🎉 Unlock the Amazing Power of Stablecoins: Your Ultimate Guide to Cryptocurrency Stability!

Welcome to the exciting world of digital money! You’ve probably heard about Bitcoin and other cryptocurrencies, known for their thrilling price rollercoaster. But what if you want the benefits of digital currency – fast transactions, global reach – without the heart-stopping volatility? Enter stablecoins, the heroes quietly revolutionizing how we think about and use digital money, offering much-needed cryptocurrency stability.

For beginners, the crypto space can seem daunting. Prices shoot up one day and plummet the next. This is where stablecoins shine. They are a special type of cryptocurrency designed to maintain a steady value, often by being pegged to a real-world asset like the US dollar. Think of them as a digital dollar (or Euro, or Yen) that lives on the blockchain. This stability opens up a universe of practical applications, making crypto accessible and usable for everyone, not just traders.

This article is your ultimate guide to understanding stablecoins. We’ll explore what they are, how they work, their incredible uses, the risks involved, and how you, as a beginner, can confidently navigate this transformative technology. Get ready to unlock the amazing power of stablecoins and discover how they’re building a more stable and accessible financial future! The journey into stablecoins begins now, and it’s a crucial step in understanding the future of finance.

The stablecoin market has seen explosive growth, with a total market cap exceeding $182 billion in 2024 and projected to reach over $1.1 trillion by 2035. This isn’t just a niche corner of the crypto world; it’s a foundational layer for the future of digital finance, offering a blend of innovation and the reliability we expect from traditional money.

Table of Contents

- 🎉 Introduction: Why Stablecoins are a Game-Changer for Your Digital Wallet

- ❓ Decoding Stablecoins: What Exactly Are These Digital Dollars?

- Beyond Bitcoin: Understanding the Need for Cryptocurrency Stability

- Stablecoins Defined: Bridging the Gap Between Crypto and Fiat

- 📜 A Quick Trip Through Time: The Fascinating Evolution of Stablecoins

- From Early Ideas to Today’s Market Leaders

- Key Milestones That Shaped the Stablecoin Landscape

- ⚙️ How Do Stablecoins Actually Work? The Magic Behind the Curtain

- The Peg: The Secret to Maintaining Value

- Different Flavors: Types of Stablecoins Explained

- 🏛️ Fiat-Collateralized: The Digital Dollar You Can Trust?

- 🔗 Crypto-Collateralized: Decentralization Meets Stability

- 🧮 Algorithmic Stablecoins: Code, Not Collateral (Handle with Care!)

- 👑 Commodity-Backed: Old-School Assets, New-School Tech

- Minting and Burning: Keeping Supply and Demand in Check

- 🌟 Meet the Stars: Top Stablecoins You Should Know in 2025

- Tether (USDT): The Controversial Giant

- USD Coin (USDC): Transparency and Compliance

- Dai (DAI): The Decentralized Contender

- PayPal USD (PYUSD) & Other New Players: Expanding the Ecosystem

- 🌍 Stablecoins in Action: Incredible Real-World Uses for Beginners

- 💸 Seamless Global Payments and Remittances

- 🛒 Everyday E-commerce and Online Spending

- 🛡️ A Safe Haven: Protecting Your Assets from Volatility

- 📈 Fueling Decentralized Finance (DeFi): Lending, Borrowing, and Earning

- 🌱 Investing for Beginners: How to Earn Yield with Stablecoins

- 🤝 Empowering Developing Economies and Financial Inclusion

- 🤔 Navigating the Risks: What Beginners Need to Watch Out For

- The Transparency Tightrope: Are Reserves Really What They Seem?

- Regulatory Rollercoasters: Governments Take Notice

- The Ghost of Terra: Lessons from Past Failures

- Centralization Concerns in a Decentralized World

- 🔮 The Future is Stable: What’s Next for Stablecoins and Cryptocurrency Stability?

- The Rise of Central Bank Digital Currencies (CBDCs)

- Innovations to Watch: Real-World Assets (RWAs) and Beyond

- The Path to Mainstream Adoption

- 🚀 Your Next Steps: Getting Started with Stablecoins Safely

- Choosing Your First Stablecoin

- Setting Up a Wallet

- Buying and Using Stablecoins Responsibly

- ✨ Conclusion: Embracing the Power of Stablecoins for a Stable Digital Future

❓ Decoding Stablecoins: What Exactly Are These Digital Dollars?

So, we’ve established that stablecoins are important for cryptocurrency stability, but what are they, really? Imagine a digital currency that combines the technological advantages of cryptocurrencies—like fast, low-cost, borderless transactions—with the price stability of traditional fiat currencies, such as the U.S. dollar or the Euro. That, in essence, is a stablecoin.

Beyond Bitcoin: Understanding the Need for Cryptocurrency Stability

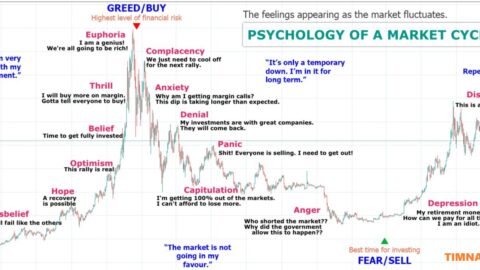

Traditional cryptocurrencies like Bitcoin and Ethereum are famous for their volatility. Their prices can swing dramatically in short periods, making them exciting for speculation but challenging for everyday transactions. If you were to buy a coffee with Bitcoin, its value could change significantly between the time you order and the time you pay! This price uncertainty is a major hurdle for widespread crypto adoption.

This is precisely the problem stablecoins aim to solve. They provide a predictable and stable medium of exchange within the crypto ecosystem and beyond. This cryptocurrency stability is crucial for practical applications like payments, remittances, and as a reliable store of value. Without it, using crypto for daily financial activities would be like trying to build a house on shifting sands.

Stablecoins act as a crucial bridge, connecting the often-turbulent world of cryptocurrencies with the more predictable realm of traditional finance. They allow users to interact with blockchain applications and decentralized finance (DeFi) without constant exposure to wild price swings. This makes the digital economy more accessible and less intimidating, especially for beginners.

Stablecoins Defined: Bridging the Gap Between Crypto and Fiat

At its core, a stablecoin is a type of cryptocurrency whose value is pegged or tied to that of another currency, commodity, or financial instrument. The most common peg is to a fiat currency, with the U.S. dollar being the most popular choice. This means that one unit of a USD-pegged stablecoin (like USDC or USDT) is designed to be worth approximately one U.S. dollar.

This peg is typically maintained through various mechanisms, which we’ll explore in detail later. These can include holding reserves of the pegged asset (like actual U.S. dollars in a bank account), using other cryptocurrencies as collateral, or employing algorithms to manage supply and demand.

The key takeaway for a beginner is that stablecoins offer the benefits of a digital dollar—programmable, easily transferable, and globally accessible—without the extreme price fluctuations associated with other cryptocurrencies. They are a cornerstone of cryptocurrency stability, enabling a vast array of financial services and applications on the blockchain.

📜 A Quick Trip Through Time: The Fascinating Evolution of Stablecoins

The idea of a stable digital currency isn’t brand new, but the journey of stablecoins to their current prominence is a fascinating story of innovation, challenges, and rapid growth. Understanding their history helps appreciate why they are so crucial for cryptocurrency stability today.

From Early Ideas to Today’s Market Leaders

The concept of stablecoins emerged from the need to address the inherent volatility of early cryptocurrencies like Bitcoin. While Bitcoin, launched in 2009, introduced a revolutionary peer-to-peer electronic cash system, its price fluctuations made it impractical for everyday transactions. Developers and visionaries soon began exploring ways to create digital assets that retained crypto’s benefits while offering a stable value.

The first significant attempt to gain traction was Tether (USDT), initially launched as Realcoin in 2014. USDT aimed to maintain a 1:1 peg with the US dollar, claiming to be fully backed by dollar reserves. Despite facing controversies over its reserve transparency, USDT quickly became popular, especially among traders seeking a stable asset to move in and out of volatile crypto positions without converting back to fiat currency.

Following Tether’s rise, the period between 2015 and 2017 saw further experimentation with different stablecoin models, including early crypto-collateralized and algorithmic designs. However, many of these early projects struggled with adoption, liquidity, or the robustness of their stability mechanisms.

Key Milestones That Shaped the Stablecoin Landscape

Several key milestones have defined the evolution of stablecoins:

- 2017: The Birth of DAI: MakerDAO launched DAI, a decentralized, crypto-collateralized stablecoin pegged to the US dollar. Unlike fiat-backed stablecoins, DAI’s stability is maintained by over-collateralizing with other crypto assets (initially Ethereum) held in smart contracts. DAI became a cornerstone of the burgeoning Decentralized Finance (DeFi) movement, offering a more transparent and censorship-resistant alternative. You can explore DAI further at the MakerDAO website.

- 2018-2019: Rise of Regulated Alternatives & Scrutiny: Concerns around Tether’s backing led to the emergence of more transparent and seemingly regulated options. In 2018, Circle, in partnership with Coinbase, launched USD Coin (USDC). USDC is backed 1:1 by U.S. dollars and short-term U.S. Treasuries held in regulated U.S. financial institutions, with regular attestations by accounting firms. This period also saw the launch of other fiat-backed stablecoins like Paxos Standard (now Pax Dollar – USDP) and TrueUSD (TUSD). Explore USDC at USDC.com, issued by Circle.

- 2019: Facebook’s Libra (Diem) Proposal: Facebook’s announcement of Libra (later rebranded to Diem), a global stablecoin project, sent shockwaves through regulatory bodies worldwide. While the project ultimately failed due to intense regulatory pressure, it significantly accelerated global conversations about stablecoin regulation and the potential of a widespread digital dollar.

- 2020-2022: The DeFi Boom & Stablecoin Explosion: The rapid growth of DeFi protocols heavily relied on stablecoins for lending, borrowing, trading, and yield farming. This era saw a proliferation of stablecoins across various blockchains, with the total market cap surging to over $150 billion by late 2021.

- 2022: The Terra/LUNA Crash: The dramatic collapse of TerraUSD (UST), an algorithmic stablecoin, and its sister token LUNA in May 2022, wiped out over $40 billion in value. This event highlighted the risks of algorithmic stablecoins that lack tangible collateral and intensified calls for stricter regulation worldwide. It was a stark reminder that not all stablecoins are created equal in their pursuit of cryptocurrency stability.

- 2023-Present: Regulatory Advancements and Institutional Adoption: Post-Terra, the focus has shifted towards greater transparency, robust regulation, and resilience. Jurisdictions like the European Union with its Markets in Crypto-Assets (MiCA) regulation and the United States with discussions around bills like the GENIUS Act are actively developing frameworks. We’re also seeing increased institutional interest and the launch of stablecoins by major financial players, such as PayPal’s PYUSD. This indicates a maturation of the digital dollar concept and its integration into mainstream finance. Tether (USDT) continues its dominance, with a market cap around $152 billion as of early 2025, followed by USDC with around $61 billion.

The history of stablecoins is still being written, but their journey so far underscores their vital role in the evolving digital economy.

⚙️ How Do Stablecoins Actually Work? The Magic Behind the Curtain

Understanding how stablecoins maintain their value is key to appreciating their role in cryptocurrency stability. It’s not actual magic, but rather a combination of clever economic design, technology, and sometimes, good old-fashioned reserves. Let’s pull back the curtain and see how these digital dollars function.

The Peg: The Secret to Maintaining Value

The core feature of a stablecoin is its “peg” – its ability to maintain a stable value relative to a chosen asset. Most commonly, stablecoins are pegged 1:1 to a fiat currency like the U.S. dollar. This means that for every one stablecoin unit (e.g., 1 USDC), the issuer aims to ensure it can be redeemed for, or is worth, $1.

Maintaining this peg is the central challenge for any stablecoin. Market forces of supply and demand can cause the price of a stablecoin to fluctuate slightly above or below its target value. Stablecoin issuers use various mechanisms to counteract these fluctuations and bring the price back to its peg. These often involve managing the supply of the stablecoin – issuing more when the price is too high (to increase supply and lower price) or buying back/burning coins when the price is too low (to decrease supply and increase price).

Different Flavors: Types of Stablecoins Explained

Not all stablecoins are created equal. They achieve their cryptocurrency stability through different methods of backing and stabilization. Here are the main types you’ll encounter:

🏛️ Fiat-Collateralized: The Digital Dollar You Can Trust?

These are the most common and perhaps the easiest type of stablecoin for beginners to understand.

- How they work: Fiat-collateralized stablecoins are backed by reserves of a fiat currency (like USD, EUR, JPY) held by a central issuer or custodian, often in traditional bank accounts or highly liquid assets like short-term government treasuries. For every stablecoin unit issued, there’s supposed to be an equivalent amount of fiat currency held in reserve.

- Examples: Tether (USDT), USD Coin (USDC), PayPal USD (PYUSD), and TrueUSD (TUSD) are prominent examples.

- Pros: They are generally considered quite stable and intuitive because their value is directly linked to a familiar currency. The 1:1 backing provides a clear redemption mechanism.

- Cons: Their primary drawback is centralization. Users must trust the issuer to maintain adequate reserves and to honor redemptions. There have been concerns about the transparency and quality of reserves for some issuers. They are also subject to traditional financial regulations and can be frozen or censored by the issuer or authorities.

🔗 Crypto-Collateralized: Decentralization Meets Stability

These stablecoins aim to achieve stability without relying on traditional fiat reserves held by a central entity.

- How they work: Crypto-collateralized stablecoins are backed by other cryptocurrencies. Because the collateral itself (e.g., Ethereum, Wrapped Bitcoin) is volatile, these stablecoins are typically “over-collateralized.” This means users must lock up a greater value of crypto collateral than the value of the stablecoins they mint. For instance, you might need to lock $150 worth of ETH to mint $100 worth of a stablecoin. Smart contracts manage this collateral, automatically liquidating positions if the collateral’s value drops too close to the value of the issued stablecoins, to maintain the peg.

- Example: Dai (DAI) by MakerDAO is the leading example.

- Pros: They offer greater transparency because collateral and operations are managed by smart contracts on the blockchain, visible to everyone. They are more decentralized and potentially censorship-resistant than fiat-collateralized stablecoins.

- Cons: The mechanism is more complex for beginners to understand. Over-collateralization can be capital-inefficient (you have to lock up more than you get). They are still susceptible to extreme volatility in the collateralizing crypto assets, which could, in rare cases, lead to a “de-pegging” event if liquidations can’t happen fast enough.

🧮 Algorithmic Stablecoins: Code, Not Collateral (Handle with Care!)

These are the most experimental and, historically, the riskiest type of stablecoin.

- How they work: Algorithmic stablecoins aim to maintain their peg through algorithms and smart contracts that manage the coin’s supply, rather than direct collateralization with fiat or crypto. The algorithm expands the supply when the price is above the peg (to lower it) and contracts the supply (e.g., by buying and burning coins, or offering incentives to hold) when the price is below the peg (to raise it).

- Examples (and cautionary tales): The most infamous example is TerraUSD (UST), which collapsed spectacularly in 2022. Ampleforth (AMPL) is another example that uses a “rebase” mechanism.

- Pros: In theory, they can be highly decentralized and capital-efficient as they don’t require large reserves to be locked up.

- Cons: They have proven to be extremely vulnerable to “bank runs” or “death spirals” where a loss of confidence can cause the peg to break catastrophically. Their stability heavily relies on market trust in the algorithm and continuous demand, which can be fragile. Beginners should approach these with extreme caution.

👑 Commodity-Backed: Old-School Assets, New-School Tech

A less common but interesting category.

- How they work: These stablecoins are collateralized by physical commodities, most commonly gold. Each token represents a claim on a specific quantity of the commodity, which is typically stored in a secure, audited vault.

- Examples: Pax Gold (PAXG) and Tether Gold (XAUT) are examples where each token is backed by one fine troy ounce of gold.

- Pros: They offer a way to invest in commodities like gold with the ease of a digital token. They can be a hedge against fiat currency inflation.

- Cons: The value is tied to the commodity’s market price, which can fluctuate (though typically less than cryptocurrencies). They share some centralization risks related to the custodian of the physical commodity and require trust in the auditing process. Liquidity can also be lower compared to major fiat-backed stablecoins.

Minting and Burning: Keeping Supply and Demand in Check

Two crucial processes for maintaining a stablecoin’s peg are “minting” (creating new coins) and “burning” (destroying existing coins).

- Minting: New stablecoins are minted when there’s demand. For fiat-collateralized stablecoins, this usually happens when a user deposits an equivalent amount of fiat currency with the issuer; the issuer then mints and provides the stablecoins. For crypto-collateralized ones like DAI, users mint new DAI by locking up approved crypto collateral in a smart contract.

- Burning: Stablecoins are burned when users redeem them for the underlying collateral or when an algorithm contracts the supply. When you redeem your USDC for US dollars, the USDC tokens are typically taken out of circulation (burned). This ensures that the total supply of stablecoins in circulation remains appropriately backed.

These minting and burning mechanisms, managed either by a central issuer or by decentralized smart contracts, are vital for adjusting the stablecoin supply in response to market demand, thereby helping to maintain the price peg and ensure cryptocurrency stability.

🌟 Meet the Stars: Top Stablecoins You Should Know in 2025

As the stablecoin market continues to mature, a few key players have emerged, each with unique features, backing mechanisms, and levels of adoption. For beginners looking to understand or use a digital dollar, knowing the major stablecoins is essential for navigating the landscape and ensuring cryptocurrency stability in their digital asset journey. Here are some of the top stablecoins making waves in 2025:

Tether (USDT): The Controversial Giant

- Overview: Tether (USDT) is one of the oldest and, by market capitalization, the largest stablecoin. It aims for a 1:1 peg with the U.S. dollar. USDT is widely available on numerous blockchains and is a primary trading pair on most cryptocurrency exchanges globally.

- Backing: USDT is fiat-collateralized. Historically, Tether Limited Inc. stated it was backed 100% by U.S. dollars, but its reserve composition has evolved to include cash, cash equivalents, commercial paper, secured loans, and other investments.

- Pros: Highest liquidity and widest acceptance across exchanges and platforms. Longest track record in the market.

- Cons: Tether has faced significant controversy and regulatory scrutiny regarding the transparency and composition of its reserves. While they now publish daily attestations, these are not full independent audits in the traditional sense, leading to ongoing concerns for some users.

- Website: https://tether.to

USD Coin (USDC): Transparency and Compliance

- Overview: USD Coin (USDC) is another leading U.S. dollar-pegged stablecoin, known for its emphasis on transparency and regulatory compliance. It is issued by Circle (and formerly co-founded by Coinbase).

- Backing: USDC is backed by U.S. dollar reserves held in segregated accounts with U.S. regulated financial institutions, primarily consisting of cash and short-duration U.S. Treasury bonds. Circle provides monthly reserve attestation reports from a major accounting firm (Grant Thornton LLP).

- Pros: High level of transparency regarding reserves. Strong focus on regulatory compliance, making it favored by institutions and users seeking a more regulated digital dollar. Available on multiple blockchains.

- Cons: As a centralized stablecoin, it is subject to the control of its issuer and U.S. regulations, meaning accounts or transactions can be frozen if required by law (e.g., sanctions compliance).

- Website: https://www.usdc.com (Issuer: https://www.circle.com)

Dai (DAI): The Decentralized Contender

- Overview: Dai (DAI) is a decentralized U.S. dollar-pegged stablecoin issued by the MakerDAO protocol. Unlike USDT or USDC, DAI is generated when users lock up approved crypto-assets as collateral in Maker Vaults (smart contracts).

- Backing: DAI is crypto-collateralized and over-collateralized, meaning more value in crypto assets is locked up than the DAI generated to ensure stability. Accepted collateral types have expanded beyond just ETH to include wrapped Bitcoin (WBTC), USDC, and even tokenized real-world assets (RWAs).

- Pros: Offers a higher degree of decentralization and censorship resistance compared to fiat-backed stablecoins as it’s governed by a Decentralized Autonomous Organization (DAO) of MKR token holders. All collateral and operations are transparent on the blockchain.

- Cons: The mechanism is more complex than fiat-backed coins. Peg stability can be challenged during extreme crypto market volatility, although it has proven resilient. Its reliance on other assets, including centralized stablecoins like USDC as part of its collateral basket, has raised some questions about its full decentralization.

- Website: https://makerdao.com

PayPal USD (PYUSD) & Other New Players: Expanding the Ecosystem

- PayPal USD (PYUSD): Launched by the payments giant PayPal in collaboration with Paxos Trust Company, PYUSD aims to bridge traditional finance with the crypto world. It is fully backed by U.S. dollar deposits, U.S. treasuries, and similar cash equivalents. PYUSD is designed for seamless payments within the PayPal ecosystem and is also available on public blockchains like Ethereum and Solana, enabling integration into dApps, wallets, and exchanges. This marks a significant entry of a major fintech player into the stablecoin space.

- Website: https://www.paypal.com/us/digital-wallet/manage-money/crypto/pyusd and for developers: https://developer.paypal.com/dev-center/pyusd

- Other Notable Stablecoins:

- TrueUSD (TUSD): A USD-pegged stablecoin that emphasizes transparency with real-time attestations of its backing.

- Binance USD (BUSD): Previously a major stablecoin issued in partnership with Paxos, its issuance was halted in 2023 due to regulatory actions, though it played a significant role.

- Frax (FRAX): An innovative stablecoin that started as partially algorithmic and partially collateralized, and has since evolved its model.

- USDD (Decentralized USD): An algorithmic stablecoin on the TRON network, which, like other algorithmic models, carries inherent risks tied to its pegging mechanism.

The stablecoin landscape is dynamic. As of early 2025, Tether (USDT) still leads with a market cap of around $152.81B, followed by USDC at $61.51B, and Dai at $3.72B. PayPal’s PYUSD has also made notable inroads, reaching a market cap of around $903.72M. New projects continually emerge, and existing ones adapt to regulatory changes and market demands. For beginners, sticking with well-established, transparently backed stablecoins like USDC or understanding the decentralized nature of DAI is often a good starting point.

🌍 Stablecoins in Action: Incredible Real-World Uses for Beginners

Stablecoins are far more than just a theoretical concept for cryptocurrency stability; they are actively being used in a multitude of ways, transforming how individuals and businesses interact with money. As a beginner, understanding these practical applications can help you see the true power and utility of a digital dollar.

💸 Seamless Global Payments and Remittances

One of the most impactful uses of stablecoins is for cross-border payments and remittances. Traditionally, sending money internationally is slow, expensive (with fees from multiple banks and currency conversions), and often bureaucratic. Stablecoins change this dramatically:

- Speed & Cost: Transactions can settle in minutes, sometimes seconds, across the globe for a fraction of the cost of traditional methods – often just a few cents, depending on the blockchain used.

- 24/7 Access: Unlike banks with limited hours, stablecoin transactions can happen anytime, anywhere there’s an internet connection.

- Accessibility: They provide a lifeline for people in countries with unstable local currencies or limited access to traditional banking, allowing them to receive funds directly in a stable digital dollar. For example, a freelancer in Southeast Asia can receive payment in USDC from a client in Europe almost instantly, without hefty bank fees or currency devaluation risks.

🛒 Everyday E-commerce and Online Spending

More and more online merchants and service providers are beginning to accept stablecoins for payments. This offers several advantages:

- Reduced Volatility for Shoppers & Merchants: Unlike paying with Bitcoin, where the value can change mid-transaction, stablecoins ensure the price you see is the price you pay. Merchants also benefit by receiving funds that maintain their value.

- Lower Transaction Fees for Merchants: Businesses can avoid the typical 2-5% fees charged by credit card processors, which can significantly improve their profit margins.

- Global Customer Reach: Businesses can easily sell to international customers without worrying about currency conversion complexities or high decline rates on international cards.

🛡️ A Safe Haven: Protecting Your Assets from Volatility

For those involved in the broader cryptocurrency market, stablecoins serve as an essential tool for managing risk and preserving capital:

- Hedging: During periods of high market volatility, traders and investors often convert their more volatile cryptocurrencies (like Bitcoin or Ethereum) into stablecoins like USDC or USDT. This allows them to “park” their funds in a stable asset without exiting the crypto ecosystem entirely (which can be slow and costly).

- Store of Value in Unstable Economies: In countries experiencing high inflation or currency devaluation (e.g., Argentina, Venezuela, Turkey), citizens are increasingly turning to USD-pegged stablecoins as a way to protect their savings from losing value. This “digital dollarization” provides a more accessible and secure way to hold a stable currency.

📈 Fueling Decentralized Finance (DeFi): Lending, Borrowing, and Earning

Stablecoins are the lifeblood of the Decentralized Finance (DeFi) ecosystem. DeFi aims to recreate traditional financial services (like lending, borrowing, trading) on the blockchain, without intermediaries. Stablecoins are crucial here because:

- Lending & Borrowing: Platforms like Aave and Compound allow users to deposit their stablecoins to earn interest (lend) or use other crypto assets as collateral to borrow stablecoins. The stability of these loans is paramount.

- Trading: Decentralized Exchanges (DEXs) like Uniswap heavily rely on stablecoin liquidity pools for users to trade various cryptocurrencies efficiently.

- Yield Farming & Liquidity Provision: Users can provide their stablecoins to liquidity pools or other DeFi protocols to earn rewards, often in the form of more tokens or a share of transaction fees.

🌱 Investing for Beginners: How to Earn Yield with Stablecoins

Beyond just holding them, beginners can also explore ways to earn a return on their stablecoins, often referred to as “yield”. This can be more attractive than traditional savings accounts in some cases:

- Lending on DeFi Platforms: As mentioned above, platforms like Aave or Compound allow you to lend your stablecoins and earn interest.

- Centralized Exchange Savings Products: Many major cryptocurrency exchanges (e.g., Binance, Coinbase, Kraken) offer savings accounts or flexible earning programs where you can deposit your stablecoins and earn a specified Annual Percentage Yield (APY). These are often simpler for beginners to access than DeFi protocols.

- Yield-Bearing Stablecoins: Some stablecoins are designed to generate yield inherently. For example, sDAI (Savings DAI) accrues yield from MakerDAO’s Dai Savings Rate. USDY from Ondo Finance is backed by short-term U.S. Treasuries and aims to pass on that yield. However, it’s crucial to understand that these often come with their own specific risks and complexities, and sometimes KYC (Know Your Customer) requirements.

- Actionable Advice: Start small, use reputable platforms, and understand the risks involved. If a yield seems too good to be true, it often is. Diversification, even within stablecoin strategies, can be wise. Always prioritize the security of your assets.

🤝 Empowering Developing Economies and Financial Inclusion

Stablecoins have immense potential to promote financial inclusion globally:

- Access for the Unbanked: Billions of people worldwide lack access to traditional banking services. Stablecoins, accessible via a smartphone and an internet connection, can provide them with a way to save, transact, and participate in the global digital economy.

- Micro-entrepreneurship: Small businesses and entrepreneurs in developing nations can use stablecoins to receive payments from international clients, access global markets, and manage their finances more efficiently, bypassing local banking inefficiencies or high fees.

The use cases for stablecoins are constantly expanding as the technology matures and adoption grows. From everyday payments to sophisticated financial applications, they are laying the groundwork for a more stable, efficient, and inclusive digital dollar economy.

🤔 Navigating the Risks: What Beginners Need to Watch Out For

While stablecoins offer remarkable benefits for cryptocurrency stability and serve as a versatile digital dollar, it’s crucial for beginners to be aware of the potential risks and controversies surrounding them. Understanding these can help you make informed decisions and protect your assets.

The Transparency Tightrope: Are Reserves Really What They Seem?

One of the most significant concerns, especially with some fiat-collateralized stablecoins, is the transparency and quality of their reserves.

- Reserve Composition: Issuers claim their stablecoins are backed 1:1 by assets like the U.S. dollar. However, the actual composition of these reserves can vary. Some issuers might hold a mix of cash, cash equivalents (like short-term government bonds), commercial paper, or even other digital assets. The risk profile of these assets differs, and not all are as liquid or secure as actual cash in a bank.

- Audits vs. Attestations: While reputable issuers like Circle (for USDC) provide regular “attestations” from accounting firms confirming their reserve holdings, these are often not as rigorous as full, independent financial audits. The frequency and depth of these reports can vary, leaving room for skepticism about whether the stablecoin is fully backed at all times. Tether (USDT) has historically faced the most scrutiny in this area.

- Risk of De-pegging: If an issuer doesn’t actually hold sufficient, high-quality reserves, or if there’s a widespread loss of confidence, the stablecoin could “de-peg” – meaning its value could drop below its intended $1 peg. This could lead to significant losses for holders.

Regulatory Rollercoasters: Governments Take Notice

The rapid growth of stablecoins has caught the intense attention of governments and financial regulators worldwide. This is a double-edged sword:

- Uncertainty: The regulatory landscape is still evolving and varies significantly between countries. What’s permissible today might be restricted or banned tomorrow. This uncertainty can impact stablecoin issuers and users.

- Potential for Strict Rules: Regulators are concerned about financial stability, consumer protection, and the potential for illicit uses (like money laundering). New regulations, such as the EU’s MiCA (Markets in Crypto-Assets) or potential new laws in the U.S. (like the proposed GENIUS Act), could impose strict requirements on issuers, potentially affecting how stablecoins operate or who can issue them. For instance, some proposals suggest only insured depository institutions (banks) should be allowed to issue stablecoins.

- Impact on Innovation vs. Security: While regulation can bring legitimacy and security, overly strict rules could stifle innovation in the digital dollar space. Finding the right balance is a key challenge for policymakers.

The Ghost of Terra: Lessons from Past Failures

The collapse of TerraUSD (UST), an algorithmic stablecoin, in May 2022, serves as a stark reminder of the risks, especially with certain types of stablecoins.

- Algorithmic Risks: UST was not backed by traditional collateral but relied on a complex algorithm and its relationship with a sister token (LUNA) to maintain its peg. When market conditions became stressed and confidence waned, this mechanism failed spectacularly, leading to a “death spiral” that wiped out billions in value.

- Contagion: The failure of a major stablecoin can have ripple effects throughout the entire crypto ecosystem, affecting other projects, exchanges, and investors.

- Key Lesson for Beginners: Not all stablecoins are created equal. Algorithmic stablecoins, particularly those without substantial, verifiable collateral, carry significantly higher risks than well-reserved fiat-collateralized or over-collateralized crypto-backed stablecoins. Always do thorough research (DYOR – Do Your Own Research) before investing in or holding any stablecoin.

Centralization Concerns in a Decentralized World

Many popular stablecoins, especially fiat-collateralized ones like USDC and USDT, are issued and managed by centralized entities. This introduces certain risks:

- Single Point of Failure: The issuer can face legal issues, technical problems, cyberattacks, or lose banking relationships, which could disrupt the stablecoin’s operation or users’ ability to redeem their tokens.

- Censorship and Control: Centralized issuers can freeze funds or blacklist addresses if compelled by law enforcement or regulatory bodies. While this can help prevent illicit activities, it also means that your digital dollar isn’t entirely under your sovereign control if held with such an issuer or on a platform that complies with such requests.

- Counterparty Risk: You are trusting the issuer to manage reserves properly and honor redemptions. If the issuer becomes insolvent, your funds could be at risk.

Being aware of these risks is not meant to deter you from exploring stablecoins, but to encourage a cautious and informed approach. Prioritize stablecoins with transparent backing, strong regulatory standing (where applicable and desired), and a proven track record.

🔮 The Future is Stable: What’s Next for Stablecoins and Cryptocurrency Stability?

The world of stablecoins is anything but static. Innovation continues at a rapid pace, and these digital dollars are poised to play an even more significant role in the future of finance. As a beginner, understanding the potential trends can help you appreciate the long-term vision for cryptocurrency stability.

The Rise of Central Bank Digital Currencies (CBDCs)

One of the most significant developments is the exploration and issuance of Central Bank Digital Currencies (CBDCs) by governments worldwide.

- What are CBDCs? A CBDC is a digital form of a country’s fiat currency, issued and backed directly by its central bank. Think of it as a government-issued digital dollar, digital Euro, or digital Yuan.

- CBDCs vs. Stablecoins: While both offer stable digital value, CBDCs are a liability of the central bank, carrying the full faith and credit of the government. Privately issued stablecoins, on the other hand, are liabilities of their issuers, and their stability depends on the quality of their reserves and their operational integrity.

- Coexistence or Competition? There’s ongoing debate about whether CBDCs will replace private stablecoins or coexist with them. Many believe they can complement each other: CBDCs could form the bedrock of a country’s digital payment infrastructure, while private stablecoins could continue to drive innovation in areas like DeFi, cross-border payments, and programmable money, potentially operating on top of or alongside CBDC systems. Regulatory frameworks, like the EU’s MiCA, are already preparing for a landscape that includes various types of crypto-assets, including e-money tokens (similar to stablecoins).

Innovations to Watch: Real-World Assets (RWAs) and Beyond

The stablecoin ecosystem is constantly evolving, with new technologies and use cases emerging:

- Tokenization of Real-World Assets (RWAs): This is a major trend where tangible assets like real estate, bonds, commodities, or even art are represented as digital tokens on a blockchain. These tokenized RWAs can then be used as collateral for stablecoins (like in DAI’s multi-collateral pools) or traded more efficiently. This could unlock trillions of dollars in illiquid assets and bring them into the digital economy, potentially enhancing the backing and utility of certain stablecoins.

- Improved Scalability and Lower Transaction Costs: As blockchain technology improves with Layer 2 scaling solutions (like Arbitrum, Optimism, Base) and more efficient base layers (like Solana), using stablecoins for micropayments and everyday transactions will become even cheaper and faster.

- Enhanced Programmability: Stablecoins can be embedded within smart contracts, enabling automated and customized financial transactions. This “programmable money” can automate everything from payroll and subscriptions to complex financial derivatives and escrow services, all settled with stable value.

- Yield-Bearing Stablecoins: Innovations continue in stablecoins that aim to offer inherent yield to holders, often by tokenizing returns from underlying assets like U.S. Treasury bills (e.g., USDY by Ondo Finance) or through DeFi lending strategies. However, these often come with increased complexity and regulatory scrutiny.

- Cross-Chain Interoperability: Efforts are underway to make it easier to move and use stablecoins across different blockchain networks seamlessly and securely. This will be crucial for a truly interconnected digital economy.

The Path to Mainstream Adoption

For stablecoins to achieve widespread mainstream adoption as a common digital dollar, several factors need to align:

- Regulatory Clarity: Clear and supportive regulatory frameworks are essential to build trust and allow issuers and users to operate with confidence. The ongoing implementation of MiCA in Europe and discussions around stablecoin bills in the U.S. are steps in this direction.

- User Experience (UX): Using stablecoins needs to become as easy, if not easier, than using traditional payment apps or online banking. This means simpler wallet interfaces, easier on-ramps (converting fiat to stablecoins), and better integration into everyday applications.

- Institutional Involvement: Increased adoption by traditional financial institutions (banks, payment processors, asset managers) will lend credibility and provide broader access to stablecoins. The launch of PYUSD by PayPal is a prime example of this trend.

- Security and Trust: Continuous improvements in security protocols, transparent reserve management, and robust auditing practices are vital to maintain user trust and ensure the cryptocurrency stability that stablecoins promise.

The future of stablecoins looks bright, with the potential to fundamentally change how we interact with money globally. They are a key component in the journey towards a more efficient, transparent, and accessible financial system.

🚀 Your Next Steps: Getting Started with Stablecoins Safely

Feeling intrigued by the potential of stablecoins and ready to dip your toes into the world of the digital dollar? Getting started is easier than you might think, but it’s important to proceed cautiously and prioritize safety, especially as a beginner. Here’s how you can begin your journey towards cryptocurrency stability.

Choosing Your First Stablecoin

With various stablecoins available, making a choice can seem daunting. For beginners, it’s generally advisable to start with well-established, highly liquid, and transparently backed options:

- Consider USD Coin (USDC) or PayPal USD (PYUSD): Both are backed by U.S. dollar reserves (cash and short-term government obligations) and are issued by entities that emphasize regulatory compliance and transparency with regular attestations. USDC, issued by Circle, has a long track record and wide availability. PYUSD, from PayPal, offers easy integration for PayPal users.

- Tether (USDT): While it’s the largest by market cap and very liquid (https://tether.to), be aware of the historical controversies surrounding its reserve transparency. If you choose USDT, ensure you’re comfortable with its risk profile.

- Dai (DAI): If you’re interested in a more decentralized option, DAI (https://makerdao.com) is a prominent choice. However, understand that its crypto-collateralized nature and DAO governance make it a bit more complex than fiat-backed stablecoins.

- Research is Key: Before choosing, visit the official websites of the stablecoins you’re considering. Look for information on their backing, transparency reports (audits or attestations), the team behind them, and their regulatory standing.

Setting Up a Wallet

To hold and use stablecoins, you’ll need a cryptocurrency wallet. Wallets come in various forms:

- Software Wallets (Hot Wallets):

- Mobile Wallets: Apps you can download on your smartphone (e.g., Trust Wallet, Coinbase Wallet, MetaMask Mobile). They are convenient for everyday use and often support multiple stablecoins and blockchains.

- Desktop Wallets: Software you install on your computer (e.g., Exodus, MetaMask for desktop browsers).

- Web Wallets (Browser Extensions): Like MetaMask, which integrates directly with your web browser, allowing you to interact with DeFi applications and websites that support crypto payments.

- Hardware Wallets (Cold Wallets): Physical devices (e.g., Ledger, Trezor) that store your private keys offline. They are considered the most secure option for storing larger amounts of cryptocurrency long-term, as they are less vulnerable to online hacking.

- Exchange Wallets: When you buy stablecoins on a cryptocurrency exchange (like Binance, Coinbase, Kraken), they are initially held in a custodial wallet provided by the exchange. While convenient for trading, it’s generally recommended to move significant amounts to a personal wallet where you control the private keys for better security.

Crucial Security Tip for Wallets: When you set up a personal (non-custodial) wallet, you will be given a “seed phrase” or “recovery phrase” (usually 12 or 24 words). Write this down on paper and store it in multiple safe, offline locations. Never share it with anyone, and never store it digitally (e.g., in a text file on your computer, in an email, or in the cloud). This phrase is the master key to your funds; if you lose it, you lose access to your crypto, and if someone else gets it, they can steal your funds.

Buying and Using Stablecoins Responsibly

- Buying Stablecoins:

- Cryptocurrency Exchanges: The most common way is through exchanges like Coinbase, Binance, Kraken, or others that operate in your jurisdiction. You’ll typically need to create an account, complete KYC (Know Your Customer) verification, and then you can purchase stablecoins using your local fiat currency (e.g., via bank transfer, debit card).

- Direct from Issuers (for larger amounts): Some issuers like Circle allow direct purchase and redemption for institutional clients or high-net-worth individuals.

- Peer-to-Peer (P2P) Platforms: Some platforms facilitate direct buying and selling between individuals, but these can carry higher risks if not used carefully.

- Understanding Fees: Be aware of transaction fees (network fees or “gas” fees) when sending stablecoins, especially on blockchains like Ethereum during peak times. Some blockchains (like Solana, Polygon, or Layer 2 solutions) offer much lower fees. Exchanges also charge fees for buying, selling, or withdrawing.

- Sending and Receiving: To send stablecoins, you’ll need the recipient’s wallet address (a long string of characters). To receive, you’ll provide your wallet address for the specific stablecoin and blockchain. Always double-check addresses before sending, as transactions are irreversible. Sending to the wrong address or the wrong blockchain type can result in permanent loss of funds.

- Start Small: As a beginner, start with small amounts you’re comfortable experimenting with. Learn the process of buying, sending, receiving, and storing before handling larger sums.

- Beware of Scams: The crypto space, unfortunately, attracts scammers. Be wary of unsolicited offers, promises of guaranteed high returns, fake giveaways, or anyone asking for your private keys or seed phrase. Always interact with official websites and reputable platforms.

By taking these steps and prioritizing security and research, you can begin to explore the practical benefits of stablecoins and their role in fostering cryptocurrency stability and the growing digital dollar economy.

✨ Conclusion: Embracing the Power of Stablecoins for a Stable Digital Future

The journey into the world of stablecoins reveals a technology that is not just a fleeting trend but a foundational pillar for the future of finance. For beginners and seasoned crypto users alike, these unique digital assets offer a compelling solution to the inherent volatility of traditional cryptocurrencies, providing much-needed cryptocurrency stability. By acting as a reliable digital dollar (or other fiat-pegged equivalent), stablecoins unlock a vast array of practical applications, from seamless global payments and accessible DeFi services to protecting savings in an increasingly digital world.

We’ve seen how stablecoins work, from their various pegging mechanisms—be it fiat collateralization, crypto-backing, or algorithmic designs—to the crucial processes of minting and burning that maintain their value. We’ve met the leading players like USDC, USDT, DAI, and newcomers like PYUSD, each contributing to the diverse and expanding ecosystem. More importantly, we’ve explored their transformative real-world use cases, empowering individuals and businesses globally.

However, the path is not without its challenges. Regulatory landscapes are still taking shape, transparency concerns persist with some issuers, and the risks, particularly with less-collateralized models, are real, as exemplified by past failures. Yet, these challenges are also driving innovation, pushing the industry towards greater accountability, security, and user-centric design.

As we look to the future, the interplay between private stablecoins and emerging Central Bank Digital Currencies (CBDCs), the tokenization of real-world assets, and advancements in blockchain technology promise an even more integrated and efficient financial system. For you, the beginner, the key is to approach this space with curiosity, a commitment to learning, and a healthy dose of caution. Start small, prioritize security, and choose stablecoins that align with your understanding and risk tolerance.

The power of stablecoins lies in their ability to democratize access to stable financial tools, bridge the gap between traditional finance and the innovative world of blockchain, and ultimately, build a more inclusive and stable digital future. Your adventure with this game-changing technology is just beginning!

Reference video: