Tired of Insane Crypto Gas Fees? Unleash These 9 Genius Hacks Now! ⛽️

If you’ve ever tried to send crypto, trade a token, or mint an NFT, you’ve likely been shocked by a surprisingly high cost: the gas fee. These crypto gas fees can sometimes feel like a highway robbery, turning a small transaction into an expensive ordeal. For beginners, this can be incredibly discouraging, making you wonder if interacting with the exciting world of blockchain is even worth it. The feeling is universal, whether you’re on Ethereum or another popular network.

The great news is that you don’t have to be at the mercy of these fluctuating costs. High blockchain fees are not an unavoidable fate. They exist for a crucial reason: to reward the people (validators) who secure the network and to prevent spam from clogging the system. But that doesn’t mean you have to pay the maximum price. With a bit of knowledge and some clever strategies, you can learn how to significantly reduce transaction fees, keeping more of your hard-earned money in your wallet.

This guide will break down everything you need to know in a simple, accessible way. We’ll transform you from a frustrated user into a savvy navigator of the blockchain world. You’ll learn how to time your transactions perfectly, use powerful tools to your advantage, and explore different networks that offer the same exciting opportunities without the exorbitant costs. Get ready to unleash these genius hacks and take control of your crypto gas fees once and for all.

Table of Contents

- Decoding the Mystery: What Exactly Are Crypto Gas Fees? 🧐

- The Power of Patience: How Timing Your Transactions Can Save You a Fortune 🕒

- Become a Gas Fee Guru: Essential Tools for Your Arsenal 🛠️

- Choose Your Playground: Selecting the Right Blockchain for the Job 🗺️

- The Express Lane: Supercharge Savings with Layer 2 Solutions ⚡

- Wallet Wizardry: Simple Adjustments for Big Savings 🧙♂️

- Combine and Conquer: The Power of Batching Transactions 📦

- Dodge the Scammers: Staying Safe While Cutting Costs 🛡️

- Your Personal Blueprint: Creating a Gas-Saving Strategy ✍️

Decoding the Mystery: What Exactly Are Crypto Gas Fees? 🧐

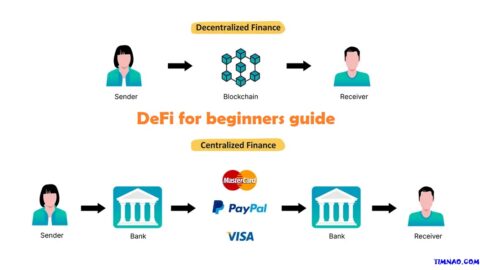

Before you can learn how to reduce transaction fees, it helps to understand what you’re actually paying for. Think of any blockchain network as a massive, decentralized supercomputer. Every action you take—whether sending tokens to a friend or using a complex financial application—requires computational energy to process, validate, and record permanently. “Gas” is simply the term for the fuel that powers these actions.

The gas fee is the payment you make to network validators for using that computational power. It’s their incentive to include your transaction in the next “block” of transactions and keep the network running securely. Each blockchain uses its own native token to pay these fees. For instance:

- Ethereum uses Ether (ETH).

- BNB Smart Chain uses BNB.

- Solana uses SOL.

- Avalanche uses AVAX.

Different blockchains also have unique ways of calculating these fees, which is why costs can vary so dramatically between them. For example, Ethereum’s EIP-1559 update introduced a more complex but predictable model consisting of a Base Fee (set by the network based on demand) and a Priority Fee (a tip you add to get processed faster). The Base Fee is then burned, which can have a deflationary effect on ETH’s supply.

In contrast, a network like Solana was built for high speed and has a much simpler fee market. Its blockchain fees are incredibly low and more predictable because the network can handle a vastly larger number of transactions per second, meaning users rarely have to compete for block space. Understanding that these systems differ is key to choosing the most cost-effective network for your specific needs.

The Power of Patience: How Timing Your Transactions Can Save You a Fortune 🕒

One of the easiest and most universal ways to slash crypto gas fees is by choosing the right time to transact. Most blockchain networks, especially popular ones like Ethereum, experience traffic ebbs and flows just like a real-world highway. During “rush hour,” when many people are trying to transact at once—often driven by a hyped NFT mint or a new DeFi application launch—the demand for block space skyrockets, and so do the fees.

This phenomenon, sometimes called a “gas war,” can see fees jump from a few dollars to hundreds in mere minutes. By simply being patient, you can avoid these costly periods. Network activity generally follows global business hours, meaning fees are often highest when Europe and North America are most active on weekdays.

The golden hours for low fees are typically late at night and on the weekends. For example, a token swap on Ethereum that costs $40 on a Tuesday afternoon might only cost you $10 on a Sunday morning. By planning your non-urgent transactions for these quieter periods, you can often cut your crypto transaction fees dramatically. Patience is a powerful, money-saving tool in the world of crypto.

Become a Gas Fee Guru: Essential Tools for Your Arsenal 🛠️

You don’t have to guess when the best time to transact is. Several fantastic tools give you a real-time view of network congestion, empowering you to make data-driven decisions. Think of these as your personal gas fee weather forecast for any blockchain.

Every major blockchain has a “block explorer” that provides a wealth of data, including current transaction fees. Here are the key ones to bookmark:

- For Ethereum: Etherscan Gas Tracker is the gold standard. It shows the current base fee and suggests priority fees for slow, average, and fast transactions, measured in “Gwei” (a small unit of ETH).

- For BNB Smart Chain: BscScan offers similar gas tracking tools for the BNB network.

- For Solana: Solscan helps you analyze transaction costs and network performance.

- For Avalanche: Snowtrace is the go-to explorer for checking fees on the Avalanche C-Chain.

For an even broader view, platforms like DeFiLlama’s Gas Tracker let you compare fees across multiple networks in one dashboard. This is incredibly useful for deciding which network is the most economical at that moment. Many wallets, like MetaMask, also have built-in gas estimators that pull this data for you in real time, making it easier than ever to avoid paying peak prices.

Choose Your Playground: Selecting the Right Blockchain for the Job 🗺️

While Ethereum is a powerhouse of activity, its high crypto gas fees have paved the way for a universe of alternative blockchains. For many use cases, especially frequent trading or gaming, choosing a different “playground” is the single most effective way to reduce transaction fees. These networks are often faster and orders of magnitude cheaper.

Here’s a simple breakdown of the most popular, beginner-friendly options:

| Blockchain | Native Token | Average Transaction Fee | Best For |

| Polygon | MATIC | ~$0.01 – $0.10 | Low-cost DeFi & Gaming on an Ethereum-friendly network. |

| Solana | SOL | $0.001 | High-speed trading, NFTs, and applications needing fast finality. |

| Avalanche | AVAX | ~$0.05 – $0.25 | A growing ecosystem for DeFi and enterprise applications. |

| BNB Smart Chain | BNB | ~$0.10 – $0.30 | A vast ecosystem with low fees, popular for DeFi and token launches. |

To use these networks, you’ll often need to “bridge” your assets. A cross-chain bridge is a special application that securely “sends” your tokens from one blockchain to another, usually by locking the original token and minting a wrapped version on the destination chain. While the bridging process itself incurs a one-time gas fee, all your subsequent transactions on the new, cheaper chain will be significantly more affordable.

The Express Lane: Supercharge Savings with Layer 2 Solutions ⚡

What if you want to reduce transaction fees but need the unparalleled security and decentralization of the main Ethereum network? This is the exact problem that Layer 2 (L2) solutions were designed to solve. L2s are scaling protocols built on top of Ethereum. They process transactions in a separate, high-speed environment and then post the results back to the main network in a compressed, efficient batch.

Think of it like a carpool lane on a congested highway. You get to bypass all the traffic (high fees and slow speeds) because you’re sharing the ride, but you’re still on the same secure highway. This approach can reduce transaction fees by over 90% while allowing you to use your favorite Ethereum applications.

There are two main types of L2s, each with a different approach:

- Optimistic Rollups (Arbitrum, Optimism): These L2s “optimistically” assume all transactions are valid and bundle them together. They have a challenge period where anyone can prove a transaction was fraudulent. They are highly compatible with existing Ethereum DApps.

- ZK-Rollups (zkSync, StarkNet): These use advanced cryptography called “zero-knowledge proofs” to mathematically prove the validity of every transaction in a batch before it’s sent to Ethereum. They offer incredible speed and security.

To get started, you’ll use an official bridge, like the Arbitrum Bridge, to move your funds from the Ethereum mainnet to the L2. The process is straightforward, and once your funds arrive, you’ll be able to trade, stake, and explore DeFi for a fraction of the cost.

Wallet Wizardry: Simple Adjustments for Big Savings 🧙♂️

Sometimes, the power to save money is right inside your crypto wallet. Most modern wallets, such as MetaMask or Rainbow, do a great job of estimating crypto gas fees, but they also give you the power to customize them. This is a crucial feature for anyone looking to optimize their spending.

When you’re about to confirm a transaction, your wallet will show an estimated fee. Look for an “Advanced” or “Edit” option. This will allow you to manually adjust the Priority Fee (the tip) on networks like Ethereum. If your transaction isn’t urgent, you can often lower this tip significantly, which will reduce your overall cost.

However, be very careful not to lower the Gas Limit. The Gas Limit is the maximum amount of “fuel” your transaction is allowed to consume. If you set it too low, your transaction will fail, but the gas fee you’ve already spent will not be refunded. It’s almost always best to leave the gas limit that your wallet suggests and only adjust the gas price or priority fee.

Combine and Conquer: The Power of Batching Transactions 📦

Every transaction on a blockchain incurs its own separate gas fee. If you need to perform multiple actions, such as sending tokens to several different wallets, doing them one by one can be incredibly expensive. This is where batching comes in. Batching involves using a smart contract or tool to group multiple actions into a single, efficient transaction.

Instead of making three separate transfers and paying three separate blockchain fees, a batching tool allows you to execute them all at once, paying the core network fee just one time. This is a game-changing hack for anyone who needs to make multiple payments, claim rewards from several DeFi protocols, or manage a portfolio across different applications.

While this was once a technique reserved for developers, user-friendly platforms like Gnosis Safe are making it accessible to everyone. Gnosis Safe is a multi-signature smart contract wallet that, in addition to providing enhanced security, has built-in features for transaction batching, helping you reduce transaction fees significantly.

Dodge the Scammers: Staying Safe While Cutting Costs 🛡️

As you explore ways to save on fees, it’s critically important to stay vigilant. Scammers know users are frustrated with high crypto gas fees, and they create sophisticated schemes to exploit this. You might see ads for browser extensions promising to eliminate fees or receive a direct message about a “secret” tool that can optimize your transactions.

Be extremely cautious of any offer that sounds too good to be true, because it always is. Legitimate strategies reduce transaction fees; they don’t eliminate them. Never download unverified software or connect your wallet to a suspicious website promising impossible savings. A common scam involves a fake “gas token airdrop” that directs you to a malicious site designed to drain your wallet.

Stick to reputable, community-vetted tools. Use the official bridges for L2s, download wallets only from their official websites, and use the block explorers mentioned earlier to verify information. Your security is always more important than saving a few dollars on gas. Also, be careful with token approvals. Use a tool like Revoke.cash to periodically review and cancel old or unnecessary permissions you’ve granted to DApps.

Your Personal Blueprint: Creating a Gas-Saving Strategy ✍️

Now that you’re armed with these powerful hacks, it’s time to build your own personal strategy. The best approach will depend on your goals and the types of transactions you make. A long-term investor will have a different plan than an active DeFi trader.

To make this practical, let’s consider two personas:

-

Persona 1: The NFT Collector. Your main costs come from minting new NFTs and trading on marketplaces. Your strategy should be:

- Prioritize Low-Cost Chains: Look for exciting new mints on Solana or Polygon.

- Use L2s for Ethereum NFTs: For Ethereum-based projects, trade on L2 marketplaces like OpenSea on Arbitrum.

- Time Your Mints: If a mint is on Ethereum’s mainnet, use a gas tracker and aim for off-peak hours (weekends, late nights) to participate.

-

Persona 2: The DeFi Yield Farmer. You are constantly interacting with protocols to stake, unstake, and claim rewards. Your strategy should be:

- Live on L2s and Alt-Chains: Move the majority of your capital to Polygon, Arbitrum, or Avalanche to interact with leading DeFi protocols like Aave and Trader Joe for a fraction of the cost.

- Batch Your Actions: Instead of claiming rewards daily (and paying fees each time), let them accumulate and claim them once a week in a single, batched transaction.

- Use a Gas Fee Comparator: Before bridging, use a tool like DeFiLlama to see which network currently offers the best yields for the lowest fees.

By creating a simple, personalized plan like this, you make conscious, cost-effective decisions a habit. You’ll no longer be a passive participant paying whatever fee is quoted. Instead, you’ll be an empowered user who knows how to navigate the blockchain world smartly, securely, and affordably.