 paying pilot customers (or one multi-site pilot)

- a stable pickup schedule that doesn’t rely on you firefighting daily

- two downstream partners you trust

- a simple monthly report you can generate in under 30 minutes

- clear numbers on your cost per stop and contamination trend

That’s enough to sell a 3-month rollout with confidence.

Week-by-week execution (what to do and why)

Week 1: Pick the wedge and lock the “two-sided market”

Reverse logistics is always two-sided: you need sources (customers) and destinations (downstream partners).

Your Week 1 tasks:

- Pick your wedge: one stream + one cluster + one buyer type

- Confirm two downstream partners (primary + backup)

- Build a simple intake system (pickup requests + site details) using Google Forms

- Create a tracking base in Airtable (sites, pickups, weights, issues, receipts)

- Recruit 3–5 pilot sites via direct outreach

The key is speed. Don’t polish branding. Don’t build a complex website. Get the workflow moving.

Week 2: Run the first routes and stabilize the “boring parts”

Week 2 is where reality shows up: mixed materials, unclear staging areas, staff confusion, unexpected delays.

Your Week 2 tasks:

- deliver bins/labels and a one-page sorting guide

- run the first pickups at fixed windows

- triage quickly and record weights

- hand off to downstream partners and collect proof receipts

- do a short feedback loop with each site (what worked, what caused contamination)

This week is about learning and tightening SOPs, not scaling.

Week 3: Improve quality and reduce operating friction

By Week 3, you should focus on the three levers:

- route density (tighten sequence and windows)

- contamination (training refresh + clearer signage)

- throughput (faster triage and predictable downstream handoffs)

Your Week 3 tasks:

- rewrite your sorting guide based on real mistakes

- create a simple “incident log” (missed pickup, overflow, contamination)

- refine your monthly report template so it’s mostly copy/paste

- test one upsell: compliance-friendly reporting or additional site coverage

If you want to automate something, start with reminders and confirmations via Zapier. Don’t automate core decisions yet.

Week 4: Present results and convert to rollout

Week 4 is where you earn the next contract.

Your Week 4 tasks:

- deliver the monthly report

- summarize improvements in plain language (what changed, what got easier)

- present a rollout plan (3 months, same cluster, expanded sites)

- propose pricing with base + variable, based on real pilot data

A good pilot presentation doesn’t feel like a “pitch.” It feels like a calm operations review.

Hypotheses test table (keep this visible during the month)

| Hypothesis | Test | Success metric | Timeframe |

|---|---|---|---|

| Sites will follow sorting rules | Provide labels + 10-min walkthrough | Contamination trend improves week over week | 2 weeks |

| Pickup windows reduce chaos | Fixed schedule + confirmation reminders | ≥ 90% on-time pickups | 2–3 weeks |

| Downstream partners accept your quality | Pre-agreed specs + sample loads | < 10% rejection rate | 1–2 weeks |

| Reporting creates buyer confidence | Deliver a 1–2 page report + receipts | Buyer asks to share internally or requests more detail | 3–4 weeks |

| Unit economics are viable | Track cost per stop + labor minutes | Positive gross margin on the pilot route | 4 weeks |

| Pilot converts to rollout | Present 3-month plan | 1 rollout proposal accepted | 4 weeks |

The “minimum data” you must capture every pickup

Don’t overcomplicate data. Capture only what makes decisions easier:

- site ID

- pickup date/time

- stream type(s)

- weight (even approximate is fine early)

- contamination notes (what went wrong)

- destination partner and handoff proof

If you capture this reliably, you’ll be able to price better, sell better, and operate better within the first month.

Operations playbook: collection routes, sorting SOPs, and chain-of-custody proof

Operations is the product here. If you run clean operations, you will win renewals. If you run sloppy operations, you’ll spend your time explaining instead of growing.

This playbook is intentionally beginner-friendly. Start simple, then level up.

Collection routes: how to make pickups predictable and profitable

Step 1: Lock pickup windows and enforce them

Pick windows that make batching easy:

- two pickup days per week for each site (or one for low-volume)

- time windows (e.g., 9–12) so the route is stable

The benefit is bigger than logistics: sites learn to prepare materials ahead of time, which reduces last-minute confusion.

Step 2: Standardize staging at the site

Every site should have:

- a designated staging corner

- labeled containers

- one short “do/don’t” guide

Your aim is to remove decision-making from busy staff. When people are rushed, they follow labels—not policies.

Step 3: Route design: cluster-first, always

A simple routing rule:

- never add a new customer unless it fits an existing route

- if it’s outside the cluster, price it as a separate route

As volume grows, consider a dispatch/routing tool like Onfleet to reduce missed pickups and improve visibility. But don’t rush it—manual routing is fine until you feel pain.

Step 4: Handle exceptions without breaking the system

Exceptions are where margins die. Define:

- how to request an extra pickup

- what it costs

- how fast you can respond

If you say yes to every exception “for free,” you’re training the customer to treat you like an emergency service.

Sorting SOPs: how to keep quality consistent without fancy tech

You want sorting to be:

- fast

- repeatable

- teachable to someone new

Your minimum viable sorting station

Even a small staging area can work if it’s organized:

- one “incoming” zone

- clearly labeled bins for each stream

- a scale (or consistent weight estimation method)

- a “hold/reject” zone so contamination doesn’t spread

A simple grading system that actually works

Keep it to three categories at first:

- Accepted (clean): ready for downstream handoff

- Needs separation: minor contamination you can fix quickly

- Rejected/hold: wrong material, too dirty, or needs special handling

This is enough to start improving quality without drowning in complexity.

The 10-minute SOP (trainable for beginners)

Every load follows the same steps:

- receive and photo (if needed)

- weigh by stream

- triage into Accepted / Needs separation / Hold

- label with date + stream + site ID

- move to outbound zone by destination partner

- log the data (site, weight, notes)

Write this SOP in plain language. Store it somewhere simple like Notion so you can update it as you learn.

Chain-of-custody proof: the trust layer you can’t skip

This is the part that turns “waste collection” into “reverse logistics infrastructure.”

Your goal is to be able to answer:

- What did we collect?

- From where and when?

- Where did it go next?

- Who received it?

- Can we show basic proof?

Minimum proof pack (what to collect every handoff)

- weight log (your scale record)

- handoff receipt or confirmation (even a simple signed note early on)

- destination partner name + date/time

- optional photos for higher-risk streams

Monthly reporting (keep it short, keep it useful)

Your first report doesn’t need to impress analysts. It needs to reassure decision-makers.

Include:

- total collected by stream

- disposition breakdown (reuse/resale/repair/recycle/dispose)

- contamination or rejection notes

- a short “what we improved this month” section

When buyers can forward your report internally and it still makes sense, you’ve done it right.

The most common ops mistakes (and how to avoid them)

- No fixed windows: leads to chaos, missed pickups, and expensive routes

- No clear rejects: contamination spreads, downstream rejects increase, reputation suffers

- No outbound schedule: staging area fills up, streams mix, throughput collapses

- No proof: customer trust erodes, especially when compliance questions appear

- Too many streams early: SOP complexity explodes, training becomes impossible

The good news is that these mistakes are avoidable with discipline, not big spending.

And once your operations are stable, the next sections of the article get much easier—because your sales, pricing, and scaling become driven by data instead of guesswork.

Beginner tool stack: Forms, Airtable, automation, and route planning

You don’t need a custom platform to run “smart reverse logistics.” What you need is a reliable workflow where nothing falls through the cracks: pickup requests are captured, routes are confirmed, weights are logged, partners are scheduled, and reporting takes minutes—not hours.

The easiest way to get there is to build a tool stack around three jobs:

- Capture (requests + site details)

- Track (what happened, where it went, proof)

- Repeat (automate reminders + reporting + route planning)

Forms: capture requests without back-and-forth

Start with a single intake form and keep it boring. Your goal is fewer messages, fewer misunderstandings, fewer “we forgot to put it out.”

Use Google Forms to capture:

- Site name + address + on-site contact

- Pickup type (scheduled / extra pickup)

- Stream type (cardboard, plastic film, pallets, returns, etc.)

- Estimated volume (small/medium/large or rough kg)

- Special notes (access restrictions, loading dock hours)

Beginner tip: add two required questions that protect your operations:

- “Is the material sorted according to the guide?” (Yes/No)

- “Is it staged in the designated area?” (Yes/No)

It sounds simple, but it nudges sites to follow the process—and gives you permission to charge extra when they don’t.

Airtable: your “single source of truth” database

A spreadsheet works until the day it doesn’t. Once you’re managing multiple sites and multiple pickups per week, you want a database-like structure. That’s where Airtable shines.

Set up four tables (that’s enough for a beginner system):

1) Sites

- Site ID, address, contact, pickup window, streams accepted, notes

- Add a “cleanliness score” (1–5) based on contamination history

2) Pickups

- Date, site ID, stream type, weight, driver/partner, status (scheduled → completed → handed off)

- Add a “exceptions” field (overflow, wrong stream, missed window)

3) Downstream partners

- Partner type (recycler/refurbisher/liquidator), accepted streams, specs, rejection rules

- Payment terms (if any), pickup schedule, proof format

4) Proof & receipts

- Link to pickup record + partner record

- Attach handoff receipts/photos (only if needed), notes, date/time received

Once this is set up, you can answer customer questions instantly:

- “How much did you collect from Site A this month?”

- “Where did the plastic film go?”

- “Which sites keep contaminating loads?”

That ability to answer quickly is a major trust signal.

Automation: small zaps that save hours (and reduce mistakes)

You don’t need 50 automations. You need three that remove repetitive admin work.

Use Zapier to set up:

- Form submission → Airtable record

Every pickup request lands in your Pickups table automatically. - Upcoming pickup reminders

A day before pickup, send the site contact a reminder: “Please stage materials by 9am.”

This reduces missed pickups more than you’d expect. - Completed pickup → internal checklist

When a pickup is marked “completed,” trigger a Slack/email to your team: “Log weight, triage category, assign downstream partner.”

Beginner rule: automate notifications and data entry first. Do not automate decision-making (routing, grading) until your SOP is stable.

Route planning: when to upgrade from “manual” to “system”

At the start, route planning can be:

- A shared Google Sheet with stop order

- A recurring weekly template (Tue/Thu routes)

- A simple checklist for drivers/partners

You upgrade when you feel one of these pains:

- You miss pickups because communication breaks

- Drivers waste time calling for directions/access

- You can’t estimate ETA for sites

- Proof of delivery is inconsistent

That’s when a route/dispatch tool like Onfleet becomes useful. It helps you manage:

- Dispatch and driver assignments

- ETA sharing and status tracking

- Proof of delivery capture

- Route optimization as volume grows

You’re not buying software to look professional. You’re buying it because it reduces operational leakage.

A starter reporting system that feels “smart” without complexity

Your first monthly report should be mostly automated from your Airtable fields:

- Total collected by stream

- Collection frequency

- Disposition breakdown (reuse/resale/recycle/dispose)

- Contamination notes + improvements

- Proof summary (receipts available upon request)

You can export data to Google Sheets, format it cleanly, and send a PDF. The point is consistency. A consistent report makes you easier to renew—and easier to refer.

First traction channel: LinkedIn + cold email to Operations/ESG leaders

This business doesn’t usually grow from viral content in the beginning. It grows from focused outreach and a pilot offer that feels safe to try.

Your best first channel is a mix of:

- LinkedIn for warm visibility + direct messages

- Cold email for scale and reach

- A tight “pilot” that lowers buying friction

Who to contact (and who not to)

In most companies, your buyers are not “marketing” and not “procurement” at first. You want the people who feel the mess daily:

Target titles:

- Operations Manager / Head of Operations

- Supply Chain Manager

- Warehouse Manager

- Facilities Manager

- Sustainability / ESG Lead (especially if reporting pressure exists)

Avoid starting with:

- CEO (unless it’s a small business)

- “Innovation” titles (often interested, not accountable)

- Generic inboxes (hard to convert)

Build a prospect list that makes routing easier

Don’t create a list of 200 random companies. Create a list of 40–60 companies in one cluster.

A simple approach:

- Choose one area: one industrial park, one retail district, or one city zone

- Find companies with multiple sites or consistent material flow

- Add key contacts and a short note on what stream they likely produce

Your list should include:

- Company name, address, segment (retail/warehouse/manufacturing/3PL)

- Likely stream (cardboard, plastic film, pallets, returns)

- Contact name + title + LinkedIn + email (if available)

Your positioning: “less disruption + proof,” not “we recycle”

Here’s the language that tends to convert:

- “scheduled take-back”

- “reduce backroom overflow”

- “clean sorting standards”

- “monthly reporting and chain-of-custody”

- “pilot in 30 days”

You’re selling calm operations. That’s what people renew.

LinkedIn outreach script (short, human, low-pressure)

Connection note (optional):

Hi [Name] — I’m building a local reverse logistics service that helps [retail/warehouse/manufacturing] teams reduce overflow and recover value from [stream]. Would love to connect.

First message after connect:

Hi [Name], quick question — how are you handling [returns/cardboard/plastic film/pallets] today, and what’s the biggest headache: space, staff time, pickup reliability, or reporting?

Follow-up (2–3 days later):

If it helps, I can share a simple 30-day pilot: fixed pickup windows + basic sorting/triage + routing to verified partners + a one-page monthly report. Open to a quick 15-minute chat this week?

Keep it conversational. You’re not trying to “close” in a DM. You’re trying to start a real operations conversation.

Cold email template (built for replies, not perfection)

Subject options:

- Reverse logistics pilot for [stream]

- Reducing [returns/overflow] at [Company]

- Take-back + reporting for [stream] (30-day pilot)

Email body:

Hi [Name],

I’m reaching out because teams like yours often end up spending too much time managing [returns/packaging/pallets] — and it turns into overflow, missed pickups, or messy reporting.

I run a simple smart reverse logistics service: scheduled take-back + basic sorting/triage + routing to verified partners + a monthly summary report.

Would you be open to a 30-day pilot for [3–5 sites / one facility] so we can measure on-time pickups, contamination trend, and time saved?

If you’re not the right person, who should I speak with?

— [Your Name]

Beginner tip: your “CTA” should be a conversation, not a proposal. Proposals come after you understand the current process.

The discovery call checklist (so you sound like an operator)

When someone agrees to talk, your job is to understand their workflow and pain—not to impress them.

Ask:

- Where does the stream come from (which sites, which teams)?

- What goes wrong (overflow, missed pickup, contamination, unclear responsibility)?

- How do they measure it today (if at all)?

- What’s the ideal future state (fewer incidents, cleaner routing, proof, predictable schedule)?

- What would make a 30-day pilot a success?

If they can’t articulate the pain, they won’t prioritize budget. If they can, your pilot will feel like relief.

The simplest “first 10 customers” plan

- Week 1: 60 prospects, 20 messages, 10 emails

- Week 2: 10 conversations, 3 pilots proposed

- Week 3–4: 1–2 pilots running, one case study drafted

The first case study doesn’t need to be fancy. It just needs to show:

- what you collected

- how you routed it

- what improved

- what proof you provided

Partnership flywheel: recyclers, refurbishers, and drop-off points

Your service is only as strong as your partner network. Even if you execute collections perfectly, you can’t create a circular supply chain without reliable “next steps” for the material.

Think of partnerships as your growth engine:

- Better partners → better routing → better outcomes → better pricing power → more volume → better partners

Downstream partners: where recovery becomes real

Downstream partners fall into a few buckets:

Recyclers

Good for clean commodity streams (cardboard, plastics by type, metals) where quality specs are clear.

Refurbishers / repair shops

Good for durable goods, components, and certain returns categories—especially if you can standardize grading.

Liquidators / resellers

Good for returns and surplus inventory where speed matters and “good enough” grading drives value.

Specialty processors

For more complex streams (e-waste categories, batteries, regulated materials). As a beginner, you generally partner here rather than doing anything yourself.

Your first goal is not to find “the perfect partner.” It’s to find two reliable options for your wedge stream:

- A primary partner you use most often

- A backup partner when volume spikes or specs change

The partner qualification checklist (use this before you commit)

Before you route anything, confirm:

- What streams they accept (and what they reject)

- Quality requirements (what counts as “clean”)

- How they handle contamination (fees, rejection thresholds)

- Documentation provided (receipt, weight ticket, confirmation)

- Pickup/drop-off process (schedule, lead time, minimum volumes)

- Payment terms (if they pay you) or fees (if you pay them)

This is how you avoid the most painful surprise: collecting a week’s worth of material and then being told, “We can’t take this.”

How to negotiate as a beginner without sounding small

You don’t need to pretend you’re huge. You need to sound organized.

A simple negotiation stance:

- “I’ll bring you consistent volume weekly.”

- “We’re standardizing sorting rules and tracking contamination.”

- “We need clear acceptance specs and a predictable handoff process.”

Partners care about consistency more than big promises. If you become the source of cleaner material, you’ll get better terms over time.

Upstream partners: scale collection without buying assets

Asset-light scaling often depends on upstream partners like:

- Local couriers and van operators

- Existing collectors with spare capacity

- Warehouses with unused corner space (micro-staging)

The key is setting standards:

- pickup windows

- proof capture (even basic)

- escalation rules when a site is not ready

- a clear pay structure

Your role becomes “network coordinator + quality controller,” which is exactly where the defensibility lives.

Drop-off points: the density multiplier

Drop-off points are optional in B2B-only models, but they can be powerful if your wedge involves returns or multi-site collection.

Good drop-off locations:

- Retail counters (for returns)

- Partner stores or service centers

- Community hubs (if it aligns with your model)

Why drop-off points matter:

- They reduce pickup cost per unit (consolidation)

- They make participation easier (less scheduling friction)

- They increase volume predictability

If you go this route, keep it simple:

- one drop-off point per cluster

- clear signage and accepted materials

- a weekly consolidated pickup schedule

Turning partnerships into a flywheel (the practical sequence)

A beginner-friendly partnership sequence looks like this:

- Secure two downstream partners for your wedge stream

- Run a pilot with 3–5 sites to prove consistent volume and quality

- Use pilot data to negotiate better terms and clearer specs

- Add a second stream that uses the same route

- Add an upstream partner (courier/collector) to expand capacity

- Add a drop-off point only if it reduces cost and increases volume

The theme is the same as everything else in this business: expand only when the system is stable.

If you build a partner network that trusts your quality and your documentation, you’ll find that customer acquisition gets easier too—because you’re no longer selling “an idea.” You’re selling a working, verified reverse-flow system.

Risks, compliance, and failure modes (and how to de-risk them)

Smart reverse logistics is a practical business, but it’s not forgiving if you ignore the “boring” parts: safety, documentation, partner reliability, and scope control. The good news is you can de-risk most of the common failure modes with clear rules from day one.

Below are the risks I see most often when beginners try to build this, plus simple ways to prevent them from becoming expensive lessons.

Risk 1: You become “the dumping ground” for everything

What it looks like:

A customer hears “we take used items” and starts sending mixed junk: contaminated packaging, random broken items, and things that require specialized disposal. Your sorting time explodes, your downstream partners reject loads, and the relationship turns into conflict.

How to de-risk it:

- Start with a strict Accepted / Not Accepted list for your pilot stream.

- Put it in writing and repeat it verbally.

- Add a rule: “Anything outside scope is either rejected or billed as a special handling fee.”

- Use a separate “Hold/Reject” zone so contamination doesn’t spread.

Beginner mantra: if you can’t route it confidently, you can’t accept it.

Risk 2: Contamination quietly kills your margin

What it looks like:

Pickups happen, but loads are messy. You spend extra labor separating streams, rebagging, and trying to salvage value. Downstream partners start discounting your loads. Your cost per kg goes up while your revenue stays flat.

How to de-risk it:

- Make sorting easy at the source: bins, labels, a one-page guide.

- Run a 10-minute staff walkthrough in week 1 and a refresh in week 3.

- Track contamination incidents by site and share the trend in your monthly report.

- Add a “contamination fee” that triggers after repeated issues.

The goal isn’t perfection. The goal is improvement week over week.

Risk 3: Route sprawl (expanding geography too early)

What it looks like:

You sign customers across a city because you don’t want to say no. Routes become long, unpredictable, and expensive. A single missed pickup throws off the entire day. Your cost per stop becomes too high to fix with pricing.

How to de-risk it:

- Enforce a “cluster-first” growth policy: new sites must fit an existing route.

- If a site is outside the cluster, price it as a separate route with its own minimum.

- Keep pickup windows tight and consistent.

Route density is not a nice-to-have. It’s your margin.

Risk 4: Downstream partner failure (your handoff breaks)

What it looks like:

A recycler changes acceptance rules without telling you. A refurbisher becomes overloaded. A liquidator delays pickup. Your staging area fills up, materials mix, and the customer starts asking hard questions.

How to de-risk it:

- Maintain two downstream options per key stream (primary + backup).

- Confirm specs and rejection rules in writing, even if informal.

- Schedule handoffs like clockwork (e.g., every Tue/Fri).

- Keep a buffer plan: what happens if Partner A can’t take this week’s load?

If you only have one downstream outlet, you don’t have a system—you have a dependency.

Risk 5: Traceability gaps (you can’t prove where things went)

What it looks like:

A customer’s ESG/compliance team asks, “Where did the material go?” You have partial records, missing receipts, or inconsistent weights. Even if you did the right thing operationally, you can’t prove it, and trust drops fast.

How to de-risk it:

- Treat chain-of-custody like part of the product, not admin.

- Log site, date/time, stream, weight, destination, and receiver confirmation every time.

- Standardize a simple proof pack: weight log + handoff receipt + partner name/date.

Your proof doesn’t need to be fancy. It needs to be consistent.

Risk 6: Handling regulated or hazardous materials without preparation

What it looks like:

A customer includes batteries, chemicals, medical waste, or certain electronics categories in the stream. You pick it up “to be helpful,” not realizing the legal/safety implications. This can become a serious liability.

How to de-risk it:

- Start with non-hazardous streams: cardboard, plastic film, pallets, clean packaging, non-regulated returns categories.

- If you want to handle regulated categories later, partner with licensed processors and follow local regulations.

- Use clear language: “We do not accept hazardous/regulatory items under the standard program.”

This section is not legal advice. If you move into regulated waste categories, talk to local experts and ensure you’re compliant.

Risk 7: Theft, loss, or disputes on returned goods

What it looks like:

Returns and surplus items can be high-value. If a box goes missing or a grading decision is disputed, you risk trust and potential legal issues.

How to de-risk it:

- Use a basic grading rubric (A/B/C) and define it upfront.

- Photograph high-value items at intake (only when necessary).

- Use sealed containers and a signed handoff for valuable loads.

- Keep “exceptions” documented and resolved quickly.

You’re not trying to run a forensic system. You’re trying to eliminate ambiguity.

Risk 8: Customer confusion (your process is too complex for real life)

What it looks like:

Your SOP is correct but too complicated. Site staff are busy. They improvise. Mistakes happen. You spend time correcting behavior instead of running the system.

How to de-risk it:

- Reduce your on-site rules to three: “where to put it,” “what’s accepted,” “when pickup happens.”

- Use visuals and simple labels.

- Build a feedback loop: one short note after each pickup when something went wrong.

If the site can’t follow your process in under 60 seconds, it’s too complex.

Risk 9: You underprice early and can’t climb back up

What it looks like:

You set a low flat price to win the pilot, then realize the work is bigger than expected. When you try to raise prices, the customer resists because you anchored too low.

How to de-risk it:

- Price the pilot as a learning-and-setup service, not as “ongoing operations.”

- Use base + variable pricing so spikes don’t crush you.

- Clearly separate “pilot pricing” from “rollout pricing” in your proposal.

Most customers accept pricing adjustments when you show data and improved outcomes.

Risk 10: You try to scale before your system is stable

What it looks like:

You add streams, sites, partners, and tools too quickly. The system becomes fragile. A few missed pickups cause cascading failures. You spend weeks firefighting.

How to de-risk it:

- Scale like a product: one stream → SOP → repeat → then expand.

- Only add a new stream when it uses the same route and similar handling.

- Add automation only when you can describe the workflow clearly.

Speed is good. Chaos is not.

4 takeaways + a 7-day checklist to land your first paid pilot

By now you have the blueprint: choose a wedge, run a Minimum Viable Take-Back pilot, track the right numbers, and build a partner network. The final step is turning that into action without getting overwhelmed.

Here are the key takeaways and a simple 7-day sprint to get your first paid pilot.

Four takeaways to keep you grounded

- A narrow wedge beats a broad vision. One stream, one cluster, one customer type is the fastest path to repeatability.

- Your real product is operational reliability plus proof. Pickups are only the beginning; documentation and routing decisions create trust.

- Margin comes from density, cleanliness, and speed. Route density lowers cost, contamination kills value, throughput keeps everything moving.

- Partners are your supply chain. Your downstream network and acceptance specs are what turn “waste” into “value.”

Your 7-day checklist (designed for beginners)

Day 1: Pick your wedge and write your one-sentence offer

Choose:

- one stream (cardboard, plastic film, pallets, returns triage)

- one cluster (district, industrial park, mall network)

- one buyer (retail ops, warehouse manager, facilities lead)

Write this offer sentence:

“We run scheduled take-back + basic sorting + routing to verified partners + monthly reporting for [stream] in [area].”

Day 2: Lock two downstream partners

Call or meet:

- one primary partner

- one backup partner

Confirm:

- accepted materials

- contamination rules

- proof/receipt format

- handoff schedule

Day 3: Build your minimum operations stack

- Create one intake form in Google Forms

- Create a simple tracking base in Airtable

- Draft a one-page “Accepted / Not Accepted” guide

You are building the “boring machine” that makes this business trustworthy.

Day 4: Build a list of 30 prospects in one cluster

Pick companies that are close to each other. Add:

- address

- likely stream

- contact role (Ops/Facilities/ESG)

If you can’t find contacts, start with site managers or operations supervisors. It’s easier to move “up” once someone confirms pain.

Day 5: Send 20 outreach messages

Send:

- 10 LinkedIn messages

- 10 cold emails

Goal: book 3 calls, not “get customers” overnight.

Day 6: Run discovery calls and propose the pilot

Use your call checklist:

- current workflow

- pain points

- what success looks like

- pilot scope (sites, windows, streams)

Propose a 30-day pilot with 3–5 measurable metrics.

Day 7: Close one pilot start date

You don’t need a perfect contract on day 7. You need:

- a start date

- a clear scope

- a pilot fee agreement

- a point of contact

Then you execute like a professional: on-time pickups, clean logs, and a simple report.

If you do this sprint and don’t land a pilot, you still win—because you’ll have real feedback on what to adjust: your wedge, your offer, or your outreach targeting.

FAQs: Beginner Questions About Smart Reverse Logistics Answered

Is this business more like “recycling” or “logistics”?

It’s closer to supply chain operations than recycling. Recycling is one possible destination. Your job is to manage the reverse flow: collection, triage, routing, and proof. That’s why companies pay—because it reduces disruption and increases control.

Do I need a warehouse to start?

Not necessarily. Many founders start with:

- a small staging corner in a shared space

- direct handoffs to downstream partners

- scheduled pickups that minimize storage time

You “earn” a dedicated space when volume and throughput make it necessary.

Do I need to build an app?

No. Start with simple tools:

- Google Forms for requests

- Airtable for tracking

- Zapier for reminders and workflows

- A route tool like Onfleet only when routes become complex

Software becomes valuable after your SOP is stable and repeatable.

What’s the best first stream for beginners?

Usually one of these:

- cardboard (clean, common, easy to route)

- plastic film (if you have a reliable downstream outlet)

- pallets/reusable crates (high-value, simple categories)

- returns triage (only if you can control process and proof)

Choose the stream that has clear downstream demand and is easy to keep clean.

How do I avoid being compared to cheap haulers?

Position your service around:

- fixed pickup windows and reliability

- sorting standards that improve recovery

- monthly reporting and chain-of-custody proof

Cheap haulers sell transport. You sell a reverse-flow system that reduces operational pain and risk.

What if my downstream partner suddenly changes pricing or rejects loads?

Always have:

- a backup partner

- written specs and rejection rules

- a buffer plan for overflow

And keep your service revenue stable so you aren’t dependent on downstream pricing for survival.

When should I expand to another stream?

Only when:

- your current stream runs smoothly for at least a few weeks

- your routes are stable

- you can train sites quickly

- the new stream uses the same route and similar handling

If a new stream doubles complexity, it’s too early.

What should my first monthly report include?

Keep it short:

- total collected by stream

- pickup consistency

- disposition breakdown (reuse/resale/repair/recycle/dispose)

- contamination notes and improvements

- confirmation that proof is available (receipts/logs)

A report that a manager can forward internally without explanation is a strong trust signal.

Yes. Many businesses succeed on:

- retainer + variable fees

- reporting/compliance add-ons

Value-share is upside once you can measure it reliably and influence it.

Disclaimer:

This article is for general educational and informational purposes only and is not legal, tax, financial, accounting, environmental, or safety advice. Reverse logistics, waste handling, recycling, take-back programs, and transport may be subject to local laws, permits, licensing, and health & safety requirements that vary by country, state/province, and city. Before handling any regulated or potentially hazardous materials (including but not limited to batteries, electronics, chemicals, medical waste, or contaminated materials), consult qualified legal/compliance professionals and work only with properly licensed partners. Always perform your own due diligence on downstream processors and documentation practices. Any examples, tools, workflows, or pricing discussions are illustrative and should be adapted to your specific context; results are not guaranteed.

If this guide helped you think clearer or take action, you can support my work by buying me a coffee ☕✨ Every coffee keeps these practical, beginner-friendly posts coming—more templates, real-world playbooks, and honest lessons learned. 🙌

👉 Buy me a coffee here: https://timnao.link/coffee 💛