Financial Mastery Roadmap: A Powerful, Stress-Saving Plan to Control Your Money 💪

Financial mastery roadmap—if that phrase sounds “big,” don’t worry. This guide is built for beginners who feel busy, overwhelmed, and stuck doing lots of “money things” without seeing real results.

In the next sections, you’ll learn why motivation isn’t the missing piece, what hidden habits quietly drain your cash, and how to set a few simple standards that stop financial leaks fast—so you can save more, stress less, and make smarter money decisions starting this week.

The real obstacle isn’t motivation—it’s “money motion” with no strategy

Most beginners don’t have a motivation problem. They have a direction problem.

They’re doing lots of “money things”:

- watching budgeting videos

- downloading apps

- trying a no-spend week

- starting a side hustle idea

- reading about investing

…but after a month, the bank account looks basically the same. That’s money motion: lots of activity, not much traction.

What “money motion” looks like in real life (quick self-check)

If any of these feel familiar, you’re probably stuck in motion:

- You restart often

- “This month I’m serious.”

- Two weeks later: “I’ll start fresh next paycheck.”

- You optimize tiny things while ignoring big leaks

- hunting coupons

- ignoring subscriptions, fees, or high-interest debt

- You collect information instead of making decisions

- saved videos

- bookmarked spreadsheets

- no consistent weekly routine

- You treat each money moment like a new decision

- every purchase is a debate

- every bill is a surprise

- every week feels improvised

None of this means you’re “bad with money.” It means you don’t have a strategy yet.

Why money motion feels productive (and why it’s a trap)

Money motion gives you quick hits of progress:

- “I learned something!”

- “I made a plan!”

- “I feel responsible!”

But learning isn’t the same as doing, and planning isn’t the same as repeating.

A strategy is boring on purpose. It’s meant to run even when you’re tired.

Money motion creates three expensive outcomes:

- Decision fatigue → impulse spending

When you’re forced to decide everything from scratch, your brain eventually takes the easiest option. - Inconsistency → fees + interest

Late fees, overdrafts, “oops” purchases, minimum payments that drag on forever. - Missed opportunities → slow income growth

You keep switching from “learn this skill” to “try that hustle,” so you never compound one path long enough to get paid.

This is why motivation doesn’t fix it. Motivation spikes. Strategy stays.

What a money strategy actually is (simple definition)

A beginner money strategy is just two things:

- A repeatable decision system

- “When payday hits, I do X.”

- “When I want to buy something, I do Y.”

- “When it’s Friday, I review Z.”

- A focus

- one main goal for the next 30–90 days

- not ten goals competing for attention

If you have those two, you will improve—even if you’re not “naturally disciplined.”

The 15-minute traction test (do this today)

If you want to switch from motion to traction, do this quick test:

- Open your bank transactions (last 14–30 days).

- Answer these three questions in plain language:

- What are my three biggest repeating expenses?

- What is my biggest leak (fees, subscriptions, impulse category)?

- What is my one best next move: stabilize, cut spending, increase income, or build assets?

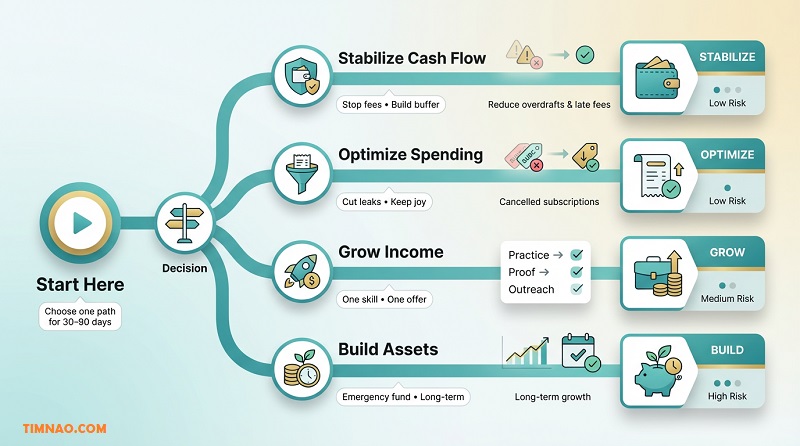

- Choose one focus for the next 30 days:

- Stabilize cash flow (stop fees/overdrafts, get control)

- Optimize spending (free up money without misery)

- Grow income (one skill + one offer)

- Build assets (emergency fund + long-term investing basics)

Don’t overthink it. Pick the path that reduces stress fastest. That’s usually the right first step.

And once you pick the path, the next question is: why is this hard to stick to in the first place? That’s where root causes come in.

Root causes you can fix: invisible defaults, emotional spending, and scattered goals

If money motion is the symptom, these are the common causes underneath it. The good news: they’re fixable—without becoming a different person.

Root cause 1: Invisible defaults are deciding for you

A “default” is what happens when you don’t actively choose.

Examples:

- subscriptions renew automatically

- food delivery is the “tired” default

- you pay bills late because you avoid checking

- the credit card becomes the default when cash gets tight

Defaults aren’t moral. They’re just systems that exist.

Reframe: Don’t try to become a willpower robot. Replace bad defaults with good defaults.

Fix it with a 3-part reset:

- Make spending visible (lightweight, not obsessive)

- Weekly 10–15 minute review

- Use a simple list in Notion or a basic tracker in Google Sheets

- Automate the good

- minimum bill autopay (to avoid fees)

- small savings auto-transfer (even $10–$25) right after payday

- Add friction to the bad

- remove saved cards from shopping sites

- turn off one-click purchases

- uninstall the most tempting app for 30 days

- use a 24-hour rule for non-essentials

Beginner win to aim for: fewer surprises. That alone reduces stress spending.

Root cause 2: Emotional spending is a regulation habit, not a “money habit”

Most impulse spending isn’t about the item. It’s about the feeling.

Common triggers:

- stress

- boredom

- loneliness

- “I worked hard, I deserve it”

- decision fatigue

Reframe: Emotional spending is your brain trying to self-regulate. You don’t fix it by shaming yourself. You fix it by giving your brain a cheaper, faster option.

Fix it with a “Pause Plan” (simple and realistic):

When you feel the urge to spend, do this sequence:

- Name the feeling

- “I’m stressed.”

- “I’m tired.”

- “I’m craving a reward.”

- Do a 5-minute free reset

Pick one:

- walk outside

- shower

- stretch

- music

- clean one small area

- text a friend

- Then decide with one question

- “Will I still want this tomorrow?”

- “What would future-me thank me for?”

- “Is there a cheaper version that still solves the real need?”

If you still want the purchase after the pause, fine—buy it consciously. The goal isn’t zero fun. The goal is not spending as an emotional reflex.

Money impact (realistic):

If you prevent just two $20 impulse purchases per week, that’s ~$160/month. That’s not theory. That’s rent, debt payoff, or savings.

Root cause 3: Scattered goals create “strategy switching” and slow progress

A lot of beginners try to do this all at once:

- cut spending

- pay debt

- start investing

- start a side hustle

- learn a skill

- build an emergency fund

That’s like trying to run four apps on a phone with 5% battery.

Reframe: You don’t need more goals. You need a sequence.

Fix it with the “One Goal + One Support” rule:

- One primary money goal for 30–90 days

- One support habit that makes it easier

Examples:

- Primary: “Stop overdrafts”

Support: weekly review every Friday - Primary: “Pay off credit card debt”

Support: automate payment + reduce one spending category - Primary: “Earn $300 extra/month”

Support: practice one skill 3x/week

When you do this, your progress compounds. When you don’t, you constantly restart.

Root cause 4: Wrong default choices (the “smart-sounding” mistakes)

These are super common and they keep people stuck:

- Mistake: Building a perfect budget before building a review habit

Better: Start with weekly review first. Then budget. - Mistake: Trying extreme restriction

Better: Reduce one category, keep life livable. - Mistake: Chasing quick wins while ignoring fees/interest

Better: Kill the leaks first. Then grow.

A simple decision rule:

If a tactic saves you $5 but costs you 2 hours of stress, it’s not a good beginner tactic. Your plan must be sustainable.

Now we’ve diagnosed the causes. Next comes the lever that fixes multiple causes at once—fast: raising your standards.

Raise Your Standards money: the fastest way to stop financial leaks

“Raise your standards” can sound motivational, but it’s actually very practical when it comes to money.

A standard is not a wish. It’s a line you don’t cross.

If you want faster financial improvement, raising standards works because it changes your defaults.

Standards vs goals (why standards work when goals fail)

Goals are outcomes:

- “Save $1,000.”

- “Pay off my card.”

- “Make more money.”

Standards are behaviors:

- “I review my money weekly.”

- “I don’t pay late fees anymore.”

- “I don’t carry high-interest debt without a payoff plan.”

Goals can be inspiring, but they don’t protect you on a random Tuesday when you’re tired. Standards do.

The “Never Again” list (your quickest leak-stopper)

If you’re a beginner, start with just one “never again” standard. Here are high-impact options:

- Never again: late fees

- Autopay minimums

- Calendar reminders for due dates

- Set alerts in your bank app

- Never again: overdrafts

- Low-balance alerts

- Keep a small buffer (even $50)

- Move bills to right after payday

- Never again: invisible subscription spending

- Cancel one unused subscription today

- Put renewal dates on a list

- Review subscriptions monthly

- Never again: impulse purchases without a pause

- 24-hour wait for non-essentials

- Cart-and-wait rule

- No shopping apps during the week

Pick the one that causes the most damage in your life. Standards are personal—choose your biggest leak.

How to set a money standard that actually sticks

Use this simple template:

Standard = trigger + action + minimum

- Trigger: “When payday hits…”

- Action: “I transfer money to savings…”

- Minimum: “At least $10.”

Why the minimum matters: it prevents the all-or-nothing trap. Even tiny standards build identity and consistency.

Examples:

- “When I get paid, I save at least $10 before spending.”

- “Every Friday, I review my transactions for 15 minutes.”

- “If I want a non-essential item, I wait 24 hours.”

Standards that protect money (even if income doesn’t change)

Here are three beginner standards that reliably improve finances:

- Weekly Money Review Standard

- 15 minutes once a week

- Look at: balances, upcoming bills, last week’s spending

- Decide: one adjustment for next week

- Payday Protection Standard

- automate savings (even small)

- automate minimum debt payments

- set aside “bills money” first

- Spending Pause Standard

- 24-hour rule

- or a “pause plan” when stressed (free reset first)

These standards reduce chaos, prevent fees, and make your next steps clearer.

Standards that help you earn more (without hype)

Raising standards isn’t only about cutting spending. It can also raise income—if you set standards for skill-building.

Try one of these:

- “I practice a marketable skill 3 times per week for 30 minutes.”

- “I apply to 5 better jobs per week.”

- “I send 10 outreach messages per week for a service I can deliver.”

Notice what’s missing: vague dreams. These are standards you can actually track.

The “proof” standard: stop buying outcomes, start buying actions

One of the most expensive beginner patterns is paying for motivation (courses, tools, subscriptions) without building habits.

A protective standard:

- “I only buy a tool/course after I’ve done the free version for 2 weeks.”

Example:

- If you want to start freelancing, draft 5 samples before paying for a course.

- If you want to budget, do 2 weekly reviews before paying for an app.

This standard saves money and increases the chance you’ll follow through.

A tiny “standards setup” you can complete today (10 minutes)

Do this now if you want immediate traction:

- Write one “Never Again” money standard.

- Write one payday rule (minimum $10 to savings).

- Schedule one weekly review time (Friday evening or Sunday night).

- Remove one spending trigger (unsubscribe email, delete one app, remove saved card).

That’s enough to change your next 30 days.

And once standards are in place, you’re ready for the next step: choosing the best strategic path (stabilize, optimize spending, grow income, or build assets) and building a 30–90 day roadmap that matches your life—without restarting every week.

Personal Rules: build an “operating system” for spending, debt, and saving

If your money life feels chaotic, it’s usually because you’re making too many decisions in real time.

Every time you open an app, see a sale, feel stressed, or get paid, you’re forced to “decide” again. That’s exhausting. And when you’re exhausted, you don’t choose the best option—you choose the easiest one.

That’s why personal rules work. They turn decision chaos into a simple operating system.

What personal rules are (and why they’re not the same as a budget)

A budget tells you what you plan to do.

A personal rule tells you what you’ll do when life happens.

Rules are powerful because they cover the messy moments:

- You’re tired and want to order food

- You’re stressed and want a “reward”

- You’re tempted by a limited-time deal

- You’re scared to check your account

- You got paid and feel rich for 24 hours

Rules are not about being strict. They’re about removing debate.

The 3 types of personal rules every beginner needs

If you build nothing else, build these three:

- A payday rule (so your money doesn’t disappear first)

- A spending rule (so impulses don’t run the month)

- A review rule (so you stay aware without obsessing)

That’s it. Three rules can dramatically change your finances.

Step 1: Find your “expensive triggers” (the moments you usually leak money)

Before you set rules, you need to know what you’re protecting yourself from.

Use this quick trigger list and circle what’s true for you:

- I spend when I’m stressed

- I spend when I’m tired

- I spend when I’m bored

- I spend after I feel like I’ve “worked hard”

- I spend because I’m avoiding something (like checking my balance)

- I spend because I’m chasing a deal (sale, discount, free shipping)

Now look at your bank transactions and connect the dots:

- What category shows up most after those triggers?

(Food delivery, shopping, subscriptions, “small” purchases, entertainment…)

This isn’t about shame. It’s about pattern recognition.

Step 2: Write rules in “If → Then” format (so they actually work)

Rules fail when they’re vague:

- “I’ll stop spending so much.”

- “I’ll be more disciplined.”

Rules succeed when they’re automatic:

- If X happens, then I do Y.

Here are beginner-friendly examples you can copy:

Payday rule examples

- If I get paid, then I transfer at least $10–$25 to savings before anything else.

- If I get paid, then I pay my minimums immediately (to avoid late fees).

- If I get paid, then I move “bills money” into a separate account or category.

Spending rule examples

- If I want a non-essential item, then I wait 24 hours before buying it.

- If I’m stressed and want to spend, then I do a free reset first (walk, shower, music).

- If I’m about to order delivery, then I check the “easy meal list” first.

Debt rule examples

- If I use a credit card, then I set a payoff plan the same day.

- If I carry a balance, then I pay more than the minimum (even $5–$20 extra).

- If I’m tempted to buy something on credit, then I ask: “Would I pay cash for this today?”

Saving rule examples

- If I save money this month, then I don’t touch it unless it’s a real emergency.

- If I want to “borrow” from savings, then I wait 48 hours and find another option first.

The magic isn’t the specific rule. The magic is that you’re deciding ahead of time.

Step 3: Make your rules realistic (minimums beat perfection)

A rule should survive your worst week.

If you set a rule that requires high energy, it will collapse. Start with minimums:

- “Save at least $10”

- “Review for 10 minutes”

- “Wait 24 hours”

- “Pay $5 extra toward debt”

Minimum rules build identity: “I’m the type of person who keeps my agreements.”

Later, you can scale up.

Step 4: Put rules where you’ll see them (visibility beats memory)

Rules in your head don’t protect you when you’re tired.

Put them somewhere visible:

- Notes app or lock screen

- A simple checklist in Notion

- A one-page sheet in Google Sheets

- A sticky note on your laptop

If you want it super simple, create a “Money Rules” note with three bullets:

- Payday rule

- Spending rule

- Weekly review rule

A starter “operating system” you can run for 30 days

If you want an easy default set, use this for one month:

- Payday rule: Save first ($10–$25 minimum).

- Spending rule: 24-hour wait for non-essentials.

- Review rule: Friday 15-minute money check.

- Debt rule (if needed): Pay more than the minimum (even small).

That’s enough to stop chaos and create traction.

And once your rules are in place, you’ll notice something interesting: you start making better choices without “trying harder.” That’s the point. But we can go one step further—by changing the questions you ask.

Quality Questions: the decision-making habit that beats willpower

Willpower is unreliable. It disappears when you’re stressed, hungry, tired, or overwhelmed.

Quality questions don’t depend on willpower. They change how you think in the moment—so you can choose better even on bad days.

Why questions matter more than motivation

Your brain is a problem-solving machine. It answers whatever question you feed it.

If you ask:

- “Why can’t I control myself?”

Your brain finds reasons you’re hopeless.

If you ask:

- “What’s the next small move that protects my money?”

Your brain finds options.

That’s not fluff. It changes behavior.

The most common “bad money questions” (and what they create)

Here are a few questions that keep people stuck:

- “How do I get rich fast?”

- Creates impatience and risky choices.

- “Why am I so bad with money?”

- Creates shame, avoidance, and rebound spending.

- “What’s the perfect plan?”

- Creates procrastination and constant switching.

- “Can I afford this?”

- Often becomes “yes” if you can technically pay, even if it hurts later.

Better questions that produce strategy (copy these)

You don’t need 50 questions. You need a few that work in real life.

When you’re about to spend

- “What problem am I trying to solve right now?”

- “Is there a cheaper way to solve the same problem?”

- “Will I still want this tomorrow?”

- “If I buy this, what am I saying no to?”

When you’re stressed

- “What would make me feel better in 10 minutes that costs $0?”

- “What’s the smallest step that reduces stress and protects money?”

When you’re planning the month

- “What’s my biggest leak, and what’s one fix?”

- “What’s one standard I’m raising this month?”

- “What’s one thing I can automate so I don’t rely on willpower?”

When you want to earn more

- “What skill would make me more valuable in 90 days?”

- “What’s one offer I can make this week?”

- “Who could I help, and how would I prove it?”

The “money clarity” question (the one to keep forever)

If you only keep one question, keep this:

“What would future-me thank me for doing this week?”

It’s powerful because it stops short-term thinking without making you miserable. It nudges you toward:

- paying down debt

- cooking one more meal at home

- doing the weekly review

- sending the application

- practicing the skill

How to install this habit (without journaling for hours)

You don’t need long writing sessions. Use a 2-minute routine:

Once a week (during your review), answer:

- What worked last week?

- What didn’t work?

- What’s one small adjustment for next week?

That’s strategy. That’s feedback. That’s how you improve without drama.

And once you’re asking better questions consistently, you’ll be ready for the next decision: picking a strategic path that matches your current reality.

Strategic paths: 4 routes to earn more or spend less (choose one first)

Beginners get stuck because they try to do everything at once.

Instead, choose one strategic path for the next 30–90 days. Your goal isn’t to “solve money forever.” Your goal is to create traction and momentum.

Path 1: Stabilize cash flow (stop the bleeding)

Who it’s for: People dealing with overdrafts, late fees, bill surprises, paycheck-to-paycheck stress.

Main idea: Before you grow money, you need to stop the chaos. Stability is a profit booster.

Money dynamics

- Upside: fast relief, fewer fees, calmer decisions

- Time horizon: days to weeks

- Risks: low, but requires consistency

Good fit if…

- You avoid checking your account.

- You feel anxious before bills.

- You often run out of money early in the month.

Not a good fit if…

- You already have a buffer and no major leaks.

Path 2: Optimize spending (free up money without misery)

Who it’s for: People with income but no progress—saving doesn’t grow, lifestyle creep is real.

Main idea: Cut the leaks that don’t improve your life. Keep what matters. Remove what doesn’t.

Money dynamics

- Upside: steady monthly savings you can redirect

- Time horizon: weeks to months

- Risks: low; biggest risk is being too restrictive and rebounding

Good fit if…

- Your money disappears in “small” spending.

- You have subscriptions you forgot about.

- You eat out more than you want to.

Not a good fit if…

- You already live lean and your bigger lever is income.

Path 3: Grow income (one skill + one offer)

Who it’s for: People who can commit 3–8 hours/week and want more upside.

Main idea: Money grows when you become more valuable. Pick one skill, build proof, and attach it to an offer.

Money dynamics

- Upside: higher ceiling, long-term leverage

- Time horizon: slower at first (weeks), then compounding

- Risks: moderate—requires discomfort, outreach, and patience

Good fit if…

- Cutting spending feels maxed out.

- You want a raise, promotion, or side income.

- You can practice consistently.

Not a good fit if…

- Your finances are chaotic and you’re in constant stress mode (start with Path 1 first).

Tools that help: use ChatGPT to draft outreach messages, refine your resume, practice interviews, brainstorm service offers, and create learning plans. Use it as a coach—not a replacement for learning.

Path 4: Build assets (long-term protection + compounding)

Who it’s for: People with stable cash flow who want future security.

Main idea: Build a buffer, reduce high-interest debt, then invest long-term in a simple, diversified way.

Money dynamics

- Upside: slow, reliable growth and protection

- Time horizon: months to years

- Risks: low if you avoid risky shortcuts; higher if you chase hype

Good fit if…

- You can leave money untouched.

- You want stability and long-term growth.

- You’re ready to be patient.

Not a good fit if…

- You’re using credit card debt to survive or you’re getting hit with fees.

How to choose quickly (beginner decision filter)

If you’re stuck, pick based on your biggest bottleneck:

- If fees/overdrafts/late bills are happening → Path 1

- If you’re stable but not saving → Path 2

- If you’re stable and want more upside → Path 3

- If you’re stable and thinking long-term → Path 4

Now commit:

Start with Path X for the next 30–90 days.

You’re not marrying the path. You’re running a focused experiment—so you finally get traction.

Decision guide: choose your route by time, skills, risk, and cash

Picking a path isn’t about “what’s best.” It’s about what you can actually run consistently for the next 30–90 days.

Use the filters below to choose without overthinking. Read the H3 that fits you most, then commit to one path.

Time: how many hours per week can you protect?

Time is the most honest filter because it predicts consistency.

- 0–2 hours/week: choose Path 1 (Stabilize) or Path 2 (Optimize spending).

- 3–6 hours/week: run Path 2 and begin Path 3 (Grow income) in a small way.

- 7–10 hours/week: Path 3 becomes realistic (practice + proof + outreach).

- 10+ hours/week: you can combine paths, but only after the basics feel stable.

Rule of thumb: If you can’t protect time, don’t pick a strategy that needs momentum. Start with stability.

Skills: do you already have something you could sell?

You don’t need “a passion.” You need a skill that solves a problem.

- No clear skill yet: choose Path 1 or 2 first, then build one skill for Path 3. Your first milestone is proof (samples, reps).

- Some skill (writing, design, admin, Excel, customer support, tutoring): go Path 3 if cash flow is stable. Turn it into a simple offer you can explain in one sentence.

- Strong professional skill: Path 3 may look like negotiating a raise, switching roles, or consulting—often faster than starting a brand-new hustle.

If you’re unsure, ask: “Could I help one person with this in the next 7 days?” If yes, it’s a sellable start.

Risk: how much uncertainty can you handle without quitting?

Risk isn’t only about money. It’s also emotional.

- Low risk tolerance: choose Path 1, 2, or 4 (Build assets).

- Medium risk tolerance: Path 3 is fine if you keep the scope small and track inputs weekly.

- High risk tolerance: the smartest risk is building skill and income—not chasing hype.

Beginner safety rule: If a strategy can wipe you out fast (debt spirals, “all-in” bets, leverage), it’s not a beginner strategy.

Cash cushion: do you have a buffer?

Cash cushion changes what’s safe.

- $0–$200 buffer: start with Path 1. Create a tiny margin.

- $200–$1,000 buffer: Path 2 is usually next. Free up monthly cash so the buffer grows.

- $1,000+ buffer (and stable bills): choose Path 3 for growth or Path 4 for long-term building.

If you don’t know your buffer, that’s already a sign to run Path 1 for a month.

Capital: do you need to spend money to make progress?

This is where beginners get tricked. Many “make money” strategies quietly assume you’ll pay for tools, ads, or courses.

- If spending money right now would stress you out, choose Path 1 or 2 first.

- If you choose Path 3, keep the early phase “low-cost”: practice, build proof, do outreach.

- If you choose Path 4, start with automation and education, not complicated products.

Simple rule: If a strategy requires you to pay before you’ve built the habit, it’s probably not your next move.

Stress and stability: are you in “survival mode” right now?

Survival mode makes you impatient and reactive.

- Constant worry about the next bill → Path 1

- Stable but not progressing → Path 2

- Stable and want upside → Path 3

- Stable and want long-term protection → Path 4

Quick commitment line (don’t skip this)

Pick one route and commit:

Start with Path X for the next 30–90 days.

Now let’s turn that choice into a simple plan you can actually follow.

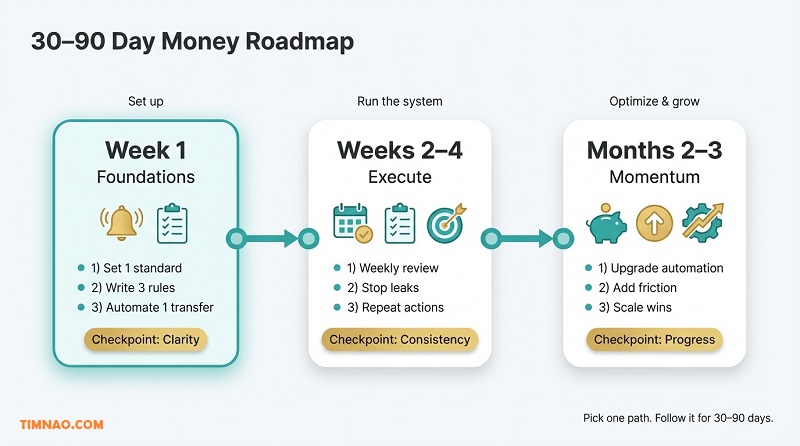

Your financial mastery roadmap (30–90 days): Week 1 foundations → Month 3 momentum

A roadmap is not a fantasy schedule. It’s small actions that fit real life.

The goal is simple:

- Week 1: install the system (standards + rules + visibility)

- Weeks 2–4: execute the path with repeatable actions

- Months 2–3: upgrade the system so it needs less willpower

Pick your lane and ignore the rest.

Week 1: foundations that reduce stress fast

Goal: stop surprises and create visibility.

Do these four things (keep it under 60 minutes total across the week):

- Choose one “Never Again” standard

- late fees, overdrafts, impulse buys, or subscription leaks

- Write your three personal rules

- payday rule (save first), spending rule (pause), review rule (weekly)

- Do a simple money inventory

- income dates, fixed bills, debt balances, minimum payments, current savings

- Set one automation

- minimum autopay for bills or a small auto-transfer to savings

Checkpoint (end of Week 1):

You can answer, without guessing:

- “What bills hit before my next payday?”

- “What is my biggest leak category?”

- “What is my one focus for the next month?”

Weeks 2–4: run your chosen path with repeatable actions

This phase is about consistency, not intensity.

If you chose Path 1: Stabilize cash flow

Weekly actions:

- 1× weekly review (10–15 minutes)

- Turn on low-balance alerts

- Set minimum autopays (to prevent late fees)

- Create a tiny buffer goal (even $50)

Helpful “friction” moves:

- remove saved cards from your most tempting store

- unsubscribe from sale emails for 30 days

Checkpoint (end of Week 4):

- Fewer (or zero) fees this month

- You completed 3–4 weekly reviews

- You have a small buffer (even if it’s not big yet)

If you chose Path 2: Optimize spending

Weekly actions:

- 1× weekly review

- Pick one category to optimize (food, shopping, subscriptions)

- Use one spending rule (24-hour wait or “cart and wait”)

A beginner-friendly approach:

- Keep 1–2 planned “joy spends” so you don’t rebound

- Cut the “I won’t even miss it” spending first (unused subscriptions, random snacks, impulse add-ons)

Checkpoint (end of Week 4):

- You freed up a specific amount (even $50–$200)

- You reduced one leak with a clear rule

If you chose Path 3: Grow income

Weekly actions:

- 2–3 practice sessions (30–60 minutes each)

- 1 proof-building session (sample, portfolio, case study)

- 1 outreach block (applications, messages, pitches)

Use ChatGPT to speed up drafts, practice scripts, and outline offers—but always customize and fact-check your output.

Checkpoint (end of Week 4):

- You have 2–3 samples/proofs

- You sent at least 10–20 outreach messages/applications

- You can explain your offer in one sentence

If you chose Path 4: Build assets

Weekly actions:

- 1× weekly review

- Auto-transfer to emergency fund

- If you have high-interest debt, set a payoff plan

Checkpoint (end of Week 4):

- Emergency fund is growing consistently

- You have a clear next step (debt plan or investment plan)

Months 2–3: upgrade your system and increase the difficulty slightly

This is where progress starts to compound.

System upgrades for all paths

- Increase automation by a small amount (savings, debt payment, bill autopay)

- Add friction to one spending trigger (delete an app, remove saved card)

- Keep the weekly review non-negotiable

- Improve one rule based on what you learned

Checkpoint (end of Month 3):

You can point to:

- one habit that stuck

- one leak you stopped

- one measurable money improvement

Busy-week fallback plan (so you don’t break the chain)

Some weeks will be messy. Your system needs a “minimum viable version.”

If you only do three things in a chaotic week:

- Do a 10-minute review (even if it’s ugly)

- Keep autopays and savings automation on

- Use your spending pause rule once before one impulse purchase

That’s enough to maintain momentum.

Path-specific upgrades

- Path 1: build the buffer toward 1–2 weeks of expenses over time

- Path 2: renegotiate one bill or switch to a cheaper plan

- Path 3: refine the offer, raise price slightly, or apply to better roles

- Path 4: start or increase long-term contributions (simple, diversified approach)

Next, you’ll need feedback signals so you don’t quit too early—or keep doing something that isn’t working.

Signals & feedback: track inputs, outputs, and lag time

Most people fail financially for one of two reasons:

- They quit before the strategy has time to work.

- They keep going with a strategy that isn’t producing results.

Feedback solves both.

Inputs vs outputs (the easiest way to stay sane)

Inputs are what you do. Outputs are what you get.

Beginners should focus on inputs weekly because outputs often have lag time.

Input signals to track (weekly)

Pick 3–5.

- Weekly money review completed (yes/no)

- Savings transfer done (yes/no)

- Debt payment above minimum (yes/no)

- Number of “pause wins” (times you avoided impulse spending)

- Income actions taken (practice sessions, outreach messages)

A simple checkbox list in Notion or Google Sheets is enough.

Output signals to track (monthly)

- Fees paid (aim for $0)

- Savings balance trend (up)

- Debt balance trend (down)

- Leak-category spending trend (down)

- Income trend (up)

If you want one emotional metric: money stress (1–10) once per week.

Metrics by path (so you track the right things)

Different paths have different “proof” signals.

- Path 1 (Stabilize): number of fees, number of bill surprises, buffer size

- Path 2 (Optimize): leak-category spending, freed-up cash per month

- Path 3 (Grow income): outreach count, reply rate, calls booked, paid projects

- Path 4 (Build assets): contribution consistency, emergency fund progress, debt trend

When you track the wrong metric, you feel like you’re failing even when you’re improving.

Lag time: the part nobody warns beginners about

Lag time is when you’re doing the right actions but the results aren’t exciting yet.

If you expect instant results, you’ll quit right before the curve bends.

When to stay the course vs pivot (simple rules)

Stay the course if:

- inputs are consistent

- outputs are slowly improving (even small)

- stress is decreasing

Pivot if:

- inputs are consistent for 3–4 weeks but outputs are flat or worse

- the path doesn’t fit your constraints (time, cash, stress)

- you can name a bottleneck (example: outreach too low, leak still active)

Most pivots should be small adjustments—not switching the entire path.

A quick feedback loop you can run every Friday

Answer:

- What worked?

- What didn’t?

- What’s one small change for next week?

Now let’s make sure you can recover quickly when you slip—because everyone slips.

Course-correct fast: mistakes, beginner profiles, and start-today moves

You don’t need perfection. You need fast recovery.

Common strategic mistakes (and how to fix them)

Mistake 1: Switching strategies every time motivation drops

Course-correct checklist:

- Shrink the plan to a minimum version (10-minute review, $10 savings, 1 outreach block)

- Keep one non-negotiable (weekly review)

- Finish the 30-day experiment before switching

Mistake 2: Going too extreme, then rebounding

Course-correct checklist:

- Keep 1–2 “joy spends” per week

- Reduce one category instead of banning everything

- Use a pause rule, not a punishment rule

Mistake 3: Ignoring fees and interest while chasing “growth”

Course-correct checklist:

- Turn on autopay minimums

- Set due-date reminders

- Make “no fees” your first standard

Mistake 4: Using credit like income

Course-correct checklist:

- Move to Path 1 for 30 days

- Build a tiny buffer

- Cut one leak category

- Add a short-term income booster (overtime, temporary gig, sell unused items)

Mistake 5: Tool collecting instead of habit building

Course-correct checklist:

- Do two weekly reviews with a simple note first

- Only upgrade tools after consistency

- Remember: the habit is the product

Mistake 6: Trying to “do it alone” in your head

Money gets easier when decisions are visible and shared.

Course-correct checklist:

- Pick one accountability person and do a 10-minute weekly check-in

- Use a simple shared checklist or note (no complicated tracking)

- Use ChatGPT to draft your rules, scripts, and weekly review questions—then rewrite in your own voice

Beginner profiles: which path fits you best?

Profile A: “I’m overwhelmed and avoid checking my balance”

Best path: Path 1 (Stabilize cash flow)

Realistic 3–6 month outcome: fewer fees, a small buffer, a weekly review habit, calmer choices

Profile B: “I’m stable, but I never get ahead”

Best path: Path 2 (Optimize spending)

Realistic 3–6 month outcome: $100–$400/month freed up, fewer impulse purchases, clearer spending rules

Profile C: “I can commit a few hours/week and want more income”

Best path: Path 3 (Grow income)

Realistic 3–6 month outcome: portfolio proof, outreach consistency, first clients or better job pipeline

Profile D: “I have stability and want long-term security”

Best path: Path 4 (Build assets)

Realistic 3–6 month outcome: emergency fund growing, debt shrinking if needed, consistent contributions, lower stress

Start-today moves (15–30 minutes, high leverage)

Pick 3 and finish them today.

- Turn on low-balance and large-transaction alerts in your banking app.

- Cancel one unused subscription.

- Write one “Never Again” standard and one If → Then personal rule.

- Set an automatic transfer to savings on payday (even $10).

- Do a 10-minute transaction scan and label: Needs / Wants / Goals.

If you do nothing else, keep the weekly review. It’s the habit that makes every other strategy smarter.

Disclaimer:

This article is for educational and informational purposes only and is not financial, legal, tax, or investment advice. I’m sharing general strategies and decision-making frameworks that may help you think more clearly about earning, saving, and protecting money, but your situation is unique. Always do your own research and consider speaking with a qualified professional (financial advisor, accountant, or attorney) before making major financial decisions. Any examples, numbers, or scenarios are illustrations—not guarantees of results. Investing and business activities involve risk, and you can lose money. Use the ideas here as a starting point, apply them cautiously, and adjust based on your own goals, income, expenses, and risk tolerance.

If this guide helped you make smarter money decisions, consider buying me a coffee ☕️💛 It supports the time and effort that goes into creating practical, beginner-friendly content (and keeps more guides like this coming!).

👉 Buy me a coffee here: https://timnao.link/coffee