Avoid These Costly Crypto Mistakes: Master Market Timing Like a Pro 🚨

Crypto market timing might sound like a superpower reserved for elite traders, but the truth is, anyone can learn to time their entries and exits with precision — if they understand how the market moves. In a world where prices swing wildly and emotions run high, having a reliable strategy isn’t just helpful — it’s essential.

Whether you’re a beginner trying to avoid buying the top, or someone who’s been burned by panic-selling during a dip, mastering the art of timing can be the difference between painful losses and powerful gains. The secret? It’s not magic — it’s a combination of understanding crypto market cycles, reading key indicators, managing your mindset, and building a flexible trading plan that adapts with the market.

In this complete guide, you’ll discover how to cut through the noise, avoid the hype traps, and make smarter decisions based on proven strategies. No complicated jargon. No guesswork. Just real, practical tools to help you win — consistently.

Let’s dive in. 👇

📚 Table of Contents

- 📊 Mastering Market Timing in Crypto

- 🧭 Understanding the 4 Crypto Market Cycles

- 🛠️ Key Metrics to Time Your Trades

- 🧠 Emotions vs. Strategy: Avoiding Costly Mistakes

- ⏰ Entry & Exit: Tools and Techniques That Work

- 🧩 Building a Personal Crypto Timing Plan

- 🔁 Adapting to Market Shifts with Confidence

- 🚀 Conclusion: From Chaos to Clarity

📊 Mastering Market Timing in Crypto

Crypto market timing isn’t about having a crystal ball — it’s about reading the signs the market gives you and using that insight to make smarter decisions. For beginners, timing your crypto trades can feel overwhelming. Prices spike and drop with terrifying speed. But what if you had a system to help you ride the waves instead of getting swept away?

Whether you’re a new investor or someone who’s taken a few hits, learning how to time your crypto trades effectively can make the difference between losses and life-changing gains. This article is your step-by-step guide to understanding the rhythms of the market — using cycles, key indicators, and your own plan to gain the upper hand.

In this guide, we’ll break down complex market movements into understandable patterns, introduce practical tools to help you act at the right moment, and walk you through how to build a strategy you can actually stick to — no guesswork required.

🧭 Understanding the 4 Crypto Market Cycles

The crypto market, like the stock market, moves in cycles. These aren’t just theoretical—they’re real patterns that repeat over time. Mastering them can give you a serious edge.

1. Accumulation Phase

This is the quiet before the storm. Prices have bottomed out after a bear market, and smart investors (including institutions) begin buying while most people are fearful or uninterested.

- What it looks like: Low volatility, sideways price action.

- What to do: Start buying gradually. This is often the best time to accumulate assets at discount prices.

2. Uptrend (Bull Market)

Optimism returns, and prices begin rising rapidly. Media coverage increases, retail investors flood in, and FOMO (fear of missing out) kicks in.

- What it looks like: Strong price rallies, high trading volume.

- What to do: Ride the wave but plan your exits. Use trailing stop-losses or sell in increments as prices rise.

3. Distribution Phase

Smart money is now selling while the general public is still buying. The market shows signs of slowing down.

- What it looks like: Price choppiness, false breakouts, increased volatility.

- What to do: Be cautious. Take profits and reduce exposure. Watch for key reversal indicators.

4. Downtrend (Bear Market)

Panic selling takes over. The market experiences significant losses, and prices fall well below previous highs.

- What it looks like: Sharp declines, lower lows, media pessimism.

- What to do: Stay calm. Avoid emotional trades. Consider stablecoins or high-conviction long-term assets.

📝 Pro Tip: Historical data shows that retail investors often buy during the uptrend and sell during the downtrend — the exact opposite of what professionals do. Understanding these phases helps you act when others hesitate.

🛠️ Key Metrics to Time Your Trades

To master crypto market timing, you need more than gut feelings or Reddit hype. The most successful traders use data-driven signals — metrics that reveal what’s happening beneath the surface of price charts. Let’s explore the most important tools and how beginners can use them effectively.

📉 1. Relative Strength Index (RSI)

What It Is:

The RSI is a momentum indicator that shows whether a cryptocurrency is overbought (too expensive) or oversold (too cheap) based on recent price moves. It ranges from 0 to 100.

- Above 70 = Overbought → possible correction incoming

- Below 30 = Oversold → possible bounce coming

How to Use It:

If RSI is nearing 30 during the accumulation phase, it may signal a great entry point. If it’s hitting 70+ during a bull run, consider taking partial profits.

Example:

In 2023, Bitcoin’s RSI dropped below 30 during a consolidation phase — those who paid attention and bought in that window saw 2x returns within months.

🔁 2. Moving Averages (MA) and Crossovers

What It Is:

Moving Averages smooth out price data over time. The two most common ones:

- 50-day MA (short-term trend)

- 200-day MA (long-term trend)

Key Signal:

The Golden Cross (50-day MA crossing above the 200-day MA) is a bullish signal.

The Death Cross (50-day MA crossing below the 200-day MA) is a bearish signal.

How to Use It:

Watch for crossovers during the transition between market phases. A Golden Cross in the accumulation phase often signals the start of an uptrend.

Example:

Ethereum flashed a Golden Cross in early 2021 — traders who noticed this early joined a rally that pushed ETH from $1,300 to over $4,000.

🧠 3. Market Sentiment Indicators

What It Is:

These tools measure crowd psychology. One of the most popular is the Fear & Greed Index, which scores the market from 0 (extreme fear) to 100 (extreme greed).

- Extreme Fear (0–25) = Good time to consider buying

- Extreme Greed (75–100) = Possible market top

How to Use It:

During distribution phases, sentiment often turns euphoric — that’s your cue to reduce exposure. During downtrends, when fear is highest, opportunities often appear.

Example:

The Fear & Greed Index hit “extreme greed” just before the 2021 Bitcoin top, helping savvy traders lock in profits before the crash.

🔗 Check the live Fear & Greed Index

📊 4. On-Chain Metrics

On-chain analysis provides deeper insights by tracking actual blockchain activity. Some beginner-friendly metrics:

- Active Addresses: More users = increased utility and potential price growth

- Transaction Volume: High volume = growing adoption

- Exchange Inflows/Outflows: More crypto flowing out of exchanges suggests holders are accumulating and planning to HODL

Example:

In early 2024, Ethereum saw massive outflows from centralized exchanges — a signal of investor confidence that preceded a 40% price rally.

🧮 5. Volume and Breakouts

Volume confirms price movement. Without strong volume, price moves often fail.

- High volume + price rise = Valid breakout

- Low volume + price rise = Likely a fakeout

How to Use It:

Look for breakout patterns during the early uptrend phase, especially from long-term resistance levels. Make sure the breakout is supported by volume — it’s the fuel behind momentum.

Example:

In April 2025, Solana broke above a critical resistance zone at $200 — but it was on low volume. Within days, it reversed. Traders watching volume avoided a bull trap.

📌 Bonus: MACD (Moving Average Convergence Divergence)

While a bit more advanced, MACD shows the relationship between two moving averages (typically 12-day and 26-day EMAs). It signals momentum changes.

- MACD line crossing above signal line = Bullish

- MACD line crossing below signal line = Bearish

Use it to confirm trends seen in RSI or price breakouts.

🧪 Putting It All Together

You don’t need to use every metric — just choose a few that make sense to you and use them consistently. Think of them like instruments in a cockpit:

- RSI tells you if the market is hot or cold.

- MA crossovers show the direction of the trend.

- Volume and MACD confirm momentum.

- Sentiment and on-chain data tell you what people and whales are doing.

Combining 2–3 of these metrics often gives clearer signals than using one alone.

📌 Beginner Tip: Keep a journal of your trades. Note the market phase, metrics you used, and outcomes. This builds your confidence and helps refine your strategy over time.

🧠 Emotions vs. Strategy: Avoiding Costly Mistakes

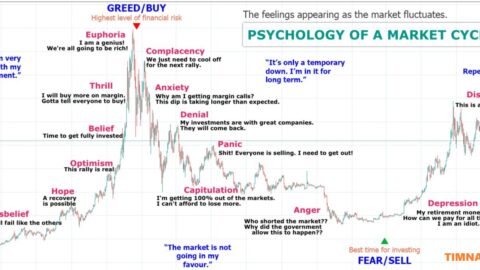

In the world of crypto trading, your biggest enemy isn’t the market — it’s your emotions. The fastest way to sabotage your success is to let fear, greed, or impatience control your actions. Even with perfect indicators and solid timing, emotional decisions can quickly drain your portfolio.

Let’s explore how to separate your feelings from your strategy — and what practical tools you can use to stay disciplined through every twist and turn of the crypto market cycle.

⚠️ Common Emotional Traps That Wreck Beginners

1. FOMO (Fear of Missing Out)

You see Bitcoin skyrocketing. You rush in. And… the moment you buy, the price drops.

Why it happens: During the uptrend or distribution phase, prices move quickly, and hype builds. But buying without a plan often means you’re entering at the top — right when smart money is selling.

Fix it: Never enter a trade just because others are. Use your timing tools (like RSI or moving averages) to check if the move is already overextended.

2. Panic Selling

The market dips. Reddit screams “crypto is dead.” You sell everything at a loss — only to see prices rebound a week later.

Why it happens: This is a classic mistake during downtrend or accumulation phases. Fear and uncertainty drive irrational selling, often right before a recovery.

Fix it: Zoom out. Study the market cycle you’re in. If it’s a healthy correction or long-term opportunity, stick to your plan — or buy more strategically.

3. Overtrading

You’re in and out of trades multiple times a day, trying to catch every tiny move.

Why it happens: Lack of patience and discipline. Crypto’s 24/7 nature makes it easy to fall into this trap.

Fix it: Focus on quality setups, not quantity. Wait for confirmed signals. Overtrading increases fees, slippage, and emotional burnout.

🧘 How to Build Emotional Discipline in Crypto

Being aware of your emotions isn’t enough — you need systems in place to keep them from hijacking your decisions.

✅ 1. Pre-Plan Every Trade

Set your entry, take-profit, and stop-loss levels before you enter a position.

- Use a risk-reward ratio of at least 2:1 (risking $100 to make $200).

- Don’t move your stop-loss out of fear — that defeats the purpose.

📌 Strategy Tip: Tools like TradingView allow you to draw trade setups on charts, helping you visualize your plan before executing.

✅ 2. Use Automation Where Possible

Many platforms like Binance, OKX, and Bybit offer limit orders, stop-losses, and take-profit triggers. Use them to enforce discipline.

- Trailing Stop-Losses: Great for locking in profits during strong trends.

- Grid Bots: Can help reduce emotional decision-making by automating range trading.

✅ 3. Journal Every Trade

Tracking your trades helps expose emotional patterns.

Include in your notes:

- Why you entered

- What the market conditions were

- How you felt (greedy, confident, fearful)

- Outcome and lesson

📘 Bonus Tool: Apps like Edgewonk or Notion can help you organize and reflect on your trades.

✅ 4. Take Breaks from the Screen

If you find yourself getting anxious or angry watching prices, it’s time to step back.

- Schedule specific times to check charts.

- Avoid trading when sleep-deprived, emotional, or distracted.

💡 Develop a Trader’s Mindset

What separates successful traders from those who burn out is mindset. This isn’t about being emotionless — it’s about staying self-aware, consistent, and unattached to short-term outcomes.

Adopt these mantras:

- “The market owes me nothing.”

- “Losses are part of the game — I just need to manage them.”

- “A missed opportunity is better than a bad trade.”

Building these beliefs over time protects you from the emotional rollercoaster that crypto often becomes — especially during unpredictable crypto market cycles.

🧩 Strategy Over Emotion: A Quick Action Plan

| Mistake | Emotion Behind It | Strategic Fix |

|---|---|---|

| Buying late in a bull run | FOMO | Wait for retracements or RSI confirmation |

| Selling during a crash | Panic | Zoom out; analyze long-term cycle |

| Chasing every pump | Greed | Focus on high-probability setups only |

| Exiting early on good trades | Anxiety | Use trailing stop-loss to let winners run |

| Taking revenge trades after a loss | Frustration | Pause. Review your trading journal before continuing |

🛡️ Final Word on Emotional Trading

Emotion-based trading is the fastest way to destroy your portfolio, especially in a fast-moving market like crypto. But when you ground your decisions in strategy and use timing tools wisely, you gain control over the chaos.

You won’t win every trade — but you’ll lose less, gain more, and sleep better.

⏰ Entry & Exit: Tools and Techniques That Work

Finding the right moment to enter or exit a trade is where fortunes are made — or lost. Even if you pick a strong asset, poor timing can wreck your gains. That’s why mastering crypto market timing is not just a nice-to-have skill — it’s essential for survival and success.

Let’s explore some simple yet powerful tools and techniques to pinpoint profitable entries and protect your gains on the way out.

🎯 Perfecting Your Entry: Don’t Chase, Plan

Buying high and selling low is what most emotional traders do. To flip that pattern, you need clarity and patience.

🔍 1. Use Support and Resistance Zones

Support: A price level where the asset tends to bounce upward

Resistance: A level where the price tends to face downward pressure

How to trade them:

- Enter near support during accumulation or pullbacks

- Avoid entering near resistance unless there’s a confirmed breakout with volume

📌 Bonus Tip: Use the “3-Touch Rule” — the more times price tests a level, the stronger it is. On the third test, expect a bigger move.

🕳️ 2. Enter on Retests After Breakouts

Don’t jump into a breakout immediately. Wait for a retest of the broken level — this is where smart traders enter with reduced risk.

Example: If Ethereum breaks above $2,500 resistance, wait for it to dip back and test that same level before entering. This confirms the move is real — not a fakeout.

🧪 Technical Entry Setups for Beginners

✅ The Moving Average Bounce

Buy when price touches and bounces off the 50-day or 200-day MA, especially during the early uptrend phase.

✅ The RSI Reversal

If RSI dips below 30 and begins to curl upward, it can signal a strong accumulation entry — especially when combined with support levels.

✅ Bullish Candlestick Patterns

Learn to recognize a few simple patterns:

- Hammer at support → possible reversal

- Engulfing bullish candle → momentum shift

- Morning star pattern → trend reversal confirmation

You don’t need to be a candlestick master — just learn a few high-probability patterns and combine them with cycle awareness.

💸 Smart Exit Strategies to Lock in Gains

Getting in is easy. Getting out at the right time? That’s where most people struggle. Let’s look at exit methods used by traders who win consistently, even in volatile crypto market cycles.

🪙 1. Use Take-Profit Targets

Set specific profit goals based on previous resistance zones, Fibonacci levels, or risk/reward ratios.

Pro method: Scale out in portions:

- Sell 25% at +20%

- Sell another 25% at +40%

- Let the rest run with a trailing stop

This way, you secure gains while staying in the game if the trend continues.

🔄 2. Trailing Stop-Loss

A trailing stop-loss moves up with price increases and locks in profits automatically if the price reverses.

- Great for trending markets

- Ideal during the uptrend phase

Example: Set a trailing stop at 10%. If your coin jumps 50%, your stop is now far above break-even. If it drops, you still exit with solid profit.

🔗 Learn to set trailing stops on Binance

🧠 Exit When the Market Tells You

📉 Watch for These Exit Signals:

- RSI above 70 and starting to decline

- Bearish divergence (price goes up, RSI goes down)

- Major resistance zones hit and price struggles to break through

- Volume drying up during uptrend = buyers losing steam

During distribution, these clues often precede larger drops. Don’t ignore them.

📈 Entry & Exit Flowchart (Beginner’s Mindset)

- Is the market in a favorable phase?

✔ Accumulation or Uptrend = YES

❌ Distribution or Downtrend = WAIT - Do technicals agree with the cycle?

✔ Support zone + RSI < 40 + bullish candlestick = GOOD ENTRY

❌ Resistance + RSI > 70 + bearish divergence = AVOID - Is your strategy defined?

✔ Stop-loss and take-profit levels in place

❌ No exit plan = NO ENTRY - Are you acting on data or emotion?

✔ Clear signals = GO

❌ Hype or panic = STOP

🧩 Tools to Execute These Strategies Like a Pro

Here are a few beginner-friendly platforms and tools to help you apply what you’ve learned:

- ✅ TradingView: Analyze charts, draw trendlines, test strategies

- ✅ CoinMarketCap: Track prices, volume, and market caps

- ✅ CryptoQuant: Monitor on-chain data for entries/exits

- ✅ Binance / OKX: Set stop-loss, limit, and trailing orders

- ✅ 3Commas: Automate your exit strategies with bots

🚀 Final Thoughts on Timing Your Moves

Mastering crypto trading strategies is less about being right all the time and more about protecting yourself when you’re wrong and maximizing your edge when you’re right.

With good entry setups, smart exit plans, and emotional discipline, you won’t just survive the market — you’ll thrive through its cycles.

As the saying goes:

👉 “Amateurs focus on making money. Pros focus on managing risk.”

🧩 Building a Personal Crypto Timing Plan

You’ve learned the phases of the crypto market, the key indicators for entry and exit, and how to control your emotions — now it’s time to bring it all together. A personal crypto trading strategy acts like your compass, helping you navigate turbulent markets with confidence.

Without a clear plan, even the best data won’t save you from second-guessing or reacting emotionally. Let’s walk through how to build a crypto market timing plan that fits your goals, risk level, and lifestyle — and keeps you accountable when it counts.

🎯 Step 1: Define Your Trading Goals

Before you open any trade, answer this:

“What do I want to achieve with crypto — and in what time frame?”

Ask yourself:

- Are you a long-term investor aiming for wealth growth over years?

- A swing trader looking to profit from medium-term trends?

- A part-time scalper aiming for small, quick gains?

🎯 Clarity Example:

“I want to grow my $1,000 portfolio to $3,000 over the next 12 months by swing trading altcoins in the accumulation and uptrend phases.”

Your goals define everything else — your risk tolerance, trade frequency, asset choices, and time spent analyzing charts.

📉 Step 2: Assess Your Risk Tolerance

Crypto is volatile. Even stable projects like Bitcoin or Ethereum can swing 20–30% in days. Knowing how much risk you’re willing to take helps avoid sleepless nights and reckless decisions.

Consider:

- How much can you afford to lose?

- What % of your portfolio will you risk per trade? (Tip: Beginners should keep this under 2%)

✅ Example Rule:

“I will never risk more than 1.5% of my total portfolio on a single trade. If my portfolio is $2,000, my max loss per trade is $30.”

This rule keeps you in the game even after a string of losses.

🛠️ Step 3: Choose Your Indicators and Tools

You don’t need 10 indicators — you need 2–3 that you understand deeply. Your tools should align with your style.

Suggested combos for beginners:

| Style | Indicators | Market Phase Focus |

|---|---|---|

| Long-term Investor | 200-day MA + On-chain data | Accumulation & Uptrend |

| Swing Trader | RSI + Support/Resistance + Volume | All phases |

| Day Trader | MACD + EMA + Sentiment Index | Distribution & Downtrend |

📌 Platform Tip: Use TradingView to set up indicator overlays and alerts so you don’t miss setups.

📈 Step 4: Create Your Entry and Exit Blueprint

Define your entry checklist and exit strategy clearly, so you’re never guessing mid-trade.

Entry Checklist Example:

- ✅ RSI under 40 and rising

- ✅ Price near long-term support

- ✅ Market sentiment: Fear or Neutral

- ✅ Trading within accumulation or early uptrend phase

Exit Plan Example:

- ✅ First sell zone at +25% (25% of position)

- ✅ Move stop-loss to break-even at +20%

- ✅ Use trailing stop for the rest

🔄 This method allows profit booking while giving your winners room to grow.

🧠 Step 5: Build Your Weekly Trading Routine

Even if you’re part-time, consistency beats intensity. Set aside time to analyze the market, journal, and review your trades.

Suggested Weekly Plan:

- Monday: Market overview, sentiment check, update watchlist

- Tuesday–Friday: Look for setups that match your timing strategy

- Weekend: Review wins/losses, update journal, refine plan

📝 Use free tools like Notion, Google Sheets, or Edgewonk to document your performance and learn from each trade.

🧰 Step 6: Use Automation to Stay Disciplined

Let technology do the heavy lifting:

- Set price alerts on TradingView

- Use stop-loss and take-profit orders on exchanges like Binance or OKX

- Try bots on platforms like 3Commas for routine trades based on your rules

📌 Why it matters: Automation reduces emotion and ensures your strategy gets executed — even if you’re asleep or away.

🚦 Step 7: Know When to Step Back

Markets can get irrational. Sometimes the best trade is no trade. Build this into your plan.

Have a rule like:

“If I lose 3 trades in a row, I will pause for 3 days and review what went wrong.”

This “cool-down rule” protects your capital and mental clarity during high-volatility crypto market cycles.

💬 Personal Trading Plan Template (Copy & Customize)

📌 Name: My Crypto Timing Plan

🎯 Goal: [Example: Grow $1,000 to $3,000 in 12 months]

⚖️ Risk per Trade: [Max 1.5% of portfolio]

📈 Preferred Indicators: [RSI, 200-day MA, Sentiment Index]

📍 Entry Rules:

- RSI < 40

- Price at or near support

- Fear Index below 30

📍 Exit Rules:

- 25% at +25%

- Move stop-loss to entry at +20%

- Trailing stop on final 50%

📆 Weekly Routine:

- Monday: Update watchlist

- Friday: Review trades, adjust strategy

🚦 Pause Rule: Stop trading after 3 straight losses, resume after journal review

🚀 Why a Plan is Your Edge

Having a personal crypto trading strategy isn’t just about discipline — it’s your competitive edge in a chaotic market.

- You avoid emotional traps.

- You stop chasing shiny coins.

- You build confidence — and eventually, consistency.

Remember: Professionals follow systems. Amateurs follow emotions.

The better your timing plan, the clearer your moves, and the greater your chance of long-term success — no matter what the crypto market cycles throw your way.

🔁 Adapting to Market Shifts with Confidence

If there’s one constant in crypto, it’s change. Markets don’t stay in the same phase forever — a bullish run can flip bearish overnight, and what worked yesterday might not work tomorrow. That’s why adaptability isn’t just a nice trait; it’s a survival skill.

This section will help you learn how to read market signals early, adjust your crypto trading strategy, and stay profitable no matter the cycle. With a flexible mindset and a few practical tools, you can thrive even in unpredictable conditions.

🌪️ Recognizing a Shift Before It Hurts

The earlier you can detect a shift in the crypto market cycle, the better prepared you’ll be to make smart decisions. Here’s what to look for:

🚨 Signs a Bull Run Is Ending:

- Parabolic price spikes with no real pullbacks

- Sentiment turns euphoric (“This coin will never go down!”)

- RSI consistently above 70, then starts declining

- Massive influencer and media hype

📉 What to do:

- Scale out of positions gradually

- Tighten stop-losses or use trailing stops

- Avoid entering new trades without strong setups

💡 Signs of Accumulation After a Downtrend:

- RSI stabilizes around 30 or below

- Flat price action with low volatility

- Exchange outflows increase (investors moving coins to wallets)

- Sentiment is quiet, bored, or fearful

📈 What to do:

- Begin small entries into long-term positions

- Watch for breakout volume and early uptrend confirmation

- Set alerts to act quickly when the market turns

🔄 Build Flexible Strategies for All Market Phases

No one strategy works in every market. The key is to have different plans based on what phase you’re in.

🧭 Strategy by Market Phase:

| Market Phase | Mindset | Strategy |

|---|---|---|

| Accumulation | Patient | DCA (Dollar-Cost Averaging), set low-buy limit orders |

| Uptrend | Confident but cautious | Ride trends, use stop-losses, take profits gradually |

| Distribution | Defensive | Reduce exposure, look for exit signals |

| Downtrend | Protective | Stay in cash/stablecoins, prepare for re-entry |

🔁 Flexible traders rotate between aggressive and conservative tactics depending on the cycle — that’s how they stay ahead.

🧠 Train Yourself to React — Not Overreact

Market shifts often trigger fear and doubt, especially for beginners. The goal isn’t to predict the market, but to respond intelligently when it tells you something is changing.

Action Steps to Stay Calm and Adapt:

- Use alerts, not your emotions. Set technical alerts on TradingView instead of staring at charts all day.

- Have pre-set strategies for each phase. Know what you’ll do before the shift happens.

- Run simulations. Practice on demo accounts or backtest your strategy using historical data.

📌 Pro Tip: Use a “what if” journal. Example:

“If BTC drops 20% in 24 hours, I’ll… [move to stablecoins/reassess my long-term positions].”

These pre-planned reactions save you from panic selling or revenge trading.

🔍 Case Study: Adapting During a Market Crash

Let’s say you’re holding SOL at $150 during a major bull run. Suddenly, Bitcoin drops 15% overnight, dragging the entire market down.

A reactive trader might panic sell at $120.

An adaptive trader does this instead:

- Checks indicators: RSI is still above 50 = trend intact

- Monitors volume: No massive spike = no panic yet

- Assesses support: SOL is near a known support zone at $110

- Plan: Set stop-loss just below $110 and reduce position size if needed

📈 If the support holds, the trader rides the recovery. If not, they exit with controlled loss and wait to re-enter — not guess.

💬 Develop a Crypto “Playbook”

Top traders think in playbooks, not predictions. These are flexible checklists that help you navigate any situation.

Sample Playbook Snippet:

Scenario: Distribution phase detected

✔ Tighten stop-losses

✔ Reduce position sizes

✔ Avoid leverage

✔ Rotate into stablecoins

✔ Wait for confirmation of new trend

Your playbook becomes your trading GPS — it won’t stop the storms, but it’ll help you steer safely through them.

🔑 Tools for Staying Adaptive

Use these to stay updated and in control as the market changes:

- 📊 Glassnode: On-chain metrics to detect whale movements

- 🧠 Crypto Panic: Real-time news aggregator to catch major events

- 📈 CoinGlass: Monitor liquidations, funding rates, and open interest

- 🚨 TradingView Alerts: Set alerts for price, RSI, MA crossovers, and volume

With the right tools and awareness, crypto market timing becomes less about luck — and more about pattern recognition.

💡 Final Thoughts: Adaptation = Longevity

Crypto is fast, volatile, and ever-changing. But change doesn’t have to be scary. In fact, it’s where the biggest opportunities lie — for those who are ready.

By building adaptive strategies, setting playbooks, and practicing mental flexibility, you don’t just survive the chaos — you use it to grow.

Remember:

“The market is a pendulum — not a line. Those who swing with it, thrive.”

🚀 Conclusion: From Chaos to Clarity

If you’ve made it this far, you’ve already taken the most important step in mastering crypto market timing — you’ve committed to learning.

Crypto is no longer a game of luck or hype. It’s a rapidly maturing ecosystem where those with a plan, a strategy, and a level head are winning consistently. Whether you’re holding a few coins or building a full trading system, you now have the blueprint to:

- Understand crypto market cycles

- Read technical and on-chain indicators

- Time your entries and exits with purpose

- Control emotions and stay strategic

- Adapt your crypto trading strategies in any environment

- Build a personal, flexible timing plan that evolves with you

🔄 It’s Not About Timing the Top — It’s About Improving Your Odds

Let’s be real — no one can time every top or bottom perfectly. That’s not the goal.

The real goal is to shift the odds in your favor:

- Enter during low-risk setups

- Exit before mass panic

- Hold with confidence when others doubt

- Sit on the sidelines when conditions aren’t ideal

Every trader who succeeds long-term embraces the reality that consistency beats perfection. If you can reduce bad trades, improve decision-making, and stay in the game longer — profits will follow.

🧠 The Crypto Trader’s Mantra

To leave you with a mindset you can carry forward, here’s a simplified mantra built from everything we’ve covered:

Plan the trade. Trade the plan. Adjust with awareness. Grow with data.

It’s not flashy. It won’t get viral likes. But it’s exactly how smart money plays this game — and how you can too.

✅ What to Do Next (Your Beginner Action Plan)

Here’s a practical checklist to help you move from reading to real-world action:

| Task | Action |

|---|---|

| 📘 Learn | Re-read the 4 market cycles and identify where the current market is |

| 🛠️ Setup | Choose 2-3 timing indicators and set them up in TradingView |

| ✍️ Document | Write your personal crypto trading strategy (use the template from Part 5) |

| 📅 Routine | Block 2–3 sessions weekly to monitor, review, and adjust your trades |

| ⚖️ Risk | Define your max risk per trade and stick to it |

| 🧠 Journal | Log every trade, including your thoughts and reasons |

| 🔁 Adjust | Review and evolve your plan every 30 days or after 10 trades |

🔗 Resources to Keep You Sharp

To stay ahead of the curve and refine your timing skills, follow these tools and platforms:

- TradingView: Charts and alerts

- CoinMarketCap: Market data

- CryptoQuant: On-chain analysis

- Binance, OKX, Bybit: Trading platforms

- 3Commas: Strategy automation

- Fear & Greed Index: Market sentiment

Bookmark them. Use them. Build your edge.

💬 Final Words of Encouragement

Crypto isn’t just a tech revolution — it’s a psychological one. Most traders fail not because the market beats them, but because they beat themselves.

But that’s not your path.

You’re now equipped with the tools, mindset, and knowledge to approach every trade with clarity. You understand the rhythm of the market, and how to dance with it — not fight it.

So the next time volatility strikes, ask yourself:

“Am I reacting… or am I executing my plan?”

That’s the moment you go from guessing to mastering.

And that’s what Crypto Market Timing is all about. 🧠💰