🚀 Unlock Your Trading Potential: A Beginner’s Guide to AI Algorithmic Trading in 2025!

The world of financial trading is undergoing a seismic shift, powered by the relentless advancements in Artificial Intelligence (AI). What was once the exclusive domain of large financial institutions and tech-savvy quants is now becoming increasingly accessible to individual investors. If you’re curious about how AI is reshaping trading and how you, even as a beginner, can tap into its potential, you’ve come to the right place. This comprehensive guide will demystify AI algorithmic trading, explore its core concepts, highlight the tools and strategies involved, and provide actionable insights to help you embark on your automated investing journey in 2025.

📜 Table of Contents

- 🤔 What Exactly is Algorithmic Trading?

- ✨ The Magic of AI in Algorithmic Trading

- 🚀 Getting Started: Your First Steps in AI Algorithmic Trading

- 🧠 Understanding the Basics: Key Concepts for Beginners

- 🛠️ Essential Tools and Platforms for AI Algorithmic Trading

- 🐍 Why Python is Popular in Algorithmic Trading

- 💡 Popular AI Trading Strategies for Beginners

- 📈 Trend Following with AI

- 📊 Mean Reversion Explained

- 💥 AI-Powered Breakout Trading

- 📰 Sentiment Analysis: Trading on News and Social Media

- 🤖 Understanding AI Trading Bots

- ⚙️ Building Your Own Simple Trading Algorithm (Conceptual Steps)

- ⚖️ The Benefits and Risks of AI Algorithmic Trading

- ✅ Advantages: Speed, Efficiency, and Emotionless Decisions

- ❗ Risks and Challenges: What Beginners Need to Know

- 🌍 Ethical Considerations in an AI-Driven Market

- 🔮 The Future of AI in Trading: Trends to Watch

- 🚶♂️ 7 Key Steps to Master AI Algorithmic Trading

- ❓ Frequently Asked Questions (FAQ)

🤔 What Exactly is Algorithmic Trading?

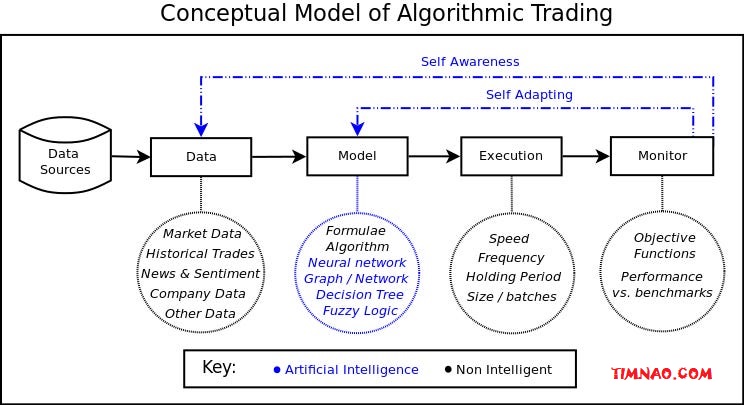

At its heart, algorithmic trading (often called “algo-trading” or “black-box trading”) uses computer programs to execute trades automatically based on a predefined set of instructions or rules. These rules can be based on various factors like timing, price, volume, or complex mathematical models. Instead of a human trader manually placing orders, the algorithm does the heavy lifting, often at speeds and volumes far exceeding human capabilities.

The journey of algorithmic trading began transforming traditional trading floors in the late 20th century with the advent of electronic trading. The introduction of computerized order matching systems, like the NYSE’s in 1982, laid the groundwork. The internet boom in the 1990s further democratized market access, fueling the rise of high-frequency trading (HFT) and quantitative methods. Events like the US National Market System (NMS) implementation in 2005 fostered a more competitive environment, leading to a proliferation of diverse trading strategies.

✨ The Magic of AI in Algorithmic Trading

Artificial Intelligence takes algorithmic trading a step further. Instead of just following fixed rules, AI-powered algorithms can learn from data, adapt to changing market conditions, and make more sophisticated trading decisions. Think of it as upgrading from a basic calculator to a supercomputer that not only calculates but also learns and strategizes.

Key AI technologies revolutionizing trading include:

- Machine Learning (ML): ML algorithms analyze vast amounts of historical and real-time market data to identify patterns, predict future price movements, and refine trading strategies over time. This is a significant leap from traditional algorithms that rely on predefined rules set by programmers. Supervised learning, for instance, uses labeled datasets (e.g., past price movements labeled as “buy” or “sell” signals) to train models. Unsupervised learning, on the other hand, uncovers hidden patterns in unlabeled data, useful for tasks like customer segmentation or anomaly detection in trading behaviors.

- Deep Learning (DL): A subset of ML, deep learning utilizes neural networks with multiple layers to learn from data in an even more nuanced way. It’s particularly effective for complex tasks like image recognition (e.g., analyzing chart patterns) or understanding subtle market dynamics from diverse data sources.

- Natural Language Processing (NLP): NLP enables computers to understand and interpret human language. In trading, this is invaluable for sentiment analysis – gauging market mood by analyzing news articles, financial reports, and social media chatter to predict potential market reactions. For example, an NLP algorithm can parse financial news to detect positive or negative sentiment around a stock, influencing buy or sell decisions.

- Reinforcement Learning (RL): This advanced technique trains algorithms through trial and error, much like a human learns from experience. In a simulated trading environment, an RL agent makes decisions (buy, sell, hold) and receives rewards or penalties based on the outcome, gradually optimizing its strategy for maximum profitability.

AI enhances trading by improving automation, increasing speed and accuracy, enabling 24/7 trading (especially in forex and crypto markets), and implementing sophisticated risk management techniques by setting automatic stop-loss and take-profit levels.

🚀 Getting Started: Your First Steps in AI Algorithmic Trading

Venturing into AI algorithmic trading might seem daunting for beginners, but with a structured approach, it’s manageable.

🧠 Understanding the Basics: Key Concepts for Beginners

Before diving into coding or platforms, familiarize yourself with these core concepts:

- Algorithms: A set of instructions or rules designed to solve a problem or perform a task. In trading, they automate responses to market data.

- High-Frequency Trading (HFT): A type of algorithmic trading characterized by high speeds, high turnover rates, and high order-to-trade ratios.1 HFT firms often execute millions of trades in seconds to capitalize on tiny price discrepancies.

- Market Maturity and Liquidity: Liquidity refers to how easily an asset can be bought or sold without significantly impacting its price. Mature markets like the NYSE typically have high liquidity.

- Order Types:

- Market Order: Executed immediately at the best available current price.

- Limit Order: Sets a maximum price to buy or a minimum price to sell.

- Stop-Loss Order: Automatically triggers a sale if a security’s price drops to a specified threshold to limit losses.

- Backtesting: Evaluating a trading strategy on historical data to see how it would have performed in the past. This is crucial for validating and fine-tuning algorithms before risking real capital.

- Slippage: The difference between the expected price of a trade and the actual price at which it’s executed. This can occur due to market volatility or execution delays.

- Data Management and Analysis: High-quality data is the lifeblood of algorithmic trading. This involves collecting, cleaning (preprocessing), and analyzing historical and real-time data to extract actionable insights.

- Brokers and Execution Venues: Brokers provide access to execution venues (exchanges where trades happen). The choice of broker impacts execution quality, latency, and costs.

- Risk Management: Essential techniques include position sizing (how much capital to allocate per trade), diversification (spreading investments), and using stop-loss orders to protect capital.

🛠️ Essential Tools and Platforms for AI Algorithmic Trading

Numerous platforms and tools cater to algorithmic traders, some more beginner-friendly than others:

- Programming Languages:

- Python: Highly recommended for beginners due to its readability, extensive libraries (like Pandas for data analysis, NumPy for numerical operations, Scikit-learn for machine learning, and TA-Lib for technical analysis), and large community support. The official website for Python is python.org.

- Trading Platforms with AI Capabilities:

- MetaTrader 4/5 (MT4/MT5): Popular for forex trading, allowing users to develop, test, and run automated trading strategies (Expert Advisors or EAs) using its MQL4/5 language. You can find more information on platforms like FOREX.com which offer MetaTrader.

- QuantConnect: A cloud-based algorithmic trading platform supporting Python and C#. It provides access to vast historical data, a powerful backtesting engine (LEAN), and a community for strategy sharing. Their official GitHub is github.com/QuantConnect.

- Interactive Brokers (IBKR): Offers a robust Trader Workstation (TWS) with a powerful API for developing custom algorithms and accessing global markets. Their official site is interactivebrokers.com.

- NinjaTrader: Provides advanced charting, strategy backtesting, and automated trading capabilities. Often favored by futures and forex traders.

- TradeStation: Another comprehensive platform offering tools for charting, analysis, backtesting, and automated trading.

- Tickeron: Offers AI-driven tools to analyze markets and generate trade ideas, including “AI Robots” for automated trading.

- Cryptohopper, 3Commas, TradeSanta, Pionex: Popular platforms specifically for cryptocurrency trading, offering various AI trading bots and automation features.

- Brokerage Platforms (some with API access for algo trading):

- E*TRADE: A well-known online broker offering various investment and trading services. Official site: us.etrade.com.

- TD Ameritrade (now part of Charles Schwab): Provided the popular thinkorswim platform, known for its advanced tools. Information can be found via adviserinfo.sec.gov.

- Robinhood: Known for commission-free trading and a user-friendly mobile app, also offering crypto trading. Official site: robinhood.com.

- Data Providers:

- Alpha Vantage: Provides free APIs for real-time and historical stock data, forex, and cryptocurrencies, making it a good starting point for data acquisition. Official site: alphavantage.co.

- Backtesting Software: Besides platform-specific tools, dedicated software like

Amibrokerand cloud platforms likeQuantConnectoffer extensive backtesting capabilities. Python libraries likeBacktraderandZiplineare also excellent for this.

When choosing a platform or bot, look for features like algorithm customization, robust security protocols (e.g., encrypted APIs, two-factor authentication), a user-friendly interface, and strong backtesting capabilities.

🐍 Why Python is Popular in Algorithmic Trading

Python has become the de facto language for many in the AI algorithmic trading space, especially for beginners, due to:

- Readability and Simplicity: Python’s syntax is clean and easy to learn.

- Extensive Libraries:

- Pandas: For data manipulation and analysis, especially time-series data.

- NumPy: For numerical computations and working with arrays.

- Scikit-learn: A comprehensive library for machine learning tasks.

- TensorFlow & Keras/PyTorch: For building and training deep learning models.

- Matplotlib & Seaborn: For data visualization.

- Statsmodels: For statistical modeling.

- TA-Lib: For technical analysis indicators.

- Large Community: Abundant resources, tutorials, and community support are available.

- Integration Capabilities: Python integrates well with many brokerage APIs and trading platforms.

💡 Popular AI Trading Strategies for Beginners

AI can enhance various traditional trading strategies. Here are a few that algorithmic trading for beginners can explore:

📈 Trend Following with AI

- Concept: This strategy is based on the idea that assets that have been trending in a particular direction (up or down) will continue to do so.

- AI’s Role: AI can analyze historical price data and technical indicators (like Moving Averages – e.g., 50-day and 200-day SMA crossovers) to identify and confirm trends more accurately and quickly than humans. AI models can also scan news and social media to gauge trend strength.

- How it works: AI scans price charts, identifies trends, and places trades in the direction of the trend (buying in an uptrend, selling in a downtrend).

📊 Mean Reversion Explained

- Concept: This strategy operates on the assumption that asset prices, after extreme moves, tend to revert to their historical average or mean price over time.

- AI’s Role: AI algorithms can identify significant deviations from an asset’s historical mean by analyzing price data and volatility. They can also determine optimal entry and exit points for trades expecting this reversion.

- How it works: AI identifies when an asset is significantly overbought (too high above its mean) or oversold (too low below its mean) and places trades expecting the price to return to the average.

💥 AI-Powered Breakout Trading

- Concept: Breakout trading involves identifying key support (price floor) and resistance (price ceiling) levels and placing trades when the price breaks through these levels, often with high volume.

- AI’s Role: AI can monitor numerous assets simultaneously for potential breakout patterns, analyze the strength of the breakout (e.g., by looking at volume and the speed of the price change), and execute trades rapidly.

- How it works: AI scans price charts for key resistance and support levels, detects when an asset breaks through these levels with high volume, and executes trades in the direction of the breakout, often using stop-loss orders.

📰 Sentiment Analysis: Trading on News and Social Media

- Concept: This strategy involves making trading decisions based on the overall attitude or emotion (sentiment) expressed in news articles, social media posts, and financial reports regarding a particular asset or market.

- AI’s Role: NLP (Natural Language Processing) algorithms can scan and interpret vast amounts of text data in real-time, assigning sentiment scores (positive, negative, neutral) to gauge market mood.

- How it works: If AI detects strong bullish (positive) sentiment from news and social media about a stock, it might initiate buy trades. Conversely, bearish (negative) sentiment could trigger sell or short-sell orders.

🤖 Understanding AI Trading Bots

AI trading bots are software programs that use AI algorithms to automate trading decisions and execution. They can operate 24/7, analyze vast amounts of data in seconds, and execute trades without emotional bias – a common pitfall for human traders.

For beginners, using a pre-built AI trading bot from a reputable platform can be a good entry point. Many platforms like Cryptohopper, 3Commas, and Tickeron offer bots with varying levels of customization and pre-set strategies.

When choosing an AI trading bot, consider:

- Specialization: Some bots are designed for specific markets (e.g., forex, crypto, stocks).

- Features: Look for algorithm customization, backtesting tools, built-in risk management (stop-loss, take-profit), and security features.

- User-Friendliness: Especially important for beginners.

- Reputation and Reviews: Research the platform and bot thoroughly.

⚙️ Building Your Own Simple Trading Algorithm (Conceptual Steps)

While using pre-built bots is an option, understanding how algorithms are built is beneficial. Here’s a conceptual outline:

- Define Your Strategy: Choose a simple strategy (e.g., moving average crossover). Clearly define entry (buy) and exit (sell) rules. For a moving average crossover:

- Entry (Buy): When the shorter-term moving average (e.g., 50-day) crosses above the longer-term moving average (e.g., 200-day).

- Exit (Sell): When the shorter-term moving average crosses below the longer-term moving average, or when a predefined profit target or stop-loss is hit.

- Select an Asset and Get Data: Choose an asset (e.g., a specific stock) and obtain historical price data (Open, High, Low, Close, Volume – OHLCV) from sources like Alpha Vantage or Yahoo Finance.

- Choose a Programming Language/Platform: Python is a good choice for its libraries.

- Implement the Logic:

- Load and preprocess the data (handle missing values, etc.).

- Calculate the necessary indicators (e.g., the two moving averages).

- Implement the entry and exit rules to generate buy/sell signals.

- Backtest Your Algorithm: Test your algorithm on the historical data to see how it would have performed. Analyze metrics like total return, win rate, and maximum drawdown.

- Optimize (Carefully): Tweak parameters (e.g., the moving average periods) to see if performance improves. Be wary of overfitting – creating an algorithm that works perfectly on past data but fails on new data.

- Paper Trading: Before live trading, test your algorithm in a simulated environment with real-time data but fake money. This helps you see how it performs under current market conditions without financial risk.

- Live Trading (Start Small): If paper trading is successful, you might consider live trading with a small amount of capital you can afford to lose.

⚖️ The Benefits and Risks of AI Algorithmic Trading

✅ Advantages: Speed, Efficiency, and Emotionless Decisions

- Speed and Efficiency: AI algorithms can process information and execute trades in milliseconds, far faster than any human. This is crucial for strategies like HFT.

- Accuracy and Reduced Errors: Automation reduces the chance of manual errors in placing trades.

- Emotionless Trading: AI eliminates emotional decision-making (fear, greed) that can lead to poor trading choices.

- Backtesting Capabilities: Strategies can be rigorously tested on historical data before deployment.

- 24/7 Operation: AI trading bots can monitor markets and trade around the clock, essential for global markets like forex and crypto.

- Data-Driven Decisions: AI can analyze vast and complex datasets to uncover insights humans might miss.

- Improved Risk Management: AI can automatically implement risk controls like stop-losses and position sizing.

❗ Risks and Challenges: What Beginners Need to Know

- Market Volatility and Instability: Algorithms based on past data may struggle to adapt to sudden, unprecedented market shocks (“black swan” events) or high volatility periods.

- Technology Failures and Glitches: System crashes, software bugs, or loss of internet connectivity can disrupt trading and lead to losses. The 2012 Knight Capital glitch is a stark reminder, where a malfunctioning algorithm caused massive losses in minutes.

- Data Integrity and Quality: Algorithms are only as good as the data they’re fed. Inaccurate, incomplete, or delayed data can lead to flawed trading decisions.

- Overfitting (Curve Fitting): This is a major risk where an algorithm is too closely tailored to historical data and performs poorly on live, unseen data.

- Lack of Human Judgment in Real-Time: While removing emotion is good, sometimes human intuition and the ability to understand unique contexts are valuable, especially during unforeseen events.

- Cybersecurity Threats: Trading systems and accounts can be targets for hacking and data breaches.

- Model Risk: The underlying mathematical models of the AI might have inherent flaws or assumptions that don’t hold true in all market conditions.

- Complexity and Cost: Developing and maintaining sophisticated AI algorithmic trading systems can be complex and require significant investment in technology and expertise, though this is becoming more accessible.

🌍 Ethical Considerations in an AI-Driven Market

As AI algorithmic trading becomes more prevalent, ethical considerations are paramount:

- Transparency and Explainability (XAI): Many advanced AI models, especially deep learning, can be “black boxes,” making it hard to understand why they make certain decisions. There’s a growing demand, including from regulators, for more explainable AI so that trading decisions can be audited and understood.

- Algorithmic Bias: AI models learn from historical data. If this data reflects past biases (e.g., related to certain sectors or types of companies), the AI can perpetuate or even amplify these biases. This can lead to unfair market advantages or disadvantages.

- Market Manipulation and Stability: High-speed algorithms interacting with each other have the potential to cause market instability or “flash crashes”. There are concerns about algorithms being designed for predatory practices like “quote stuffing.”

- Data Privacy: AI trading systems often use vast amounts of data, some of which could be sensitive. Ensuring data privacy and security is crucial.

- Fairness and Access: The sophisticated tools of AI algorithmic trading were once only available to large institutions. While access is improving, ensuring a level playing field for retail investors remains a concern.

Responsible AI development and deployment involve robust testing, ongoing monitoring, clear governance frameworks, and a commitment to fairness and transparency.

🔮 The Future of AI in Trading: Trends to Watch

The role of AI in trading is set to expand significantly by 2025 and beyond:

- Hyper-Automation: Expect even faster execution speeds and more complex tasks to be automated.

- Advanced Predictive Analytics: AI models will become more sophisticated in forecasting market trends, leveraging more diverse datasets.

- Enhanced Risk Management: AI will play an even greater role in proactive risk identification and mitigation.

- Greater Use of Alternative Data: AI will increasingly analyze non-traditional data sources like satellite imagery, shipping data, and IoT sensor data to gain market insights.

- Explainable AI (XAI): As mentioned, there will be a stronger push for AI models whose decision-making processes are transparent and auditable to satisfy regulatory demands and build trust.

- Quantum Computing: While still in its nascent stages, quantum computing has the potential to revolutionize complex calculations needed for portfolio optimization and risk analysis at speeds unimaginable today.

- Blockchain and DeFi Integration: AI could be used to create more intelligent trading strategies on decentralized finance (DeFi) platforms and to analyze blockchain data for trading signals.

- Increased Accessibility for Retail Traders: Platforms and tools will continue to make AI-powered trading more accessible to individual investors.

- Human-AI Collaboration: The future likely involves a synergistic relationship where AI augments human traders’ abilities, handling data processing and execution while humans provide strategic oversight and interpret complex, novel situations.

🚶♂️ 7 Key Steps to Master AI Algorithmic Trading

For those ready to embark on or advance their journey in AI algorithmic trading, here are seven key steps to guide you towards mastering automated investing:

- 📚 Step 1: Build a Strong Foundation: Education and Core Concepts

- Action: Dedicate time to continuous learning. Start with the fundamentals of financial markets, trading principles, and then delve into AI, machine learning (ML), and data analysis. Understand key concepts like liquidity, order types, backtesting, and risk management.

- Why it’s key for beginners: A solid understanding prevents costly mistakes and forms the basis for all future development in AI algorithmic trading.

- 📊 Step 2: Master Your Data: Analysis and Preparation

- Action: Learn how to source, collect, clean, and preprocess financial data. High-quality data is the lifeblood of any successful AI trading model. Practice data manipulation and visualization using tools like Python with Pandas and Matplotlib.

- Why it’s key for beginners: Flawed data leads to flawed AI trading bots and strategies. This step is crucial for accuracy.

- 💻 Step 3: Choose Your Tools Wisely: Platforms and Programming

- Action: Select appropriate trading platforms, programming languages (Python is highly recommended for algorithmic trading for beginners), and brokerage APIs that align with your skills and trading goals. Explore platforms offering demo accounts to familiarize yourself.

- Why it’s key for beginners: The right tools can significantly lower the entry barrier and accelerate your learning curve.

- 🧪 Step 4: Strategize and Simulate: Develop, Backtest, and Paper Trade

- Action: Start with a simple, well-defined trading strategy. Implement its logic and then rigorously backtest it on historical data to evaluate potential performance. Before risking real capital, use paper trading (simulated trading) to test your algorithm in live market conditions.

- Why it’s key for beginners: This iterative process helps refine strategies and builds confidence without financial risk.

- 🛡️ Step 5: Prioritize Safety: Implement Robust Risk Management

- Action: Define your risk tolerance clearly. Implement essential risk management techniques such as setting stop-loss orders, determining appropriate position sizes for each trade, and diversifying your strategies or assets if applicable. Be acutely aware of the common risks in AI algorithmic trading.

- Why it’s key for beginners: Protecting your capital is paramount; effective risk management prevents significant losses.

- 🟢 Step 6: Go Live Responsibly and Monitor Diligently

- Action: If, after thorough testing, you decide to go live, start with a small amount of capital you can afford to lose. Continuously monitor your AI trading bots and algorithm’s performance in real-time. AI models are not “set-and-forget”; they require oversight.

- Why it’s key for beginners: Live trading introduces real-world factors like slippage and emotional pressure; starting small minimizes potential fallout.

- 🌱 Step 7: Commit to Ethical Practices and Continuous Evolution

- Action: Always trade responsibly, being mindful of ethical implications and regulatory compliance. The field of AI algorithmic trading is constantly evolving, so commit to ongoing learning, adapt your strategies based on performance and market changes, and stay updated with new technologies and trends.

- Why it’s key for beginners: Ethical conduct builds long-term trust, and adaptability ensures your strategies remain relevant and effective.

❓ Frequently Asked Questions (FAQ)

- Is AI algorithmic trading profitable? It can be, but it’s not a guarantee of profits. Success depends on the strategy, the quality of the AI model, risk management, and market conditions. Many AI-driven funds exist, but like all trading, there are risks involved.

- Do I need to be a coding expert to use AI in trading? Not necessarily. Many platforms now offer AI trading bots and tools with user-friendly interfaces that don’t require deep coding knowledge. However, to build custom AI algorithms from scratch, programming skills (especially in Python) are essential.

- What’s the minimum investment needed for AI algorithmic trading? This varies greatly. Some platforms allow you to start with small amounts, especially for crypto trading bots. If you’re developing your own systems, initial costs might involve data subscriptions or more powerful hardware, though cloud computing can mitigate some of this.

- How does AI reduce emotional errors in trading? AI algorithms execute trades based on pre-programmed logic and data analysis, without being influenced by human emotions like fear, greed, or panic, which can often lead to irrational trading decisions.

- Can AI predict the stock market with 100% accuracy? No. While AI can significantly improve predictive capabilities by analyzing vast amounts of data and identifying complex patterns, financial markets are inherently unpredictable due to numerous influencing factors, including unforeseen global events. No system can predict the market with absolute certainty. Studies suggest AI can predict price movements with high accuracy (e.g., up to 85% in some crypto studies), but this is not guaranteed profit.

Embarking on the AI algorithmic trading journey is an exciting prospect. By combining a solid understanding of trading principles with the power of artificial intelligence, beginners can unlock new possibilities in the financial markets. Remember to prioritize learning, start cautiously, and always manage your risks. Good luck!

Reference video: