Bitcoin for Beginners: Unstoppable, Proven Framework to Navigate Crypto Volatility 🚀

If you’ve been hunting for a no-nonsense guide to Bitcoin for beginners, this is for you. We’ll demystify how Bitcoin grows, why it keeps returning to long-term trends, and exactly how a newcomer can get started without blowing up their budget. You’ll see how Bitcoin investing can be approached steadily, how the Bitcoin power law helps you zoom out from the noise, and how to use simple tools to buy, store, and manage risk like a pro.

Table of Contents

- 📌 Big Picture: Why Bitcoin Still Matters for Beginners

- 📈 The “Power Law” Lens: A Simple Way to Understand Bitcoin’s Long-Term Path

- 🔗 Adoption, Scarcity & Network Effects: Why Demand Can Snowball

- 🏦 New On-Ramps: ETFs, Corporates & Countries (and what they mean for you)

- 🛒 Getting Your First Bitcoin Safely (Exchanges, apps, and self-custody)

- 🧭 Simple Strategies for Bitcoin Investing (DCA, rebalancing, time horizons)

- 🧯 Risk, Volatility & Common Mistakes (and how to avoid them)

- 📚 Taxes, Records & Staying Compliant (without headaches)

- ⚡ Using Bitcoin Beyond Holding (payments, Lightning, and everyday examples)

- 🔭 Future Bitcoin Investing Scenarios: What Could Go Right — or Wrong — From Here

- 🛠 Best Bitcoin Investing Tools & Resources (Wallets, ETFs, and Learning Hubs)

- 🙋 FAQs: Beginner Questions About Bitcoin for Beginners Answered

- ✅ Key Lessons & Takeaways

📌 Big Picture: Why Bitcoin Still Matters for Beginners

If you’re new to the world of cryptocurrency, Bitcoin can feel overwhelming. People talk about it as if it’s magic internet money, a speculative bubble, or the future of finance — often in the same sentence. But strip away the hype and headlines, and Bitcoin is surprisingly simple: it’s a global, digital form of money that no one controls, no one can print more of, and anyone can use.

This simplicity is exactly why Bitcoin matters. For the first time in human history, we have a financial system that’s decentralized, borderless, and limited in supply. That might sound abstract, but the implications are enormous — especially in a world where traditional currencies lose purchasing power year after year.

💸 Why the Old System Is Cracking

Our current money system is built around government-issued currencies like the US dollar or euro. Central banks can create new money whenever they want — and they often do. Over the last 50 years, the global money supply has grown by more than 7% per year on average. That’s a polite way of saying your savings lose value slowly but steadily over time.

If you saved $1,000 under your mattress in 1990, today it buys about half of what it did back then. Inflation quietly erodes your purchasing power. And when governments print too much money, they don’t just devalue the currency — they distort financial markets, inflate asset bubbles, and widen inequality.

Bitcoin is a direct response to this system. With only 21 million coins ever to exist, it’s designed to be scarce and predictable. You can’t “print” more Bitcoin, and no single entity — not a government, not a company — can change that rule. It’s hard-coded into the software itself.

🏦 A Hedge and an Alternative

For beginners, Bitcoin is often best understood not as a get-rich-quick asset, but as a form of financial insurance. Just as people buy gold, real estate, or index funds to protect their wealth, Bitcoin offers a modern alternative — one that’s portable, divisible, and globally accessible.

- 💰 Portable: You can send any amount of Bitcoin anywhere in the world, 24/7, without banks or intermediaries.

- 🪙 Divisible: You don’t need to buy a whole coin. One Bitcoin can be split into 100 million smaller units called satoshis, so anyone can start small.

- 🌍 Global: Bitcoin doesn’t care where you live or what passport you hold. If you have internet access, you can participate.

This universal accessibility makes Bitcoin especially powerful for people in countries with unstable currencies, strict capital controls, or limited banking options. Millions of people around the world already use Bitcoin not for speculation, but for basic financial freedom — saving in a currency their government can’t devalue, or sending money to family across borders without exorbitant fees.

📊 Why “Now” Still Makes Sense

One of the most common beginner mistakes is thinking they’re “too late.” Maybe they saw Bitcoin at $100, then $10,000, and now at $60,000 or more and assume the opportunity is gone. But this mindset misses the bigger picture.

Bitcoin is still a tiny fraction of global wealth. The total value of all Bitcoin is roughly $1.2 trillion — small compared to gold (~$14 trillion), real estate (~$300 trillion), or global equities (~$110 trillion). If Bitcoin even partially captures the role of digital gold or global settlement money, there’s significant room for growth ahead.

For beginners, the key takeaway is this: you don’t need to predict Bitcoin’s price tomorrow to benefit from its long-term potential. Understanding why it exists — and how it fits into a changing financial landscape — is the first step toward using it wisely.

And that’s where a simple but powerful concept called the “power law” comes in.

📈 The “Power Law” Lens: A Simple Way to Understand Bitcoin’s Long-Term Path

New investors often look at Bitcoin’s price chart and see chaos — dramatic spikes, brutal crashes, wild swings that seem to defy logic. But zoom out far enough, and a very different picture emerges: Bitcoin’s growth isn’t random. It follows a pattern known as a power law, and understanding it can help you approach Bitcoin with confidence instead of fear.

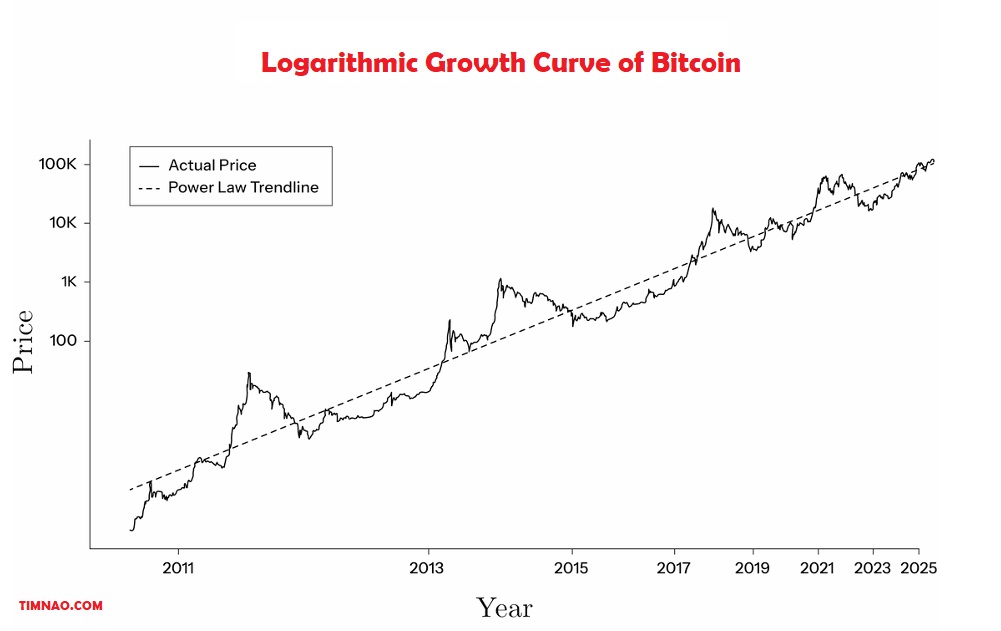

This chart shows Bitcoin’s long-term price trend plotted on a logarithmic scale, revealing its consistent power-law growth despite short-term volatility.

📊 What Is a Power Law?

A power law is a mathematical relationship that shows how one quantity changes relative to another — often exponentially. You see power laws everywhere in nature and technology: population growth, city sizes, internet traffic, even the spread of ideas.

In Bitcoin’s case, when you plot its price, network activity, or adoption on a logarithmic scale over time, the data points line up surprisingly close to a straight line. This means Bitcoin doesn’t grow linearly — it grows in waves that consistently follow a predictable curve over the long term.

Think of it like a river winding through a valley. On the surface, the water twists and turns unpredictably, but it always flows downhill. Bitcoin’s short-term price moves might look random, but the underlying trend — adoption, usage, and value — keeps pushing upward.

📈 Price Behavior Through the Power Law Lens

Here’s a simple way to interpret Bitcoin’s past using this framework:

- Boom phases: The price shoots far above the long-term trend line during periods of hype, media attention, and rapid adoption.

- Bust phases: The price crashes below the trend when enthusiasm fades, often overcorrecting before stabilizing again.

- Reversion to the mean: Over time, Bitcoin returns to its power-law growth path, which has historically pointed toward higher valuations.

For example, Bitcoin’s price surged from around $1,000 in 2013 to nearly $20,000 in 2017 — then collapsed to $3,000 in 2018. Many thought it was dead. But zooming out, the price was still well above its previous lows and roughly on track with the power-law trend. Fast forward a few years, and Bitcoin hit new highs above $60,000.

This repeating cycle — boom, bust, recover, repeat — is not a flaw. It’s how disruptive technologies grow. The internet, smartphones, and social media all followed similar adoption curves, with hype cycles and shakeouts paving the way for steady, long-term expansion.

📏 What This Means for Beginners

If you understand the power law, you stop obsessing over daily or even yearly price moves. Instead, you focus on the long-term trajectory — which, so far, has been remarkably consistent.

For beginners, this means:

- Time in the market beats timing the market. Don’t try to catch every dip or sell every top. Consistent, long-term exposure matters more.

- Volatility is a feature, not a bug. Price swings are part of Bitcoin’s growth curve. Learn to see them as opportunities rather than threats.

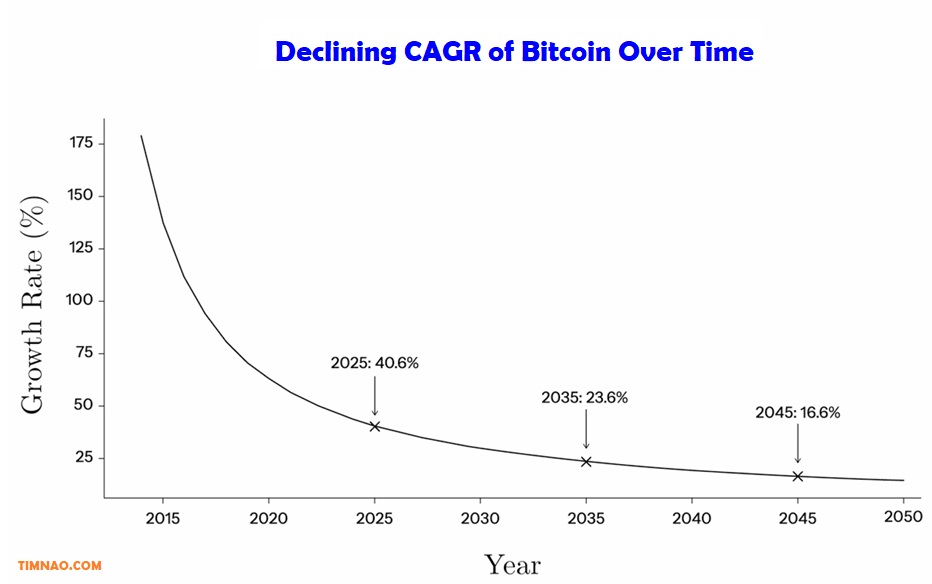

- Set realistic expectations. Bitcoin probably won’t 100x overnight again — but doubling or tripling over a decade remains plausible if adoption continues.

By focusing on the power-law path rather than short-term noise, beginners can approach Bitcoin with a calmer mindset and a more disciplined plan. And that leads us to the deeper forces driving that growth: adoption, scarcity, and network effects.

🔗 Adoption, Scarcity & Network Effects: Why Demand Can Snowball

The power-law growth we just explored isn’t magic — it’s the result of three reinforcing forces working together: adoption, scarcity, and network effects. Understanding how they interact will help you grasp why Bitcoin keeps growing — and why it may continue to do so.

🌱 Adoption: From Niche to Mainstream

Bitcoin’s journey began in 2009 with a handful of developers and cryptography enthusiasts. Today, it’s held by millions of people, traded on regulated exchanges, used by major companies, and integrated into payment platforms. This growth follows a classic “S-curve” adoption pattern seen in many technologies.

- Innovators (2009–2012): Tech pioneers and early believers experiment with Bitcoin before it’s widely known.

- Early adopters (2013–2016): Investors, libertarians, and forward-thinking businesses start paying attention.

- Early majority (2017–2024): Institutional players, hedge funds, and everyday retail investors enter.

- Late majority (next decade): Pension funds, governments, and global payment networks integrate Bitcoin.

Each wave builds on the previous one, creating momentum. And adoption isn’t just about individuals — corporations like Tesla, MicroStrategy, and Square have all added Bitcoin to their balance sheets. Even governments like El Salvador are experimenting with it as legal tender.

The more adoption grows, the harder it becomes to dismiss Bitcoin as a fringe idea. And as more people demand it, scarcity begins to matter.

🔥 Scarcity: The Economics of a Fixed Supply

Unlike dollars, euros, or yen — which can be printed indefinitely — Bitcoin has a hard cap of 21 million coins. This finite supply is not just a technical curiosity; it’s a fundamental part of its value proposition.

Every four years, a process called the “halving” cuts the number of new Bitcoins entering circulation in half. This built-in schedule ensures that Bitcoin’s inflation rate drops over time — from 50 BTC per block in 2009 to just 3.125 BTC per block by 2024.

What does this mean for beginners? It’s basic supply and demand. If more people want something that’s becoming scarcer, the price tends to rise. And because Bitcoin’s supply is known and predictable, investors can plan decades into the future — something impossible with fiat currencies.

This scarcity also changes investor psychology. Instead of spending Bitcoin freely, many choose to hold it long term — a behavior known as “HODLing.” This reduces the circulating supply even further, amplifying upward price pressure over time.

🌐 Network Effects: Growth Begets Growth

Finally, Bitcoin benefits from a powerful feedback loop known as the network effect: the more people use a network, the more valuable it becomes — which attracts even more users.

You’ve seen this before:

- The more people join social media platforms, the more useful they are.

- The more websites link to Google, the better its search results become.

- The more businesses accept credit cards, the more people use them.

Bitcoin follows the same pattern. As adoption grows:

- More wallets and apps appear, making it easier to use.

- Liquidity improves, reducing volatility and trading costs.

- Merchants and platforms add Bitcoin payment options.

- Developers build new tools, from lending platforms to Lightning Network micropayments.

Each of these improvements feeds back into the system, attracting more users and making Bitcoin more resilient. Even governments and financial institutions — once skeptical — are beginning to participate because ignoring Bitcoin now carries more risk than engaging with it.

⚙️ How the Flywheel Works

These three forces — adoption, scarcity, and network effects — form a self-reinforcing loop:

- More adoption increases demand.

- Scarcity amplifies the impact of that demand.

- Network effects improve utility and attract more users.

And the cycle repeats, driving Bitcoin’s power-law growth higher over time.

🧠 Practical Takeaways for Beginners

So how can you use these insights to your advantage as a new investor?

- Think long term. Bitcoin is still early in its global adoption curve. Even small, consistent investments today could become meaningful over a decade.

- Start small but stay steady. You don’t need to buy a whole Bitcoin. Accumulating small amounts regularly — even $10 or $50 — can build a position over time.

- Don’t fear volatility. It’s a natural part of disruptive technology growth. Focus on the underlying adoption trends, not the short-term noise.

- Educate yourself. Understanding scarcity, network effects, and adoption will help you make better decisions and avoid emotional mistakes.

As we’ve seen, Bitcoin isn’t just a speculative asset. It’s a new kind of money built for a digital, global future — one whose growth follows patterns we can understand and prepare for. And when you combine the power-law trend with the unstoppable forces of adoption and scarcity, you begin to see why so many believe we’re still in the early innings of this financial revolution.

In the next part of this guide, we’ll explore how new investors can start buying Bitcoin safely, understand key investment strategies, and protect themselves from common pitfalls — so you can participate in this journey with confidence and clarity.

🏦 New On-Ramps: ETFs, Corporates & Countries (and What They Mean for You)

For Bitcoin to move from a niche technology to a mainstream financial asset, it needs something more than passionate believers — it needs infrastructure. In the past few years, three major “on-ramps” have accelerated adoption: ETFs, corporations, and even countries. They’re breaking down barriers, inviting new participants, and reshaping the market in ways that matter deeply to beginners.

Let’s explore how each of these forces is transforming Bitcoin — and how they change what it means to be an investor today.

ETFs: The Easiest Way for Anyone to Invest

For a long time, investing in Bitcoin meant navigating a maze of new tools: exchanges, wallets, seed phrases, and private keys. Many beginners simply gave up. That’s where Exchange-Traded Funds (ETFs) come in — they make Bitcoin as easy to buy as a stock.

An ETF is a financial product that tracks the price of an asset. With a Bitcoin ETF, a fund buys and holds actual Bitcoin on behalf of investors. You then buy shares of that fund through a regular brokerage account — no technical knowledge required.

There are two main types:

- Spot Bitcoin ETFs: These hold Bitcoin directly. Your investment tracks the real market price.

- Futures Bitcoin ETFs: These use contracts to speculate on Bitcoin’s future price — more complex and less ideal for beginners.

When the U.S. approved the first spot Bitcoin ETFs in early 2024, it was a watershed moment. Suddenly, Bitcoin was available in retirement accounts, investment platforms, and traditional portfolios. Billions of dollars flowed in within weeks, and major asset managers like BlackRock and Fidelity now offer these products.

Why it matters for beginners:

- You can gain exposure to Bitcoin without worrying about wallets or security.

- ETFs are regulated, reducing legal and custodial risk.

- It’s a great “training wheels” approach — perfect if you’re curious but not ready to hold Bitcoin yourself.

The only trade-off? You don’t truly own the Bitcoin. You’re investing in a fund that owns it. That means you can’t spend it, move it, or store it independently. But for many beginners, that’s an acceptable first step.

Corporations: Bitcoin Moves Into Boardrooms

Bitcoin’s journey began as a grassroots, anti-establishment idea — but now, it’s showing up in corporate balance sheets. This shift is more than symbolic: it’s a sign that large, sophisticated organizations are treating Bitcoin as a strategic asset.

The most famous example is MicroStrategy, a U.S.-based business intelligence company. In 2020, it began converting its cash reserves into Bitcoin, citing inflation as a key risk. Over the next few years, MicroStrategy accumulated more than 150,000 BTC, making it one of the largest holders in the world. Its stock price soared as a result.

Other companies soon followed:

- Tesla purchased $1.5 billion worth of Bitcoin in 2021, adding credibility to the asset.

- Block (formerly Square) integrated Bitcoin into its products and treasury.

- Galaxy Digital, Marathon, and Nexon all made strategic Bitcoin investments.

But corporate adoption isn’t just about investing. Businesses are exploring Bitcoin for cross-border payments, treasury diversification, and even brand positioning. Accepting Bitcoin can signal innovation and attract younger, tech-savvy customers.

For beginners, this matters because corporate adoption drives both legitimacy and liquidity. When well-known companies hold Bitcoin, it sends a powerful message: this isn’t just a speculative trend — it’s a serious financial asset.

Countries: Governments Enter the Arena

The most unexpected adopters of Bitcoin aren’t companies — they’re countries. What started as a fringe experiment is now influencing monetary policy in some corners of the world.

The most famous example is El Salvador. In 2021, it became the first nation to adopt Bitcoin as legal tender. Citizens can use it to pay for groceries, taxes, and bills. The government created a national Bitcoin wallet and offered incentives for usage. While the rollout wasn’t without challenges, it proved a critical point: a sovereign nation could integrate Bitcoin into its financial system.

Other countries are watching closely. Argentina, Paraguay, and Nigeria have floated pro-Bitcoin policies. The Central African Republic briefly followed El Salvador’s lead. And nations like Switzerland, Singapore, and the UAE are positioning themselves as crypto-friendly financial hubs.

Why does this matter to you? Because if even a small percentage of global reserves shift into Bitcoin, the resulting demand could dramatically increase its value. And more importantly, it validates Bitcoin as part of the global monetary system — not just a digital curiosity.

Why These On-Ramps Change Everything

Together, ETFs, corporations, and countries are rewriting Bitcoin’s story. They:

- Make it easier for everyday people to invest.

- Bring institutional capital that reduces volatility and deepens liquidity.

- Signal trust, attracting more participants.

For beginners, this means the barriers to entry are lower than ever. You no longer need to be a tech enthusiast or a financial expert. Bitcoin is steadily becoming a normal part of the global economy — and that’s an opportunity worth paying attention to.

🛒 Getting Your First Bitcoin Safely (Exchanges, Apps, and Self-Custody)

So you’re convinced: Bitcoin is here to stay, and you want in. The next step is figuring out how to buy it safely. Fortunately, there are more options today than ever — and each suits a different comfort level.

This section will walk you through the three main approaches: ETFs and brokerages, crypto exchanges, and self-custody wallets. We’ll explore the pros, cons, and best practices for each.

Option 1: ETFs and Brokerage Platforms

If your primary goal is investment — not using Bitcoin for transactions — ETFs are the easiest way to start. You can buy them through your existing brokerage account, often in minutes.

Advantages:

- Simple and beginner-friendly.

- Can be held in retirement accounts.

- Regulated and secure.

Drawbacks:

- You don’t actually own Bitcoin.

- You can’t withdraw, send, or spend it.

For many beginners, ETFs are a great “gateway.” But if you want the full Bitcoin experience — including self-custody and direct ownership — you’ll want to go further.

Option 2: Crypto Exchanges and Apps

Most people’s first direct Bitcoin purchase happens on a cryptocurrency exchange. These are online platforms where you can buy, sell, and trade Bitcoin using traditional money.

Some of the most trusted options include:

- Coinbase – Very beginner-friendly.

- Kraken – Focused on security and transparency.

- Binance – Offers advanced tools and global support.

- Cash App – Simplified mobile experience.

How it works:

- Sign up and verify your identity. This is usually required for compliance.

- Deposit money. You can use a bank transfer, debit card, or payment service.

- Buy Bitcoin. Choose how much you want — even $10 is fine.

- Withdraw to a wallet (optional but recommended). Once you’re comfortable, move your coins off the exchange for better security.

Pro tip: Start small. Your first transaction isn’t about profit — it’s about learning the process and building confidence.

Advantages:

- Full exposure to Bitcoin.

- Can withdraw and use your coins.

- Often lower fees than ETFs.

Drawbacks:

- Requires managing your own security.

- Exchanges can be hacked or restricted.

That last point is important: exchanges are convenient, but they’re still third parties. If they go down or freeze withdrawals, you could lose access. That’s why many Bitcoin users eventually move on to the final step: self-custody.

Option 3: Self-Custody – True Bitcoin Ownership

Owning Bitcoin is about more than investment — it’s about control. Self-custody means holding your Bitcoin in a wallet where only you control the private keys. This eliminates third-party risk and gives you full sovereignty over your money.

There are three main types of wallets:

- Mobile wallets: Easy to use, good for small amounts. Examples: BlueWallet, Muun.

- Hardware wallets: Physical devices that store keys offline. Examples: Ledger, Trezor.

- Desktop wallets: Installed on your computer, offering advanced features. Example: Electrum.

How to set up a self-custody wallet:

- Choose a trusted wallet. Pick one suited to your needs and experience level.

- Write down your seed phrase. This is your ultimate backup — if you lose it, you lose your Bitcoin.

- Secure the backup. Store it offline, ideally in multiple safe locations.

- Test with a small transaction. Send a tiny amount from your exchange to your wallet to make sure everything works.

- Increase security over time. Consider using a hardware wallet once you’re comfortable.

Golden rule: Never share your seed phrase. No legitimate company or support agent will ever ask for it.

Mistakes Beginners Should Avoid

Bitcoin isn’t complicated, but beginners often make predictable mistakes. Avoid these and you’ll be ahead of 90% of new investors:

- Leaving coins on an exchange: Use exchanges to buy Bitcoin — not to store it.

- Losing backups: Without your seed phrase, your coins are gone forever. Double-check your storage plan.

- Falling for scams: If someone promises to double your Bitcoin, it’s a scam. Always verify sources.

- Sending to the wrong address: Double-check every transaction — Bitcoin transfers can’t be reversed.

Building a Simple Routine

The best Bitcoin strategy is often the simplest. Try this:

- Start with a small ETF position to get familiar with the price movement.

- Move to buying Bitcoin directly on an exchange.

- Withdraw small amounts to a self-custody wallet.

- As confidence grows, make self-custody your main storage method.

- Review your security setup once or twice a year.

This gradual approach lets you build knowledge step by step — without taking unnecessary risks.

Why This Matters More Than Ever

Getting started with Bitcoin is no longer a high-risk, high-complexity project. Thanks to ETFs, mainstream apps, and beginner-friendly wallets, it’s now as straightforward as opening a bank account. But the real power of Bitcoin isn’t in just owning it — it’s in understanding and controlling it.

By starting small, practicing good security habits, and learning as you go, you’re not just investing — you’re taking part in a financial revolution built for the digital age.

🧭 Simple Strategies for Bitcoin Investing (DCA, Rebalancing, Time Horizons)

If there’s one thing that scares beginners away from Bitcoin, it’s volatility. Prices can skyrocket one month and tumble the next, making it feel more like a rollercoaster than an investment. But here’s the good news: you don’t need to predict the future or watch charts all day to invest successfully. With the right strategies, you can build wealth steadily and manage risk — without losing sleep.

In this part, we’ll break down practical, beginner-friendly investing approaches that actually work: dollar-cost averaging (DCA), portfolio rebalancing, and time horizon planning. These tools are simple, proven, and — most importantly — designed to keep your emotions out of the driver’s seat.

Why Strategy Matters More Than Timing

Before diving into specific methods, let’s address a common beginner mistake: trying to “time the market.” New investors often think they need to buy Bitcoin at the perfect low and sell at the perfect high. The truth is, even professional traders struggle to do this consistently. For most people, strategy beats timing every single time.

Having a plan gives you three major advantages:

- Reduces emotional decisions: You won’t panic sell during dips or FOMO-buy during peaks.

- Keeps you consistent: Instead of reacting to headlines, you follow a steady plan.

- Improves returns: Over time, disciplined investing often outperforms random buying and selling.

Let’s explore the most beginner-friendly strategy first: dollar-cost averaging.

Dollar-Cost Averaging (DCA): The Beginner’s Best Friend

If you learn just one Bitcoin investing strategy, make it dollar-cost averaging (DCA). It’s simple, effective, and removes most of the emotional noise from investing.

What is DCA?

Dollar-cost averaging means investing a fixed amount of money at regular intervals — for example, $50 every week — regardless of the current price. Sometimes you’ll buy when Bitcoin is high, sometimes when it’s low. Over time, these purchases average out, smoothing your entry price.

How DCA Works in Practice

Let’s say you invest $100 every month into Bitcoin:

- In January, Bitcoin is $40,000 — you buy 0.0025 BTC.

- In February, it drops to $30,000 — you buy 0.0033 BTC.

- In March, it rises to $50,000 — you buy 0.002 BTC.

Instead of stressing about timing, you simply keep investing. Over the course of a year, your average cost might be lower than the market price — and more importantly, you’ll have consistently built your position.

This strategy works because it turns volatility into your ally. Every time the market dips, your regular purchase buys more Bitcoin for the same money. Over the long term, those lower-cost buys boost your returns.

Why DCA Works So Well for Beginners

- It’s emotion-proof: You don’t have to guess the right time to buy.

- It builds discipline: Investing becomes a habit, not a gamble.

- It reduces risk: You avoid going “all-in” at the wrong time.

- It works automatically: Most exchanges let you set recurring buys and forget about them.

The best part? DCA is ideal for people with busy lives. You don’t need to watch the market daily — you simply set it and let time do the heavy lifting.

How to Implement a DCA Plan

- Choose an amount you can afford. Never invest more than you’re willing to lose. Many beginners start with $10 to $50 per week.

- Pick a frequency. Weekly or monthly works well.

- Automate if possible. Most apps like Coinbase, Kraken, or Cash App allow automatic recurring purchases.

- Stick to the plan. Don’t stop buying during crashes — that’s when DCA is most powerful.

Rebalancing: Keeping Your Portfolio in Check

As Bitcoin grows (or drops) in value, its share of your portfolio will change. Rebalancing is the process of adjusting your investments back to your target allocation. This simple habit helps you manage risk, lock in gains, and stay aligned with your goals.

Why Rebalancing Matters

Imagine you decide that 10% of your portfolio should be in Bitcoin. Over the next two years, Bitcoin’s price soars, and now it’s 25% of your portfolio. Congratulations — you’ve made money! But you’re also more exposed to volatility than you planned.

Rebalancing means selling a portion of your Bitcoin to return to your 10% target. That might feel counterintuitive, but it’s powerful: you’re selling high and maintaining discipline. The reverse is also true. If Bitcoin crashes and falls to 5% of your portfolio, rebalancing would mean buying more to return to 10% — buying low.

How to Rebalance Effectively

- Set a target allocation. Beginners often choose 5%–15% of their total portfolio for Bitcoin.

- Choose a schedule. Many investors rebalance once or twice a year.

- Use thresholds. Some prefer to rebalance only when Bitcoin’s share drifts by more than, say, 5%.

- Rebalance tax-efficiently. In taxable accounts, selling can trigger capital gains. Rebalancing within retirement accounts or by adding new contributions can help avoid taxes.

The Hidden Power of Rebalancing

Rebalancing isn’t just about controlling risk — it’s a long-term performance tool. Because Bitcoin tends to move in cycles, disciplined rebalancing often means:

- Selling some Bitcoin during euphoric bull markets (locking in profits).

- Buying more during fearful bear markets (accumulating at lower prices).

This systematic approach takes advantage of Bitcoin’s volatility rather than fearing it. And because you’re following a plan, you’re less likely to make emotional mistakes — like panic selling at the bottom.

Time Horizons: Thinking in Years, Not Days

If there’s one principle that separates successful Bitcoin investors from unsuccessful ones, it’s this: long-term thinking.

Bitcoin’s short-term price moves are chaotic. In the span of a few months, it can crash 50% or double in value. But over longer periods — five, ten, even fifteen years — the trend has been consistently upward. That’s why your time horizon is one of the most important decisions you’ll make as an investor.

Bitcoin’s compound annual growth rate (CAGR) decreases as the network matures, yet it continues to outperform traditional asset classes, illustrating the power of long-term holding across multiple market cycles.

Understanding Bitcoin’s Market Cycles

Bitcoin tends to move in multi-year cycles, often influenced by a key event called the halving — when the number of new coins created every 10 minutes is cut in half. Historically, these cycles look like this:

- Accumulation phase (12–18 months): Prices are low and stable. Sentiment is quiet.

- Bull market (12–18 months): Demand surges, prices skyrocket, and media attention peaks.

- Correction phase (6–12 months): Prices crash, often 50% or more.

- Recovery (12–18 months): Prices stabilize and slowly climb again.

The entire cycle typically lasts about four years. Understanding this pattern helps you avoid emotional decisions. If Bitcoin is crashing, it’s probably not “dead” — it’s likely just in a different part of the cycle.

Setting a Time Horizon That Works for You

Your time horizon is simply the length of time you plan to hold an investment before selling. For Bitcoin, the longer, the better. A good rule of thumb: if you can’t commit to holding for at least four years, you’re not investing — you’re speculating.

Here’s how to think about different time horizons:

- Short-term (under 1 year): High risk, high stress. Suitable only for traders.

- Medium-term (1–4 years): Better, but still vulnerable to market cycles.

- Long-term (4+ years): Most reliable path to success. This allows you to ride out crashes and benefit from the power-law trend.

Practical Tips for Long-Term Investors

- Ignore daily news. Headlines don’t matter much when you’re thinking in decades.

- Zoom out. Check your portfolio quarterly or annually, not daily.

- Use DCA to stay consistent. It’s easier to commit long-term when investing feels effortless.

- Think in Bitcoin, not dollars. Over time, focus less on short-term price swings and more on how many satoshis you’ve accumulated.

Combining DCA, Rebalancing, and Time Horizons

Each of these strategies is powerful on its own, but they’re even stronger together. Here’s how a simple beginner plan might look:

- Start with DCA. Automate a weekly or monthly Bitcoin purchase.

- Set a target allocation. Decide how much Bitcoin you want relative to your total investments (e.g., 10%).

- Rebalance annually. Adjust your portfolio back to your target weight once or twice a year.

- Commit for 4+ years. Treat Bitcoin as a long-term investment — not a short-term bet.

This simple plan checks every box: it reduces emotional decision-making, turns volatility into opportunity, and aligns your actions with Bitcoin’s natural growth cycle.

Managing Risk the Smart Way

Even with a solid strategy, risk management is key. Here are a few beginner tips to keep your portfolio safe and your peace of mind intact:

- Don’t invest more than you can afford to lose. Bitcoin is volatile. Start small and scale up as your confidence grows.

- Diversify. Bitcoin can be a powerful part of your portfolio, but it shouldn’t be the only part.

- Use secure storage. If you hold Bitcoin directly, use hardware wallets and offline backups.

- Plan for taxes. Selling Bitcoin can trigger capital gains taxes. Keep records and consult a tax professional if needed.

- Prepare emotionally. Expect 50% drawdowns. If that’s too stressful, lower your allocation.

Mistakes to Avoid When Investing in Bitcoin

Many beginners fall into the same traps. Avoid these common mistakes and you’ll dramatically improve your chances of success:

- Chasing quick profits: If you’re looking for overnight riches, Bitcoin isn’t the right investment.

- Going “all-in”: Putting too much money into Bitcoin too soon can lead to panic selling during volatility.

- Neglecting security: A strong investing plan means nothing if your Bitcoin is stolen or lost.

- Changing strategies constantly: Stick to your plan. Frequent changes usually hurt returns.

- Ignoring your emotions: Fear and greed are your biggest enemies. Good strategies help you stay disciplined.

Building Confidence Over Time

Investing in Bitcoin is a journey. You’ll learn as you go, make small mistakes, and refine your approach. That’s normal — and it’s part of the process.

The key is to start with a plan you understand and can stick to. DCA makes investing consistent and stress-free. Rebalancing keeps your portfolio healthy. And a long time horizon allows the power of Bitcoin’s growth curve to work in your favor.

With patience and discipline, you’ll stop thinking like a gambler and start thinking like an investor — one who sees Bitcoin not as a lottery ticket, but as a tool for building long-term wealth and financial independence.

🧯 Risk, Volatility & Common Mistakes in Bitcoin Investing (and How to Avoid Them)

Anyone who’s spent more than five minutes looking at a Bitcoin price chart knows one thing: volatility is part of the game. Bitcoin’s value can jump 10% in a day or drop 50% in a few months. For many beginners, that’s intimidating — but it doesn’t have to be. With the right mindset and strategies, you can manage volatility, minimize risk, and avoid the mistakes that cost investors the most.

In this section, we’ll break down the most common risks in Bitcoin investing, explain why they happen, and show you how to navigate them like a pro.

Understanding Volatility in Bitcoin Investing

Volatility simply means price swings — and Bitcoin has plenty of them. Because it’s still an emerging asset class, the market is smaller, liquidity is thinner, and sentiment plays a huge role. News headlines, regulatory announcements, or large trades can move the price dramatically.

While that volatility scares some people away, seasoned investors see it differently: it’s a feature, not a bug. Volatility is part of what makes Bitcoin such a powerful asset. Without it, there would be no dramatic long-term growth. If you can manage the ups and downs, volatility becomes an opportunity instead of a threat.

Why Bitcoin Is So Volatile

- Supply is fixed: With only 21 million coins, even small changes in demand can cause big price swings.

- Market is young: Bitcoin is barely 15 years old — tiny compared to stocks or bonds.

- Liquidity is thinner: Large trades can move the market more than in mature asset classes.

- Emotions dominate: Fear and greed still drive a lot of buying and selling.

Understanding these drivers helps you anticipate volatility instead of fearing it. And once you accept volatility as normal, you can plan for it — and profit from it.

Risk Management Strategies for Bitcoin Investing Beginners

Managing risk is less about predicting the future and more about preparing for uncertainty. Here are practical steps to keep your portfolio safe:

- Position sizing: Never invest more than you can afford to lose. A common beginner guideline is 5%–15% of your total portfolio.

- Diversify: Bitcoin can be a powerful asset, but it shouldn’t be the only one. Include stocks, bonds, or real estate to reduce overall volatility.

- Use DCA: Dollar-cost averaging smooths out entry points and reduces the impact of short-term swings.

- Secure your holdings: The biggest risk isn’t price — it’s losing access to your coins. Use hardware wallets and back up your seed phrases.

- Have a plan: Know when you’ll rebalance, how long you plan to hold, and what would make you sell. A plan reduces emotional decisions.

Common Bitcoin Investing Mistakes (and How to Avoid Them)

Even smart investors make mistakes — but beginners tend to make the same ones over and over. Avoid these traps and you’ll save yourself money, stress, and regret.

Mistake 1: Investing Too Much Too Soon

Excitement leads many beginners to overcommit. They see a bull run and dump half their savings into Bitcoin — only to watch it drop 40% the next month.

How to avoid it: Start small. Build your position over time with DCA. If you’re still learning, aim for a small allocation (even 1%–5%) and scale up as you gain confidence.

Mistake 2: Panic-Selling During Volatility

One of the worst feelings is buying Bitcoin, watching it fall 30%, and selling in a panic — only to see it rebound later. Unfortunately, this is one of the most common beginner errors.

How to avoid it: Zoom out. Bitcoin’s price has crashed many times in its history, but long-term holders have consistently been rewarded. Focus on your time horizon, not daily price action.

Mistake 3: Falling for Scams

The crypto world is full of scams: fake giveaways, phishing emails, Ponzi schemes, and “guaranteed profit” platforms. Beginners are prime targets.

How to avoid it:

- Never share your seed phrase.

- Be suspicious of anything promising unrealistic returns.

- Double-check URLs and only use official websites.

- If something sounds too good to be true, it is.

Mistake 4: Neglecting Security

Many people focus so much on buying Bitcoin that they forget the most important part: protecting it. Exchanges can be hacked, accounts can be phished, and phones can be compromised.

How to avoid it: Use hardware wallets for long-term storage, enable two-factor authentication, and keep backups offline in secure locations.

Mistake 5: Constantly Changing Strategies

Chasing the “next big thing” — from meme coins to day trading — is a fast way to lose money. Beginners often abandon their plans too quickly.

How to avoid it: Stick to a long-term plan. Bitcoin investing rewards patience and discipline, not impulsive decisions.

Emotional Discipline: The Hidden Skill in Bitcoin Investing

Even the best plan fails if emotions take over. Fear and greed are the two biggest enemies of successful investing. The best investors aren’t necessarily smarter — they’re more disciplined.

Here are a few ways to build emotional resilience:

- Focus on the big picture: Bitcoin’s short-term swings matter less when your time horizon is 5+ years.

- Check your portfolio less often: Daily price checks feed anxiety.

- Pre-commit: Decide in advance how you’ll act during crashes or rallies.

- Remember past cycles: History shows that volatility is temporary — growth is long-term.

📚 Taxes, Records & Staying Compliant in Bitcoin Investing (Without Headaches)

Many beginners think that Bitcoin is “outside the system” — but the taxman disagrees. In most countries, Bitcoin is treated as property or an investment asset, which means tax rules apply. Ignoring those rules can lead to penalties, audits, or worse. But with a little preparation, staying compliant is straightforward.

This section covers the basics of taxes in Bitcoin investing, how to track your transactions, and how to avoid common mistakes.

How Bitcoin Investing Is Taxed

In most jurisdictions, Bitcoin is treated similarly to stocks or real estate for tax purposes. That means you owe taxes when you sell, trade, or spend Bitcoin — not when you buy or hold it.

Here’s how different transactions are typically taxed:

- Selling Bitcoin: If you sell Bitcoin for cash at a higher price than you bought it, you pay capital gains tax on the profit.

- Trading Bitcoin for another crypto: This also counts as a taxable event in many countries.

- Spending Bitcoin: Buying goods or services with Bitcoin is often treated like selling it — if it’s worth more than when you bought it, you owe taxes on the gain.

- Mining or staking income: If you earn Bitcoin through mining, staking, or interest, it may be considered income and taxed at your regular income rate.

Capital gains are usually divided into two categories:

- Short-term gains: For assets held less than one year, often taxed at your income rate.

- Long-term gains: For assets held more than one year, often taxed at a lower rate.

Keeping Accurate Bitcoin Investing Records

The biggest mistake beginners make is failing to keep records. Without accurate data, calculating taxes becomes a nightmare.

What you should track:

- Date of each transaction

- Amount of Bitcoin bought or sold

- Purchase price and sale price (in fiat currency)

- Fees paid

- Purpose of the transaction (investment, payment, income, etc.)

Most exchanges provide downloadable transaction histories. You can also use tax software like Koinly or CoinTracker to automate the process.

Best Practices for Staying Compliant

- Report everything: Even small transactions may be taxable. Failing to report can trigger audits.

- Understand local rules: Tax treatment varies by country — consult a tax professional if you’re unsure.

- Use tax-loss harvesting: If your Bitcoin drops in value, selling it at a loss can offset gains elsewhere.

- Separate investment and spending wallets: This makes record-keeping simpler.

- Plan ahead: Selling Bitcoin for a major purchase? Know the tax implications before you do.

Remember: compliance isn’t just about avoiding penalties. It also gives you peace of mind — and that’s worth a lot when markets get volatile.

⚡ Using Bitcoin Beyond Holding (Payments, Lightning, and Everyday Examples)

Most people think of Bitcoin purely as an investment — something you buy, hold, and (hopefully) sell for a profit. But Bitcoin was originally designed to be peer-to-peer money — a tool for sending value anywhere in the world without intermediaries. And thanks to new technologies, using Bitcoin in daily life is easier than ever.

Exploring Bitcoin’s real-world uses can deepen your understanding, strengthen your conviction, and unlock new opportunities beyond price speculation.

Everyday Use Cases for Bitcoin Investing Enthusiasts

Bitcoin’s utility goes far beyond “buy low, sell high.” Here’s how people are using it every day:

- Remittances: Families in countries with high remittance fees use Bitcoin to send money cheaply and instantly across borders.

- E-commerce: Some online retailers accept Bitcoin directly, often with discounts for crypto payments.

- Travel: Services like Travala allow you to book flights and hotels with Bitcoin.

- Donations: Charities like Save the Children accept Bitcoin for global relief efforts.

- Business payments: Freelancers and international businesses use Bitcoin to bypass slow, expensive bank transfers.

These examples show that Bitcoin isn’t just a speculative asset — it’s a practical tool that can solve real-world problems.

The Lightning Network: Fast, Cheap Bitcoin Payments

One of the biggest criticisms of Bitcoin has been its transaction speed and cost. On the main network, sending Bitcoin can take minutes and cost several dollars. Enter the Lightning Network — a second-layer solution that enables near-instant, virtually free payments.

How it works:

- Users open a payment channel between each other.

- Transactions within that channel are instant and nearly free.

- Only the opening and closing transactions are recorded on the main blockchain.

The result is a scalable, efficient payment system that makes Bitcoin practical for everyday use — from buying coffee to tipping creators online.

Popular Lightning-enabled wallets include Muun, Phoenix, and Breez. Merchants can use payment processors like BTCPay Server or Strike to accept Lightning payments easily.

Why Spending Bitcoin Can Strengthen Your Bitcoin Investing Mindset

It might seem counterintuitive, but spending small amounts of Bitcoin can actually make you a better investor. Using Bitcoin in the real world reinforces why it’s valuable: it’s borderless, permissionless, and censorship-resistant. It also helps you understand the technology better — making you less likely to panic during market turbulence.

A practical tip: keep two Bitcoin “buckets” — one for long-term investing and one for spending or experimenting. That way, you can explore Bitcoin’s utility without touching your core holdings.

The Future: Beyond Savings and Payments

Bitcoin’s use cases are expanding rapidly. In the near future, we’re likely to see:

- Bitcoin-backed loans: Borrow against your Bitcoin without selling it.

- Microtransactions: Pay fractions of a cent for online content.

- Streaming money: Real-time payments for services and work.

- Smart contracts on Bitcoin: Unlocking programmable money use cases.

These innovations make Bitcoin not just a store of value, but a foundation for the future of digital finance.

Bitcoin Is More Than a Price Chart

Understanding and managing risk, staying compliant, and exploring real-world use cases are what turn beginners into confident investors. Bitcoin isn’t just about “number go up” — it’s about taking control of your money, participating in a global financial revolution, and unlocking new possibilities that traditional finance simply can’t offer.

With smart risk management, proper tax planning, and hands-on use, you’ll see Bitcoin for what it truly is: not just an investment, but a tool for freedom, innovation, and financial independence.

🔭 Future Bitcoin Investing Scenarios: What Could Go Right — or Wrong — From Here

Every beginner in Bitcoin investing eventually asks the same question: “Where could this all go?” Will Bitcoin become the backbone of a new global financial system — or fade away as a failed experiment? The truth is, no one can predict the future with certainty. But we can explore the most likely scenarios — both bullish and bearish — and prepare accordingly.

Thinking through these possibilities isn’t about predicting the future; it’s about building a resilient strategy that works no matter what happens. By understanding potential outcomes, you can make smarter decisions, manage risk better, and avoid emotional reactions when the unexpected happens.

Optimistic Bitcoin Investing Scenario: Bitcoin Goes Mainstream

The most bullish case is also the one that many long-term believers are betting on: Bitcoin evolves from a niche digital asset into a mainstream global store of value — the digital equivalent of gold, but far more useful.

Here’s how that could happen:

1. Mass Institutional Adoption

We’re already seeing early signs of this. Spot Bitcoin ETFs have attracted billions in inflows from traditional finance, and major corporations are integrating Bitcoin into their balance sheets. Over the next decade, we could see:

- Pension funds and sovereign wealth funds allocating 1–5% of portfolios to Bitcoin.

- Central banks experimenting with Bitcoin reserves as a hedge against currency debasement.

- Payment processors and fintech apps offering Bitcoin as a standard option.

Even a small shift of global assets into Bitcoin — say 1% of the $300 trillion global financial market — could push its market cap into tens of trillions of dollars.

2. Regulatory Clarity Boosts Confidence

Right now, regulation is a double-edged sword: it creates uncertainty but also legitimacy. In a bullish future, governments worldwide would establish clear frameworks for Bitcoin ownership, taxation, and trading. With legal certainty, both institutions and individuals would feel more comfortable investing.

We might see:

- Bitcoin recognized as legal tender in more countries.

- Tax laws that encourage long-term holding.

- Banks offering custody, lending, and payment services using Bitcoin.

3. Global Demand for Hard Money

As governments continue to print fiat currency and debt levels rise, demand for scarce, non-sovereign money could surge. Bitcoin — with its fixed 21 million supply — is uniquely positioned to meet that demand. This macroeconomic backdrop is one of the strongest arguments for long-term adoption.

In this scenario, Bitcoin becomes a standard asset in diversified portfolios, a hedge against monetary inflation, and possibly even a settlement layer for global trade. Price projections range widely, but many analysts believe Bitcoin could reach $500,000 to $1 million per coin within 15–20 years under this scenario.

Bearish Bitcoin Investing Scenario: The Bear Bites Back

While the optimistic story is compelling, responsible Bitcoin investing also means preparing for downside risks. Here are a few realistic scenarios where Bitcoin could face major setbacks.

1. Hostile Regulation

If major economies — like the U.S., EU, or China — were to impose aggressive restrictions on Bitcoin usage, trading, or ownership, adoption could stall. Governments could target exchanges, limit banking access, or impose heavy taxes, driving investors away.

While it’s unlikely that Bitcoin could ever be “banned” outright (because of its decentralized nature), regulation could make it much harder to buy, sell, or use in certain jurisdictions.

2. Technological Disruption

Bitcoin’s core design is robust, but it’s not immune to technological risk. Quantum computing, for example, could theoretically break the cryptographic algorithms that secure Bitcoin wallets — though experts believe this risk is still decades away.

There’s also the possibility of another cryptocurrency surpassing Bitcoin in utility, scalability, or institutional support. While Bitcoin’s brand and network effects make this unlikely in the near term, it’s a risk worth watching.

3. Investor Disillusionment

Bitcoin’s narrative relies heavily on trust — not in a central authority, but in the idea that Bitcoin will continue to gain adoption. If that narrative breaks — perhaps due to a catastrophic protocol bug, a major security breach, or simply a decade of poor performance — investor confidence could erode.

This scenario wouldn’t necessarily kill Bitcoin, but it could limit its upside and confine it to a niche role in global finance.

Most Likely Bitcoin Investing Scenario: The “Middle Path”

The reality will probably lie somewhere between these extremes. Bitcoin is unlikely to replace fiat currencies entirely, but it’s equally unlikely to disappear. The most plausible outcome is that Bitcoin matures into a globally recognized store of value and investment asset — similar to gold but more portable, programmable, and accessible.

In this middle path:

- Bitcoin stabilizes as a key part of diversified investment portfolios.

- Institutional adoption grows steadily, even if slowly.

- Regulatory frameworks become clearer, but not always favorable.

- Technological innovations like the Lightning Network make Bitcoin more usable for payments.

This scenario still points to significant long-term upside — but with continued volatility and periodic setbacks along the way.

How to Prepare for Any Scenario

As a Bitcoin investor, your job isn’t to predict the future — it’s to build a strategy that works regardless of what happens. Here’s how:

- Diversify your portfolio: Don’t put all your money into Bitcoin. Pair it with traditional assets.

- Manage risk: Only invest what you can afford to lose.

- Think long term: Bitcoin’s most powerful growth drivers unfold over years, not weeks.

- Stay informed: Follow regulatory developments, technological innovations, and macroeconomic trends.

- Be adaptable: If the landscape changes, adjust your strategy rather than clinging to outdated assumptions.

🛠 Best Bitcoin Investing Tools & Resources (Wallets, ETFs, and Learning Hubs)

To succeed in Bitcoin investing, you need the right tools — not just for buying and holding, but also for storing, tracking, learning, and staying secure. The good news? There are now more beginner-friendly resources than ever.

Below is a curated list of essential tools and platforms to help you navigate every stage of your Bitcoin journey.

Bitcoin Wallets: Take Control of Your Coins

Owning Bitcoin is one thing. Owning it securely is another. Wallets give you control of your private keys — and therefore, your Bitcoin.

Mobile Wallets (Great for Beginners)

- Muun Wallet: Simple and intuitive with Lightning support.

- BlueWallet: Beginner-friendly with strong security features.

- Phoenix Wallet: Combines ease of use with Lightning capabilities.

Hardware Wallets (Best for Long-Term Storage)

- Ledger: Industry-leading hardware wallet with strong security and app integrations.

- Trezor: User-friendly, open-source, and highly respected in the community.

Desktop Wallets (For Advanced Users)

- Electrum: Lightweight, secure, and ideal for advanced users who want full control.

Bitcoin Investing ETFs & Brokerage Tools

If you’re not ready for self-custody, ETFs and brokerage platforms are the easiest way to gain exposure.

- BlackRock iShares Bitcoin Trust (IBIT): One of the largest spot Bitcoin ETFs, ideal for passive investors.

- Fidelity Wise Origin Bitcoin Fund (FBTC): A regulated, low-cost option.

- ARK 21Shares Bitcoin ETF (ARKB): A growth-oriented fund focusing on Bitcoin’s long-term potential.

For buying and selling Bitcoin directly, trusted exchanges include:

- Coinbase: Beginner-friendly interface and strong security.

- Kraken: Great for security-focused investors.

- Binance: Low fees and a wide range of features.

Learning Resources: Master Bitcoin Investing

Education is your greatest asset as an investor. These platforms will help you go deeper:

- Bitcoin.org: The official Bitcoin website — a must-read for beginners.

- Swan Bitcoin Education: High-quality beginner-friendly articles and videos.

- Mastering Bitcoin: A free, open-source book by Andreas Antonopoulos.

- BTC Sessions YouTube: Hands-on tutorials for wallets, Lightning, and self-custody.

These resources will give you a solid foundation — and more importantly, the confidence to make informed decisions.

🙋 FAQs: Questions About Bitcoin for Beginners Answered

Every beginner in Bitcoin investing starts with a lot of questions — and that’s perfectly normal. Here are clear, concise answers to the most common ones.

1. How Much Should I Invest in Bitcoin as a Beginner?

Start small — most experts recommend 1–5% of your total investment portfolio. This keeps your risk manageable while still giving you meaningful exposure to Bitcoin’s potential upside. As you gain confidence, you can increase your allocation.

2. Is It Too Late to Start Bitcoin Investing?

No. While Bitcoin’s price has risen dramatically since its launch, adoption is still in early stages. It’s estimated that less than 5% of the world’s population owns Bitcoin. If Bitcoin becomes a global store of value or reserve asset, today’s prices could still be cheap compared to its future potential.

3. What’s the Best Way to Store My Bitcoin?

For beginners, a reputable mobile wallet or a hardware wallet is ideal. Keep long-term holdings in a hardware wallet (like Ledger or Trezor) and use mobile wallets for spending or small transactions. Avoid leaving large amounts on exchanges.

4. Do I Have to Pay Taxes on Bitcoin?

In most countries, yes. Selling Bitcoin for a profit, trading it for another asset, or spending it on goods and services are all taxable events. Keep detailed records of every transaction and consult a tax professional if you’re unsure.

5. Can Bitcoin Be Hacked?

The Bitcoin network itself has never been hacked. However, individual wallets, exchanges, and users can be compromised — usually due to phishing scams, poor security, or stolen devices. Protect yourself with hardware wallets, strong passwords, and two-factor authentication.

6. How Long Should I Plan to Hold Bitcoin?

The most successful Bitcoin investors think in years, not weeks. Many recommend a minimum holding period of four years (a full market cycle), but a decade or more is even better. The longer your time horizon, the more likely you are to benefit from adoption and growth.

7. Can I Use Bitcoin for Everyday Purchases?

Yes — and it’s getting easier every year. With payment solutions like the Lightning Network, you can make fast, low-cost Bitcoin payments for coffee, groceries, travel, and more. Many online merchants now accept Bitcoin directly.

✅ Key Bitcoin Investing Lessons & Takeaways

We’ve covered a lot of ground in this guide, from Bitcoin’s fundamentals to advanced investing strategies. But before you move forward, here are the most important lessons to remember:

- Start small and stay consistent: Dollar-cost averaging helps you build a position without stress.

- Think long term: Bitcoin rewards patience. The most successful investors hold for years, not weeks.

- Control your keys: Self-custody is the safest way to own Bitcoin.

- Expect volatility: It’s normal — and part of why Bitcoin offers high long-term returns.

- Manage risk: Diversify, size positions wisely, and never invest money you can’t afford to lose.

- Stay compliant: Keep records and understand tax rules from day one.

- Use Bitcoin beyond investing: Experiment with payments, the Lightning Network, and new applications.

- Keep learning: The Bitcoin ecosystem evolves quickly — continuous education is your best defense against mistakes.

With these principles in mind, you’ll be better prepared to navigate the ups and downs of Bitcoin investing, make smarter decisions, and capture the long-term potential of one of the most revolutionary financial technologies in history.

⚠️ Disclaimer

The information provided in this article, “Bitcoin for Beginners,” is for educational and informational purposes only and should not be considered financial, investment, or legal advice. Cryptocurrency markets, including Bitcoin, are highly volatile and involve significant risk. You should never invest money you cannot afford to lose.

Before making any financial decisions or engaging in Bitcoin investing, you are strongly advised to conduct your own research and consult with a qualified financial advisor, tax professional, or legal expert who understands your individual situation. The author and publisher of this content make no representations or warranties about the accuracy, completeness, or reliability of the information contained herein and assume no responsibility for any losses or damages that may result from reliance on this material.

By reading this article, you acknowledge that you are solely responsible for your own investment decisions and that past performance is not indicative of future results.