Token ecosystem analysis: a calm, powerful way to stop buying “random coins” 🧭

Token ecosystem analysis is the fastest way to stop buying coins based on hype and start making calm, smart decisions you can actually defend later. In this guide, you’ll learn a simple, beginner-friendly process to understand who needs a token, why they need it, how supply enters the market, and whether you can exit safely—so you can avoid common traps and spot better opportunities without gambling.

If you’ve ever felt overwhelmed by tokenomics jargon or confused by “good projects” that still dump, you’re in the right place. Let’s break it down step by step, with practical checks you can do in under an hour.

If you’re worried your article will “overlap,” shift the target: ecosystem → rules → outcomes

If you’ve read a few “ultimate tokenomics” posts, you’ve probably noticed a pattern: they all teach the same pillars (supply, demand, utility, governance). Those pillars aren’t wrong. They’re just… everywhere.

That creates a real problem for beginners and for SEO:

- Beginners finish the post thinking “Cool… but what do I do before I buy?”

- Google sees 20 pages answering the same intent with the same structure.

So for this article, we’re not trying to write “the best tokenomics definition.” We’re building a beginner skill that’s harder to copy-paste:

Token ecosystem analysis = understanding the people, roles, and rules that create real demand for a token (not just hype).

Here’s the big shift in one line:

Don’t start with “Is this token cheap?”

Start with “Who needs this token, for what job, and what happens if rewards disappear?”

The 3-tab rule (beginner-friendly, no rabbit holes)

Before you look at a price chart, open exactly three tabs. This prevents the classic “chart-first” impulse buy.

- Token overview (basic supply + market context)

- Use CoinGecko or CoinMarketCap

- On-chain explorer (holders + transfers + contract reality)

- Ecosystem / DeFi reality check (TVL, chains, protocols)

- Use DeFiLlama

You don’t need to “analyze everything.” You just need enough to avoid obvious traps.

Do this next (10 minutes):

- Search the token on CoinGecko/CoinMarketCap:

- Note Market Cap, Circulating Supply, and whether Max Supply exists.

- Open the token’s contract page on the explorer:

- Look for top holders concentration (are a few wallets holding most of it?)

- Scan recent transfers (do you see constant sell-side movement?)

- Check DeFiLlama (if the project is DeFi or claims on-chain activity):

- Is there meaningful TVL or is the “ecosystem” basically empty?

Constraint note: If any of these three tabs are confusing, that’s not your fault. It’s a signal to slow down or reduce position size. Clarity is part of the risk management.

Turn “ecosystem → rules → outcomes” into a simple decision

To keep this practical, we’ll use one repeatable flow:

- Ecosystem: Who participates, and what’s the real job being done?

- Rules: Who gets rewarded, who pays, and what behavior does the system create?

- Outcomes: What should be true if it’s healthy (and what looks wrong if it’s not)?

At the end of Part 1, you’ll be able to make a calm call:

- Buy small (you understand it),

- Watchlist (you see potential but need proof),

- Walk away (too many unknowns).

The “new country” test: who lives here, what do they do, and why do they stay?

If crypto jargon makes your eyes glaze over, use this mental model instead:

Every token project is like a new country trying to build an economy.

A country needs:

- citizens (participants),

- jobs (useful activity),

- laws (rules/incentives),

- and a reason people stay (stickiness).

If it doesn’t have those, it’s not a country. It’s a temporary festival.

1) Who lives here? (the “citizens” list)

In token ecosystems, “citizens” are the groups whose behavior decides the token’s fate. Common groups:

- Users: people using the product for a real purpose

- Builders: teams adding apps, integrations, tooling

- Security providers: validators/miners/nodes securing the network

- Liquidity providers: people who supply liquidity on DEX pools

- Speculators/traders: people chasing price action

- Governance voters/delegates: people who can change rules

Do this next (5 minutes):

Make a “Top 3 citizens” list in your notes:

If your list is basically “traders, farmers, speculators,” that’s not automatically a scam—but it is fragile. A real economy needs at least one strong non-speculative group.

Where to check quickly:

- DeFi project? Look at TVL and where it lives on DeFiLlama.

- Token on Ethereum? Check top holders and transfer patterns on Etherscan.

- Token on Solana? Check holders and activity on Solscan.

2) What do they do all day? (the “jobs”)

A healthy ecosystem has a clear “main job”—the activity that creates value. Examples:

- paying fees to use a network

- borrowing/lending

- trading with real volume and liquidity

- staking to secure the network

- building apps that attract users

A beginner trap is counting activity that exists only because rewards exist.

Do this next (3 minutes):

Write one sentence:

- “The main job in this ecosystem is ________.”

Then add: - “People do it because ________ (benefit).”

If the benefit is basically “earn rewards,” you’re looking at a subsidy-driven economy.

3) What are the laws and incentives? (the “rules of the game”)

This is where many projects look good on the surface but behave badly in reality.

Rules include:

- reward formulas (how tokens are paid out)

- staking lockups and penalties

- fee collection and distribution

- governance voting systems

- risk parameters (especially in lending)

The key insight: rules create behavior. And behavior creates outcomes.

Do this next (7 minutes):

Create a tiny “incentive loop” in your notes:

- Rewarded action: ________

- Who pays for rewards: fees / treasury / token printing

- What recipients do next: hold / lock / sell

- Net effect on ecosystem: builds value / drains value / unclear

If the loop ends with “sell immediately” and “drains value,” you’ve found a structural issue—before the chart teaches it to you the hard way.

4) Why do they stay? (the “stickiness” test)

This is the question that separates real ecosystems from hype cycles:

If rewards dropped to near zero tomorrow, who would still be here—and why?

Sticky reasons might be:

- the product solves a real pain point

- users need the token for fees/collateral/access

- builders stick around because users stick around

- liquidity stays because trading volume is real

Non-sticky reasons often sound like:

- “because the APR is high”

- “because the community is strong”

- “because it’s early”

Those can be true, but they’re not a foundation.

Do this next (2 minutes):

Finish this sentence:

- “Even without rewards, people would stay because ________.”

If you can’t fill it honestly, don’t force a buy. Move to watchlist mode.

The 15-minute “new country worksheet” (copy/paste)

If you want something you can use every time, copy this into a notes app:

- Citizens (top 3 groups): ________ / ________ / ________

- Main job (one core action): ________

- Stay reason (without rewards): ________

- Who receives new tokens first: ________

- Who is likely forced to buy/hold (if anyone): ________

- Today’s decision: Buy small / Watchlist / Walk away

This worksheet is intentionally simple. The goal is not perfect accuracy—it’s avoiding blind bets.

“I want to buy this token” scenario: what should I understand before price even matters?

Let’s talk about the real moment: you’ve seen the token on social media, maybe a friend mentioned it, maybe it’s trending. You feel the itch to buy.

Before you touch the chart, do three practical checks: job, agents, demand quality.

How do I quickly define the token’s job in one sentence (without sounding like marketing)?

Use this template:

“This token helps [who] do [what] inside [which ecosystem], because [specific benefit].”

Good answers sound like tools:

- “Used to pay fees.”

- “Used as collateral.”

- “Used to coordinate governance that actually changes parameters.”

Weak answers sound like slogans:

- “Powers the future.”

- “Enables innovation.”

- “Builds community.”

Do this next (micro-step):

Write your job sentence, then answer two follow-ups:

- Is the token required, or just “nice to have”?

- Can users get the benefit without holding the token?

If the token is optional, long-term demand is harder.

Tool tip: If you can’t find a clear job statement, check the token’s “Overview” on CoinGecko and compare it to what people claim on social media. When those two stories differ wildly, pause.

Who are the “economic agents,” and why does it matter for my money?

Economic agents are simply the groups whose incentives move the token.

Here’s the beginner-friendly way to map them:

- Who needs the token to use something? (users)

- Who earns the token for providing something? (stakers/LPs/builders)

- Who can change the rules? (governance / multi-sig / core team)

A token can have a great narrative and still be a weak buy if the main agents are “people who earn and sell.”

Do this next (10 minutes): the agent map

In your notes, write:

- The 3 most important agent groups: ________ / ________ / ________

- For each group:

- What do they want?

- What do they get?

- What do they risk?

- What would make them leave?

If you can’t name at least one strong non-speculator group, you’re likely looking at a token that lives and dies by hype cycles.

What’s a “healthy demand signal” vs “reward-only demand”?

This is the most practical filter in Part 1.

Healthy demand often looks like:

- people use the ecosystem for a real job (even with modest rewards)

- fees or utility create a reason to acquire the token

- activity continues across time, not just during campaigns

Reward-only demand often looks like:

- users show up when APR is high

- they sell rewards immediately

- activity drops sharply when incentives end

Do this next (the “rewards-off” question):

Ask:

“If rewards went to zero tomorrow, who would still use this—and why?”

If you can name a real user group and a real reason, you can keep researching.

If the only reason is “people will still trade it,” you’re relying on speculation.

Bonus: a fast governance reality check (only if it’s a governance token)

If a token claims governance value, check whether governance is alive or just marketing.

- Many DAOs vote using Snapshot.

Do this next (5 minutes):

- Search the project on Snapshot.

- Look at recent proposals:

- Are there real decisions?

- Are there many voters or just a few wallets?

- Is participation consistent?

If voting is dead or dominated, treat “governance value” as weaker.

The calm decision rule (so you don’t spiral)

After job + agents + demand quality, make one of three calls:

Buy small if:

- the token job is clear and required

- at least one real user group exists beyond speculators

- you have a believable “rewards-off” reason

Watchlist if:

- the story makes sense but proof is thin

- you need to see whether users stick around

Walk away if:

- the job is vague

- demand looks incentive-only

- you can’t explain who stays and why

That’s it. You’re not trying to predict the future. You’re trying to stop making avoidable mistakes.

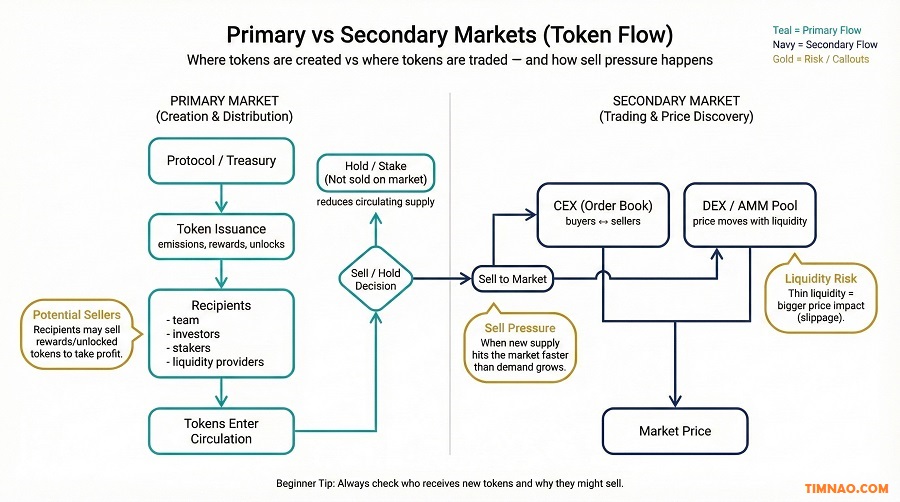

The most ignored beginner topic: primary vs secondary markets (where tokens are made vs where they’re traded)

Most beginners think price is driven by “news + hype + charts.”

Sometimes. But very often, price is driven by something less exciting and far more predictable:

how many tokens are entering circulation… and who’s receiving them.

That’s the whole point of understanding primary vs secondary markets.

What do “primary” and “secondary” mean in one minute?

- Primary market (token creation & distribution): where tokens enter circulation. Think emissions, rewards, vesting unlocks, treasury distributions, airdrops.

- Secondary market (token trading): where you buy/sell on exchanges and DEX pools. Think spot trading on CoinGecko listings, CEX order books, or DEX pools like Uniswap.

Here’s the beginner trap:

You buy on the secondary market… but you get punished (or rewarded) by what’s happening in the primary market.

Where new tokens actually come from (the 5 “pipes” you must check)

When people say “token supply,” beginners often imagine one supply number. In real life, supply enters the market through pipes. These are the common ones:

- Emissions / protocol rewards

Tokens paid to validators/stakers/participants. - Liquidity mining incentives

Tokens paid to liquidity providers to keep trading liquid. - Vesting & unlocks

Tokens released to team, investors, advisors, ecosystem funds. - Treasury distributions

Grants, partnerships, operational spending (often paid in tokens). - Airdrops / user rewards

Tokens distributed as growth marketing.

None of these are automatically “bad.” The money question is:

Who receives tokens first, and what’s their most rational move?

If a group gets tokens as income, they often sell some portion. That’s normal. Your job is to know whether the market can absorb it.

The 12-minute Sell Pressure Scan (do this before you look at the chart)

This is designed for beginners. No spreadsheets. Just three tabs and one note.

Tab 1 — Token basics (2 minutes)

Use CoinGecko or CoinMarketCap:

- Market cap (context)

- Circulating supply (what’s already “out there”)

- Max supply (if it exists)

- Short description (what the token claims to do)

Tab 2 — Unlocks & vesting (4 minutes)

Check TokenUnlocks (if the token is listed):

- Are there big unlocks in the next 7–30 days?

- Who receives them (team, investors, ecosystem)?

- Are unlocks steady or “cliff-style”?

If the token isn’t listed: treat it as unknown, and reduce your risk.

Tab 3 — Holder concentration & transfers (6 minutes)

Use an explorer:

Look for:

- Top holders: Is supply concentrated in a few wallets?

- Transfers: Is there constant distribution from large wallets?

- Contract labels: Are top holders exchanges, treasury wallets, vesting contracts?

Write one note (the whole point):

- “Primary supply pipes: ________”

- “Top receiver groups: ________”

- “Why they might sell: ________”

If you can’t fill those three lines, it’s not “too hard”—it’s too unclear to size confidently.

How to tell if sell pressure is structural (not “just volatility”)

A bad week is random. Structural sell pressure has a steady engine.

Common “structural” signs:

- Emissions are high and continuous (rewards paid daily/weekly)

- Unlocks happen on a predictable schedule

- Incentive programs attract short-term farmers

- Treasury is continuously distributing tokens

Beginner rule (simple but powerful):

If tokens are constantly being paid out to groups that don’t need to hold them, assume ongoing sell pressure.

That doesn’t mean “don’t buy.” It means don’t buy blindly.

What to do when supply is heavy (your 4 beginner-safe plays)

If your scan shows heavy or unclear supply flow, you still have good options:

- Wait for the market to digest the supply

This is underrated. Waiting isn’t “doing nothing.” It’s choosing not to fight a headwind. - Enter smaller and earn the right to add

Start with a tiny position you can emotionally ignore. Add only if real demand proves itself. - Time your entry around known supply events

If unlocks are monthly, watch how price behaves around those dates before buying bigger. - Use the product before you invest

If it’s DeFi, try a tiny amount on the protocol first. It turns “belief” into observation.

A quick scenario (how this prevents the classic slow bleed)

You see a token trending. People say “undervalued.” The chart looks calm.

You run the Sell Pressure Scan:

- Unlocks are steady for early investors

- Rewards are high (meaning lots of tokens paid out)

- Top holders are concentrated

Now you don’t panic—you just don’t pretend it’s a clean hold.

You either:

- wait until supply pressure cools, or

- size small with a clear review date, or

- stay on the watchlist until demand clearly absorbs supply.

That’s how beginners stop feeling “mysteriously unlucky.”

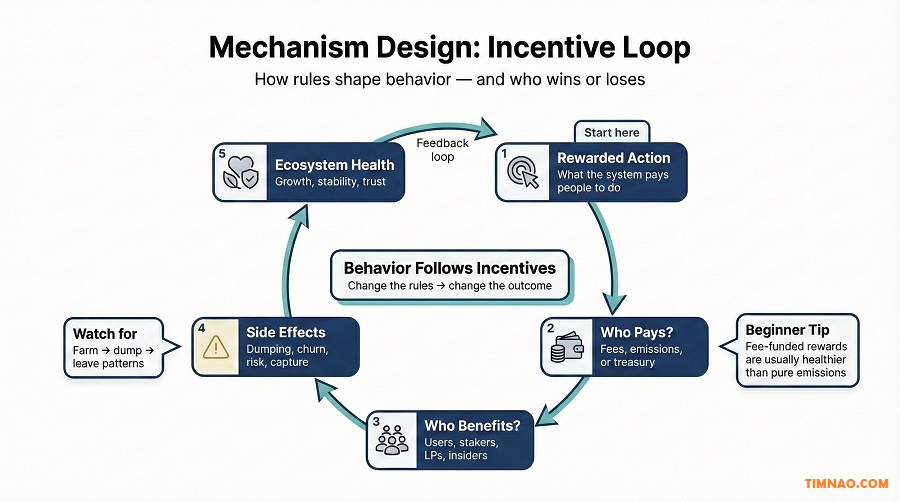

Mechanism design: the rules that quietly decide winners and losers

Primary vs secondary markets tells you where tokens come from.

Mechanism design tells you why people behave the way they do once they have the tokens.

And crypto is brutally honest about incentives:

People will do what pays them, not what the whitepaper hopes they’ll do.

Mechanism design in plain English (no academic vibes)

Mechanism design = rulebook + incentives.

In crypto, that usually means:

- staking rules (lockups, rewards, penalties)

- reward formulas (who gets paid, how often)

- fee model (who pays fees, where fees go)

- lending rules (collateral ratios, liquidations)

- governance design (who can change parameters and how)

If you can’t explain the rulebook, you can’t predict behavior.

And if you can’t predict behavior, you’re paying tuition.

The 4-line Incentive Loop (your best practical tool)

Every time you evaluate a token ecosystem, fill this out:

- Rewarded action: What does the system pay people to do?

- Reward source: Where does the reward come from? (fees vs printing tokens)

- Next behavior: What will recipients likely do? (hold, lock, sell)

- Net effect: Does this build value or drain value?

Do this next (5 minutes):

Pick the main incentive in the ecosystem (staking rewards, LP rewards, borrowing incentives) and write the loop in your notes.

If your loop ends in “sell immediately,” you’ve learned something important before the chart teaches you painfully.

Fees vs emissions: a beginner filter for “real vs fragile” rewards

A lot of newbies get hypnotized by APR.

Instead, ask: where does the reward money come from?

- Fee-funded rewards: users pay fees → fees fund rewards

This can be sustainable if usage is real. - Emission-funded rewards: protocol prints/distributes tokens → rewards exist regardless of usage

This often creates sellers, especially when rewards are claimable anytime.

You can sanity-check real usage with:

- DeFiLlama (TVL and ecosystem footprint)

- Project dashboards (if available)

- Token behavior on explorers (Etherscan / Solscan)

Beginner takeaway:

High APR is not a feature. It’s a signal. Your job is to understand what kind.

Mechanism red flags beginners can spot without deep math

You don’t need to be a quant to catch these:

1) “Farm → dump → leave” mechanics

- Rewards attract mercenaries

- Rewards get sold

- Liquidity vanishes when rewards drop

What to do: Treat it as a short-term trade or avoid sizing big until you see stickiness.

2) Rewards for activity that doesn’t create real value

- wash trading, spam transactions, meaningless quests

What to do: Ask “What would still exist if incentives were cut?”

3) Governance capture

If a few wallets can change the rules, you’re not buying “decentralization.” You’re buying exposure to a small group’s decisions.

Quick check: If the protocol uses DAO voting on Snapshot, scan:

- how many voters show up

- whether votes are dominated by a few addresses

- whether proposals are meaningful or cosmetic

4) Fragile stress behavior

Some systems look great in calm markets and break under stress:

- price drops → users exit → utility drops → price drops again

- liquidity dries up exactly when you need it

What to do: Ask stress questions before you buy.

The 6-question stress test (copy/paste)

Put this in your notes and answer honestly:

- If rewards drop 50%, users would: stay / partly stay / leave

- If price drops 30%, participants will: buy more / hold / exit

- If TVL/liquidity drops, the protocol: stabilizes / struggles / breaks

- Governance power is: distributed / unclear / concentrated

- The system’s main value comes from: usage fees / emissions / mixed

- The biggest “selfish optimization” risk is: ________

If you can’t answer these, it’s not a failure—it’s a signal to keep risk small.

A practical way to study mechanism design (without drowning)

Pick one well-known protocol and study it like a mechanic studies an engine.

For lending mechanics and risk parameters, browse Aave.

For AMM-style incentives and liquidity behavior, browse Uniswap.

You’re not copying them. You’re training your eye to recognize how rules shape outcomes.

Token velocity: when “lots of transactions” can still be unhealthy

This is where beginners get fooled by “activity.”

You’ll hear:

- “Transactions are exploding!”

- “Volume is up!”

- “The chain is so active!”

Sometimes that’s adoption. Sometimes it’s just churn.

Token velocity in plain English

Velocity is how quickly a token changes hands over time.

High velocity can mean:

- healthy usage (spending on fees/payments)

- unhealthy behavior (reward dumping, hot potato trading)

The only way velocity becomes meaningful is when you link it to the token’s job.

Match velocity to the token’s job (spend token vs hold token)

If the token is meant to be spent (fees, gas, payments):

Higher velocity can be normal. People buy → use → move on.

If the token is meant to be held (governance, collateral, long-term stake):

Extremely high velocity can be a warning. It can mean nobody wants to hold it.

Do this next (2 minutes):

Write:

- “This token is mainly used to: spend / hold / mixed”

Then: - “So high velocity would be: normal / suspicious / depends”

That one line will stop you from being hypnotized by “activity” headlines.

The “coupon token” problem (the most common unhealthy velocity)

Some tokens behave like coupons:

- you earn them

- you sell them

- you repeat

The ecosystem may look busy, but holding demand stays weak because the token’s role is “claim and dump.”

Beginner tell:

If the token’s top use case is “earn rewards,” velocity will be high for the wrong reason.

The 10-minute Velocity Sanity Check (no fancy dashboards required)

You can do this with the same tools you already opened earlier.

Step 1: Check transfers on the explorer

Ask:

- Do transfers look like constant distribution from large wallets?

- Are there patterns that resemble farming payouts?

Step 2: Check whether there’s a real “hold reason”

Hold reasons include:

- staking lockups with real benefits

- governance power that actually affects outcomes

- collateral requirement for core activity

- access utility that users can’t easily bypass

If none exist, high velocity often means churn.

Step 3: Cross-check ecosystem weight

If it’s DeFi:

- Look at the protocol footprint on DeFiLlama

Stable or growing TVL doesn’t guarantee health, but it’s a stronger signal than “tweets per day.”

A simple “Hold Reason Score” (beginner-friendly)

Give the token 1 point for each true statement:

- I need it to use the core product (fees/access)

- I need it as collateral for the core product

- Locking it gives meaningful benefits (not just more printed tokens)

- Governance is active and not obviously captured (Snapshot check)

- There’s evidence users stick around without huge incentives

Score interpretation:

- 0–1: mostly speculative / coupon-like behavior likely

- 2–3: mixed; proceed carefully and size small

- 4–5: stronger foundation; still not a guarantee, but more “hold-worthy”

What to do if velocity looks unhealthy (so you don’t argue with the design)

If your checks suggest high-churn behavior, you have three sane choices:

- Watchlist it until the design improves

You’re waiting for something that creates holding demand (utility, value capture, reduced emissions). - Trade it honestly

Small size, clear exit rules, no pretending it’s a long-term hold. - Learn the ecosystem first

Use the product with tiny capital before committing. This builds real understanding fast.

One last practical move before you do anything else

Open your notes and write one sentence:

“I’m buying this token because ________.”

If your sentence is basically “because it’s trending” or “because it’s cheap,” don’t try to rescue it with more browsing. Put it on a watchlist.

Then do this 10-minute routine:

- Check basics on CoinGecko

- Check holder concentration on Etherscan or Solscan

- If it’s DeFi, sanity-check the ecosystem footprint on DeFiLlama

If all three look reasonable, great—you’re ready to go deeper into liquidity mechanics and exit risk. If they don’t, you just saved yourself a painful lesson.

DeFi reality check: bonding curves, AMMs, and “yield” that hides risk

If you’re new to DeFi, “yield” can feel like free money. A protocol shows 18% APY, your brain does the math, and suddenly you’re emotionally invested.

Here’s the reality: yield is never free. In DeFi, yield is usually payment for taking a specific risk—sometimes a risk you don’t notice until it bites you.

What is an AMM, and why does it change the way prices move?

An AMM (automated market maker) is a trading system where prices are set by a formula, not by a traditional order book. You’ll see AMMs on DEXs like Uniswap.

For beginners, this matters because:

- AMM prices can move fast when liquidity is thin.

- You can get wrecked by slippage if you buy/sell too aggressively.

- “Liquidity providers” are not just “earning fees”—they’re taking a position.

Do this next (5 minutes):

- If a token mostly trades on a DEX, check whether liquidity is actually deep enough to exit.

- Use DeFiLlama to sanity-check whether the protocol/chain has meaningful TVL and whether liquidity looks stable over time.

Beginner rule: If you can’t exit without moving the price, you don’t really have profits—you have a screenshot.

What’s a bonding curve in plain English (and why launches can be misleading)?

A bonding curve is a pricing rule where the token price changes based on supply—often used in token launches or “continuous” sales. It can create the feeling of guaranteed upward movement early on.

But bonding curves don’t remove risk. They often concentrate risk into one question:

“What happens when demand slows down?”

If demand stalls:

- price growth can flatten (or reverse in some designs),

- early buyers may rush to exit,

- later buyers become exit liquidity.

Do this next (10 minutes):

Before you touch a bonding-curve launch, write down:

- Who buys early and why?

- Where does liquidity come from later?

- If new buyers stop for 48 hours, what happens to price and exit ability?

If you can’t answer those, treat it as high-risk speculation, not an “investment.”

“I’m earning yield” — yield from what, exactly?

This is the most useful beginner question in DeFi:

“Where does the yield come from?”

Most yield falls into these buckets:

- Fees from real activity

- Trading fees (DEX)

- Borrowing interest (lending)

- Protocol revenue sharing (varies widely)

- Incentives from token emissions

- Rewards paid in newly distributed tokens

- Often high at the beginning, often decreases over time

- Risk premia

- You’re being paid because the position is exposed to volatility, liquidation, depegs, or smart contract risk

Do this next (2 minutes):

If you see a juicy APY, label it:

- “Fee-based,” “Emission-based,” or “Risk-premium.”

If you can’t tell which, assume it’s not beginner-safe.

Liquidity providing: what beginners think it is vs what it really is

Beginner expectation:

- “I deposit two tokens, earn fees, withdraw later.”

Reality:

- You’re effectively running a strategy that can underperform simply holding the tokens.

- Your outcome depends on price movement, pool design, and how concentrated liquidity is (on platforms that support it).

This is where the term “impermanent loss” shows up. You don’t need to master the math to avoid common mistakes—you just need to understand the behavior:

- When prices move a lot, your position can drift into holding more of the weaker asset.

- Fees may not compensate for the drift in volatile markets.

Do this next (beginner-safe LP checklist):

Before you provide liquidity, answer these:

- Am I okay holding either token long-term?

- If one token drops 30%, will I panic-sell?

- Are fees likely to be real (volume) or mostly incentives (rewards)?

- Do I understand how to exit without rushing?

If you answer “no” to #1 or #4, don’t LP with meaningful money.

Lending and borrowing: “safe yield” that can still blow up

Lending protocols can look “safer” than LP because you’re not dealing with two tokens in a pool. But lending has its own beginner traps:

- collateral liquidation risk (if you borrow)

- stablecoin depeg risk (if you lend/hold stablecoins)

- protocol risk (smart contract, governance changes)

- market-wide cascades

If you want a concrete protocol to study mechanics, Aave is a good place to understand how collateral, borrowing rates, and liquidations fit together.

Do this next (10 minutes):

If you’re about to borrow:

- Write your liquidation buffer in plain language: “If my collateral drops __%, I’m in danger.”

- Don’t borrow against volatile assets unless you fully accept the possibility of forced selling.

The 30-minute “DeFi reality check” routine (no hero moves)

If you only do one routine before using a DeFi protocol, make it this:

- Check protocol footprint

- Look it up on DeFiLlama

- If it’s tiny and brand-new, risk is automatically higher

- Check the token’s exit reality

- Start with a “test-size” transaction

- A tiny amount you can afford to lose

- Your goal is to learn the UX, fees, and exit process

- Write your exit rule before entering

- “I exit if APY drops below __%”

- “I exit if token price drops __%”

- “I exit if TVL drops sharply over a short window”

This is how you keep DeFi from turning into casino behavior.

Governance “capture” and control: when decentralization is mostly marketing

A lot of projects love the word “decentralized.” Beginners love it too—because it sounds safe, fair, and community-driven.

But here’s the uncomfortable truth:

many governance systems are decentralized in branding, not in power.

That doesn’t mean “avoid all governance tokens.” It means you should learn how to spot when governance is real versus decorative.

What “governance capture” actually means (simple version)

Governance capture is when decision-making power ends up controlled by:

- a small set of whales,

- insiders/team wallets,

- investors with large allocations,

- or a multisig group that can override “community votes.”

In that world, governance tokens can feel like you “own a voice,” but the system behaves like you don’t.

The 3 checks that reveal whether governance is real

You can do these checks without being a governance nerd.

Check 1: Who holds the power?

- Look at token holder concentration on Etherscan or Solscan.

- If the top wallets control a huge portion of supply, don’t assume votes are democratic.

Check 2: Do people actually vote?

Many DAOs vote on Snapshot.

Open Snapshot and look for:

- recent proposals

- how many voters participated

- whether the same small group dominates repeatedly

Check 3: Do votes change anything meaningful?

Some proposals are real decisions (fees, treasury spending, risk parameters). Others are “temperature checks” that don’t bind anyone.

If governance is mostly symbolic, treat “governance value” as weaker.

“But it’s decentralized!” — the multisig reality beginners should know

Even in projects that genuinely want to decentralize, many start with multisigs for safety and speed.

The practical takeaway:

- multisig control isn’t automatically bad

- but it changes your risk profile: you’re trusting a small group

Do this next (2 minutes):

Before buying a governance token, write:

- “The real decision-makers are: token voters / delegates / multisig / unclear.”

If the answer is “unclear,” you don’t have to bail—you just don’t size big.

Delegates, quorum, and the “quiet power” problem

In many governance systems, power concentrates not only through whales but through:

- low voter turnout

- delegated voting to a small group

- quorum rules that let a minority decide

This creates a weird beginner trap:

You assume “community owns it,” but only 0.5% of holders actually vote.

Do this next (5 minutes):

On Snapshot, look at:

- number of voters per proposal

- trend over time (is participation dying?)

- whether proposals pass with tiny turnout

If a protocol’s governance is dead, the token may still pump—but don’t pretend governance utility is the reason.

A practical way to use governance info in your buy decision

Here’s the clean beginner logic:

- If governance is active and reasonably distributed: governance may be a real part of token value.

- If governance is active but concentrated: token value may depend on insiders (higher risk).

- If governance is inactive: ignore governance as a value driver and focus on other utility.

Do this next:

Choose one label for the token in your notes:

- “Governance matters,” “Governance is concentrated,” or “Governance is marketing.”

This keeps you from telling yourself a comforting story that isn’t true.

Money angle: how this approach helps you earn (or save) without hype

Let’s be honest: most people don’t read about token ecosystems because they love frameworks. They read because they want better outcomes.

So here’s the money angle—without the “get rich quick” nonsense.

The first win is usually saving money, not making it

Beginners often lose money through avoidable mistakes:

- buying into heavy unlock schedules without realizing it

- chasing emission-based APY and getting dumped on

- entering thin liquidity where they can’t exit

- trusting “decentralization” without checking who controls governance

If this approach helps you avoid even two of those mistakes, you’re already ahead.

Do this next (the “save money” habit):

Before every buy, write these three lines:

- “Supply enters via: rewards / unlocks / treasury / unknown”

- “My exit plan is: ________”

- “If I’m wrong, my max loss is: ________”

That’s not flashy. That’s how people survive long enough to win.

How to earn with lower risk: three realistic paths for beginners

If you want practical earning opportunities, aim for paths where skill beats hype.

1) Earn by being useful to ecosystems (not by predicting pumps)

A lot of people try to earn by guessing price. A smaller group earns by doing work:

- research summaries

- community moderation

- writing documentation

- translation

- data analysis

- simple product/testing feedback

Do this next (15 minutes):

Pick one ecosystem you actually use or want to learn. Then:

- follow its official channels

- look for contributor programs, bounties, or community work

If you build a public portfolio (even small), tools like GitHub can help you show what you’ve done.

2) Earn by creating beginner-friendly content that is genuinely helpful

This is underrated, especially if you can explain “why people lose money” in plain language.

Beginner content that performs well usually:

- shows a repeatable checklist

- teaches exit planning

- explains risk clearly

- avoids hype words and price predictions

Do this next:

Turn one part of this guide into a downloadable checklist:

- “12-minute Sell Pressure Scan”

- “4-line Incentive Loop”

- “30-minute DeFi Reality Check”

That kind of content builds trust—which is the real currency long-term.

3) Earn through careful DeFi participation (only after you prove you can exit)

Yes, you can earn yield. But beginners should treat it like learning a craft:

- start tiny

- track your positions

- understand your exit

- avoid stacking risks (LP + leverage + new protocol all at once)

Do this next (beginner-safe ladder):

- Start with a tiny, simple action on a reputable protocol

- Track results for 2–4 weeks

- Increase complexity only after you can explain your risks clearly

If you can’t explain the risk in one paragraph, you’re not ready to size up.

The “no-hype expectation” that keeps you sane

Here’s a healthier expectation than “I want a 10x.”

Aim for:

- fewer bad buys

- better entries (not fighting supply headwinds)

- better exits (not trapped in thin liquidity)

- learning that compounds

That’s how you turn crypto from a stress machine into a skill-building process.

A simple closing routine you can repeat every time

When you’re done researching a token, do this:

- Write: “I’m buying because ________.”

- Write: “I’m wrong if ________.”

- Write: “I exit if ________.”

- Size the position so you can sleep.

If you do this consistently, you won’t need perfect predictions. You’ll need good process.

Red flags checklist (short, sharp, and beginner-safe)

This is the section you come back to when your brain is screaming “but what if this is the next big thing?”

Read it like a bouncer at a club. If too many red flags show up, you don’t negotiate. You just don’t go in.

“Is this token basically a story with a price chart?”

If you can’t explain the token’s job in one sentence (from Part 1), you’re buying a narrative.

Red flags:

- The token’s “utility” is vague (“govern the future,” “build community”).

- The value proposition changes every month (“now we’re DeFi… now gaming… now AI…”).

- The only clear reason to hold is “it might pump.”

Do this next (2 minutes):

Write: “This token is needed for ________.”

If you can’t fill the blank without sounding like marketing, it’s watchlist at best.

“Is demand real, or is it paid demand?”

Paid demand is when incentives create activity, but the activity disappears when rewards disappear.

Red flags:

- The headline is always about APY.

- Users show up during campaigns and vanish afterward.

- The ecosystem feels busy, but nobody can explain what people use it for.

Do this next (1 minute):

Ask: “If rewards went to near zero, who stays—and why?”

If the honest answer is “nobody,” don’t size it like an investment.

“Is sell pressure baked in?”

This is the silent killer for beginners: you buy in the secondary market while the primary market keeps printing and distributing.

Red flags:

- Constant emissions to groups likely to sell (farmers/LPs).

- Big unlocks coming soon (especially recurring monthly unlocks).

- You can’t find a clear unlock schedule (unknown risk).

Do this next (10 minutes):

- Check basics on CoinGecko or CoinMarketCap.

- Check unlocks on TokenUnlocks if available.

- Check top holders on Etherscan (Ethereum) or Solscan (Solana).

If you can’t map who receives tokens and why they wouldn’t sell, keep the position tiny—or skip.

“Can I actually exit without pain?”

A lot of people learn this lesson too late: profit isn’t real until you can exit.

Red flags:

- Token trades mostly on a DEX with thin liquidity.

- The price moves wildly with small buys/sells.

- The pool looks deep only because incentives are propping it up.

Do this next (5 minutes):

- If it’s DeFi-ish, check the ecosystem footprint on DeFiLlama.

- If it trades on a DEX like Uniswap, assume slippage matters and size accordingly.

“Is governance real, or is decentralization just a vibe?”

A token can say “governance” and still behave like a small group controls everything.

Red flags:

- Top holders are extremely concentrated.

- Voting participation is tiny or inconsistent.

- Proposals are mostly “temperature checks” with no real effect.

Do this next (5 minutes):

If the project uses Snapshot, scan recent votes:

- Are there meaningful proposals?

- Are there enough voters to feel healthy?

- Does the same small group dominate outcomes?

“Are you being targeted by scams because you’re a beginner?”

This isn’t about being paranoid. It’s about not donating money to criminals.

Red flags:

- Someone DMs you “support,” “airdrop help,” or “urgent verification.”

- You’re asked to share seed phrases, export private keys, or sign random messages.

- The site looks real but the URL is slightly off.

Do this next (non-negotiable safety rules):

- Never share seed phrases. Never.

- Use official links only (from the project’s official website, not DMs).

- For interacting with DeFi, start with a fresh wallet and small test funds.

- If you’re storing meaningful value long-term, use a reputable hardware wallet and keep backups offline.

“Are you sizing like a gambler instead of an adult?”

Even a “good token” can be a bad buy if you size it like it can’t fail.

Red flags:

- You’re averaging down without a reason.

- You have no exit plan, only hope.

- One token is a huge chunk of your portfolio.

Do this next (30 seconds):

Pick a risk cap before you buy:

- “If this goes to zero, I lose at most ____% of my crypto portfolio.”

For most beginners, smaller is smarter. You want to survive long enough to learn.

Start today (45 minutes): a low-stress workflow to analyze any token

This is the exact routine I’d want a beginner friend to use. It’s short, calm, and designed to prevent the most common mistakes: buying vague utility, ignoring sell pressure, and getting trapped in illiquid markets.

You’ll need three things:

- a notes app

- three browser tabs

- the discipline to do a tiny “test buy” later instead of aping in

Step 0 (2 minutes): Write your “why” before you research

Open your notes and write two lines:

- “I’m interested in this token because ________.”

- “This would be a bad buy if ________.”

If you can’t write line #2, you’re not ready to buy. You’re just excited.

Step 1 (8 minutes): Token identity and basics (one screen only)

Open CoinGecko or CoinMarketCap.

Goal: not prediction—just context.

Write down:

- Market cap (small, mid, large—just a label)

- Circulating supply (is it already mostly out there?)

- Max supply (if it exists)

- Where it trades (CEX/DEX mix)

Quick interpretation:

- If supply info is missing or confusing, treat it as a risk signal.

- If the token is “everywhere” but nobody can explain why it exists, pause.

Step 2 (10 minutes): The one-sentence job + the “rewards-off” test

In your notes, write:

“This token helps [who] do [what] inside [ecosystem] because [specific benefit].”

Then answer:

- If rewards disappeared tomorrow, would anyone still use it? Why?

Pass examples (practical reasons):

- needed for fees/access

- needed as collateral

- needed for governance that changes real parameters

Fail examples (vibes):

- “community”

- “future”

- “it’s early”

If it fails, you can still watchlist or trade it—just don’t pretend it’s a safe hold.

Step 3 (10 minutes): Primary vs secondary reality (sell pressure scan)

Now you’re looking for the supply “engine.”

If the token appears on TokenUnlocks, check:

- What unlocks are coming in the next 7–30 days?

- Who receives them?

Then open the chain explorer:

Check:

- Top holders (is supply extremely concentrated?)

- Recent transfers (do you see consistent distribution?)

Write three lines:

- New supply enters via: rewards / unlocks / treasury / unknown

- Main receiver groups: ________

- Why they might sell: ________

If you can’t fill these lines, you don’t have clarity. Lack of clarity = smaller size or no buy.

Step 4 (10 minutes): Exit reality (liquidity + “can I sell?”)

This is where beginners get trapped.

If it’s a DeFi token or lives on-chain, open DeFiLlama and check:

- Does the ecosystem/protocol have meaningful footprint (TVL, presence)?

- Is it growing organically or spiking like a campaign?

If it mainly trades on a DEX (e.g., Uniswap), assume:

- slippage exists

- liquidity can vanish when incentives end

Do this next (practical):

- Decide your maximum buy size based on exit comfort, not hype.

- If you can’t confidently explain how you’ll exit, buy smaller—or don’t buy.

Step 5 (5 minutes): Make a decision that you can defend tomorrow

Pick one:

Buy small (starter position) if:

- token job is clear and necessary

- you understand who receives tokens and why they might sell

- you believe you can exit without chaos

Watchlist if:

- story makes sense, but proof is thin

- you want to observe how it behaves around unlocks/incentives

Walk away if:

- utility is vague

- demand looks paid

- supply flow is unclear or heavy

- liquidity/exit looks risky

Low-risk starter path (the one most beginners should use)

If you choose “Buy small,” do this:

- Buy a tiny amount (small enough you won’t stare at the chart all day).

- Set one review date (7–14 days).

- Write one exit trigger (price-based or thesis-based).

The point of the starter path is not to “get rich.”

It’s to build decision-making reps without emotional damage.

Higher-leverage path (only if you want a real edge)

If you want to earn opportunities without gambling on price, build skill inside one ecosystem.

Pick one direction:

- Learn DeFi mechanics deeply by studying a lending protocol like Aave.

- Learn AMM dynamics by studying how Uniswap works.

- Build a small public learning log or checklist on GitHub (even if you’re not a coder—notes count).

This path pays off because:

- you stop relying on hype

- you understand risk faster than most beginners

- you become useful (and usefulness creates opportunities)

What to remember before you buy any token

- Start with the token’s job, not the chart. If you can’t explain why someone needs the token, don’t buy it like an investment.

- Primary market rules your life. Emissions and unlocks create sell pressure that secondary-market hype can’t magically fix.

- Incentives create behavior. If the system pays people in tokens, assume many will sell—plan your sizing and timing accordingly.

- Activity isn’t always adoption. High velocity can be healthy usage or pure churn; always match “activity” to the token’s purpose.

- Exit ability is part of profit. If liquidity is thin, your gains might be imaginary when it’s time to sell.

- Process beats prediction. A simple routine with small position sizes will outperform emotional “all-in” buys over time.

Disclaimer

This article is for educational and informational purposes only and reflects general observations about cryptocurrencies, tokens, and DeFi mechanisms. It is not financial advice, not investment advice, and not a recommendation to buy, sell, or hold any asset.

Cryptocurrencies and crypto-tokens are high-risk and can be extremely volatile. You may lose some or all of your money. DeFi products can include additional risks such as smart contract vulnerabilities, liquidity risk, slippage, oracle failures, governance changes, bridge risks, and stablecoin depegs.

Any examples, tools, or platforms mentioned are provided for convenience and do not imply endorsement. Always do your own research, confirm details from official project documentation, and consider speaking with a licensed financial professional before making decisions. You are solely responsible for your actions and outcomes.

If this guide helped you make smarter crypto decisions (or saved you from a costly mistake), you can support my work with a coffee ☕😊

Your support keeps new beginner-friendly guides coming—clear, practical, and hype-free.

👉 Buy me a coffee here: https://timnao.link/coffee 💛