Zen Trading Breakthrough: Turn Fear into a Profitable Edge 🧘♂️🚀

Zen trading, trading psychology, and non-attachment aren’t mystical buzzwords. They’re practical tools you can use today to make fewer impulsive trades, follow your plan, and sleep better at night. This beginner-friendly guide shows you how to build a calm edge—step by step—so your decisions become clearer and your results more consistent.

Table of Contents

- Why Your Mindset Decides Your P&L 🧭

- Non-Attachment 101: Caring Without Clinging 🪶

- Control vs. Clarity: Stop Wrestling the Market 🧩

- The Duality Trap & The Beginner’s Mind 🧠

- Your Calm Edge: Meditation & Tactical Breathing 🫁

- A 10-Minute Pre-Market Ritual That Actually Works ⏱️

- Risk First: Rules That Protect Your Mind & Account 🛡️

- A Simple Starter System: Trend, Risk, Repeat 📈

- Timeframes: Trade Less, See More 🕰️

- Bias Busters: Beat Gambler’s Fallacy & Hot-Hand Hype 🎲

- Implementation Intentions: If-Then Plans That Stick 🧩

- Journaling Like a Pro: What to Track (and Why) 📓

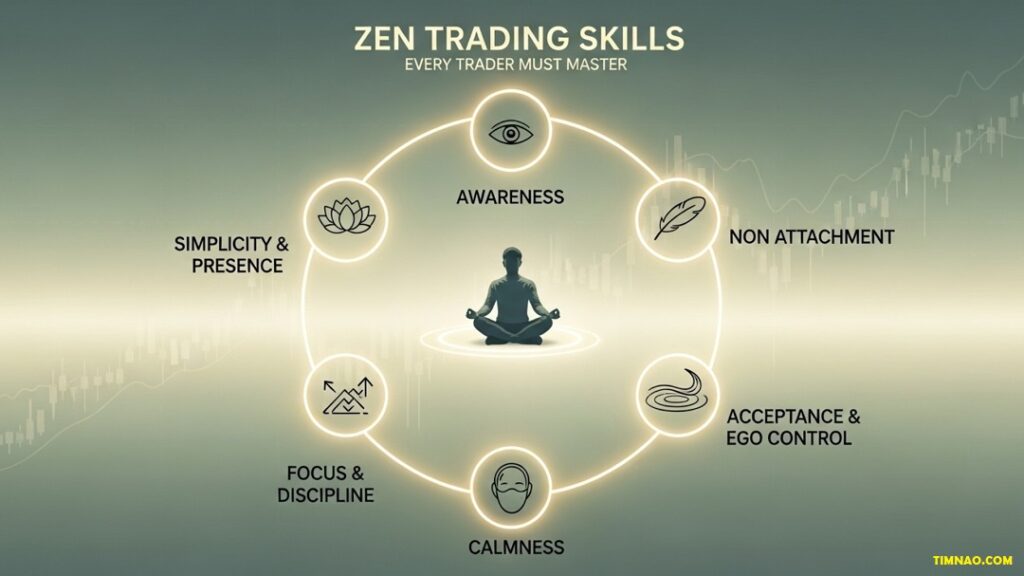

- 💎 6 Zen Trading Skills Every Trader Must Master 🧘♂️

- Tools You’ll Love: Platforms, Apps & Checklists 🛠️

- Case Studies: Three Calm Responses to Market Stress 🎯

- 7-Day Zen Trading Starter Plan 📅

- FAQs: Beginner Questions About Zen Trading Answered 🙋

- Key Lessons & Takeaways ✅

Why Your Mindset Decides Your P&L 🧭

When you first start trading, it’s tempting to believe that your success or failure will come down to how well you read charts, how fast your internet connection is, or how clever your strategy might be. But talk to any seasoned trader, and they’ll all tell you the same thing: your mindset is the single most powerful factor that determines your profit and loss (P&L).

Why? Because trading isn’t just a numbers game — it’s an emotional game. Every trade you take is influenced by how you feel in that moment: confident or scared, patient or impulsive, calm or panicked. Most beginners underestimate this and pay the price with inconsistent results. But once you understand how much of your performance is driven by psychology, you’ll see why mastering your mindset is far more valuable than memorizing any technical pattern.

🎯 Emotions Are the Hidden Hand Behind Every Trade

Let’s imagine two traders: Alex and Jamie. Both spot the same breakout setup. Alex enters calmly, sticks to the plan, and takes profit according to the rules. Jamie, on the other hand, hesitates at the last second, fearing the breakout might fail. They enter late, panic during a minor pullback, and exit for a small loss.

What caused the difference? Not the market. Not the setup. Not even the broker fees. The difference was emotional discipline. Alex acted based on logic. Jamie acted based on fear.

This example repeats itself countless times across trading desks around the world. It’s not that traders don’t know what to do — it’s that their emotions override their plans.

Some of the most common emotional traps include:

- Fear: Selling too early because you’re scared profits will vanish.

- Greed: Holding too long because you believe the price must go higher.

- FOMO (Fear of Missing Out): Jumping into trades you didn’t plan because you’re afraid of being left behind.

- Revenge Trading: Taking impulsive trades after a loss to “win it back.”

Each of these emotional reactions leads to decisions that stray from your trading plan — and those tiny deviations, repeated over time, destroy profitability.

🧠 Turning Reaction Into Response

The goal isn’t to eliminate emotions — that’s impossible. The goal is to manage them. The most successful traders don’t feel less fear or greed than you; they’ve simply trained themselves not to let those emotions dictate their behavior.

Here’s a simple three-step exercise you can use before every trade:

- Pause: When you feel a strong urge to act, stop for just 5–10 seconds.

- Label: Name the emotion — “I’m feeling FOMO,” or “I’m scared.” This reduces its power.

- Redirect: Ask yourself, “What does my trading plan say?” If your next move isn’t part of the plan, don’t do it.

This pause-label-redirect technique sounds simple, but with consistent practice, it builds the mental muscle to respond intentionally rather than react impulsively.

Non-Attachment 101: Caring Without Clinging 🪶

One of the most misunderstood but crucial trading principles is non-attachment. Beginners often assume that “detachment” means not caring — as if you should shrug off your trades and hope for the best. But that’s not what non-attachment means at all. In trading, non-attachment is about caring deeply about the process while being completely unattached to any specific outcome.

This is easier said than done. As humans, we crave certainty. We want our trades to win. We want to feel right. But the market doesn’t care about our wishes — it will do whatever it wants. The more emotionally attached you are to an outcome, the harder it is to adapt when reality doesn’t match your expectations.

💡 Caring vs. Clinging: The Crucial Difference

Here’s the distinction:

- Caring: “I followed my setup and risk rules. If it wins, great. If not, I’ll review and improve.”

- Clinging: “This trade has to work. I know I’m right. I’ll add more even though it’s falling.”

The first mindset keeps you objective and flexible. The second traps you in stubbornness — which often leads to bigger losses.

A classic example: You’re convinced that gold is in a long-term bull market. You buy. But instead of rising, it starts falling. If you’re clinging to your opinion, you double down (“It must bounce!”). If you’re non-attached, you cut the loss and move on. The first trader suffers a major drawdown. The second preserves capital and lives to trade another day.

🧘♂️ Techniques to Build Non-Attachment

Non-attachment is a skill — one you can train with deliberate practice. Here are three beginner-friendly methods:

- Reframe Losing Trades: Instead of seeing a loss as “failure,” view it as “data.” Each losing trade teaches you something — if you’re willing to listen.

- Pre-Plan Exits: Set stop losses and profit targets before you enter a trade. This prevents emotional decision-making when price starts moving.

- Detach Identity From Results: Your value as a person isn’t tied to your win rate. You’re a trader who follows a process — not a fortune teller who predicts markets.

🧪 A Simple Mindset Shift

Repeat this phrase before every session:

“My job is not to be right. My job is to follow my plan.”

It may feel strange at first, but this small shift helps you accept whatever the market gives you — profit or loss — without emotional overreaction. And the less you cling to outcomes, the more consistently you’ll execute your edge.

Control vs. Clarity: Stop Wrestling the Market 🧩

One of the most common beginner mistakes is believing that success in trading comes from more control — more indicators, more screen time, more trades, more alerts. But here’s the truth: the market is completely outside your control. You can’t control the price, the news, or the actions of millions of other traders. The only thing you can control is yourself.

Trying to control the uncontrollable leads to stress, overtrading, and inconsistent results. Clarity — not control — is what you should aim for.

🪙 The Illusion of Control

It’s natural to want control. After all, in most areas of life, more effort equals more results. But trading is different. The harder you try to “force” the market to behave, the more likely you are to make costly mistakes.

Here are a few signs you’re stuck in the control trap:

- You constantly change strategies after a few losing trades.

- You monitor every tick, convinced you can “outsmart” the market.

- You move stop losses because you don’t want to be wrong.

- You enter more trades just to feel “in control” of your results.

All of these behaviors stem from a misunderstanding: the belief that more action equals more success. In reality, more control often equals worse performance.

🧭 Focus on What You Can Control

Instead of trying to control the market, shift your focus to the few things you can control:

- Your Risk Per Trade: Decide in advance how much you’re willing to lose.

- Your Entry & Exit Rules: Clearly define them — and stick to them.

- Your Position Sizing: Never risk more than your plan allows.

- Your State of Mind: Use breathing, breaks, and journaling to stay calm and focused.

By mastering these controllable elements, you free yourself from obsessing over the rest. And ironically, when you stop wrestling the market, your trading becomes smoother and more consistent.

🧩 The Power of Clarity

Clarity means seeing the market for what it is, not what you want it to be. It’s about observing without judgment, adapting without panic, and acting without emotional baggage.

Here’s a practical daily exercise to develop clarity:

- Morning Reset: Before the session, spend 2 minutes writing down what you don’t know (e.g., “I don’t know if the market will go up or down.”).

- Plan Focus: Next, write what you do know (e.g., “If price breaks above this level, I’ll buy. If not, I’ll wait.”).

- Detach: Finally, repeat: “I control my plan, not the market.”

This ritual rewires your brain to approach trading with humility and openness — two traits shared by every consistently profitable trader.

Mastering your trading psychology isn’t about reading motivational quotes or forcing yourself to “be disciplined.” It’s about building habits and mental models that support rational, process-driven decisions.

- Your mindset determines how you interpret and act on information.

- Non-attachment allows you to execute plans without emotional baggage.

- And clarity, not control, is the key to consistent decision-making.

When you stop trying to “win” every trade and instead focus on executing your plan with emotional neutrality, trading becomes dramatically easier — and far more profitable. Remember: the market is unpredictable, but your behavior doesn’t have to be. Train your mind, and your P&L will follow.

The Duality Trap & The Beginner’s Mind 🧠

One of the biggest challenges for new traders isn’t the market itself — it’s the way they think about the market. Most beginners quickly fall into what I call the duality trap. This is the habit of labeling every trade, every move, and every day as either good or bad, right or wrong, win or loss.

This black-and-white thinking seems logical at first. After all, a trade either makes money or it doesn’t, right? But the reality is more nuanced. The market is just movement: prices go up, down, or sideways. It’s not good or bad until you attach a judgment to it. And those judgments are what create stress, panic, and poor decision-making.

How Dualistic Thinking Hurts Beginners

Duality creates emotional turbulence. When you call a trade “bad,” you might overreact, abandon your plan, or hesitate the next time a valid setup appears. When you call a trade “good,” you risk overconfidence, doubling down, or forgetting your risk rules.

Here are some common ways duality plays out:

- Confirmation bias: You only look for evidence that proves you’re right, ignoring signals that suggest otherwise.

- Emotional swings: You feel like a genius when price moves in your favor, and a fool when it doesn’t.

- Rigidity: You stick to your original opinion (“the market must go up”) even when new data says otherwise.

A classic beginner mistake looks like this: you’re convinced that a stock is about to rally. You buy in, but instead of going up, it dips. Instead of cutting the trade according to your plan, you hold on, telling yourself “it will come back.” That stubbornness is the duality trap in action.

What Is the Beginner’s Mind?

Zen philosophy offers a way out: the beginner’s mind (or shoshin). It means approaching each situation with openness, curiosity, and humility — as if you’re seeing it for the first time.

In trading, the beginner’s mind allows you to stay flexible. Instead of clinging to being right, you stay aligned with your process. You don’t fight the market; you observe and respond.

For example:

- Instead of “This is a bad trade,” ask: “What information is the market giving me?”

- Instead of “I can’t afford another loss,” ask: “What does my plan suggest if this fails?”

This simple shift takes the pressure off being right and places it back where it belongs — following a process consistently.

How to Practice Beginner’s Mind in Trading

- Empty Cup Journaling (5 minutes daily): Write down three things you admit you don’t know about today’s market. Example: “I don’t know how investors will react to earnings.” This softens your urge to predict.

- If–Then Planning: Create clear rules. Example: “If price breaks above $50 on volume, then I’ll buy half my position. If it falls below $48, then I’ll stop out.” This keeps you flexible and removes ego.

- Label Switch: When you feel tempted to call a trade “good” or “bad,” instead label it “interesting,” “instructive,” or “worth reviewing.” This reframe lowers emotional intensity.

Trading with a beginner’s mind isn’t about ignoring risk. It’s about staying adaptable, curious, and aligned with your plan rather than your ego.

Your Calm Edge: Meditation & Tactical Breathing 🫁

Every beginner wants to know the best indicator, the best chart setup, or the best strategy. But here’s a secret: your biggest edge isn’t another tool — it’s your ability to stay calm. Calm traders follow their plan. Anxious traders break it.

Two simple practices can help you develop that calm edge: meditation and tactical breathing. You don’t need hours a day or a yoga mat. Just a few minutes of practice can dramatically improve your decision-making.

Meditation for Traders

Meditation is often misunderstood. It’s not about “emptying your mind” or chanting for hours. It’s about training your attention. In trading, that means learning to notice emotions like fear or greed without immediately reacting to them.

Imagine this: you see a breakout forming, and your mind screams, “Don’t miss it!” Instead of rushing in blindly, meditation gives you the skill to pause, notice the thought, and return to your trading plan. That pause might be the difference between a disciplined entry and a costly mistake.

How to start meditating as a trader:

- Start with just 2–5 minutes daily.

- Sit comfortably, close your eyes, and focus on your breath.

- When your mind wanders (and it will), simply bring it back to the breath.

Over time, meditation strengthens your ability to stay calm under pressure. It builds the “muscle” of focus you’ll rely on when the market gets volatile.

Tactical Breathing: Your Instant Reset Button

Sometimes you don’t have five minutes. You need calm right now. This is where tactical breathing (also known as box breathing) comes in. It’s a proven method used by soldiers, athletes, and yes, professional traders to reset their nervous system in stressful moments.

Here’s how it works:

- Inhale through your nose for 4 seconds.

- Hold for 4 seconds.

- Exhale through your mouth for 4 seconds.

- Hold empty for 4 seconds.

Do this for 3–4 cycles. Within a minute, you’ll feel your heart rate drop and your focus sharpen.

Best times to use tactical breathing:

- Before the market opens, to start calm.

- After a loss, to prevent revenge trading.

- When tempted to chase a move.

Calm as a Trading Superpower

Calm doesn’t guarantee profits. But it guarantees you show up in the best possible mental state. Without calm, even great strategies fail because you won’t execute them consistently. With calm, even a simple setup can bring long-term success.

Meditation and tactical breathing are your foundation. They don’t replace your trading plan; they make it possible to actually follow it.

A 10-Minute Pre-Market Ritual That Actually Works ⏱️

Imagine starting your trading day scattered: scrolling news, flipping charts, checking social media, second-guessing setups. By the time the bell rings, your mind is already exhausted. This is how many beginners operate — and why they struggle.

What you need instead is a pre-market ritual. A short, structured routine that clears your head and prepares you to execute. Think of it as a warm-up for your trading brain.

Why You Need a Ritual

High-pressure professions — like surgeons, pilots, or firefighters — rely on checklists and rituals. Why? Because routines reduce stress and prevent mistakes. Trading is no different. A ritual ensures you’re grounded, focused, and aligned before the chaos begins.

The 10-Minute Routine

Here’s a simple, effective sequence you can adopt tomorrow:

- (2 minutes) Breathing Reset: Do tactical breathing to calm your nervous system.

- (2 minutes) Review If–Then Rules: Read your trading rules aloud. Example: “If my daily stop is hit, then I stop trading for the day.”

- (3 minutes) Mark Key Levels: Identify major support and resistance levels. Keep it simple — don’t overcomplicate.

- (2 minutes) Risk Check: Confirm your position sizing and daily max loss.

- (1 minute) Visualize Patience: Close your eyes and imagine yourself not trading when conditions aren’t right. This strengthens discipline.

Total: 10 minutes. That’s all it takes to set yourself up for success.

Why This Routine Works

This ritual works because it combines three essential elements:

- Mindset reset: You start calm, not reactive.

- Clarity: You know exactly what to do in different scenarios.

- Risk awareness: You’ve protected yourself before placing a trade.

Over time, this routine becomes second nature. It grounds you in process, not emotion. And that consistency is what separates struggling traders from those who succeed long-term.

Risk First: Rules That Protect Your Mind & Account 🛡️

Most beginners enter trading focused entirely on profit. They chase big wins, dream of doubling their account, and treat risk as an afterthought. This is one of the fastest ways to fail. Successful traders know something very different: risk comes first — profits follow.

The truth is, trading is a game of probability. Even the best strategies lose trades. What separates a professional from a beginner isn’t how much they make when they win, but how little they lose when they’re wrong. The mindset shift from “How much can I make?” to “How much can I afford to lose?” is one of the most powerful turning points in a trader’s journey.

Why Risk Management Is Your Psychological Safety Net

Without clear risk rules, every trade feels like a life-or-death event. A single losing position can spiral into panic and revenge trading. You start making emotional decisions — doubling down, moving stops, or refusing to cut losses — because you’re afraid of the consequences.

But when you have risk limits in place, you give yourself permission to lose. You accept that losses are part of the game, and they no longer control you. This psychological safety net keeps you calm and objective — and ironically, that calmness leads to better decisions and bigger profits over time.

The Core Principles of Risk-First Trading

Let’s break down the most important rules every trader — especially beginners — should adopt:

1. Define Your “R” Value

“R” represents the amount of capital you’re willing to risk on a single trade. Most professionals risk between 0.5% and 2% of their account per trade. This means that even after a losing streak, your capital remains intact and recoverable.

For example, if your account is $10,000 and you risk 1% per trade, your “R” is $100. Every trade you take should be structured so that if your stop loss hits, you lose no more than $100.

2. Use Hard Stop-Losses — Always

Mental stops are a recipe for disaster. The moment emotions kick in, you’ll convince yourself to “wait just a little longer.” Instead, always place hard stops directly in your trading platform before you even enter a trade. This one habit can save you from catastrophic losses.

3. Set a Daily Max Loss Limit

Even with good risk per trade, emotions can spiral during losing streaks. That’s why professionals also set a daily max loss — often around 2–3% of their account. If you hit that limit, you stop trading for the day, no exceptions.

This rule isn’t just about protecting capital — it’s about protecting your state of mind. A few bad trades won’t destroy you. Emotional trading after a few bad trades might.

4. Always Think in Risk-Reward Ratios

Before taking a trade, ask: “Is the potential reward worth the risk?” A healthy minimum is 2:1 — meaning you aim to make at least twice what you’re risking. If you’re risking $100, the trade should offer a realistic $200 profit potential. This ensures that even if you lose more often than you win, your profits will still outpace your losses.

A Psychological Bonus: The Risk Ceiling Mindset

Here’s a powerful shift: instead of thinking, “I’m risking $100,” think, “I’m buying information for $100.” Each trade — win or lose — teaches you something about your system, your psychology, or the market. This removes the sting from losses and reframes them as part of your long-term growth.

A Simple Starter System: Trend, Risk, Repeat 📈

Once you’ve built a solid risk foundation, the next step is to simplify your trading approach. Most beginners overcomplicate things — they use too many indicators, chase too many setups, and end up confused and inconsistent.

Here’s the truth: the simplest systems often work best, especially for new traders. The key is to focus on trend, risk, and repetition — three pillars that make trading easier, clearer, and more effective.

Step 1: Follow the Trend

You’ve probably heard the phrase, “The trend is your friend.” It’s cliché because it’s true. Trading in the direction of the prevailing trend dramatically increases your odds of success. Fighting the trend is like swimming upstream — exhausting and unnecessary.

How to identify a trend:

- Higher highs and higher lows = uptrend

- Lower highs and lower lows = downtrend

- Sideways range = no clear trend (best to stay out)

You don’t need complicated tools. Even a simple 20-day and 50-day moving average can help you spot the dominant direction.

Step 2: Plan Your Entry and Exit

Once you identify a trend, plan your trades around it:

- Entry: Look for pullbacks to support in an uptrend or resistance in a downtrend.

- Stop Loss: Place it just beyond the previous swing low (for longs) or swing high (for shorts).

- Target: Use a 2:1 reward-to-risk ratio as a minimum. If you’re risking $100, aim for at least $200 in profit.

A simple example:

- Price is trending up.

- It pulls back to a previous support level.

- You enter long, risking $100 with a stop below support.

- Your profit target is $200 above entry.

This approach isn’t glamorous, but it’s effective — and that’s what matters.

Step 3: Keep It Consistent

The final step is the most important: repetition. Many beginners sabotage themselves by constantly changing strategies. They take three trades, have two losses, and then abandon the system.

Here’s the reality: even the best systems lose trades. The goal isn’t to win every trade — it’s to execute your edge consistently over time. Your results will stabilize only when your behavior does.

A Practical Checklist for a Beginner System

Before each trade, ask yourself:

- Am I trading with the trend?

- Is my risk per trade defined and acceptable?

- Do I have a clear entry, stop, and target?

- Is the risk-reward ratio at least 2:1?

- Am I following my plan — not my emotions?

If you answer “yes” to all five, you’re on the right track.

Timeframes: Trade Less, See More 🕰️

Many beginners believe that trading more often equals more profit. They stare at 1-minute charts, take dozens of trades a day, and end up exhausted — with little to show for it. The truth is the opposite: trading less often usually leads to better results.

Why? Because higher timeframes (like the 1-hour, 4-hour, or daily charts) filter out noise and show you the real market structure. They give you more reliable signals and reduce emotional whiplash.

The Dangers of Trading Too Frequently

- More noise: Lower timeframes are filled with random price movement that means nothing.

- More stress: Rapid decisions increase emotional fatigue and impulsive mistakes.

- More costs: Frequent trades mean more commissions and slippage eating into your profits.

In short: overtrading destroys clarity, confidence, and capital.

How to Choose the Right Timeframe

As a beginner, start with higher timeframes. Daily or 4-hour charts give you more reliable signals and plenty of time to plan trades. Once you master discipline and risk control, you can experiment with shorter timeframes if you want.

A useful rule of thumb:

- Daily charts: Best for swing traders (holding positions for days or weeks).

- 4-hour charts: Good for position traders (holding for hours or days).

- 1-hour charts: Acceptable for active day traders — but only if your discipline is strong.

The “Three Timeframe” Method

A great beginner technique is to use three timeframes together:

- Higher timeframe (daily): Defines the major trend.

- Middle timeframe (4-hour): Identifies key support and resistance zones.

- Lower timeframe (1-hour): Times your entry and exit precisely.

This multi-layered view keeps you aligned with the big picture while still allowing for tactical execution.

Why Trading Less Works Better

Fewer trades mean better trades. By waiting patiently for high-probability setups, you improve your win rate and reduce emotional decision-making. Think of it like fishing: casting 100 times in random spots won’t beat waiting patiently at the right place and time.

A good rule to follow: “If there’s no clear setup, there’s no trade.” Doing nothing is a valid — and often profitable — choice.

Bias Busters: Beat Gambler’s Fallacy & Hot-Hand Hype 🎲

One of the most powerful forces working against traders — especially beginners — isn’t the market. It’s cognitive bias. Biases are built-in shortcuts your brain uses to make decisions faster. They help in everyday life, but in trading, they often lead to costly mistakes. Two of the most common and dangerous are Gambler’s Fallacy and Hot-Hand Bias.

Understanding and defeating these biases isn’t just about becoming more “rational.” It’s about protecting your capital and improving decision quality. Once you recognize their subtle influence, you can build systems to counter them — and start trading with clarity instead of instinct.

🎰 Gambler’s Fallacy: “It Has to Reverse Soon!”

The Gambler’s Fallacy is the belief that past events somehow influence future outcomes in random situations. In trading, this shows up as the assumption that a losing streak “has to” end soon, or that a winning streak “can’t” continue.

Here’s a classic example:

- A trader loses five trades in a row. They think, “I’m due for a win,” and place a larger position on the next trade — only to lose again.

- Or, they see a stock rally for seven straight days and think, “It has to pull back soon,” so they short it — and the rally continues.

The market doesn’t have memory. Each trade is independent, and probabilities don’t “correct” themselves in the short term. Thinking they do is one of the fastest ways to blow up an account.

✅ How to fight it:

- Use position sizing rules that don’t change based on recent wins or losses.

- Focus on your trading plan, not your emotional need for balance.

- Track data over hundreds of trades to understand your real win/loss probabilities — not assumptions from a small sample.

🔥 Hot-Hand Bias: “I Can’t Miss!”

Hot-Hand Bias is the opposite problem: believing that a winning streak will continue simply because it’s happening. After a few great trades, you start to feel invincible. You size up, skip confirmations, or deviate from your plan because you “just know” the next one will work too.

This bias is especially dangerous because it hides behind confidence. The more wins you have, the more justified your overconfidence feels — until one oversized losing trade wipes out all the gains.

✅ How to fight it:

- Use a consistent risk percentage per trade, no matter how many wins you’ve had.

- Add a “cooling-off” period after a big win to avoid impulsive trades.

- Review your journal weekly to spot any signs of growing overconfidence.

By understanding both biases, you can see how they’re really two sides of the same coin: one pushes you to chase after losses, and the other tempts you to gamble with your winnings. Mastering your mindset here can dramatically reduce emotional trading mistakes.

Implementation Intentions: If-Then Plans That Stick 🧩

Trading isn’t about knowing what to do — it’s about doing it consistently. Most traders know they should cut losses quickly, let winners run, and avoid chasing trades. But in the heat of the moment, emotion takes over and discipline vanishes.

One of the most powerful psychological tools to solve this problem is something behavioral scientists call implementation intentions — or, more simply, If-Then plans. These are pre-made decisions that guide your actions automatically when certain conditions occur.

🧠 How If-Then Planning Works

An If-Then plan links a specific situation (if) to a pre-decided action (then). Instead of making a choice in the heat of the moment, you’ve already made it in advance. This reduces decision fatigue and emotional interference.

For example:

- If my trade hits my stop loss, then I will exit immediately and step away for 10 minutes.

- If the stock breaks above yesterday’s high with volume, then I will enter half my position.

- If I feel FOMO pushing me to trade, then I will recheck my plan before acting.

These simple statements might look obvious, but they’re powerful because they automate discipline. Over time, they become second nature, reducing hesitation and impulsive mistakes.

📊 How to Build Effective If-Then Plans

- Identify your problem points. Where do you struggle most? Exiting too early? Chasing entries? Oversizing?

- Write specific triggers. Make the “if” condition as clear as possible. (“If RSI > 70” is better than “If it feels overbought.”)

- Decide the response. Keep the “then” action simple and actionable. (“Then I will exit half” is better than “Then I will reconsider.”)

- Review and refine. Over time, track which plans you followed and adjust them if they’re too vague or unrealistic.

✅ Pro tip: Say your If-Then plans out loud before each session. This strengthens the mental connection and makes you more likely to follow them in real time.

🧩 Why If-Then Plans Are a Game-Changer for Beginners

Beginners often struggle not because they lack knowledge, but because they can’t act on what they know. Implementation intentions bridge that gap. They reduce hesitation, build automatic habits, and help you execute your plan — even when emotions run high.

With enough practice, If-Then planning becomes your built-in autopilot. And when discipline is automated, consistency follows.

Journaling Like a Pro: What to Track (and Why) 📓

If there’s one habit that separates amateurs from professionals, it’s journaling. Yet most beginners skip it because it feels boring or unnecessary. That’s a huge mistake. A trading journal is more than a record of trades — it’s a mirror that reveals your strengths, weaknesses, and psychological patterns.

Think of your journal as your personal trading lab. It’s where you collect data, analyze results, and make adjustments. Without it, you’re flying blind. With it, you gain insight that compounds over time.

🧾 What to Track in Your Journal

A great trading journal goes beyond simple P&L. It should capture both technical and psychological data. Here’s what to include:

1. Trade details:

- Ticker, entry/exit price, position size, date/time.

- Setup type and market conditions.

2. Pre-trade mindset:

- How were you feeling before entering? (Calm, rushed, overconfident, anxious)

- Did you follow your If-Then plan?

3. Post-trade review:

- Was the trade executed according to plan?

- What went well? What went wrong?

- What would you do differently next time?

4. Screenshot the chart:

Visual evidence is extremely valuable. Screenshots help you review trades later and see patterns you might have missed in the moment.

📈 The Hidden Benefits of Journaling

- Pattern recognition: Over time, you’ll see which setups consistently work — and which don’t.

- Psychological awareness: You’ll notice emotional triggers that lead to bad decisions.

- Objective feedback: Your journal becomes a truth serum. It shows whether you’re really following your plan or just telling yourself you are.

A journal also transforms losses from setbacks into learning opportunities. Instead of saying “I lost again,” you can say, “I exited too early because I was scared — next time I’ll trust my plan.”

🛠️ Tools to Make Journaling Easier

You don’t have to build a journal from scratch. Platforms like TradingView let you annotate charts and keep trade notes directly on-screen. Or you can use a spreadsheet tool or dedicated journaling apps to log trades and performance metrics. The tool isn’t important — what matters is consistency.

🧭 Turning Journaling Into a Performance Engine

Set aside 15–20 minutes every week to review your journal. Look for patterns:

- Are most of your losses from the same type of setup?

- Are you skipping profitable trades because of fear?

- Are you breaking your rules after a big win or a big loss?

Use these insights to refine your strategy, strengthen your If-Then plans, and target specific areas for improvement. This is how amateurs evolve into professionals — not by guessing, but by studying themselves relentlessly.

💎 6 Zen Trading Skills Every Trader Must Master 🧘♂️

Success in trading is not only about charts, numbers, or strategies — it’s about mastering yourself.

The market is neutral. What makes trading feel chaotic or peaceful is the state of your own mind.

That’s the philosophy behind Zen Trading: learning to respond to markets with clarity, not emotion.

Below, we’ll explore six foundational Zen Trading skills every trader needs to develop — step by step, in practical, beginner-friendly language. These are not abstract ideas. They are trainable skills that can completely transform how you trade, think, and feel.

1. Awareness – Seeing Without Reacting 👁️🗨️

Zen begins with awareness — the ability to see things as they are, not as your emotions color them.

In trading, awareness means recognizing your internal state while analyzing or executing a trade.

A beginner often focuses 100% on price action, but forgets to watch their own mind. They see a red candle and feel fear; they see a green one and feel greed. Without awareness, emotion drives action — and action without clarity leads to chaos.

How to build awareness

- Pause before entering a trade.

Ask yourself: What am I feeling right now? Excitement, anxiety, boredom? Naming the emotion weakens its control. - Track your state.

In your trading journal, add a small column for “emotional rating” (e.g., calm = 1, tense = 5). - Practice short meditations.

Spend 2–3 minutes simply observing your breath before the trading session begins. Don’t “try to relax.” Just watch.

Real-world example

A trader notices their hands tightening on the mouse before clicking “buy.” That tiny awareness allows them to pause and realize: I’m chasing a move, not following my plan.

One deep breath later, they skip the trade — and avoid a loss.

✅ Zen takeaway: Awareness is not about eliminating emotion; it’s about seeing it clearly enough that it doesn’t control you.

2. Non-Attachment – Caring Without Clinging 🪶

Non-attachment doesn’t mean not caring — it means not clinging.

Traders often attach to outcomes (“I must win”), to ideas (“this setup can’t fail”), or to identity (“I’m a good trader”).

When attachment grows, fear of loss increases, and clarity fades.

The Zen trading mindset

Instead of chasing certainty, Zen traders embrace uncertainty.

They understand that losses are not failures — they’re feedback.

You still care about results, but you don’t let them define you.

Your worth doesn’t fluctuate with your profit and loss statement.

Practical ways to practice non-attachment

- Set your risk per trade before you click “buy.”

Once defined, accept that money as already lost. This instantly lowers emotional pressure. - Detach from individual outcomes.

Focus on executing your edge 100 times — not whether this trade wins. - Use “what if I’m wrong?” rituals.

Before every entry, ask yourself calmly: If this fails, what’s my response?

Example in action

Imagine taking a trade that hits your stop-loss. Instead of frustration, you note:

“I followed my plan. This outcome doesn’t change my skill.”

That mindset shift is what separates amateurs from professionals.

✅ Zen takeaway: Non-attachment turns losing trades from emotional wounds into neutral data points.

3. Calmness – Your Unfair Advantage 🌊

Calmness is not passive — it’s active balance.

In Zen Trading, calmness is your edge: the mental clarity to make decisions while everyone else panics.

A calm mind sees clearly. A reactive mind sees distortions.

The neuroscience of calm

When we panic, the brain’s amygdala takes over, shutting down logical reasoning.

Simple breathing exercises — especially box breathing (inhale 4s, hold 4s, exhale 4s, hold 4s) — shift the body back to a balanced state where logic returns.

How to build calmness into your daily trading

- Pre-market breathing ritual:

Sit for two minutes and perform three rounds of box breathing. Feel the body settle before analysis. - Use breathing between trades:

Every time you close a position, breathe before you look at your results. - Digital calm-down:

Turn off sound alerts and social media feeds during trading hours. Noise fuels anxiety.

Practical story

During a high-volatility session, two traders see the same chart. One panics, sells at the bottom, and regrets it. The other pauses, breathes, and waits. The price recovers, and the calm trader exits profitably.

The market didn’t change — only the state of mind did.

✅ Zen takeaway: Calmness is not the absence of stress; it’s the ability to stay centered amid stress.

4. Acceptance & Ego Control – The Art of Letting Go 🪞

In trading, ego is your invisible enemy.

It whispers: “You’re smarter than the market.” Or worse: “You can’t afford to be wrong.”

But Zen traders understand — the market doesn’t care about your ego. It rewards humility and punishes pride.

The power of acceptance

Acceptance doesn’t mean liking a loss — it means acknowledging reality as it is.

When you accept, you stop wasting energy resisting.

That frees up mental bandwidth for intelligent action.

Ways to practice ego control

- Normalize being wrong.

Even elite traders are wrong 40–50% of the time. Your goal is profitable imperfection, not perfection. - Journal your “ego trades.”

Whenever you enter a trade to prove something (“I’ll show I’m right”), mark it in your journal. - Adopt a learning mindset.

Replace “I lost” with “I learned.” Ask: What did the market just teach me?

Practical example

After three wins, a trader feels invincible and doubles their position size. The next trade goes against them, erasing all gains. Ego turned confidence into destruction.

Contrast that with a Zen trader: they celebrate wins privately, but keep their size consistent. Their self-worth doesn’t depend on any single trade.

✅ Zen takeaway: Acceptance is strength. Ego resists; wisdom adapts.

5. Focus & Discipline – The Bridge Between Intention and Action 🎯

Discipline is where most traders fail — not because they lack skill, but because they don’t execute their knowledge consistently.

Zen teaches that discipline comes not from willpower, but from structure and awareness.

Why discipline feels hard

Your brain is wired to avoid pain — and losing trades feel painful. So it creates shortcuts (revenge trading, skipping stops, chasing moves) to escape discomfort.

Zen trading reframes discipline: instead of forcing behavior, you design your environment to support the right behavior automatically.

How to build focus and discipline

- Create your daily structure.

Same pre-market checklist, same trading window, same review time. Routine builds mental safety. - Trade less to trade better.

Choose one or two setups and master them. Simplicity enhances focus. - Use a “rule card.”

Write your five golden rules on a card near your desk. Read them before every session.

When it clicks

Discipline becomes freedom.

When you no longer debate whether to follow your plan — you just do — trading stops being stressful.

The less mental energy you waste on decisions, the more clarity you gain for analysis.

✅ Zen takeaway: True discipline isn’t about restriction — it’s about liberation through consistency.

6. Simplicity & Presence – The Beauty of Doing Less 🌿

Modern traders drown in information: 10 indicators, 8 timeframes, 20 opinions.

Zen trading returns you to simplicity — the art of focusing on what truly matters.

Why simplicity wins

Complex systems create confusion under pressure.

When you’re emotional, you can’t process 10 indicators. You need one clear signal and trust in your plan.

Presence complements simplicity.

Presence means being fully here — not thinking about yesterday’s loss or tomorrow’s news.

A present trader executes now, not later.

How to cultivate simplicity & presence

- Simplify your chart.

Remove unnecessary indicators. Keep price action, key levels, and volume. - Trade in silence.

Eliminate background noise and distractions. Multitasking is the enemy of presence. - Single-task your attention.

When you trade, just trade. No checking social media, no browsing.

Real-life parallel

Think of a Zen archer. They don’t worry about the last arrow or the next. They draw the bow, breathe, release.

Trading is the same: align, breathe, execute — one trade at a time.

✅ Zen takeaway: Simplicity reveals truth. Presence transforms chaos into clarity.

Integrating the Six Skills Into Daily Practice 🧩

These six skills are not abstract — they can be trained just like muscle memory. Here’s how to blend them into your day:

Morning (Preparation)

- 5 minutes meditation or calm breathing (Calmness, Presence)

- Review daily affirmations: “I accept losses; I follow my process.” (Non-Attachment, Acceptance)

- Visualize executing 3 trades flawlessly, regardless of result. (Discipline)

During the Trading Session

- Pause before every trade (Awareness).

- Record your emotion level (Awareness).

- Follow rule card and position size limits (Discipline).

- Take 3 deep breaths after each exit (Calmness).

Post-Market Routine

- Journal emotions and rule adherence (Acceptance, Awareness).

- Note where ego interfered. (Ego Control)

- Simplify tomorrow’s plan — fewer charts, cleaner workspace. (Simplicity)

The key isn’t perfection. It’s repetition. Each time you practice, you weaken the grip of emotion and strengthen your inner balance.

When All Six Skills Work Together ⚙️

Imagine this:

You’re watching a setup unfold. You feel tension (Awareness), breathe deeply (Calmness), and execute according to plan (Discipline).

You take your stop-loss (Non-Attachment), accept it without ego (Acceptance), and prepare for the next setup with clear focus (Simplicity & Presence).

That’s Zen Trading in motion — effortless precision born from inner peace.

The Deeper Reward of Zen Trading 🌺

These skills don’t just make you a better trader — they make you a better human.

You’ll notice the same calm clarity appearing in other parts of your life:

- You’ll respond to stress instead of reacting to it.

- You’ll communicate more patiently.

- You’ll stop needing constant control and start trusting your process.

Trading becomes not a battle, but a mirror — reflecting who you are and who you can become.

“The goal of Zen is not to escape life, but to live it with awareness.

The goal of Zen Trading is not to escape loss, but to trade with awareness.”

Tools You’ll Love: Platforms, Apps & Checklists 🛠️

Trading is a craft — and like any craft, your tools matter. A skilled trader with the wrong platform, disorganized data, or missing risk checks is like a chef trying to cook without knives. The right setup doesn’t make you profitable by itself, but it removes friction, keeps you organized, and helps you stay consistent.

In this section, we’ll break down the essential tools you should consider as a beginner — from trading platforms and research apps to journaling software and ready-to-use checklists. You’ll learn not just what to use, but also how to integrate each tool into your daily routine for maximum impact.

Trading Platforms: Your Control Center

Your trading platform is where everything happens — charting, analysis, execution, and order management. It’s the cockpit of your trading journey, so choose it carefully. A good platform should be fast, stable, and intuitive, with the flexibility to grow with your skills.

Here are three of the most popular platforms worth mastering:

- TradingView – Ideal for beginners and pros alike, TradingView is a web-based platform with excellent charting tools, social trading features, and a huge community sharing setups and scripts. Its intuitive interface and powerful alert system make it a must-have for technical analysis.

- MetaTrader 5 – A classic choice for forex and CFD traders, MetaTrader offers fast execution, a built-in strategy tester, and support for automated trading systems (Expert Advisors). It’s also lightweight and widely supported by brokers.

- Thinkorswim – Perfect for stock and options traders, Thinkorswim is a robust platform with powerful analytics, backtesting capabilities, and advanced order types. It also offers a paper trading mode — a great feature for beginners to practice without risk.

Tips for beginners:

- Don’t overload your platform with dozens of indicators. Start with price, volume, and maybe one or two moving averages.

- Save custom layouts and templates so you don’t waste time setting up charts each day.

- Explore paper trading or demo accounts before risking real money.

Research & Analysis Tools: See the Bigger Picture

No matter how technical your strategy is, markets are influenced by news, macro events, and sentiment. Having a few good research tools in your arsenal can give you an edge and keep you ahead of sudden market shifts.

Here are some trusted tools to help you analyze and understand the broader market:

- Finviz – A powerful stock screener that helps you filter thousands of tickers based on criteria like price, volume, fundamentals, and technical signals. A must-use for swing and position traders.

- Benzinga Pro – Real-time news, audio alerts, and unusual options activity tracking. Ideal for active traders who need up-to-the-second information.

- Seeking Alpha – Deep market analysis, earnings breakdowns, and sentiment insights. Useful for building a narrative around trades and understanding the fundamental backdrop.

Pro tip: Combine research tools with technical analysis. For example, if your charts show a breakout, check the news flow before entering. Sometimes, knowing the “why” behind the price action can improve your conviction — or save you from a bad trade.

Risk & Position Management: Protect Your Capital

Every successful trader understands this fundamental truth: capital preservation is priority #1. That’s why risk management tools are non-negotiable. They help you calculate position size, manage exposure, and avoid catastrophic drawdowns.

Here are some tools that make risk management much easier:

- Myfxbook – Excellent for forex and CFD traders, this platform automatically tracks your trades and risk metrics. It gives you insights into win rates, drawdowns, and risk exposure.

- TraderSync – A trade journal and performance analytics tool that visualizes your risk profile over time. It helps you identify when you’re taking too much risk or deviating from your plan.

- Portfolio Visualizer – Best for backtesting strategies and understanding risk-return relationships. If you mix trading with investing, this is an invaluable tool.

Beginner tip: Set a daily max loss limit (e.g., 2% of your account) and use a risk calculator before every trade. Over time, this habit will save you from emotional blow-ups.

Journaling Tools: Turn Data Into Insights

If trading is a performance skill, journaling is how you measure progress. Keeping a record of every trade — including the reasons you took it, how you felt, and what the outcome was — is one of the most powerful ways to accelerate your learning.

Here are the best tools for journaling and performance tracking:

- Edgewonk – A comprehensive journaling platform that lets you tag trades, track emotions, and analyze performance trends. Its simulation tools even show how small behavioral changes could improve results.

- Tradervue – Simpler and more beginner-friendly, Tradervue automatically imports trades from most brokers and provides analytics, reports, and trade summaries.

- Notion – While not a dedicated trading tool, Notion is incredibly flexible. You can build a fully customized trading journal, dashboard, or performance database.

What to record in your journal:

- Trade details (ticker, entry, exit, size, stop, result)

- Setup notes (trend, pattern, news catalyst)

- Psychological notes (confidence level, emotional state)

- Post-trade review (what went right, what you’ll change)

Pro tip: Review your journal weekly. Patterns will emerge — maybe you lose more on trades you enter late, or win more when volatility is low. These insights are gold for refining your edge.

Automation & Alerts: Trade Without Watching Every Candle

Watching charts all day isn’t sustainable. That’s where automation and alerts come in. They let you monitor setups, track conditions, and even execute trades without being glued to your screen.

Recommended tools include:

- TradingView Alerts – Set alerts for price levels, indicator crossovers, or trendline breaks. Instead of staring at charts, you’ll get notified when a trade-worthy event occurs.

- TrendSpider – A next-level charting tool with automated pattern recognition and multi-timeframe analysis. It also allows you to backtest strategies and set complex alerts.

- QuantConnect – For advanced users interested in algorithmic trading. It lets you design, test, and run trading bots across multiple markets.

Caution: Automation is a double-edged sword. Always understand the logic behind any alert or algorithm before relying on it. Automation should enhance your edge, not replace your judgment.

Checklists: Your Daily Guardrail

Even with the best tools, mistakes happen when discipline slips. A trading checklist is your defense against impulsive decisions. Think of it as your pre-flight safety check — nothing happens until you complete it.

Here’s a sample checklist to build on:

Pre-Trade Checklist:

- ✅ Is the trade aligned with the broader trend?

- ✅ Is the risk/reward ratio at least 2:1?

- ✅ Have you defined your stop loss and position size?

- ✅ Are you following your trading plan (not reacting to FOMO)?

- ✅ Have you checked for relevant news or events?

Post-Trade Review Checklist:

- ✅ Did you follow your plan exactly?

- ✅ Was the entry and exit based on logic, not emotion?

- ✅ What did you learn from this trade?

- ✅ Are there patterns forming in your mistakes or successes?

Building the habit of checklist use keeps your execution clean. Over time, it becomes second nature — and one of the most reliable predictors of consistent results.

Daily Workflow:

The final step is integrating all these tools into a daily routine. Here’s an example workflow to model:

Pre-Market (30 min):

- Use Finviz or Benzinga Pro to scan for opportunities.

- Mark key levels and plan trades on TradingView.

- Set alerts and review your daily risk limits.

During Market Hours:

- Execute trades via MetaTrader 5 or Thinkorswim.

- Use alerts and watchlists to focus only on setups that meet your plan.

- Journal emotional reactions in real-time (even just quick notes).

Post-Market (20 min):

- Record trades in Edgewonk or Tradervue.

- Review screenshots and notes.

- Update your watchlist and If-Then plans for tomorrow.

With this structured approach, your tools stop being “nice-to-haves” and become an integrated part of your trading system.

Case Studies: Three Calm Responses to Market Stress 🎯

No matter how strong your strategy is, trading will always throw you curveballs. Sudden news events, unexpected volatility, and emotional swings are part of the game. What separates consistent traders from impulsive ones is how they respond under pressure.

In this section, we’ll walk through three real-world-style scenarios that illustrate how to respond calmly and effectively to market stress. Each case demonstrates practical principles from Zen Trading — awareness, acceptance, and action — that you can apply in your own trades.

Case Study 1: The Sudden Market Crash

Scenario:

It’s 9:30 a.m. and the market opens with a sharp gap down. News breaks that a major tech company’s earnings missed expectations by a wide margin. The index drops 3% in the first hour, and your positions — mostly tech stocks — are deep in the red. Panic sets in across social media. Your instinct screams: “Sell everything before it gets worse!”

The Typical Reaction:

Most beginners hit the “panic sell” button. They dump positions at the worst possible moment, often near the bottom. Then, as the market stabilizes and rebounds, they’re left watching from the sidelines — frustrated and emotionally drained.

The Calm Zen Response:

- Pause and Breathe: Before reacting, step away from the screen. Take five deep, slow breaths or do a quick round of box breathing. This interrupts panic and gives your rational mind a chance to engage.

- Assess Objectively: Ask three key questions:

- Has your stop-loss been triggered?

- Has the fundamental reason for your trade changed?

- Is this volatility part of your original risk plan?

- Act According to Plan: If your stop has not been hit and your thesis remains valid, do nothing. Accept that volatility is part of trading. If your stop is hit, exit calmly — not out of fear, but discipline.

✅ Lesson: A market crash is not a signal to abandon your system. It’s a test of whether you trust your risk management. Calm traders don’t predict; they follow their plan even when emotions run high.

Case Study 2: The Winning Streak Trap

Scenario:

You’ve had five winning trades in a row. Your confidence is sky-high. You feel unstoppable. The next trade looks good but not great — still, you double your position size because “this one is probably going to work too.”

The Typical Reaction:

Beginners fall victim to the hot-hand bias. Overconfidence blinds them to risk, and one oversized losing trade erases all prior gains. Emotion takes control, and discipline evaporates.

The Calm Zen Response:

- Awareness: Recognize the surge of confidence as a signal that bias may be influencing you. Awareness turns emotion into data.

- Return to Rules: Double-check your trading plan. Are you risking more than your pre-defined maximum per trade? If so, scale back immediately.

- Neutralize the Ego: Use a technique called “reset trading.” Imagine you just started today with zero wins or losses. Would you still take this trade under your usual rules?

✅ Lesson: Confidence is useful, but unchecked confidence is dangerous. Calm traders stick to position-sizing rules no matter how hot the streak. They know consistency, not excitement, builds wealth.

Case Study 3: News-Driven Whiplash

Scenario:

You’re in a trade with a solid setup. Suddenly, unexpected news hits the wire — a central bank rate hike. The price spikes violently, stops you out, then quickly reverses in your original direction. You feel frustration boiling up and are tempted to “jump back in” to recover the loss.

The Typical Reaction:

This is classic revenge trading. Emotion overrides logic, and traders re-enter impulsively — often at the worst price — leading to deeper losses.

The Calm Zen Response:

- Accept the Chaos: Remind yourself that news events are unpredictable. You can’t control them — but you can control how you respond.

- Log the Trade: Write a quick note in your journal: “Stopped out by news spike — setup still valid.” This creates distance between emotion and action.

- Reassess After a Cooldown: Wait for a fresh setup to form. If the original trade idea is still valid, plan a new entry with proper risk — but only after the market calms down.

✅ Lesson: Revenge trading is the enemy of consistency. Calm traders don’t chase losses; they reset, reassess, and re-engage with a clear mind.

7-Day Zen Trading Starter Plan 📅

Understanding Zen principles is one thing — applying them consistently is another. That’s why we’ve designed a simple, structured 7-day plan to help you build discipline, calm, and clarity into your trading routine. Each day introduces a new habit or exercise, and by the end of the week, you’ll have a foundation you can build on for years.

Day 1: The Awareness Shift 🧠

Goal: Build emotional awareness before, during, and after trades.

- Keep a “feelings log” next to your trade journal.

- Before each trade, write down your emotional state in one word: calm, impatient, greedy, fearful.

- After the trade, write how you felt during execution.

- Review at the end of the day. Patterns will emerge.

✅ Why it works: Emotional awareness is the foundation of trading psychology. You can’t manage what you don’t notice.

Day 2: The If-Then Blueprint 🧩

Goal: Pre-program disciplined responses.

- Write five If-Then rules. Examples:

- If I lose three trades in a row, then I stop trading for the day.

- If price hits my stop, then I exit immediately without hesitation.

- Read them aloud before the session.

- Review whether you followed them afterward.

✅ Why it works: If-Then plans replace impulsive decisions with pre-planned actions — even under pressure.

Day 3: The 10-Minute Mindset Reset 🧘♂️

Goal: Train your focus and calm under pressure.

- Spend 5 minutes meditating before the market opens.

- Use box breathing for 3–5 rounds before your first trade.

- Take a 2-minute pause between trades to recenter your mind.

✅ Why it works: Calm isn’t natural under stress — it’s trained. Daily mental practice builds that muscle.

Day 4: The Risk Rule Drill 🛡️

Goal: Cement risk discipline.

- Define your “R” value (risk per trade) and daily max loss.

- Review your risk on every planned trade before entry.

- If you’re tempted to break a rule, walk away for 10 minutes.

✅ Why it works: Rules protect your account — and your psychology. Practicing them daily builds automatic discipline.

Day 5: The One-Trade Journal Focus 📓

Goal: Improve quality over quantity.

- Take only one carefully planned trade today.

- Journal every detail: setup, rationale, emotional state, and outcome.

- Review what you did well and where you can improve.

✅ Why it works: Deep analysis of one trade teaches more than skimming over ten. Focus builds mastery.

Day 6: The Bias Check 🔍

Goal: Expose and eliminate cognitive biases.

- After every trade, ask: “Was this decision influenced by Gambler’s Fallacy or Hot-Hand Bias?”

- Write down one example if it was.

- Create one If-Then rule to counter it next time.

✅ Why it works: Bias awareness transforms blind spots into strategic advantages.

Day 7: The Weekly Review 🪞

Goal: Turn experience into growth.

- Review your trades, journals, and emotions from the week.

- Ask three key questions:

- Where was I most disciplined?

- Where did I break my rules?

- What one habit will I improve next week?

- Update your trading plan with one improvement.

✅ Why it works: Reflection turns raw data into wisdom. Weekly reviews are how traders evolve.

Making It Stick

At the end of this 7-day program, you’ll have built a foundational routine of awareness, discipline, and calm. But the real results come from repetition. Repeat this plan for four weeks and watch how your trading — and your mindset — transform.

Zen trading isn’t about perfection. It’s about continuous refinement. Over time, you’ll react less, plan more, and trade with a sense of clarity and confidence that few ever reach.

FAQs: Beginner Questions About Zen Trading Answered 🙋

Every trader — even the most seasoned pros — started out with basic, sometimes even “silly” questions. But here’s the truth: the only real mistake is not asking them. In this section, we’ll tackle the most common beginner questions about Zen Trading — from mindset and strategy to tools and discipline — and provide clear, practical answers that you can apply immediately.

What exactly is Zen Trading?

Zen Trading is a philosophy of trading that emphasizes clarity, discipline, and emotional balance over prediction and excitement. It’s not a strategy or system — it’s a mental framework. At its core, Zen Trading is about focusing on what you can control (your risk, your process, your mindset) and letting go of what you can’t (the market’s next move).

This approach encourages you to trade with awareness, acceptance, and action:

- Awareness: Recognize your emotions and biases before they control you.

- Acceptance: Embrace uncertainty and understand that losses are part of the game.

- Action: Execute your plan consistently without attachment to the outcome.

When you trade this way, stress levels drop, decision quality improves, and results become more consistent over time.

Is Zen Trading only for advanced traders?

Not at all. In fact, beginners often benefit the most from Zen principles. Early in your journey, you’re still forming habits — and Zen Trading helps you build the right ones from the start.

Think of it like learning to drive: if you master calmness and patience behind the wheel as a beginner, you’re less likely to develop bad habits later. Similarly, if you train your trading mind to prioritize process over emotion early on, you’ll accelerate your learning curve and avoid many painful mistakes.

How long does it take to “master” Zen Trading?

Zen Trading isn’t something you “master” once — it’s a continuous practice. Just like meditation or fitness, the benefits compound over time. Most traders start noticing significant improvements in decision-making and emotional control within 4–6 weeks of consistent practice.

Here’s a good timeline for beginners:

- Weeks 1–2: Increased emotional awareness (you start noticing biases and impulses).

- Weeks 3–4: Better discipline and adherence to your trading plan.

- Weeks 5–6: Noticeable reduction in emotional mistakes and improved consistency.

The key is to practice daily — even if only for a few minutes — and reflect on your decisions through journaling.

Do I need to meditate to follow Zen Trading?

Meditation is a powerful tool — but it’s not mandatory. The real goal is to develop mental stillness and focus, and meditation is just one way to achieve that. Some traders use breathing techniques, journaling, visualization, or even short walks before trading sessions to get into a calm, centered state.

If you’re new to meditation, start small:

- 2 minutes of focused breathing before the market opens.

- A 5-minute body scan after a stressful trade.

- Box breathing during volatile market conditions.

Over time, these habits build mental resilience — the foundation of Zen Trading.

What if I’m naturally emotional — can I still succeed?

Absolutely. In fact, self-awareness about your emotional nature is an advantage. Many of the world’s top traders are emotional people — they’ve just learned how to manage their responses.

The key is systems over feelings. Use tools like:

- If-Then plans: Predefine your reactions before emotions can hijack them.

- Checklists: Verify decisions logically before acting.

- Trading breaks: Step away after a big win or loss to reset your psychology.

Zen Trading isn’t about becoming emotionless. It’s about being emotionally intelligent — aware of your feelings but not controlled by them.

How many trades should I take as a beginner?

Less than you think. Many new traders believe more trades = more profits. In reality, more trades often mean more mistakes. Start with 1–3 high-quality trades per day or even per week, depending on your style.

Quality > Quantity. Zen Trading teaches you to wait patiently for setups that truly match your plan. As you gain experience and confidence, you can increase frequency — but never at the expense of discipline.

Can Zen Trading work with any strategy?

Yes — and that’s one of its biggest strengths. Zen principles are strategy-agnostic. Whether you’re a scalper, swing trader, algorithmic trader, or options trader, the philosophy remains the same:

- Focus on process, not prediction.

- Prioritize risk over reward.

- Detach from outcomes and trust your edge.

Zen Trading doesn’t replace your system — it makes your system work better by improving your decision quality and execution discipline.

How do I know if I’m improving?

Progress in Zen Trading isn’t always visible immediately in your P&L. Instead, watch for these early signs:

- Fewer impulsive trades.

- Less emotional reaction to wins and losses.

- More consistent adherence to your trading plan.

- A growing sense of calm, even during volatile markets.

Once these behaviors become habitual, profits tend to follow naturally.

What should I do after a losing streak?

Losing streaks happen — even to professionals. The difference is how you respond. Zen traders treat losing streaks as feedback, not failure.

Here’s a simple 3-step plan:

- Stop trading temporarily. Step back for a day or two.

- Review your journal. Look for patterns — are you breaking rules, overtrading, or chasing losses?

- Refine and reset. Adjust your plan if needed and restart with smaller position sizes.

The worst thing you can do is try to “make it back” immediately. Patience and perspective are your best allies here.

Key Lessons & Takeaways ✅

Zen Trading isn’t a quick fix — it’s a long-term mindset that turns chaos into clarity. If you’ve followed this guide from the beginning, you now understand how to build a trading process that’s disciplined, balanced, and adaptable. Here are the most important lessons to carry with you:

1. Your Mindset Shapes Your Results

Markets don’t care about your feelings — but your decisions do. Emotional awareness, detachment, and discipline matter more than any indicator or algorithm. Cultivate calmness, and your trading decisions will naturally improve.

2. Risk Management Is Everything

Your first job isn’t to make money — it’s to protect what you have. Define your risk per trade, use hard stop-losses, and never exceed your daily loss limit. Longevity, not excitement, is the goal.

3. Simplicity Wins in the Long Run

Complexity often leads to confusion. A simple, repeatable system — based on trend, risk, and discipline — beats a complicated one you can’t follow under pressure. Focus on process, not perfection.

4. Biases Are Silent Account Killers

Cognitive traps like Gambler’s Fallacy and Hot-Hand Bias sabotage decision-making. Learn to recognize and neutralize them before they influence your trades. Awareness is your first line of defense.

5. Journaling and Review Are Non-Negotiable

Your journal is your trading laboratory. Review it weekly to spot patterns, measure progress, and refine strategies. Growth isn’t about trading more — it’s about learning more from every trade.

6. Calm Is a Skill, Not a Trait

You’re not born calm — you train it. Through meditation, breathing exercises, and deliberate pauses, you build the ability to act logically even under pressure. That’s your ultimate trading edge.

7. Small Habits Build Massive Results

Whether it’s using a checklist, writing If-Then plans, or running a 7-day trading plan, consistent small actions compound into long-term success. Focus on the process today, and the profits will take care of themselves tomorrow.

The Path of Zen Trading

Zen Trading isn’t about predicting markets — it’s about mastering yourself. It’s the discipline to follow your plan, the patience to wait for the right setups, and the humility to accept losses as part of the journey.

If you apply these principles with consistency and intention, you’ll gradually shift from a reactive, emotional trader into a calm, strategic one. And that shift — not a secret indicator or algorithm — is what ultimately leads to lasting success.

The market will always be uncertain. But your response doesn’t have to be.

Disclaimer ⚠️

The information provided in this article on Zen Trading is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. The concepts, strategies, and tools discussed are intended to help readers improve their mindset, discipline, and trading process — not to guarantee profits or eliminate risk.

Trading financial instruments such as stocks, forex, or crypto involves substantial risk of loss and may not be suitable for every investor. You should carefully consider your financial situation, risk tolerance, and trading experience before engaging in any market activity. Always conduct your own research or consult a licensed financial advisor before making trading or investment decisions.

The author and publisher are not responsible for any losses or damages arising directly or indirectly from the use of the information contained in this article. Past performance is not indicative of future results.

By reading this article, you acknowledge that you are solely responsible for your own trading decisions and outcomes.

Appreciate the thorough breakdown. This is high-quality content.