Introduction: How DeFi and NFTs Are Transforming the Crypto Landscape

The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has dramatically reshaped the cryptocurrency industry. No longer just about Bitcoin and Ethereum, the crypto space is evolving into a decentralized ecosystem where financial services, digital ownership, and blockchain utility are more accessible than ever.

Understanding the role of DeFi and NFTs is crucial for investors, developers, and enthusiasts looking to navigate the future of crypto. This guide explores how DeFi and NFTs impact the crypto world, their current trends, and how they are set to revolutionize the industry.

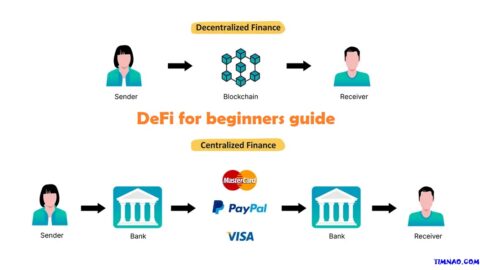

1. What is Decentralized Finance (DeFi)?

Understanding DeFi

DeFi, short for Decentralized Finance, refers to blockchain-based financial services that eliminate the need for traditional banks and intermediaries. Through smart contracts and decentralized applications (DApps), users can lend, borrow, trade, and earn interest on crypto assets without relying on centralized institutions.

Key Features of DeFi

✅ Permissionless Access – Anyone with an internet connection can participate.

✅ Smart Contracts – Automated agreements executing financial transactions.

✅ Transparency – All transactions are recorded on public blockchains.

✅ Yield Farming & Staking – Opportunities for passive income.

🔹 Pro Tip: DeFi eliminates middlemen, reducing fees and increasing financial inclusivity worldwide.

2. How DeFi is Revolutionizing Finance

1. Lending and Borrowing Without Banks

Platforms like Aave, Compound, and MakerDAO allow users to lend their crypto assets and earn interest or borrow against collateral without credit checks.

2. Decentralized Exchanges (DEXs)

DEXs such as Uniswap, SushiSwap, and PancakeSwap let users trade cryptocurrencies without a central authority, reducing risks of fraud and censorship.

3. Stablecoins & DeFi Banking

Stablecoins like DAI, USDC, and USDT offer price stability, making them ideal for DeFi transactions and cross-border payments.

4. DeFi Yield Farming & Liquidity Pools

Users can provide liquidity to DeFi protocols and earn rewards in return. This process, known as yield farming, allows investors to maximize returns on their holdings.

🔹 Pro Tip: Always research before investing in DeFi projects—some offer high returns but come with risks like impermanent loss and smart contract vulnerabilities.

3. What are NFTs and Why Are They Important?

Understanding NFTs

NFTs (Non-Fungible Tokens) are unique digital assets stored on a blockchain. Unlike cryptocurrencies like Bitcoin, which are interchangeable, NFTs represent ownership of distinct items, such as art, music, virtual land, and collectibles.

How NFTs Work

Each NFT is verified on a blockchain, making it impossible to duplicate or forge. The most popular blockchain for NFTs is Ethereum, but others like Solana, Polygon, and Binance Smart Chain also support NFT marketplaces.

Popular NFT Use Cases

✅ Digital Art & Collectibles – Platforms like OpenSea, Rarible, and Foundation allow artists to sell tokenized art.

✅ Gaming & Virtual Worlds – NFTs power in-game items, metaverse assets, and virtual land (e.g., Decentraland, Axie Infinity, The Sandbox).

✅ Music & Entertainment – Musicians and content creators can monetize their work directly without middlemen.

✅ Real Estate & Identity Verification – NFTs enable secure, transparent property ownership and digital identities.

🔹 Pro Tip: Always verify authenticity and rarity before buying NFTs—many projects flood the market with low-value tokens.

4. How NFTs are Changing the Crypto Industry

1. NFT Marketplaces & Creator Economy

NFT platforms empower artists, musicians, and content creators by allowing direct sales and royalties without third-party control.

2. NFTs in Gaming & the Metaverse

- Play-to-Earn (P2E) Games: Players earn real-world value through in-game NFTs.

- Virtual Land Ownership: Users can buy and sell virtual real estate in metaverse worlds like Decentraland and The Sandbox.

3. NFT Utility Beyond Art

- Identity & Digital Credentials: Universities and employers use NFTs for verifiable digital certificates.

- Tokenized Assets: Physical assets (e.g., real estate, luxury goods) are represented as NFTs for easier transfer and verification.

🔹 Pro Tip: NFT adoption is expanding—future applications could disrupt industries from education to healthcare.

5. How DeFi and NFTs Work Together

1. NFT Lending & Collateralization

- Platforms like NFTfi allow users to borrow crypto by using NFTs as collateral.

- Fractionalized NFTs let investors own a portion of high-value NFTs.

2. DeFi-Powered NFT Staking

- Some projects allow NFT holders to stake their assets and earn rewards.

3. NFT-Based Insurance & Smart Contracts

- DeFi protocols are exploring NFTs for insurance policies, ensuring transparency in claims processing.

🔹 Pro Tip: The merging of NFTs and DeFi is creating new investment opportunities and use cases.

6. The Future of DeFi and NFTs

1. Mass Adoption & Regulation

- Governments are starting to regulate DeFi and NFTs, which could lead to increased mainstream adoption.

- Traditional financial institutions are exploring DeFi-powered banking solutions.

2. Expansion into Real-World Applications

- Expect NFTs and DeFi to integrate with supply chain management, healthcare records, and tokenized real estate.

3. Multi-Chain Interoperability

- Cross-chain DeFi solutions will allow NFTs and DeFi assets to move across blockchains seamlessly.

🔹 Pro Tip: The future of DeFi and NFTs is evolving fast—stay informed and explore projects with strong fundamentals.

Conclusion: DeFi and NFTs Are Reshaping the Crypto Industry

The role of DeFi and NFTs in the future of crypto is undeniable. While DeFi is revolutionizing finance by removing intermediaries, NFTs are redefining ownership, gaming, and digital assets.

🚀 Want to stay ahead? Explore promising DeFi projects, NFT use cases, and keep up with emerging blockchain trends to maximize your crypto investment potential!