Psychology of Money Mastery: Shockingly Simple Habits for Stress-Free Wealth 😊

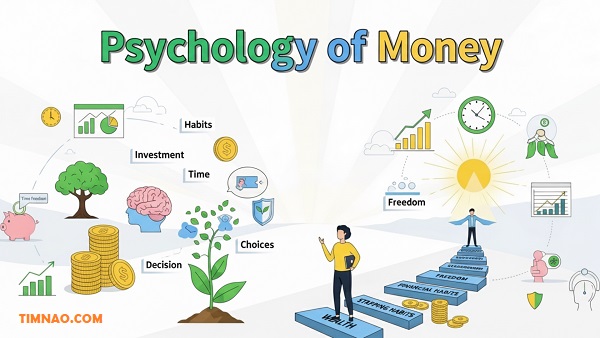

Psychology of money is more than just a buzzword — it’s the key to transforming the way you think, feel, and act with your finances. Most people assume that wealth comes from mastering complex formulas or having insider knowledge of the stock market. But in reality, long-term financial success is built on something much more personal and universal: our behaviors, habits, and emotions around money.

From the decisions you make on payday to how you react during a market crash, your mindset shapes every financial outcome. The way you grew up, the stories you believe about wealth, and even the subtle pressures of society all influence how you spend, save, and invest — often without you realizing it. Understanding this invisible force is the first step to building real, lasting financial confidence.

In this guide, we’ll explore practical ways to master your money mindset, avoid common behavioral traps, and make smarter financial choices — even if you’re just starting out. You’ll discover how tiny habits compound into life-changing wealth, why “enough” is the most powerful word in personal finance, and how to create a system that works for you instead of against you. Most importantly, you’ll walk away with actionable strategies you can start applying today to build a future of financial freedom and peace of mind.

Ready to rethink your relationship with money and finally take control of your financial story? Let’s dive in.

Table of Contents

- 🧠 Why Behavior Beats Math

- ✍️ Your Money Story (and How to Rewrite It)

- 🎲 Luck, Risk & Real-Life Outcomes

- ✅ How to Define “Enough” in the Psychology of Money (and Mean It)

- ⏳ Compounding: Tiny Wins, Huge Results

- 🛡️ Getting Rich vs. Staying Rich

- ⏱️ Time Freedom in the Psychology of Money: The Ultimate Dividend

- 🚗 The Status Trap in the Psychology of Money: What Flashy Buys Don’t Buy

- 👀 Wealth Is What You Don’t See

- 💾 Saving in the Psychology of Money: The Only Lever You Fully Control

- 🤝 Reasonable > Rational in the Psychology of Money (for Real People)

- 🧯 Room for Error in the Psychology of Money: Build Your Shock Absorbers

- 🙌 Your Future Self Will Thank You: Thinking Long-Term in the Psychology of Money

- 📉 Why Pessimism Sounds Smart (and What to Do)

- 🧭 An Action Plan for Beginners (Step-by-Step)

- 🔧 Helpful Tools & Trusted Brands in the Psychology of Money

- 🙋 FAQs: Beginner Questions About Psychology of Money Answered

- 🧩 Key Lessons & Takeaways

🧠 Why Behavior Beats Math

When it comes to building wealth, most beginners assume that success depends on mastering complex formulas, advanced investing strategies, or insider knowledge. But here’s the truth that most financial experts agree on: your behavior with money matters far more than your mathematical ability.

Think of it like fitness — you don’t need a PhD in nutrition to get healthy. What you need is the discipline to eat better and move more consistently. Money works the same way. You don’t need to solve complex equations or perfectly time the market. You need to build small, sustainable habits and stick with them over time.

Understanding this principle is life-changing because it levels the playing field. You don’t have to be a genius to achieve financial independence — you just need the right mindset, emotional control, and a system that works even when life gets messy.

💡 Why Emotions Outweigh Equations

The biggest challenges in money management are rarely about numbers. They’re about human nature. We are emotional creatures. We chase quick wins, fear losses more than we value gains, and often compare ourselves to others — all of which lead to poor financial decisions.

Here’s how behavior tends to sabotage us:

- Impatience: We abandon good investments because they don’t pay off quickly.

- FOMO (Fear of Missing Out): We buy into trends just because others are getting rich.

- Panic: We sell when markets drop, locking in losses that would have reversed if we’d stayed calm.

- Lifestyle inflation: As we earn more, we spend more — often faster than our income grows.

Each of these mistakes has little to do with financial knowledge and everything to do with psychology. Recognizing these behavioral traps is the first step toward avoiding them.

📊 Simple Beats Complex (and Wins More Often)

Behavior-focused strategies aren’t just easier — they’re often more effective. For example:

- Consistent investing: Putting $200 into a broad-market index fund every month will outperform most day traders over time.

- Automatic saving: Setting up an auto-transfer into a savings account builds wealth effortlessly.

- Ignoring noise: Investors who check their portfolios less frequently often earn higher returns because they aren’t reacting emotionally to every market swing.

The key is consistency. A 7% annual return compounded for 30 years is far more powerful than a 20% return for three years followed by panic-driven selling.

🛠️ How to Build Better Money Habits

Here’s a simple framework to shift your focus from math to behavior:

- Automate everything: Set up automatic transfers for savings, investments, and bills. Automation removes willpower from the equation.

- Make decisions in advance: Decide how much you’ll invest and where — and write it down. That way, you’re not reacting emotionally when markets swing.

- Track behavior, not just balances: Instead of obsessing over your net worth, measure how consistently you stick to your savings or investment plan.

- Limit exposure to noise: The less you check market news, the less likely you are to make impulsive decisions.

The sooner you master your behavior, the faster your money will start working for you.

✍️ Your Money Story (and How to Rewrite It)

Every person has a “money story” — a set of beliefs, emotions, and habits formed from their earliest experiences with money. These stories shape how we save, spend, and invest, often without us even realizing it.

If you grew up watching your parents struggle with debt, you might associate money with stress. If wealth was flaunted in your community, you might equate money with status. These subconscious narratives influence every financial decision you make.

The good news? Your money story isn’t fixed. You can rewrite it — and doing so can completely transform your financial life.

🧠 Step 1: Identify the Story You’re Telling Yourself

Before you can change your relationship with money, you need to understand it. Start by reflecting on these questions:

- What’s your earliest memory of money?

- How did your parents or caregivers talk about wealth?

- What financial habits did you absorb from them?

- Do you feel guilty about spending? Do you feel anxious about saving?

Write your answers down. Patterns will emerge. Maybe you overspend to feel successful. Maybe you hoard cash because you’re afraid of losing it. Awareness is the first step toward change.

✏️ Step 2: Challenge Limiting Beliefs

Many people hold unconscious beliefs that hold them back financially, such as:

- “I’m just bad with money.”

- “I’ll never be rich.”

- “Investing is too risky.”

- “People like me can’t build wealth.”

These beliefs are stories — not facts. Challenge them by seeking out real examples of people who’ve built wealth starting from where you are now. Learn their strategies. Most importantly, remind yourself that financial skills are learned, not inherited.

🔁 Step 3: Rewrite Your Narrative

Once you know your old story, you can write a new one. Here’s how:

- Replace “I’m bad with money” with “I’m learning how to manage money better every month.”

- Replace “Investing is too risky” with “Investing is a tool for building long-term security.”

- Replace “I’ll never be rich” with “I’m building wealth step by step.”

Write your new money story on paper and read it regularly. Repetition reprograms your mindset.

🧭 Step 4: Align Actions With Your New Story

Beliefs alone won’t change your financial life — but beliefs plus action will. If your new story is “I’m becoming an investor,” start with small, consistent investments. If it’s “I’m building financial freedom,” set up an automatic savings plan.

The goal is to make your actions reflect your new beliefs until those beliefs become your default reality.

💡 Quick Exercise: Your “Money Identity” Statement

Try writing a simple statement that captures the financial identity you want to embody. For example:

- “I am someone who saves before I spend.”

- “I invest a portion of every paycheck for my future.”

- “I make money decisions based on my values, not other people’s opinions.”

Post it somewhere visible — like your phone lock screen or bathroom mirror — as a daily reminder.

🎲 Luck, Risk & Real-Life Outcomes

Money isn’t just about effort. It’s also about timing, circumstance, and randomness. That’s why two people with similar habits can end up in very different places financially. One might get rich after their startup takes off. Another might lose everything in a medical emergency or market crash.

Understanding the roles of luck and risk isn’t about giving up control — it’s about developing realistic expectations and building systems that work under uncertainty.

🍀 The Role of Luck: Why Success Is Never Entirely Self-Made

We love stories of self-made millionaires, but almost every success story includes a dose of good fortune:

- Being born in a stable country with strong property rights.

- Entering the workforce during a booming economy.

- Meeting the right mentor or partner at the right time.

These factors are outside anyone’s control — but they matter enormously. Recognizing the role of luck keeps you humble when things go well and compassionate when they don’t.

⚠️ The Role of Risk: Why Even Smart Decisions Can Fail

Just as luck can lift you, risk can strike without warning. Even careful investors lose money in recessions. Even diligent savers face job losses or medical bills.

The solution isn’t to fear risk — it’s to prepare for it:

- Emergency fund: Keep 3–6 months of expenses in a high-yield savings account.

- Insurance: Protect against catastrophic losses with health, life, and disability coverage.

- Diversification: Spread your investments across asset classes so one bad bet doesn’t sink you.

- Avoid overconfidence: Never assume you’re immune to setbacks.

🎢 Judge Decisions, Not Just Outcomes

It’s easy to judge someone by their results, but results are often influenced by luck and risk. A bad decision can sometimes pay off, while a smart decision can fail due to circumstances.

When reviewing your financial choices, ask:

- Did I make the best decision with the information I had?

- Was my risk level appropriate for my situation?

- Would I make the same decision again knowing what I know now?

This approach keeps you focused on process, not just outcome — and that’s what compounds over time.

🔄 Play the Long Game

Luck and risk balance out over the long term. The longer you stay in the game, the more likely your outcomes will reflect your skill and discipline rather than random chance.

That’s why consistency matters more than intensity. It’s better to invest small amounts for 30 years than to go all-in for three and burn out. It’s better to steadily increase your savings rate than to chase a “get rich quick” scheme.

🧭 Practical Ways to Build Luck Into Your Strategy

You can’t control luck, but you can increase your chances of benefiting from it:

- Say yes to opportunities: Networking, learning new skills, and trying side projects create more chances for “lucky breaks.”

- Stay liquid: Cash on hand lets you seize opportunities when they arise.

- Stay curious: The more you learn, the more connections and insights you can act on.

By combining discipline with open-mindedness, you create a strategy that thrives under uncertainty — and that’s the ultimate financial advantage.

Behavior, mindset, and an understanding of risk set the stage for everything that comes next. Once you master these foundations, you’re ready to explore deeper strategies — like defining what “enough” really means, harnessing the power of compounding, and designing a wealth-building system that runs on autopilot. That’s exactly where we’re headed next.

✅ How to Define “Enough” in the Psychology of Money (and Mean It)

One of the most powerful but underrated concepts in personal finance is the idea of “enough.” Most of us live in a culture that glorifies more — more money, more possessions, more success. But without a clear definition of what “enough” means for you, no amount will ever feel satisfying. You’ll keep chasing, buying, and comparing, only to find that happiness remains just out of reach.

Defining “enough” is not about limiting ambition. It’s about creating a clear, grounded sense of what truly matters so you can stop running in circles and start building a life that feels fulfilling.

🧠 Why “Enough” Matters More Than You Think

If you don’t decide what “enough” looks like, the world will decide for you — and it will always push you toward more. That’s a trap that leads many people to overspend, overwork, and overextend themselves financially.

Here’s why defining “enough” is a financial superpower:

- It keeps your lifestyle inflation in check, even as your income grows.

- It helps you say “no” to unnecessary purchases or risks.

- It focuses your efforts on what truly moves the needle for your happiness.

- It reduces financial anxiety by setting a clear finish line.

When you know what’s “enough,” you stop chasing someone else’s definition of success and start living by your own.

✍️ Step 1: Identify Your Core Values

Your version of “enough” should reflect what matters most to you, not what society says you should want. Begin by answering these questions:

- What makes me feel secure and content?

- What experiences bring me lasting happiness?

- What possessions do I actually use and value?

- What would I still spend money on if no one could see it?

You might find that “enough” has less to do with luxury and more to do with freedom — the ability to spend time with your family, travel occasionally, or pursue hobbies without financial stress.

📊 Step 2: Define “Enough” in Numbers

Once you know your values, translate them into specific numbers. This step turns vague goals into actionable targets.

Here’s how:

- Essential expenses: Calculate what you need each month for housing, food, transportation, and healthcare.

- Safety net: Add 3–6 months of expenses for emergencies.

- Future security: Estimate how much you need to save and invest for long-term goals (e.g., retirement, education, a house).

- Lifestyle wants: Include reasonable discretionary spending for fun, hobbies, and travel.

This creates a “baseline budget” that represents your version of enough. Anything beyond that is a bonus — not a necessity.

🛠️ Step 3: Build an “Enough Statement”

To reinforce this mindset, write a simple statement that defines your financial target. For example:

“Enough for me means covering my monthly needs, saving 20% of my income, and having the flexibility to take two family trips a year.”

Review this statement before major financial decisions. It will remind you to evaluate choices based on your priorities — not someone else’s.

🧭 Step 4: Protect Yourself from “More-itis”

The pull toward “more” is powerful and constant. To stay grounded:

- Limit exposure to social media comparison traps.

- Practice gratitude — write down three things you’re thankful for each day.

- Review your progress quarterly to see how close you are to your version of enough.

- Automate savings and investments so excess income builds wealth instead of fueling lifestyle creep.

By defining and defending your “enough,” you create a financial life that’s both sustainable and deeply satisfying.

⏳ Compounding: Tiny Wins, Huge Results

Once you know what “enough” looks like, the next step is learning how to build it. And here’s where one of the most powerful forces in finance comes into play: compounding — the simple idea that small actions, repeated consistently over time, create extraordinary results.

Compounding is often called the “eighth wonder of the world,” and for good reason. It can turn modest savings into significant wealth, even if you never earn a huge salary or win the lottery.

🧠 How Compounding Works (In Plain English)

Compounding happens when your money earns returns — and then those returns start earning returns too. Over time, this creates exponential growth.

For example:

- If you invest $200 a month at a 7% annual return, you’ll have around $240,000 after 30 years.

- But if you wait 10 years to start, you’ll end up with less than $120,000 — even if you invest the same monthly amount.

The lesson? Time is the most important ingredient. The earlier you start, the harder compounding works for you.

📉 Why Most People Miss Out on Compounding

Despite its simplicity, many people fail to benefit from compounding because:

- They delay investing, thinking they’ll “start later.”

- They panic-sell during market downturns and interrupt the compounding process.

- They withdraw returns instead of reinvesting them.

- They chase quick gains instead of patient growth.

The key to harnessing compounding is not brilliance — it’s discipline and patience.

🛠️ How to Harness the Power of Compounding

Follow these steps to make compounding your greatest wealth-building tool:

- Start as early as possible. Even small amounts invested now will outperform larger amounts invested later.

- Stay consistent. Automate monthly contributions, even if they’re modest.

- Reinvest earnings. Let your money grow on itself — don’t pull it out unless necessary.

- Avoid emotional decisions. Don’t stop investing during downturns; that’s when compounding prepares for its biggest gains.

- Think long-term. Compounding is boring in the beginning and magical later. Give it time to work.

📈 The Power of Habit + Compounding

Compounding isn’t just about money — it applies to habits too. Saving a small percentage every month, learning one new skill each week, or improving your spending discipline slightly each year all compound into massive improvements over time.

Think of it this way: wealth is rarely built by big, dramatic moves. It’s built by small, consistent actions that snowball into something far larger than the sum of their parts.

🛡️ Getting Rich vs. Staying Rich

It’s one thing to build wealth. It’s another thing entirely to keep it. Many people focus all their attention on getting rich, but the truth is that staying rich often requires an entirely different skill set.

This is where patience, humility, and risk management come into play. If compounding is the engine of wealth, protecting your money is the seatbelt — and you need both to reach your destination.

💼 Getting Rich Requires Boldness

The early stages of wealth-building usually involve taking calculated risks — investing aggressively, starting businesses, learning new skills, or taking career leaps. That’s because growth requires optimism and initiative.

Examples of “getting rich” behaviors:

- Investing heavily in growth assets like stocks or real estate.

- Pursuing higher-paying opportunities, even if they’re uncomfortable.

- Reinventing your skill set to stay competitive in the job market.

However, once you’ve built a foundation, that same boldness can become a liability if it’s not balanced with caution.

🛑 Staying Rich Requires Caution

To stay wealthy, you must shift from offense to defense. Your goal is no longer just maximizing returns — it’s minimizing the risk of ruin.

Here’s what staying rich looks like:

- Diversify: Spread investments across different asset classes to reduce risk.

- Protect: Have adequate insurance, an emergency fund, and legal protections (like a will or trust).

- Limit debt: Avoid overleveraging — even “good debt” can backfire during economic downturns.

- Play the long game: Focus on slow, steady growth instead of chasing high-risk opportunities.

As the saying goes, getting rich is about offense, but staying rich is about defense.

🔄 The Role of “Room for Error”

No matter how careful you are, the future is uncertain. That’s why every financial plan should include room for error — a margin of safety that protects you when things go wrong.

Practical ways to build margin:

- Keep a larger emergency fund than you think you’ll need.

- Avoid spending based on best-case scenarios (like assuming constant raises or high investment returns).

- Revisit your risk tolerance regularly as your circumstances change.

The best investors and savers are not those who never make mistakes — they’re the ones who can survive their mistakes and keep compounding over time.

🔁 Balance Offense and Defense

The real secret is knowing when to shift gears. Early on, prioritize growth. As you accumulate wealth, gradually increase your focus on protection. The right balance might look like:

- Early career: 80% growth, 20% safety.

- Mid-career: 60% growth, 40% safety.

- Pre-retirement: 40% growth, 60% safety.

This gradual shift ensures that you build wealth when you need to and preserve it when it matters most.

Defining “enough,” harnessing the quiet power of compounding, and learning how to protect what you’ve built are three of the most important steps on the journey to financial freedom. Once you master these, you’re ready to move on to an even deeper layer of money mastery — exploring how time freedom transforms wealth, why appearances can be deceiving, and how real financial independence is built from what you don’t spend. That’s exactly where we’re headed next.

⏱️ Time Freedom in the Psychology of Money: The Ultimate Dividend

One of the most overlooked — yet most life-changing — ideas in the psychology of money is this: the greatest reward wealth can give you isn’t stuff. It’s time.

Time freedom means having the ability to choose how you spend your hours. It’s waking up without a panic alarm, choosing meaningful work instead of tolerating a toxic job, and spending afternoons with your kids or exploring new passions without financial stress. In short, money is valuable not for what it buys, but for the life it allows you to design.

🧠 Why Time Freedom Matters More Than Luxury

It’s easy to chase financial goals for the wrong reasons — a bigger house, a nicer car, a designer lifestyle. But countless studies show that beyond a certain point, these luxuries don’t significantly increase happiness. What does? Control over your time.

According to Harvard Business Review, people who prioritize time over money report significantly higher levels of life satisfaction. This shift is at the heart of financial independence: not endless wealth, but the ability to control how you live.

Time freedom transforms money from a source of anxiety into a source of options. It gives you permission to:

- Say no to work that drains you.

- Spend more time with people you care about.

- Explore creative pursuits or side projects.

- Live at a pace that feels intentional, not frantic.

📊 How to Build Time Freedom Step-by-Step

Achieving time freedom isn’t about quitting your job tomorrow — it’s about building financial habits that give you more choices over time.

- Start with an emergency fund: Saving 3–6 months of expenses is the first step toward reducing financial fear and gaining flexibility.

- Pay yourself first: Automate savings and investments so your future freedom grows without relying on willpower.

- Reduce fixed costs: The lower your baseline expenses, the easier it is to work less, change careers, or take sabbaticals.

- Pursue flexible income streams: Freelancing, remote work, or passive income sources expand your choices.

- Invest in yourself: Skills and knowledge compound like money. The more valuable your skills, the more control you have over how you trade time for income.

🧭 Reframe “Success” Around Time, Not Things

Traditional measures of success — salary, job title, square footage — are seductive but incomplete. A $300,000 salary that requires 80-hour weeks and zero free time might actually be worse than a $90,000 income that allows you to live the life you want.

The goal is to optimize for autonomy — not for appearances. In practice, this might mean:

- Choosing a slightly lower-paying job with remote flexibility.

- Downsizing your lifestyle to reduce financial pressure.

- Designing a “mini-retirement” every few years instead of waiting for age 65.

🚗 The Status Trap in the Psychology of Money: What Flashy Buys Don’t Buy

One of the biggest behavioral pitfalls in the psychology of money is the status trap — the urge to spend money to signal success. Luxury cars, designer clothes, high-end tech — these purchases often have less to do with utility and more to do with how we want others to see us.

But here’s the irony: most people are too busy thinking about their own lives to care much about yours. And even if they notice your fancy car or expensive watch, they’re admiring the object — not you.

🧠 Why We Crave Status (and Why It’s a Trap)

Status-seeking is deeply human. Evolution wired us to seek approval and social standing. But in the modern world, this instinct can lead to destructive financial behavior. When you tie your self-worth to what others think, you’re more likely to:

- Overspend on things you don’t need.

- Sacrifice long-term financial security for short-term impressions.

- Measure success by comparison rather than personal progress.

The result? A cycle of stress, debt, and dissatisfaction — often called the “hedonic treadmill.” No matter how much you buy, the feeling fades, and you start chasing the next upgrade.

💡 The Psychology Behind the Status Game

Behavioral finance experts like Daniel Kahneman explain that humans are terrible at predicting what will make us happy. We think a luxury purchase will improve our well-being, but the emotional boost is usually fleeting. Soon, it becomes the new normal.

Worse, chasing status often prevents the very wealth we want. The more you spend on appearances, the less you have to save and invest — and the further you drift from financial independence.

🛠️ Strategies to Escape the Status Trap

Here’s how beginners can break free from the urge to “flex”:

- Adopt the “invisible wealth” mindset: Real wealth isn’t visible — it’s the money you don’t spend. A strong investment portfolio or a paid-off home may not show off on Instagram, but it creates true security.

- Ask the “if no one saw it” question: Before any big purchase, ask yourself, “Would I still buy this if no one knew I had it?”

- Redirect status drives: Channel the desire for recognition into areas that compound — generosity, expertise, creativity — instead of consumption.

- Practice value-based spending: Spend money intentionally on things that deeply matter to you, not what society says you should want.

📚 For more on status-driven spending and how to overcome it, explore Behavioral Scientist — a great resource on psychology, decision-making, and money.

👀 Wealth Is What You Don’t See

One of the most profound insights in the psychology of money is this: wealth is not what you see — it’s what you don’t see. Most people assume wealth is visible — luxury cars, large houses, expensive clothes. But these are often signs of spending, not saving.

True wealth is hidden — in brokerage accounts, retirement funds, paid-off debt, and the freedom to walk away from work you don’t enjoy. And because it’s invisible, it’s easy to underestimate.

🧠 Why We Confuse Rich and Wealthy

Being rich means having a high income. Being wealthy means having assets that generate income — and give you choices — whether you’re working or not.

Here’s the difference:

- Rich: Earns $500,000 a year but spends $490,000 on lifestyle.

- Wealthy: Earns $120,000, lives on $60,000, invests the rest — and builds long-term freedom.

The first person looks rich. The second one is wealthy.

💡 The Power of “Invisible” Financial Wins

Invisible wealth comes from habits most people never see:

- Regular contributions to an IRA or 401(k).

- Debt-free living that reduces monthly stress.

- Owning investments that quietly grow over decades.

- Having a cash reserve that lets you take risks.

These choices don’t impress anyone at a party. But they do impress your future self.

📊 Steps to Build Invisible Wealth

Building real wealth is about shifting your mindset from showing off to building up. Here’s how:

- Automate investing: Use platforms like Vanguard or Fidelity to grow wealth passively over time.

- Increase your savings rate: Focus less on chasing returns and more on how much you save — the one variable you control completely.

- Live below your means: The gap between income and expenses is the fuel for building wealth.

- Ignore appearances: Remember that most people with flashy lifestyles are often deeply in debt. True financial confidence is quiet.

🧭 Redefine Success for Yourself

Ultimately, the psychology of money teaches us that success isn’t about being admired — it’s about being free. The more wealth you build quietly, the less dependent you become on others’ opinions, your employer, or even luck.

Wealth isn’t about buying more. It’s about needing less — and gaining the freedom to live on your terms.

Time freedom, escaping the status trap, and building invisible wealth are three of the most transformative mindset shifts in the psychology of money. Once you embrace them, your financial goals stop being about comparison and consumption — and start being about freedom, security, and peace.

In the next part, we’ll explore the most practical levers you can pull: saving consistently, thinking reasonably (not just rationally), and building a buffer for life’s uncertainties — the habits that keep your wealth growing steadily for decades.

💾 Saving in the Psychology of Money: The Only Lever You Fully Control

If there’s one principle in the psychology of money that beginners should master before anything else, it’s this: you have no control over market returns, inflation, or economic cycles — but you have complete control over how much you save.

Saving is the foundation of every financial plan. It’s the quiet engine behind wealth, financial security, and freedom. Yet, because it’s not flashy, many people underestimate its power. They obsess over stock picks, crypto trends, or side hustles — all while ignoring the one variable that has the most predictable and lasting impact on their future.

🧠 Why Saving Matters More Than Earning

Most people believe wealth is built by earning more. But in reality, saving more often matters far more than income growth — especially early in your financial journey. Consider two people:

- Person A earns $120,000 per year but saves 5%.

- Person B earns $70,000 but saves 25%.

In 10 years, Person B will have far more financial flexibility, less stress, and more investment capital — despite earning less. Why? Because wealth isn’t what you make — it’s what you keep.

📚 Want to learn more about the power of saving? Investopedia’s guide to saving is a great place to start.

📊 How Much Should You Save?

There’s no universal “right number,” but here are general guidelines based on financial experts:

- Beginners: Start with 10% of your take-home pay.

- Intermediate goal: Aim for 20% (split between savings and investments).

- Aggressive goal (for early financial independence): 30–50% if possible.

The exact percentage matters less than consistency. Saving a small amount regularly is more powerful than saving a large amount sporadically.

🛠️ Simple Ways to Boost Your Savings Rate

Most people don’t save because they think they “can’t.” But often, it’s a matter of design — not discipline. Here’s how to make saving automatic and painless:

- Pay yourself first: Set up an automatic transfer to savings or investment accounts the moment your paycheck hits.

- Use “invisible money”: Redirect salary raises, tax refunds, or side income into savings before you adjust your lifestyle.

- Trim recurring expenses: Audit subscriptions and fixed costs quarterly.

- Cap lifestyle inflation: When your income increases, upgrade your lifestyle by only half — and save the rest.

- Name your savings goals: People save more effectively when they’re saving for something specific (e.g., “Freedom Fund,” “Travel Account”).

💡 The Psychological Benefits of Saving

Saving isn’t just about money — it’s about peace of mind. Knowing you have a safety net reduces anxiety, improves decision-making, and gives you leverage in life choices. It lets you negotiate jobs from a position of strength, leave toxic situations, or invest confidently during downturns.

As financial writer Morgan Housel puts it: “Wealth is the nice cars not purchased, the first-class upgrade declined, and the clothes still in the store.”

🤝 Reasonable > Rational in the Psychology of Money (for Real People)

Financial textbooks teach us how to be rational — but humans aren’t robots. We make decisions based on emotions, habits, and circumstances. That’s why one of the most powerful lessons in the psychology of money is this: it’s better to build a financial plan that’s reasonable and sustainable than one that’s perfectly rational but impossible to follow.

🧠 Why “Perfect” Plans Often Fail

A “rational” plan might tell you to invest 100% in stocks, live on 30% of your income, and never touch your emergency fund. On paper, it’s optimal. In real life, it’s miserable. And miserable plans don’t last.

Here’s what usually happens:

- You panic-sell during a market crash because your portfolio is too aggressive.

- You abandon a strict budget because it feels restrictive.

- You raid your investments early because you didn’t leave room for emergencies.

A plan that’s slightly less efficient but easy to follow will outperform a “perfect” plan you quit after six months.

📘 For more on this idea, check out Morningstar’s behavioral finance insights, which explore why real people make irrational decisions — and how to design systems that account for them.

📊 Examples of Reasonable Financial Decisions

- Investing 80% in stocks and 20% in bonds — even if 100% stocks could yield higher returns — because it helps you sleep at night.

- Keeping 6–12 months of cash even though it “loses” to inflation — because it prevents panic-selling.

- Buying a home for stability and happiness, even if renting would maximize investing potential.

- Spending on experiences instead of saving every penny — because life satisfaction matters too.

These aren’t mistakes. They’re strategic decisions that prioritize behavioral sustainability over mathematical precision.

🛠️ How to Design a “Reasonable” Financial Plan

Here’s a framework for creating a plan that works in the real world:

- Start with psychology, not numbers: Ask, “What kind of plan will I actually stick to?”

- Add flexibility: Life changes — your plan should too. Build in room to adjust savings, spending, and investments.

- Use guardrails, not strict rules: For example, save at least 20% instead of exactly 20%.

- Make it automatic: Automate savings, investments, and bill payments to reduce decision fatigue.

- Review annually: Small adjustments each year keep your plan aligned with your life.

Reasonable plans work with human nature instead of against it — and that’s why they win over the long term.

🧯 Room for Error in the Psychology of Money: Build Your Shock Absorbers

No matter how smart your plan is, life will always surprise you. Markets crash. Jobs disappear. Medical bills happen. That’s why one of the most practical lessons in the psychology of money is building room for error — a financial cushion that keeps setbacks from becoming disasters.

🧠 Why Margin of Safety Is Essential

Most financial failures don’t happen because people make bad choices — they happen because they don’t leave themselves any room for error. They assume everything will go right and structure their finances for perfection.

But real life isn’t perfect. A plan that only works under ideal conditions isn’t a plan — it’s a gamble.

Here’s how room for error protects you:

- It turns unexpected expenses into inconveniences instead of crises.

- It buys you time to make thoughtful decisions instead of desperate ones.

- It allows you to stay invested during downturns instead of selling at a loss.

📊 According to Bankrate, fewer than half of Americans can cover a $1,000 emergency expense from savings — a vulnerability that often leads to debt traps.

📉 Key Areas Where You Need Room for Error

- Emergency Fund: 3–6 months of living expenses in cash (more if self-employed or in a volatile industry).

- Insurance: Health, disability, and life insurance protect against catastrophic costs.

- Diversification: Spread investments across different asset classes to avoid concentrated risk.

- Debt Management: Keep debt levels low so a job loss or rate hike doesn’t destabilize your finances.

- Lifestyle: Live below your means so you have flexibility during tough times.

🛠️ Practical Ways to Build Your Safety Net

- Start small, but start now: Even $500 in an emergency fund is better than zero.

- Automate safety savings: Set up a monthly transfer to a “rainy day” account.

- Use windfalls wisely: Bonuses, refunds, or side hustle income should go toward padding your buffer.

- Review your risks annually: As your life changes, your margin of safety should too.

💡 Room for Error in Investing

Investing without a margin of safety is one of the biggest mistakes beginners make. Avoid it by:

- Holding a portion of your portfolio in cash or bonds.

- Avoiding leverage (borrowed money).

- Planning for lower-than-expected returns when forecasting future goals.

A good rule of thumb: Plan for 80% of the best-case scenario. If reality turns out better, you win. If it doesn’t, you’re still fine.

Saving gives you control. Reasonable planning keeps you consistent. And building room for error ensures that unexpected shocks don’t derail your progress. Together, these three principles form the “defensive” side of the psychology of money — the part that protects your wealth and gives you resilience.

In the next section, we’ll explore how to use these solid foundations to make even smarter long-term decisions — including future-focused thinking, avoiding pessimism traps, and designing an action plan that works for you.

🙌 Your Future Self Will Thank You: Thinking Long-Term in the Psychology of Money

One of the most underrated truths in the psychology of money is this: most of your financial decisions aren’t really for you today — they’re for you tomorrow. Every dollar saved, every investment made, every habit formed compounds into a future where your life is easier, freer, and more fulfilling. But here’s the challenge: humans are wired for short-term gratification. We crave immediate rewards and underestimate the power of patience.

Learning to think long-term — to prioritize the well-being of your future self — is a skill that separates people who build lasting wealth from those who struggle financially their entire lives.

🧠 Why Long-Term Thinking Is So Hard (But So Important)

Our brains evolved to focus on the present. Thousands of years ago, survival depended on immediate needs — food, shelter, safety — not retirement planning. This “present bias” still influences how we handle money. We overspend now and promise ourselves we’ll save “later.” We delay investing because it doesn’t feel urgent.

But time is the most powerful variable in wealth creation. The earlier you make smart decisions, the bigger their impact. Small habits today — like saving 10%, paying down debt, or investing regularly — can mean the difference between financial stress and financial freedom decades from now.

💡 According to NerdWallet, investing just $200/month at 7% for 30 years can grow to over $240,000 — even if you never increase the amount. Start 10 years later, and you’d have less than half that.

📊 Build a “Future Self” Mindset

Here are powerful ways to start thinking like your future self:

- Visualize your life 10, 20, 30 years ahead. What does financial freedom look like? Where do you live? How do you spend your days?

- Name your future goals. Instead of saving “for retirement,” save “to buy a beach house,” “to pay for my child’s college,” or “to work part-time by 50.”

- Make decisions with future-you in mind. Before a purchase, ask, “Will this still matter to me in five years?”

- Reward your future self now. Automate investments and savings so your future self benefits without requiring constant willpower.

🛠️ Future-Proofing Your Financial Plan

Thinking long-term isn’t just about investing — it’s about designing a financial life that ages well.

Here’s how:

- Prioritize retirement accounts early: Contribute consistently to your 401(k), IRA, or similar plans. Even small contributions compound massively.

- Build habits, not just goals: A goal is “save $10,000.” A habit is “save 15% of every paycheck.” Habits are stronger because they don’t rely on motivation.

- Avoid irreversible decisions: High-interest debt, lifestyle inflation, and poor insurance choices are mistakes your future self can’t easily fix.

- Leave room for flexibility: Your future self’s priorities might change. Build a plan that’s adaptable.

Remember, every good decision today is a gift to the person you’ll be tomorrow.

📉 Why Pessimism Sounds Smart (and What to Do)

If you’ve ever felt paralyzed by financial headlines — recessions, inflation, crashes — you’re not alone. Negativity sells, and pessimism often sounds more intelligent than optimism. After all, warnings feel like wisdom. But in the psychology of money, understanding and managing pessimism is crucial — because pessimism can keep you from building wealth.

🧠 Why Our Brains Love Pessimism

Humans are wired with a negativity bias. We’re more sensitive to potential threats than potential rewards — an evolutionary trait that kept our ancestors alive. In money terms, this means we pay more attention to market crashes than to decades of growth.

This is why pessimists often sound “smarter.” Predicting problems feels cautious and thoughtful. Predicting growth sounds naive. But history tells a different story: markets recover, economies grow, and innovation continues.

📊 According to J.P. Morgan’s Guide to the Markets, the S&P 500 has risen in roughly 75% of years since 1928 — despite wars, recessions, pandemics, and crises.

💡 How Pessimism Hurts Your Finances

- You delay investing: Fear of a crash keeps you on the sidelines, missing out on compounding.

- You sell too soon: Negative news triggers emotional selling, often at the worst times.

- You over-save in cash: Trying to “stay safe” by avoiding risk leads to inflation eroding your wealth.

- You miss opportunities: Overestimating risks makes you underinvest in yourself, your skills, or your business.

🛠️ How to Stay Rational When Headlines Get Scary

- Zoom out: Daily news looks chaotic. Long-term charts show steady growth. Always look at 10–20-year trends, not 10-day headlines.

- Remember the recovery record: Every bear market in history has eventually been followed by a bull market.

- Diversify and automate: A diversified portfolio and automatic contributions help you stay invested regardless of market noise.

- Limit financial news: Checking the market once a week is enough. Daily updates fuel emotional decisions.

- Think in decades, not months: Most financial goals — retirement, homeownership, independence — are decades away. Short-term volatility matters less than you think.

Pessimism sounds smart, but optimism builds wealth. The most successful investors aren’t those who avoid risk — they’re those who manage it and stay the course.

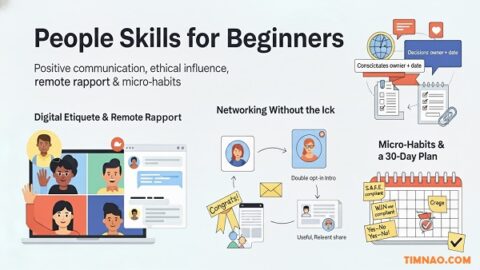

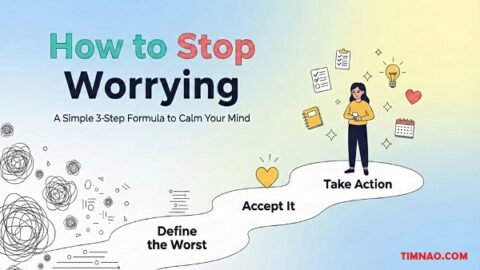

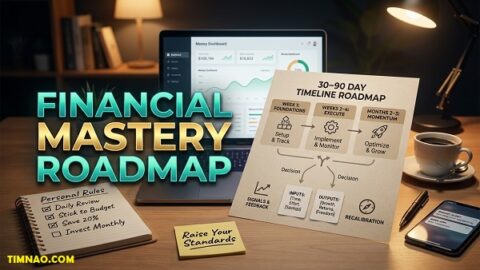

🧭 An Action Plan for Beginners (Step-by-Step)

If you’re new to managing money, it’s easy to feel overwhelmed. Where do you start? What matters most? How do you avoid mistakes? The good news: building financial stability doesn’t require perfection — just small, consistent steps.

This action plan breaks down the psychology of money into a simple, beginner-friendly roadmap. Follow it, and you’ll create a strong foundation for lifelong financial success.

🪜 Step 1: Get Your Financial Picture in Order

Before you can improve anything, you need to understand where you stand.

- List your income sources and total monthly take-home pay.

- Track your fixed expenses (rent, bills, debt payments) and variable expenses (food, entertainment, shopping).

- Identify your current savings rate and any debt balances.

- Review your credit report (AnnualCreditReport.com) and score.

This snapshot is your starting point. From here, you can make strategic decisions with clarity.

💾 Step 2: Build an Emergency Fund

Your first priority is safety. Aim to save 3–6 months of essential expenses in a high-yield savings account. This gives you a financial cushion against unexpected events like job loss, medical bills, or car repairs.

If saving that much feels impossible, start smaller: $500, then $1,000, then one month of expenses. Momentum builds confidence.

📈 Step 3: Pay Off High-Interest Debt

Debt is the enemy of compounding. Prioritize paying off high-interest debts (like credit cards) before investing heavily. The interest saved is essentially a guaranteed return on your money.

The debt avalanche method — paying off the highest-interest balances first — is the most efficient. But if motivation is hard, try the debt snowball — starting with the smallest balances for quick wins.

💰 Step 4: Automate Saving and Investing

Set up automatic transfers the day you get paid:

- 10–20% to savings or investments.

- Retirement contributions to your 401(k) or IRA.

- Extra payments toward any remaining debt.

Automation removes willpower from the equation — and consistency is the key to success.

📊 Step 5: Start Investing Early (Even Small Amounts)

You don’t need thousands to begin. Platforms like Vanguard and Fidelity allow you to start with low-cost index funds. The earlier you start, the more compounding works in your favor.

🧭 Step 6: Review and Adjust Annually

Your life will change — and so should your financial plan. Schedule an annual “money checkup” to:

- Rebalance your portfolio.

- Adjust your savings goals.

- Review insurance coverage.

- Update your “enough” statement and long-term goals.

Financial planning is a lifelong process, not a one-time project.

Your financial future isn’t built in a single decision — it’s built day by day through habits, patience, and resilience. By thinking long-term, resisting pessimism, and following a structured plan, you’ll give your future self something priceless: freedom, peace, and choice.

Next, we’ll pull everything together with practical resources, recommended tools, and key lessons to ensure you’re equipped to apply everything you’ve learned — and keep growing for decades to come.

🔧 Helpful Tools & Trusted Brands in the Psychology of Money

Mastering the psychology of money isn’t just about mindset — it’s also about using the right tools to turn that mindset into action. Beginners often struggle not because they lack discipline, but because they don’t have systems to make good financial habits automatic. The good news? There’s an entire ecosystem of apps, platforms, and services designed to help you save, invest, track, and grow your money with less effort.

Below are some of the most reliable tools and trusted brands to support every stage of your financial journey.

💰 Saving & Budgeting Tools

These tools help you understand where your money is going and make saving effortless:

- YNAB (You Need A Budget): One of the most beginner-friendly budgeting apps. It teaches you to “give every dollar a job” and proactively plan spending instead of reacting.

- Mint: A free, automated budget tracker that links to your accounts and categorizes expenses. Great for people who want a quick snapshot of their financial life.

- PocketGuard: Simplifies budgeting by showing how much disposable income you have after bills and savings goals.

💡 Pro tip: Automating even small savings — like $10 a week — builds momentum and rewires your brain to prioritize future wealth over impulse spending.

📈 Investing Platforms for Beginners

Investing is where the psychology of money meets long-term wealth. These platforms make it easy — even if you’re starting with $0:

- Vanguard: Renowned for low-cost index funds and ETFs. Perfect for long-term, hands-off investors.

- Fidelity: Offers a wide range of retirement accounts, fractional shares, and educational resources.

- Charles Schwab: Great for beginners who want a mix of automated investing and expert support.

- Betterment: A robo-advisor that builds and manages a diversified portfolio based on your goals and risk tolerance.

🔎 Why this matters: Many beginners fail to invest because they feel overwhelmed. Using user-friendly platforms removes barriers — and once investing becomes a habit, compounding does the rest.

📊 Tools for Tracking Net Worth and Progress

Seeing your progress is one of the best motivators for sticking to good habits. These tools help you visualize how your money grows over time:

- Empower (formerly Personal Capital): Links your accounts to show net worth, track investments, and plan for retirement.

- Kubera: An advanced tool for tracking assets, including real estate, crypto, and global investments.

- Spreadsheet Templates: For DIY lovers, building a custom tracker in Excel or Google Sheets can be incredibly powerful — and free.

🛡️ Insurance, Protection & Planning Tools

Protecting your wealth is as important as building it. These services help ensure that an unexpected event doesn’t wipe out your progress:

- Policygenius: A marketplace to compare life, disability, and home insurance.

- Ladder: Offers flexible term life insurance that grows or shrinks with your needs.

- LegalZoom: Simplifies wills, trusts, and estate planning — crucial for long-term wealth preservation.

🙋 FAQs: Beginner Questions About the Psychology of Money Answered

The psychology of money can feel abstract when you’re starting out. To make it more practical, let’s tackle some of the most common beginner questions — with straightforward, actionable answers.

🤔 1. “I don’t earn much. Can I still build wealth?”

Absolutely. Wealth is not about how much you make — it’s about how much you keep and how consistently you grow it. Many millionaires started with modest salaries but built wealth through regular saving, consistent investing, and avoiding lifestyle inflation. Even $50 a month, invested consistently, compounds significantly over decades.

💡 Start small, but start now. The habit is more important than the amount.

💭 2. “What if I invest and lose money?”

Losing money temporarily is part of investing. Markets fluctuate — that’s normal. What matters is staying invested long enough to let compounding and recovery work in your favor. Historically, the U.S. stock market has delivered 7–10% average annual returns over long periods, despite frequent downturns.

✅ Tip: Use low-cost, diversified index funds and invest consistently through market ups and downs.

📆 3. “Should I pay off debt or invest first?”

It depends on the interest rate. As a general rule:

- If your debt interest rate is above 6–7%, pay it down first — that’s a guaranteed return.

- If it’s below 5%, consider a balanced approach: pay down debt and start investing simultaneously.

💸 4. “How much should I have in an emergency fund?”

A good rule of thumb:

- 3 months of expenses: If you have a stable job and income.

- 6+ months: If your income is variable or you’re self-employed.

This fund is your financial shock absorber — it keeps you from going into debt when life throws a curveball.

📊 5. “Do I need a financial advisor?”

Not necessarily. Many beginners can manage their finances using free tools, robo-advisors, and low-cost index funds. However, a fee-only fiduciary advisor can be worth it if:

- Your financial situation is complex (multiple income streams, inheritance, business, etc.).

- You want help with tax strategy, estate planning, or retirement optimization.

Check out NAPFA to find certified fiduciary advisors.

🧠 6. “What’s the most important thing I should focus on as a beginner?”

Behavior. It’s not the market, the economy, or even the products you choose — it’s your habits that determine success. Automate your savings, invest consistently, avoid lifestyle creep, and think long-term. Do those things, and time will do the heavy lifting.

🧩 Key Lessons & Takeaways

After exploring every concept — from behavior and compounding to saving, risk, and future planning — let’s tie it all together. These are the most important, actionable principles to remember:

💡 1. Behavior Beats Brilliance

You don’t need to be a financial genius. The people who build real wealth are those who spend less than they earn, save consistently, and stay invested over time. Good decisions repeated over decades beat perfect decisions made occasionally.

🛠️ 2. Saving Is the Ultimate Superpower

You can’t control the market, inflation, or interest rates — but you can control how much you save. Your savings rate is the single most powerful predictor of financial success.

📊 3. Time Is Your Greatest Ally

The earlier you start, the harder compounding works for you. Even small contributions grow exponentially over decades. Start now — your future self will thank you.

🧭 4. Plan for the Worst, Hope for the Best

Build room for error — emergency funds, insurance, diversification — to protect yourself from inevitable surprises. Financial resilience is as important as growth.

🙌 5. Focus on “Enough,” Not “More”

Wealth is not about endless accumulation. It’s about building a life where you control your time, reduce stress, and spend money on what truly matters. Define “enough” for yourself — and ignore the rest.

📈 6. The Journey Never Ends

Financial mastery is not a destination but a process. Your goals, priorities, and strategies will evolve — and that’s okay. Keep learning, adjusting, and improving as you go.

You’ve now walked through every major principle of the psychology of money — from behavior and mindset to practical systems and long-term planning. With the right tools, habits, and perspective, anyone — regardless of income, age, or background — can achieve financial security and freedom.

The next step is simple but powerful: take action today. Choose one habit to implement, one account to open, or one expense to cut. Every small step compounds into a future where money works for you — not the other way around.

Wow superb blog layout How long have you been blogging for you make blogging look easy The overall look of your site is magnificent as well as the content