Why Most Beginners Fail at Digital Investing 😨—And How You Can Win with Tokenized Assets

Digital asset investing is no longer a futuristic concept—it’s happening right now, and it’s rewriting the rules of how everyday people build wealth. From earning rental income through tokenized real estate to staking crypto for passive returns, the digital economy of 2025 offers more opportunities than ever for those who know where to look.

But here’s the challenge: the landscape is fast-moving, often overwhelming, and filled with hype. That’s why this guide was created—to give beginners a clear, actionable roadmap for navigating the new frontier of digital wealth with confidence.

Whether you’re starting with $50 or want to transform your savings into a diversified, tech-powered portfolio, this article will equip you with the tools, strategies, and mindset to thrive in today’s digital-first financial world.

Let’s explore how to turn emerging technologies into sustainable income—and how tokenized assets and smart diversification could change your future forever.

📚 Table of Contents

- 🌍 Welcome to the New Wealth Frontier

- 📉 Real vs. Digital: What Every Beginner Needs to Know

- 💸 Passive Income in the Digital Age

- 🧠 Smart Ways to Start Your Digital Asset Journey

- ⚖️ Tokenization: Fractional Ownership, Full Potential

- 📈 Diversification Strategies for a Volatile Market

- 🤖 How AI and Tech are Powering Digital Wealth

- 🌐 Examples of Real People Winning in Digital Assets

- 🚧 Risks You Can’t Ignore (and How to Manage Them)

- 🛠️ Tools to Build Your Digital Portfolio from Scratch

- 🧭 Final Thoughts: Mapping Your Future in Digital Investing

🌍 Welcome to the New Wealth Frontier

The way we think about money, assets, and wealth is being completely rewritten.

In 2025, you no longer need to be born into money or climb the rigid corporate ladder to build wealth. Thanks to the rise of digital asset investing, anyone with a smartphone and internet access can participate in powerful new wealth-building strategies—from tokenized real estate to crypto-based passive income and beyond.

But here’s the truth: Most beginners still fail.

Why? Because they rush in without the right strategy, tools, or understanding of how this new frontier really works. This guide is here to change that. Whether you’re starting with $50 or $50,000, this beginner-friendly roadmap will show you how to invest smarter—not harder—with digital assets that are reshaping the financial world.

📉 Real vs. Digital: What Every Beginner Needs to Know

Before we dive into how to earn and grow your digital wealth, let’s clear up a common point of confusion: What’s the difference between real-world and digital assets?

Tangible vs. Intangible

Real-world assets are things you can touch and hold—like houses, cars, or gold. They have physical presence and usually require in-person transactions.

Digital assets, on the other hand, live on the internet. You can’t touch them, but you can own them—and many are backed by real-world value. Examples include:

- Cryptocurrencies like Bitcoin or Ethereum

- Tokenized assets like fractional real estate

- NFTs that represent digital ownership of media, art, or memberships

Why This Matters for You

Here’s why beginners should care: Digital assets are often cheaper, faster, and more accessible. You don’t need a lawyer, real estate agent, or huge savings to invest. In fact, you can start building a diversified portfolio from your phone—without leaving your couch.

Liquidity and Accessibility

- Real estate can take months to sell.

- Digital assets like crypto or tokenized shares can be traded in seconds—24/7.

You’re no longer limited by geography or bureaucracy. That’s the power of decentralization.

💸 Passive Income in the Digital Age

What if your assets could earn money while you sleep?

That’s the promise of passive income—and digital tools have made it more powerful than ever. Let’s look at the modern landscape of digital passive income opportunities.

1. Staking Crypto for Rewards

Platforms like Ethereum, Solana, or Cardano let you stake your tokens to support the network and earn returns—kind of like earning interest in a savings account, but often with higher yields.

2. Yield Farming and DeFi Protocols

If you’re more advanced, decentralized finance (DeFi) platforms like Aave or Compound allow you to lend your crypto assets and earn interest, often automatically.

3. Tokenized Real Estate Income

Some platforms now allow you to invest in tokenized property shares. You earn rental income proportionally, without ever dealing with tenants or property managers.

Popular platforms include:

4. Stablecoin Savings Accounts

Stablecoins like USDC and USDT are pegged to the dollar. Platforms like Nexo or Crypto.com offer savings plans where you can earn interest (sometimes up to 10%) on these stable digital dollars.

🧠 Smart Ways to Start Your Digital Asset Journey

Feeling overwhelmed? Don’t worry—starting smart is all about the right steps.

Step 1: Define Your Investment Goal

Are you:

- Building long-term wealth?

- Looking for monthly passive income?

- Trying to hedge against inflation?

Knowing your goal helps you pick the right assets and avoid common traps.

Step 2: Choose a Secure Wallet

A digital wallet stores your crypto. There are two main types:

- Hot wallets (like MetaMask or Trust Wallet) are online and user-friendly.

- Cold wallets (like Ledger or Trezor) are offline and ultra-secure.

Tip: Beginners should start with a reputable hot wallet, then graduate to cold storage as your portfolio grows.

Step 3: Pick a Reliable Exchange

Use well-established platforms like:

- Coinbase (great for beginners)

- Binance (offers more assets)

- Kraken (excellent security and features)

Start small. Stick to widely used coins like Bitcoin or Ethereum until you get more confident.

Step 4: Start Investing Consistently

You don’t need to time the market. Consider dollar-cost averaging (DCA)—investing a fixed amount weekly or monthly. It removes emotion and helps you buy at different market levels.

⚖️ Tokenization: Fractional Ownership, Full Potential

Imagine being able to own a piece of a luxury apartment in Manhattan, a Picasso painting, or even a share of a renewable energy project—without being a millionaire. That’s the power of tokenized assets.

What Is Tokenization?

Tokenization is the process of turning a real-world asset (like real estate or art) into digital tokens on a blockchain. These tokens represent fractional ownership, meaning you can own a piece of an asset without buying the whole thing.

For example:

- A $1,000,000 property could be split into 10,000 tokens at $100 each.

- You can buy just 1 token and still earn a portion of the rental income or asset appreciation.

This is how digital asset investing unlocks access to markets previously reserved for institutions or ultra-wealthy investors.

Benefits of Tokenized Assets for Beginners

✅ Low Entry Barrier: You don’t need tens of thousands of dollars to invest. Start small and scale as you learn.

✅ High Liquidity: Tokens can be traded quickly on digital platforms, unlike traditional real estate which can take months to sell.

✅ Global Access: Whether you’re in New York, Bangkok, or Nairobi, tokenized platforms are open to you.

✅ Transparency: Blockchain records every transaction, so ownership history and performance are verifiable.

Real-World Use Case

Platforms like Lofty AI let users buy tokenized real estate shares for as little as $50. You start earning rental income right away—no property management or landlord headaches.

And it’s not just real estate:

- Art marketplaces like Masterworks allow users to invest in fractional shares of blue-chip artwork.

- Stock tokenization platforms like FTX (note: operations vary by region) let investors trade tokenized shares of major companies.

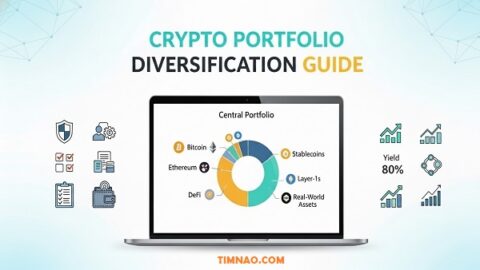

📈 Diversification Strategies for a Volatile Market

Now that you understand tokenized assets, let’s talk about how to build a smart, resilient portfolio—especially in a market that moves fast and unpredictably.

Why Diversification Matters

The old saying “don’t put all your eggs in one basket” is even more relevant in the world of digital finance. Markets move quickly, trends change overnight, and new innovations emerge constantly.

By spreading your investments across different asset classes, you:

- Minimize risk exposure

- Capture more opportunities

- Avoid catastrophic losses from a single failing asset

Beginner-Friendly Diversification Plan

Here’s a basic portfolio model you can start with:

| Asset Class | Suggested Allocation |

|---|---|

| Stablecoins (e.g. USDC) | 20% |

| Blue-chip crypto (BTC, ETH) | 30% |

| Tokenized real estate | 20% |

| DeFi/Yield platforms | 10% |

| NFTs or emerging tokens | 10% |

| Cash (for flexibility) | 10% |

This model provides a good mix of safety, income, and growth potential—ideal for 2025’s evolving digital asset landscape.

When to Rebalance

As your assets fluctuate in value, it’s important to rebalance your portfolio every 1–3 months. This keeps your risk levels aligned with your original goals. Use tools like CoinStats or Zapper to track and manage your portfolio.

Advanced Tip: Sector-Based Diversification

Once you’re more experienced, diversify by use case or sector, not just asset type. For example:

- Smart contract platforms (Ethereum, Solana)

- Gaming tokens (GALA, AXS)

- Stablecoins for passive yield

- NFT collections with long-term brand value

Diversification is your safety net. The digital world is volatile—but with the right balance, it can be incredibly rewarding.

🤖 How AI and Tech are Powering Digital Wealth

In the age of smart everything—phones, homes, even fridges—your wealth-building strategy should be just as smart. Thankfully, AI-powered investing tools are making it easier than ever.

AI in Investing: Not Just for Wall Street

In 2025, even beginner investors can harness artificial intelligence (AI) to:

- Analyze market trends in real-time

- Get automated portfolio suggestions

- Detect scams or suspicious wallet behavior

- Optimize when to buy, sell, or hold

Platforms like:

- TokenMetrics: Offers AI-based token ratings and trend predictions.

- Wealthfront & Betterment: AI-powered robo-advisors for managing traditional and digital investments.

The Rise of Robo-Advisors

Forget about paying expensive financial advisors. Robo-advisors use algorithms to create and manage personalized portfolios based on your risk tolerance and goals.

Advantages:

- Lower fees

- Always on (no business hours)

- Emotion-free investing

- Ideal for passive income and dollar-cost averaging strategies

AI Meets DeFi: Smart Yield Optimization

Tools like Yearn Finance or Beefy automatically move your crypto assets between DeFi protocols to get the best returns.

Let’s say:

- Protocol A pays 4% APY

- Protocol B jumps to 6%

AI rebalances your assets in real time to maximize profits—all without you lifting a finger.

Don’t Forget Security

AI is also helping fight cyber threats. Advanced machine learning can detect hacking attempts or phishing attacks before they drain your wallet. Always choose platforms that use AI-backed fraud detection.

🌐 Examples of Real People Winning in Digital Assets

Real success stories make digital asset investing feel real—and achievable.

Let’s explore how ordinary individuals and early adopters have built passive income in 2025 through smart use of tokenized assets, crypto, and decentralized platforms.

1. Lisa – The Airbnb Landlord Who Went Digital

Lisa, a 43-year-old in Toronto, started by renting out property on Airbnb. But during the pandemic, she discovered tokenized real estate. Now, she holds shares in 15 properties across 5 countries through platforms like Lofty AI.

💡 Her Outcome:

She earns daily rental income directly to her crypto wallet and reinvests the earnings—growing her wealth passively while maintaining her main job.

2. Andre – From 9-to-5 to 24/7 DeFi Yield

Andre, a 28-year-old software engineer, was fascinated by DeFi. He started with $1,000 on Aave and learned how to lend assets for high-yield interest. After 12 months of consistent compounding, his crypto portfolio had grown by over 60%.

💡 His Tip:

Use DeFi aggregators like Yearn Finance or Beefy Finance to automate returns and reduce risk.

3. Mei – NFT Collector Turned Micro-Angel Investor

Mei, a student in Vietnam, turned her love for digital art into a side hustle. She started flipping NFTs but later used her profits to buy tokenized equity in startups on platforms like Republic.

💡 Her Strategy:

Buy undervalued NFTs, flip them, and move profits into longer-term tokenized startups for future growth.

🚧 Risks You Can’t Ignore (and How to Manage Them)

While digital asset investing opens up a world of opportunities, it also comes with serious risks. Beginners must stay alert—especially when chasing high returns.

1. Volatility

Digital assets are highly volatile. Prices can skyrocket or crash overnight.

How to manage it:

- Only invest what you can afford to lose

- Use stablecoins for predictable income

- Diversify across multiple asset types

2. Scams and Fake Projects

Rug pulls, phishing sites, and shady tokens can wipe out your wallet in seconds.

How to avoid it:

- Never click links from strangers

- Stick with trusted platforms like CoinGecko or CoinMarketCap

- Research whitepapers, teams, and audits before investing

3. Lack of Regulation

The regulatory landscape is evolving. Some platforms may face shutdowns or legal battles.

How to protect yourself:

- Choose projects with compliance history or based in regulation-friendly countries

- Keep part of your funds in more traditional, stable investments

- Stay informed on local crypto laws

4. Technical Complexity

Smart contracts and blockchain wallets can be confusing at first.

What to do:

- Start small

- Use beginner-friendly wallets (like Coinbase Wallet or MetaMask)

- Watch tutorials and join community forums

🔒 Bonus Tip: Use two-factor authentication and store seed phrases offline—never in the cloud.

🛠️ Tools to Build Your Digital Portfolio from Scratch

Let’s get tactical. These tools will help you go from “curious beginner” to “confident digital asset investor” in no time.

🔐 Wallets

- MetaMask (hot wallet) – great for DeFi and NFT beginners

- Trust Wallet – supports many chains and tokens

- Ledger Nano X (cold wallet) – industry standard for offline storage

📊 Portfolio Trackers

- Zerion – clean DeFi tracker with wallet integration

- CoinStats – track both CeFi and DeFi portfolios

- Kubera – for advanced tracking, including real estate and stocks

🧠 Learning Platforms

- Bankless – DeFi education hub

- Coin Bureau – YouTube and articles for crypto insights

- Investopedia’s Crypto Section – great for traditional investors learning digital assets

💸 Earning Platforms

- Lofty AI – tokenized real estate

- Crypto.com Earn – simple interest accounts

- Uniswap / PancakeSwap – for DeFi liquidity and swaps

Combine these tools with your goals and strategies, and you’re well on your way to building digital wealth.

🧭 Final Thoughts: Mapping Your Future in Digital Investing

The truth is, you don’t need to become a blockchain expert to succeed. What you need is:

- A clear goal

- A safe setup

- Consistent effort

- And a willingness to learn and adapt

The landscape of digital asset investing is only growing. By 2030, experts predict trillions of dollars in tokenized assets will be circulating worldwide. The earlier you get in—strategically—the more upside you can capture.

Key Reminders

- Don’t chase hype—follow value

- Focus on building passive income in 2025, not just quick wins

- Stay diversified and secure

- Use automation and AI to your advantage

- Keep learning, always

Your Next Steps

✅ Choose your first wallet

✅ Invest $20–$100 in a tokenized asset or crypto

✅ Track your portfolio

✅ Join a community or newsletter

✅ Set a monthly review date to assess and grow

The financial system is being rewritten—and now, you have a seat at the table.