Smart Trading Secrets 2025: Why Most Beginners Fail — and How You Can Succeed 🚀

Smart trading Secrets for beginners is more than just placing random buy or sell orders — it’s about learning how to navigate the financial markets with confidence, clarity, and control. In 2025, with more people seeking online income opportunities, trading has become one of the most accessible yet misunderstood paths to building wealth.

But here’s the truth most gurus won’t tell you: the majority of beginner traders fail, not because the market is unbeatable, but because they jump in without the right mindset, tools, or strategy.

This guide is your shortcut past the chaos.

Whether you’re curious about Forex, crypto, or stock trading, this beginner trading guide is designed to help you avoid the costly mistakes most newcomers make. You’ll discover proven strategies, must-have tools, and real-world insights to help you build a strong foundation, even if you’ve never placed a trade before.

From understanding how markets work to mastering risk and psychology, this guide is packed with trading success tips tailored for absolute beginners who want to start smart and stay in the game.

Let’s dive in.

📚 Table of Contents

- 📚 Introduction: From Confused to Confident Trader

- 💡 Understanding How Trading Works

- 📊 Choosing the Right Market: Forex, Stocks, or Crypto?

- ⏱️ Day Trading vs. Swing Trading vs. Long-Term Investing

- 💰 How Much Money Do You Need to Start Trading?

- 🧩 How to Choose the Right Broker or Platform

- 🧪 Best Beginner Strategies That Actually Work

- 🧠 Mastering the Trading Mindset & Psychology

- 🛡️ Risk Management: Protecting Your Capital Like a Pro

- 🔧 Tools & Platforms: What Every Beginner Must Use

- 📚 How to Learn Fast: Courses, Books, and Smart Practice

- 🏁 Final Tips for New Traders in 2025

- ❓ FAQs: Common Beginner Trading Questions Answered

📚 Introduction: From Confused to Confident Trader

Smart trading secrets for beginners isn’t just about clicking “buy” or “sell” on a screen. It’s about understanding the game — the rules, the players, and how to protect yourself while playing to win.

In 2025, more people than ever are looking to make money online through trading. But here’s the truth: most beginners lose money fast. Why? Because they jump in without a plan, overestimate their skills, or treat trading like gambling.

This guide is designed to change that.

Whether you’re interested in Forex, stocks, or crypto, this step-by-step beginner trading guide will give you everything you need to start your journey the smart way. You’ll learn how to choose the right markets, avoid rookie mistakes, use essential tools, and master the one skill most traders ignore — mindset.

Let’s turn confusion into clarity — and set you up for long-term trading success.

💡 Understanding How Trading Works

Trading is the art of buying and selling financial instruments like currencies, stocks, or cryptocurrencies — ideally at a profit. But behind that simple idea is a dynamic, fast-moving world where timing, strategy, and discipline matter.

The Basic Flow of a Trade:

- Analysis – You study the market to find a trading opportunity.

- Execution – You place a trade using a broker or app.

- Risk Management – You use tools like stop-losses to control potential losses.

- Trade Management – You decide when to exit, take profits, or cut losses.

There are two main ways traders analyze opportunities:

- Technical Analysis – Uses charts and indicators to spot patterns.

- Fundamental Analysis – Focuses on news, data, and economic conditions.

Modern trading is done through electronic platforms (like TradingView, MetaTrader, or eToro) that give you access to real-time data, order execution, and trading tools — often right from your phone.

💡 Pro Tip: Even as a beginner, practice using both analysis types together. Think of fundamentals as the why behind a move, and technicals as the when to act.

📊 Choosing the Right Market: Forex, Stocks, or Crypto?

Not all markets are created equal. Choosing the right one based on your budget, time, and goals can make or break your early experience.

🔁 Forex (Foreign Exchange)

- What it is: Trading currency pairs like EUR/USD or GBP/JPY.

- Why trade it: Open 24/5, low starting capital, high liquidity.

- Beginner Tip: Ideal if you want a low-cost entry into trading and enjoy macroeconomic news.

📈 Stocks

- What it is: Buying shares of companies like Apple or Amazon.

- Why trade it: Easier to understand, long history, regulated.

- Beginner Tip: Good for long-term investors or those interested in analyzing businesses.

🪙 Cryptocurrencies

- What it is: Trading digital coins like Bitcoin or Ethereum.

- Why trade it: 24/7 market, high volatility, low entry cost.

- Beginner Tip: Only invest what you can afford to lose. It’s high risk, high reward.

👉 Quick Start Strategy: Start with the market you’re most curious about — then try a demo account (offered by most platforms) to practice without using real money.

⏱️ Day Trading vs. Swing Trading vs. Long-Term Investing

Before you dive in, it’s essential to pick a style that fits your lifestyle and personality.

🧠 Day Trading

- Time commitment: Full-time or several hours a day.

- Strategy: In-and-out within one day.

- Tools needed: Fast charts, real-time news, a powerful PC or app.

- Best for: Those with time, fast reflexes, and a cool head under pressure.

🌀 Swing Trading

- Time commitment: A few hours per week.

- Strategy: Hold trades for days or weeks.

- Tools needed: Technical charts, economic calendar.

- Best for: People with jobs or other commitments who can check markets after work.

🏦 Long-Term Investing

- Time commitment: Minimal — maybe once a week.

- Strategy: Buy and hold based on fundamentals (like earnings, valuation, etc.).

- Tools needed: Research sites like Morningstar, Yahoo Finance.

- Best for: Beginners who want a hands-off, wealth-building strategy.

💡 Pro Insight: It’s okay to combine styles. Many beginners start as swing traders and slowly build a long-term portfolio on the side.

💰 How Much Money Do You Need to Start Trading?

One of the biggest myths is that you need a lot of money to begin. The truth? You can start small — as long as you’re smart.

Here’s a breakdown of minimums and realistic ranges:

| Market | Absolute Minimum | Recommended Starting Capital |

|---|---|---|

| Forex | $50 | $1,000 |

| Stocks | $100 | $2,000–$5,000 |

| Crypto | $10 | $500+ |

💡 Golden Rule: Never risk money you can’t afford to lose. Always use position sizing and risk limits — which we’ll dive into later.

Also, consider using demo accounts first to simulate trading until you’re comfortable.

🧩 How to Choose the Right Broker or Platform

Choosing the right broker is like choosing a long-term business partner. The platform you pick will determine your trading experience, costs, and access to markets — so don’t rush this decision.

Here’s what beginners need to focus on:

✅ Regulation & Safety

Before you do anything, check if the broker is licensed by a trusted regulatory body like:

A regulated broker must follow strict rules, which helps protect your money and your personal data. Avoid unregulated offshore brokers — no matter how attractive their offers seem.

💸 Fees & Commissions

Don’t just look at spreads (the difference between the buy and sell price). Check for:

- Hidden charges (inactivity fees, withdrawal limits)

- Commissions per trade (especially for stocks and ETFs)

- Overnight funding (also called “swap” or “rollover” fees)

📌 Tip: For frequent traders, low spreads and no commissions (like on Pepperstone or eToro) are ideal. For investors, look for zero-commission brokers like Robinhood.

🖥️ Platform Features

A great trading platform should be:

- Easy to use with a clean, intuitive interface

- Mobile-friendly for trading on the go

- Equipped with real-time charts, alerts, technical tools, and news integration

Some popular platforms include:

- TradingView – top for charting and social ideas

- MetaTrader 4/5 (MT4/MT5) – great for Forex and algorithmic strategies

- Interactive Brokers – ideal for advanced users

🏦 Funding & Withdrawals

Check:

- Minimum deposit amount

- Accepted methods (bank, credit/debit, PayPal, crypto)

- Withdrawal speed (some take days, others just hours)

📌 Pro Tip: Always test the withdrawal process with a small amount first before committing large funds.

📞 Customer Support

You’ll need help — especially as a beginner. Choose platforms with:

- 24/5 or 24/7 live chat

- Quick response times

- Support in your language

Look for reviews on Trustpilot, Reddit, and trading forums before making your choice.

💡 Bottom Line: Start with a demo account to get a feel for the platform before you deposit real money. And always prioritize security over flashy features.

🧪 Best Beginner Strategies That Actually Work

Forget about flashy signals, complicated algorithms, or “get rich quick” tactics. The best strategies for beginners are simple, reliable, and repeatable.

Here are 4 proven approaches to build your foundation in smart trading for beginners:

1. 🔼 Trend Following Strategy

“The trend is your friend” — and this strategy is perfect for beginners.

- How it works: You trade in the direction of a clear trend using indicators like moving averages.

- Example: When the 20-day moving average crosses above the 50-day MA, it’s a signal to go long.

- Tools needed: Moving averages, RSI (for confirmation)

💡 Ideal for swing traders who like smoother, longer moves.

2. 💥 Breakout Strategy

This method focuses on catching new trends early by identifying breakouts from key levels.

- How it works: Wait for price to break above resistance or below support — confirmed with volume.

- Example: Bitcoin breaks above a multi-week $30,000 level on high volume — enter long.

- Tools needed: Support/resistance zones, volume indicator, trendlines

💡 Works well in volatile markets like crypto or after big economic news.

3. 🎯 Support & Resistance Bounce

This classic method involves trading off key levels where price has historically reversed.

- How it works: Buy near a strong support zone; sell near resistance.

- Example: The S&P 500 bounces every time it hits a certain level — you buy at that level with a stop below it.

- Tools needed: Horizontal lines, Fibonacci retracements, candlestick patterns

💡 Great for learning patience and timing your entries better.

4. ⚡ Scalping (Advanced)

Scalping is a fast-paced strategy where you make many small trades for quick profits. It’s not recommended for most beginners, but if you’re confident, disciplined, and quick — it can work.

- Tools needed: Very fast platform, low spreads, and access to Level II or order book data

💡 Only try scalping with a demo account until you’re consistently profitable.

👨🔬 Risk Management Makes the Strategy

Even the best strategy is useless if you don’t control risk.

Always follow these golden rules:

- Never risk more than 0.5%–2% of your capital per trade

- Use a stop-loss on every single trade

- Stick to a consistent risk-reward ratio (like 2:1)

Example: If your stop-loss is $10 away from entry, set your take-profit at least $20 away.

📌 Bonus Tip: Backtest your strategy on historical data and forward-test on demo before going live.

🧠 Mastering the Trading Mindset & Psychology

If you ask successful traders what really separates winners from losers, most won’t say strategy — they’ll say psychology.

It’s not your charts, indicators, or broker. It’s what’s going on in your head.

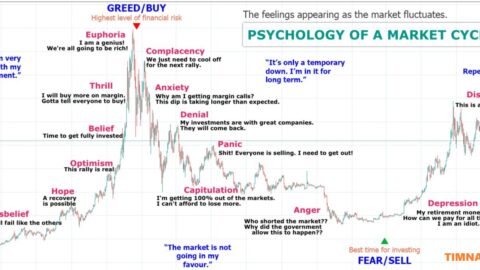

🎢 The Emotional Rollercoaster

New traders often face emotional highs and lows:

- Euphoria after a big win → overconfidence

- Fear after a loss → hesitation or panic selling

- Revenge trading to win back money → disaster

The truth is, markets don’t care how you feel. To win, you need to trade based on logic, not emotion.

🧠 Train Your Trader Brain

- Detach from Outcomes

You can have a great trade setup and still lose. That doesn’t make it a bad trade. Focus on executing your plan, not the result of a single trade. - Build Emotional Resilience

Losing trades are part of the game. The goal isn’t to avoid them — it’s to handle them without falling apart. - Stay Process-Oriented

Don’t obsess over profits. Ask yourself daily: “Did I follow my plan?” If yes, you’re succeeding — even if the trade lost money. - Create a Pre-Trade Routine

Just like athletes warm up, you should too. Check your charts, review economic news, and take a deep breath before clicking “buy.” - Use a Trading Journal

After every session, write down:- What trades you took and why

- What went right or wrong

- How you felt during the trade

📌 This is the fastest way to spot emotional patterns and correct them.

🧱 Common Psychological Pitfalls (And How to Avoid Them)

| Mistake | Fix |

|---|---|

| Overtrading | Stick to 1–3 high-quality setups per day |

| FOMO (Fear of Missing Out) | Have a clear entry rule — no setup = no trade |

| Chasing losses | Step away, journal your thoughts, and reset |

| Impulsive decisions | Wait for candle close or confirmation signals |

💡 Mindset is a skill. The more you trade, journal, and reflect — the more stable and confident you’ll become.

🛡️ Risk Management: Protecting Your Capital Like a Pro

This is the section most beginners skip — and then regret it.

Risk management isn’t just a trading tip. It’s the foundation of survival.

Even with a great strategy, one bad trade without protection can wipe out months of progress.

💸 Golden Rule: Never Risk More Than 0.5%–2% Per Trade

This means if you have $1,000 in your account:

- Risking 1% = $10 per trade

- That includes how far your stop-loss is from your entry

📌 Small risk allows you to stay in the game long enough to win.

🛑 Use Stop-Losses Like Seatbelts

A stop-loss is an automated level that closes your trade when the price goes against you.

Benefits:

- Limits emotional panic exits

- Protects your capital

- Makes your risk predictable

🧠 Set it based on strategy, not gut feelings. For example, just below a recent swing low.

🧮 Risk-to-Reward Ratio: Your Profit Compass

This is the ratio of how much you risk vs. how much you aim to gain.

Aim for at least 2:1.

- Risk $10 to make $20

- Win 50% of the time and you’re profitable

| Win Rate | R:R 2:1 Outcome |

|---|---|

| 50% | PROFITABLE |

| 40% | Small loss |

| 60% | Big profit |

📌 Your goal isn’t to win every trade — it’s to win more than you lose, and win bigger than you lose.

⚙️ Advanced Tools to Manage Risk

- Position Size Calculators (use them online or in apps)

- Trailing Stops: Automatically adjust your stop-loss as price moves in your favor

- Hedging: Use options or opposing positions to protect your trades (for intermediate traders)

🚫 Risk Management Mistakes to Avoid

- No Stop-Loss

A recipe for disaster. One bad move = big drawdown. - Overleveraging

Trading too big, especially with borrowed money (leverage), amplifies risk. Stick to 1x or 2x leverage if you’re a beginner. - Ignoring Volatility

High-volatility days require wider stops — or no trades at all. - Revenge Trading

Lost a trade? Don’t try to “get it back.” Take a break instead.

✅ The Capital Preservation Checklist

- ⬜ Use stop-losses on every trade

- ⬜ Know your risk per trade before entry

- ⬜ Adjust size based on market conditions

- ⬜ Never risk more than 2% per trade

- ⬜ Track drawdowns and step away if things get emotional

💡 Real traders protect their capital like gold. The goal is not to win today — it’s to be around tomorrow.

🔧 Tools & Platforms: What Every Beginner Must Use

To trade smart in 2025, you need more than just a good idea — you need the right tools to turn that idea into action.

Think of tools as your trading cockpit: the cleaner, faster, and more reliable it is, the better decisions you’ll make.

Here’s a breakdown of the essential tools every beginner should know and use:

🧭 Charting Platforms

This is where you’ll analyze price movements, find trade setups, and monitor trends.

Top Picks:

- TradingView – user-friendly, packed with indicators, social sharing features

- MetaTrader 4/5 (MT4/MT5) – great for Forex and CFD traders, highly customizable

- ThinkorSwim (by Schwab) – advanced analytics for stocks and options

💡 Tip: TradingView’s free plan is enough for most beginners. Upgrade later when you need more indicators or alerts.

📊 Economic Calendars

These show scheduled news events (like interest rate announcements or jobs data) that can move the markets.

Best Options:

💡 Check the calendar every morning before trading to avoid surprises.

📈 Indicators and Risk Tools

Use a small set of proven indicators — don’t overload your charts.

Must-Know Indicators for Beginners:

- Moving Averages – for identifying trends

- RSI (Relative Strength Index) – to spot overbought/oversold conditions

- MACD – to confirm momentum and direction

- ATR (Average True Range) – to measure volatility and set realistic stop-losses

📌 Use these in combination — for example, a moving average crossover + RSI confirmation = stronger setup.

🧮 Position Size Calculators

These tools help you determine the correct amount of money to risk per trade based on your account size and stop-loss.

Try:

💹 Trading Platforms (Execution)

This is where you place your trades. Look for:

- Low spreads

- Fast execution

- Mobile access

- Security features (like 2FA)

Popular Choices for Beginners:

- eToro – copy trading & crypto support

- Interactive Brokers – powerful for global stocks & options

- Robinhood – clean and commission-free (US only)

- Pepperstone – great for Forex with MetaTrader integration

💡 Always start with a demo account before going live with real money.

🧠 Smart AI Tools (New in 2025)

AI-powered platforms are becoming more beginner-friendly.

- Capitalise.ai – lets you automate strategies using plain English

- Forecaster.ai – uses machine learning to predict short-term moves

- CopyTrading – lets you follow the trades of top performers on platforms like eToro

📌 Use AI to support your thinking — not to replace it.

📚 How to Learn Fast: Courses, Books, and Smart Practice

To become a consistently profitable trader, you need a mix of education + real practice.

Here’s how to learn fast — without burning out or wasting time.

🧠 Learn the Right Topics (In the Right Order)

Many beginners start with chart patterns or indicators, but that’s putting the cart before the horse.

Here’s a smarter roadmap:

- Basic Concepts: What is trading? What markets exist? What are candlesticks and price charts?

- Trading Psychology: Learn this early! You’ll avoid 90% of mistakes most newbies make.

- Risk Management: Understand stop-loss, position sizing, and drawdowns.

- Trading Strategies: Trend following, breakout trading, support/resistance, etc.

- Analysis Tools: Technical (charts) + Fundamental (economic news)

- Trading Plans: Write one and test it over time.

- Practice & Journal: Track your progress, even in demo accounts.

🎓 Best Beginner-Friendly Courses

- BabyPips School of Pipsology – free, fun, and perfect for Forex beginners

- Coursera: Financial Markets by Yale – academic insight from Professor Robert Shiller

- Investopedia Academy – beginner-friendly paid courses

- SMB Capital YouTube – pro trading firm sharing deep insights

💡 Don’t rush. Give yourself 4–6 weeks to go through the basics before risking real money.

📚 Best Trading Books for Beginners

These are timeless classics that deliver value:

- Trading in the Zone by Mark Douglas

→ Mindset and discipline made simple - The Intelligent Investor by Benjamin Graham

→ Great for long-term investing mindset - Technical Analysis of Financial Markets by John J. Murphy

→ The ultimate chart-reading reference - The Little Book of Common Sense Investing by John C. Bogle

→ Perfect for passive investing fans

📌 Start with one mindset book + one technical book.

🧪 Simulators & Demo Accounts

Most brokers offer demo accounts where you can trade with fake money.

Use them to:

- Practice entries/exits

- Master your trading platform

- Test strategies without risk

💡 Don’t stay in demo forever. Switch to real money with tiny size after 1–2 months of consistent practice.

📝 Use a Trading Journal

Track:

- Date & time of trade

- Entry & exit price

- Strategy used

- What went right/wrong

- Emotional state

Over time, you’ll see patterns in what makes you profitable — and what doesn’t.

Try tools like:

- Edgewonk or TraderSync

- Or just use Google Sheets or Notion

⏰ How Much Time Do You Need to Learn?

- Per day: 30–60 minutes of focused study or practice

- Per week: 5–10 hours is ideal

- Per month: Track progress, test new ideas, review journal

💡 Learning to trade is like learning a language — repetition and real-world application make all the difference.

🏁 Final Tips for New Traders in 2025

You’ve learned about strategies, mindset, risk management, tools, and education. But before you hit the “Buy” button — let’s wrap up with the most important real-world tips that can save you time, money, and stress in your first year of trading.

✅ 1. Start Small — But Start Real

Demo accounts are great for practice, but trading with real money — even just $50 — teaches you how you feel under pressure. Start with tiny positions (micro-lots or fractional shares). The goal is to learn, not earn.

⏳ 2. Give Yourself 6–12 Months to Learn

Success doesn’t happen overnight. Treat trading like a skill — like learning to play an instrument or speak a language. Stay consistent, patient, and open to growth.

📉 3. Expect Losses — They’re Normal

Even pros lose 40–50% of their trades. Don’t panic. Don’t chase. Don’t give up. Instead, review what happened, and improve step by step. Every loss is a tuition fee.

🧠 4. Choose Logic Over Emotion

Train yourself to follow rules. Not instincts. Not FOMO. And definitely not Reddit hype.

When in doubt: sit out.

📋 5. Write and Follow a Trading Plan

Without a trading plan, you’re gambling. With a plan, you’re managing risk and building consistency. A basic plan should include:

- What market you trade

- Entry and exit rules

- Risk per trade

- Max daily loss

- Review schedule (weekly or monthly)

🤖 6. Don’t Rely on Signals or Bots

They can help, but they shouldn’t replace your decision-making. No strategy is perfect, and blindly following someone else’s trades without understanding the context is a recipe for disaster.

📚 7. Invest in Yourself More Than in the Market

Tools and tech are useful. But your most valuable asset is you — your knowledge, your discipline, your mental game. Prioritize learning over chasing profits.

🔁 8. Review, Refine, Repeat

Every month, look back at your trades. What worked? What didn’t? Adjust your plan based on data — not gut feelings. This is how traders evolve.

💡 9. Stick to One or Two Markets First

It’s tempting to trade everything — stocks, Forex, crypto, commodities. But each market has its own rhythm. Master one before adding more.

📆 10. Know That You Don’t Need to Trade Every Day

Some of the best trades come when you do nothing and wait. Patience pays more than overtrading.

❓ FAQs: Common Beginner Trading Questions Answered

Let’s clear up the biggest questions that most new traders ask before getting started:

💬 Do I Need a Finance Degree to Trade?

No. Many successful traders are self-taught. All you need is curiosity, discipline, and the willingness to learn consistently.

💬 Can I Trade Part-Time While Working a Job?

Absolutely. Swing trading or long-term investing works well for people with day jobs. You only need 30–60 minutes a day to manage trades or research.

💬 What’s the Best Market for Beginners?

There’s no one-size-fits-all. But generally:

- Forex = Great for low capital, fast learning curve

- Stocks = Good for familiar names, long-term growth

- Crypto = High potential, high risk

Choose the market that interests you most, and focus there first.

💬 How Much Money Do I Need to Start?

You can technically start with:

- $50 in Forex

- $10 in Crypto

- $100–$500 in Stocks (especially with fractional shares)

But realistically, aim for:

- $500–$1,000 if you’re serious about applying risk management properly

💬 Is Trading Risky?

Yes — but controlled risk is what trading is all about. With stop-losses, proper sizing, and discipline, you can limit risk while maximizing reward.

💬 How Do I Know If My Strategy Works?

Backtest it using historical data. Then demo trade it live for 4–6 weeks. If it shows consistent results and fits your personality, you’re on the right path.

💬 What Tools Are Must-Haves for Newbies?

- TradingView for charting

- MetaTrader or eToro for execution

- Myfxbook or BabyPips calculators for sizing

- A trading journal (even a Google Sheet works!)

- An economic calendar to avoid surprise volatility

💬 What If I’m Losing Money?

Stop. Take a break. Review your trades and your mindset. Most likely, the issue isn’t your strategy — it’s emotions, overtrading, or lack of a clear plan.

Go back to demo or reduce position size until you rebuild confidence.

💬 What’s the #1 Reason Traders Fail?

They trade emotionally and ignore risk management.

If you can stay logical, use stop-losses, and remain patient, you’re already ahead of 90% of beginners.

🎉 Final Words

Becoming a successful trader doesn’t require genius — just consistency, humility, and hunger to improve.

If you’re reading this in 2025, you’re at a massive advantage: AI tools, 24/7 access, tons of free education, and a global community are at your fingertips.

Don’t just aim to make money fast. Aim to build skill for life.

Take it one trade at a time — and enjoy the journey.